Posted On: 02/15/2016 2:36:59 PM

Post# of 2561

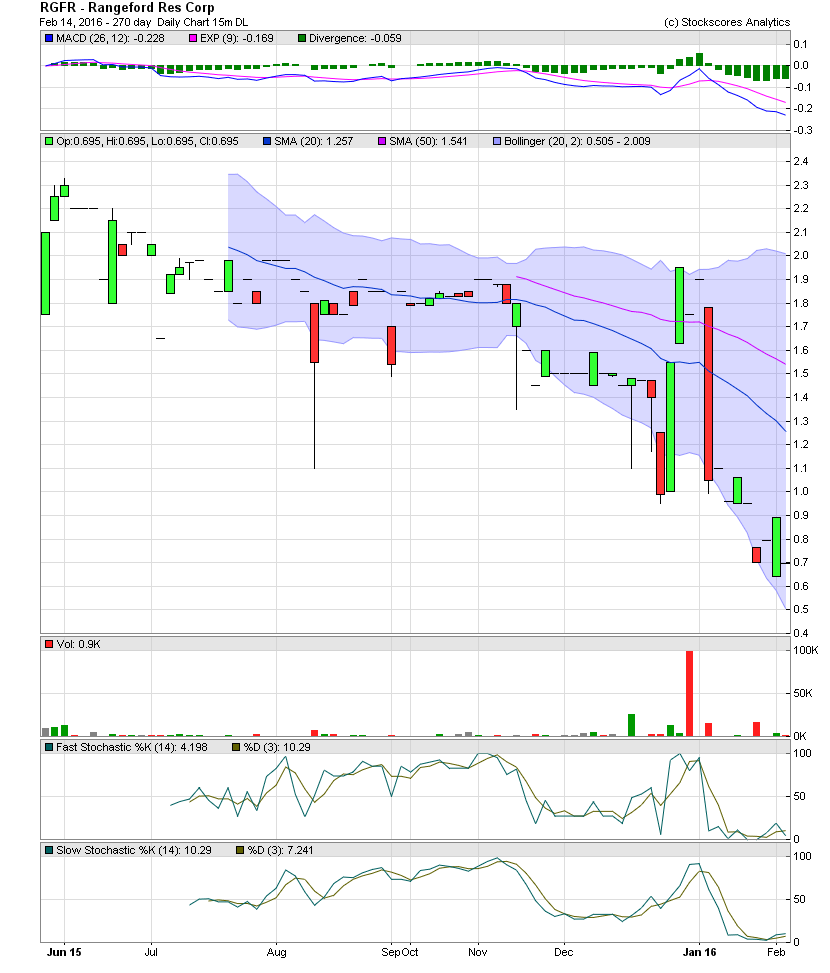

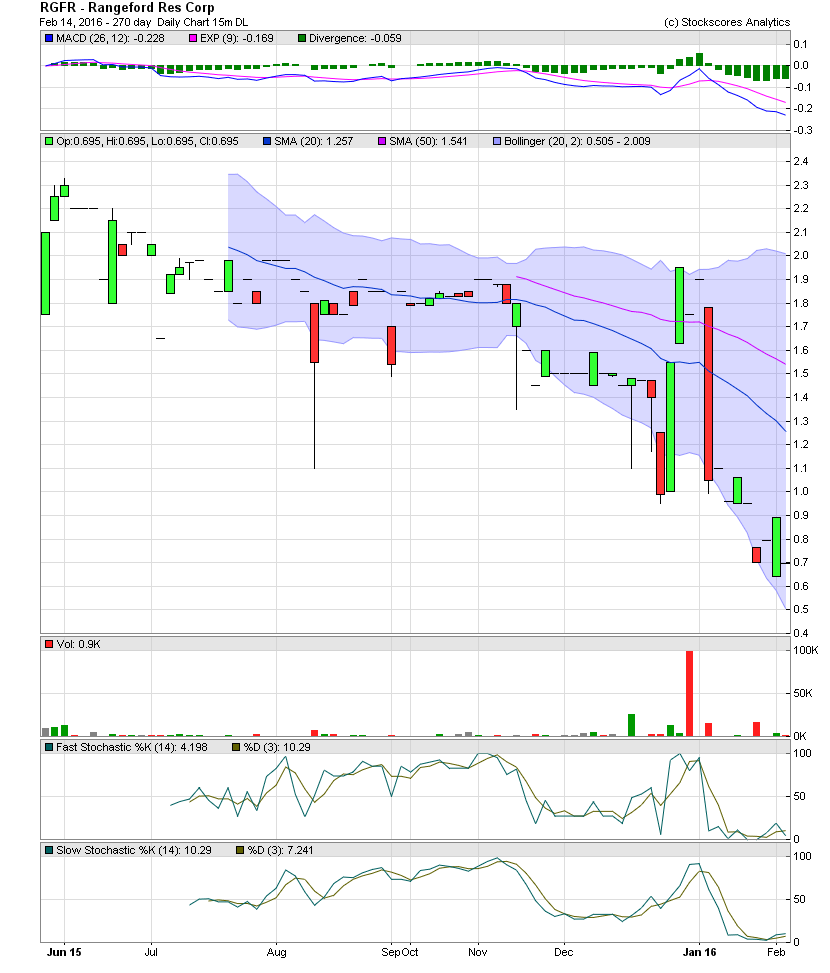

RGFR Daily Chart ~ Again, Not a Chart Play at This Time

As I've mentioned previously, RGFR is a long term accumulation play. The weakness in the energy sector may have been the leading factor for the low volume decline from the mid to high $1.00s. A few of us have once again started adding more shares in the .60s to .70s this last week, although with small buys. With Rangeford being a startup energy play, I like the timing of their entry into the oil patch. Now would be the time to be acquiring oil wells and properties at huge discounts from those entities having to filing for liquidation of their assets or outright bankruptcy. As with SNST, I'll be sharing fundamentals, charts and technicals on RGFR for some time to come.

As I've mentioned previously, RGFR is a long term accumulation play. The weakness in the energy sector may have been the leading factor for the low volume decline from the mid to high $1.00s. A few of us have once again started adding more shares in the .60s to .70s this last week, although with small buys. With Rangeford being a startup energy play, I like the timing of their entry into the oil patch. Now would be the time to be acquiring oil wells and properties at huge discounts from those entities having to filing for liquidation of their assets or outright bankruptcy. As with SNST, I'll be sharing fundamentals, charts and technicals on RGFR for some time to come.