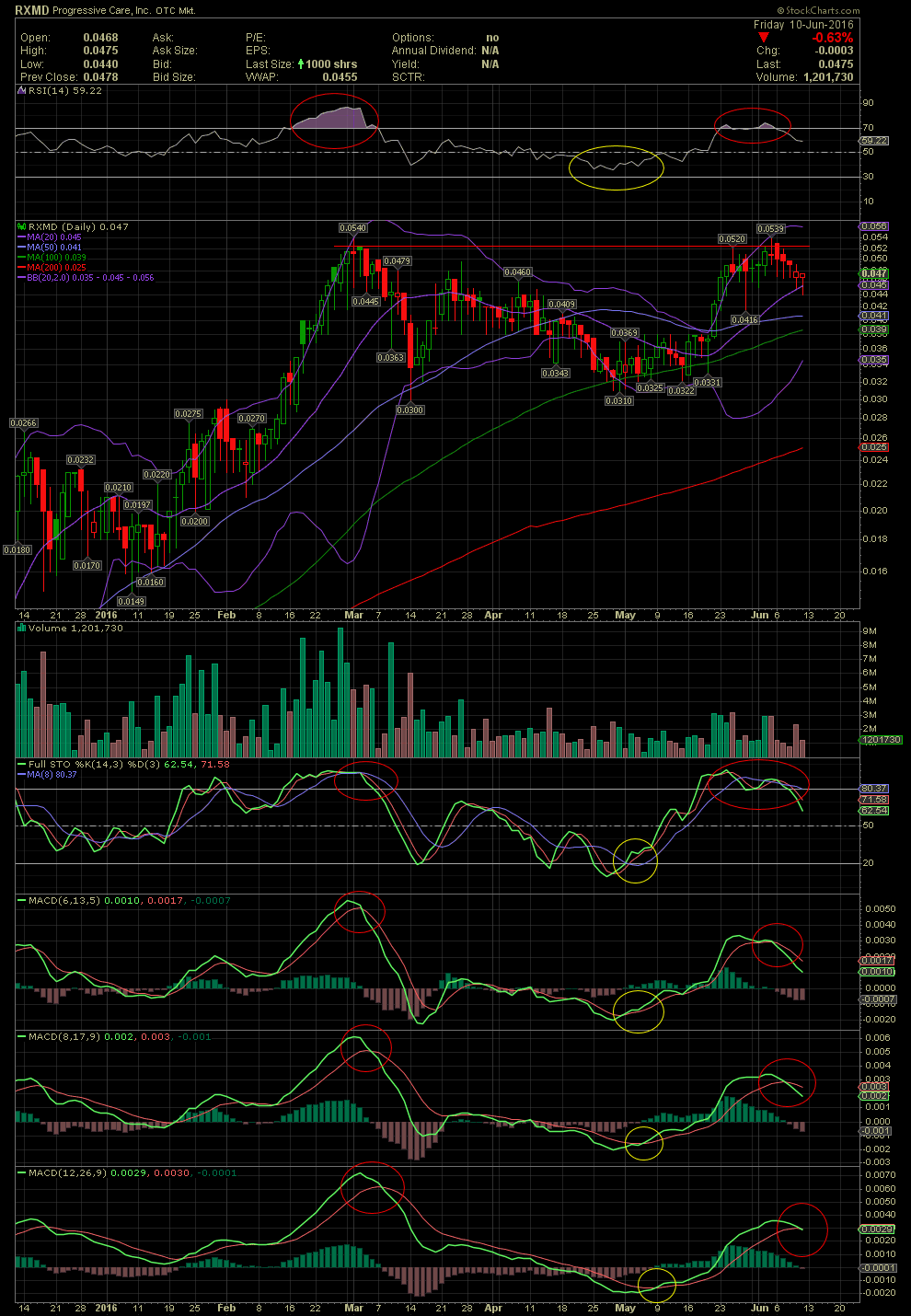

RXMD Daily Chart ~ Another Correction Underway

Post# of 2561

Link back to my post of May 31 ( http://investorshangout.com/post/view?id=3785188 ) which references our exits from another successful swing trade on RXMD. From May 26 to May 31, we sold our positions in RXMD in favor of purchasing more IORG and RGFR at that time. IORG was trading in the low to mid .30s and has since seen a move into Friday's close of $1.08. RGFR was in the .70s and .80s and has since appreciated to $1.00 and closing at .95 on Friday. Some of those funds also found their way into ATOC in the .30s and .40s, which is now at .70 with Friday's close.

As to RXMD, one can see on the chart below, a double top has been formed. If the share price were to reverse in the next few days, we would probably have to sit back and see if the double top can be surpassed with a decisive move, with volume. Currently, the RSI is receding from the overbought levels of the 'Nose Bleed Zone', although it was only slightly overbought as compared to the very overbought levels of late Feb/early March. The FullSto had already entered its overbought levels in late May as the MACDs began to level out and curl into their negative crossovers. The final confirmation of a sell signal, using the default 20 day MACD, just occurred on Friday. By using the faster MACDs, it tends to give one an earlier view of a momentum shift than those using the 20, thus another reason for our exits of May 26-30 rather than waiting until Friday. But as I've mentioned in the past, it can also result in a head fake and getting one in or out a bit early. The good thing is, with an exit prior to when the rest of the street exits, it will always offer one the ability to re-enter quickly if needed, as their funds will already be in hand. As in most cases with penny stocks, though, when the indicators begin to top out, it almost always results in a decent exit. More importantly, if those funds are then invested in a stock where the chart says it is time to enter, the results are better than fighting the tape of the the stock that is near its highs.

What to do now? As with our previous trades in RXMD, we'll sit and wait for the technicals to reset and allow another calculated entry. As you can see on the chart, the various indicators have a ways to go until they once again enter oversold territory. Let's see if the share price retreats to the low .03s again, where we entered the last time. I am not a shareholder at the current time. GLTA

(0)

(0) (0)

(0)