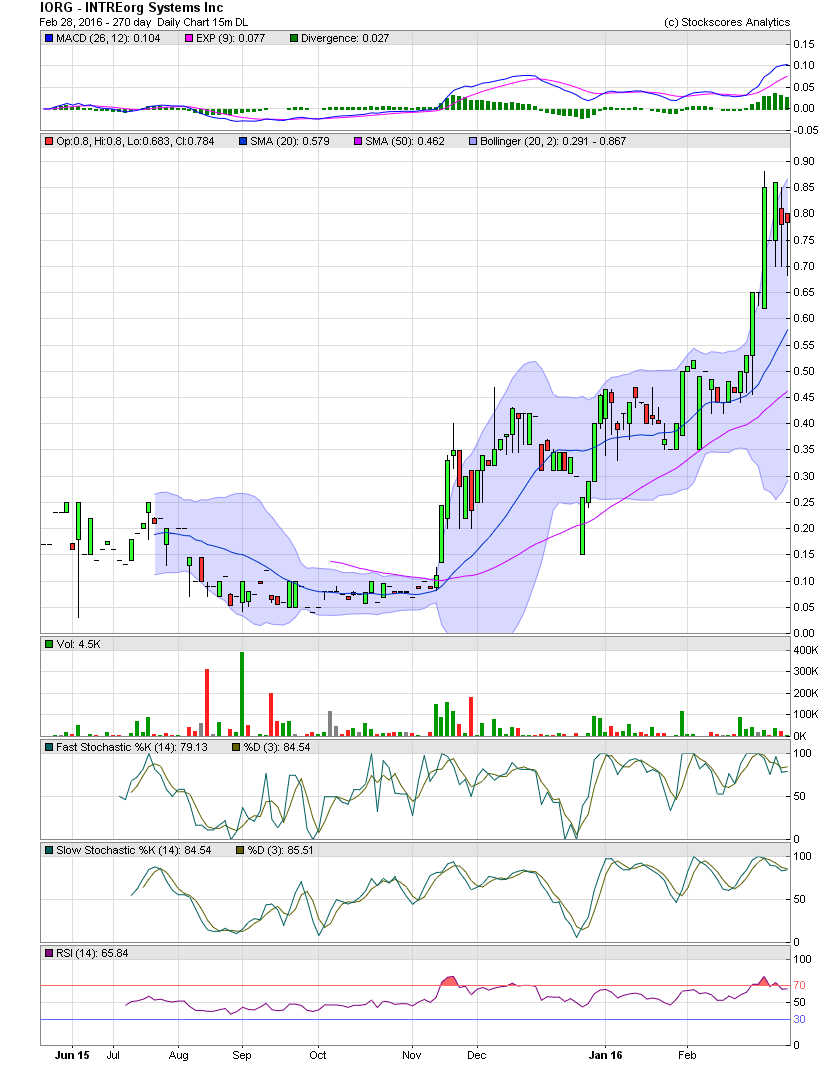

IORG Daily Chart ~ Another New Multi Year High

Post# of 2561

IORG set two new multi year highs this week closing on day .86 while with an intraday high of .88. The stock closed up 31% for the week as the previous Friday saw a multi year high close at .65. As management readies their financials and continues to execute their business plan, I would hope to see the stock price rise steadily as has been seen since the sub .10 levels of November.

Technically, IORG did get overbought on Monday with the move from its previous close of .65 and running to the intraday high of .88 before closing at .85 on Monday. The share price was significantly outside the upper bollie, so one way or the other, the stock price was going to come back inside the bollie bands. Tuesday saw a low volume day with two trades at .75 as one market maker entered an order to sell 10,000 shares at .75. The stock is very thinly traded, and days with spreads of 10-25% are not uncommon. Therefore, one should expect major percentage swings intraday. Wednesday through Friday was consolidation trading with most of the volume in the .75-.80 range. There was some strange executions as a few friends and I actually had bids in from .70-.75, and although the stock traded down to the .68s, none of us got any shares below .75.

(0)

(0) (0)

(0)