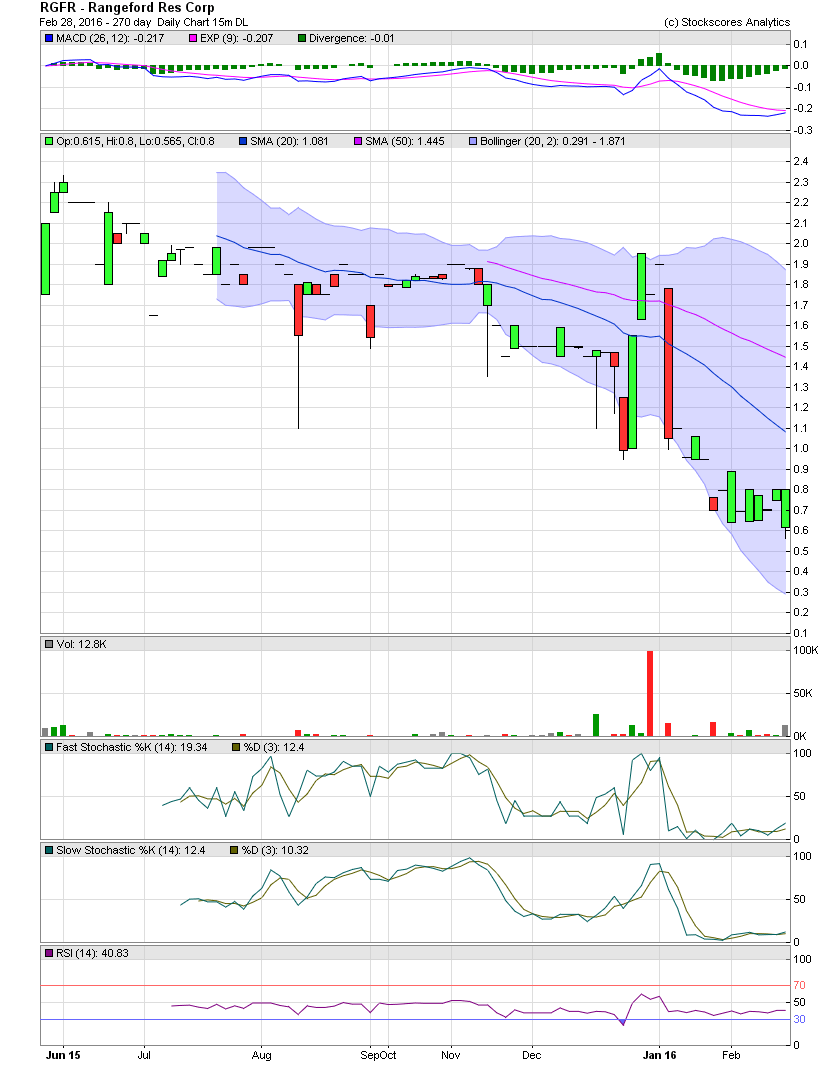

RGFR Daily Chart ~ Technicals Suggesting the Botto

Post# of 2561

The volume on RGFR was low again this week, but that is expected with this very low float stock, especially in the current oil and gas environment of very low prices. Taking the contrarian view, this would be the time to accumulate stocks in sectors that are very much out of favor. The strategy of management of RGFR is to acquire properties at very enticing prices from those companies that are losing their oil wells due to the collapse in the oil sector. Again, RGFR is a long term energy play imo.

Technically there still isn't much to say other than the basing seen at the .60-.80 levels over the last couple of weeks. The indicators are very oversold, and therefore it's buy time for a few friends and me. As of Friday's close, L2 showed approx 12,000 shares to get back over $1.00.

(0)

(0) (0)

(0)