Pump and dump is a kind of securities fraud involving artificial inflation of the price of a stock by using misleading and false positive statements. The primary objective is to ensure that they sell all their cheaply purchased shares at a much higher price. With time, the operators of the scheme “dump” will sell their overvalued shares, and the stock’s price will fall drastically making the investors lose a lot money.

The pump and dump scheme is a common thing especially to penny stocks with small corporations and cap cryptocurrencies. In the past, these penny stock fraudsters were relying on cold calls, but currently, the internet is offering them a cheap and much easier way to reach a large number of investors through false information, social media, bad data, and spam email.

Penny Stock Pump and Dump Scenarios

Pump and dumps can take place through the internet using media channels, email spam campaign, telemarketing and also fake press release all planned in brokerage houses or a promoters office. What will happen is that a stock promoter claims to have inside information regarding the impending news.

On the other hand, the Newsletters can purport to offer the stock promoter in delivering unbiased recommendations so that he or she can tout the penny stock company of having “hot” stock so that they can garner their benefits. Moreover, the promoters, on the other hand, might also send some messages through the chat rooms or maybe stock message boards where they urge the potential investors to come and buy the stock fast.

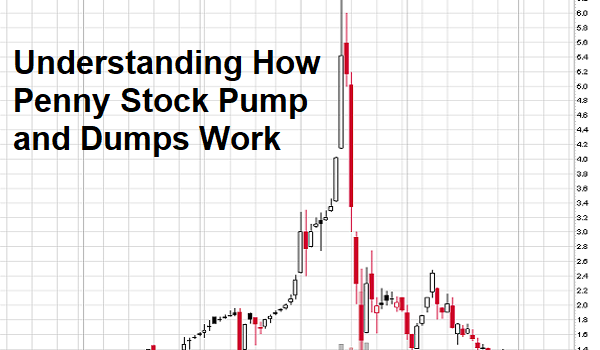

During the promoter’s campaign also called “pump” a stock becomes successful and leads to unwitting the investors to buy the shares from their target companies. It will result in an increased demand leading to an increase in the price of the penny stock. However, due to trading volume of the specific commodity, it will continue convincing more inexperienced investors to believe the hype is making them use their money to purchase the shares. After the promoters who are behind the pump and dump scheme sell all their shares, they stop promoting the specific stock. Due to the dump, the stock’s price plummets and the other investors are left in the market holding their worthless stock, and it will be priced much less than they had paid for them.

It is a process that the fraudsters will frequently apply and especially to the small and thinly trading companies that can only offer penny stocks. These penny stocks sell over the counter in markets like pink sheets and OTC Bulletin Board instead of big stock exchange markets like NASDAQ and NYSE. The fraudsters utilize their activity in these penny stocks because the companies offering the shares lack or have independent information available. It is a principle that applies in most countries including the UK and target companies are small to trade in OFEX or AIM.

Today there is a modern spin of the pump and dump called a hack. In this form, the investor will purchase penny stocks and hire compromised brokerage accounts and purchase large quantities of the penny stocks through their accounts. It will increase price and pushed further by the day traders as they seek a quick advance in the penny stocks. At last, the original stockholder will cash out at a premium.

Penny Stocks Scams

Penny stocks are mostly sold in those markets lacking regulations, and therefore manipulation takes place. The schemes will play again and again with penny stocks. There is a theme that is presently consistent across the scams and schemes.

So, when there are promises or hints of getting higher returns, with no or little risk, let them be your classic warning signs for you losing.

Most times, some people approach you who are not even close to resembling a broker and will try to get you into a penny stock. However, sometimes it can be part of allure making the opportunity look like legitimate.

When you find that the individual or firm is not yet registered or they are trying to sell you some unregistered stocks, be cautious and keep off. You can also contact the relevant authority.

Legally, firms or individuals have no authority to offer any investment advice or even sell securities when they lack specific registrations and licenses. You can confirm their certification from the website.

Comparison of Penny Stock Pump and Dumps Work with Other Schemes

This pump and dump work is an economic bubble that you need to be careful as an investor. The main difference of this pump and dump scheme is that unlike other bubbles, it is deliberately perpetuated through unlawful activity. However, penny stock pump and dump works are similar in various ways to other scam schemes that use misrepresentations aiming to only enrich the initial or promoter investors from the later investors’ money. However, there are some differences between this penny stocks pump and dump works to the Ponzi schemes:

-

Pump and dump works happen through typical marketing to the public and therefore trading takes place on the public stock exchanges where the perpetrators and victims don’t acquaint other. Ponzi type of schemes, on the other hand, is investments that are traded privately and they are more often between the known individuals to the other.

-

Pump and dump schemes will only come with implied, or general promises for substantial profits whereas Ponzi schemes will typically promise investors on specific investments including a falsified record that indicates the steady and consistent returns.

-

Pump and dump scams aim at making profits through a fast method where they are executed within hours, days or weeks. Comparing to the Ponzi schemes, they usually come when expecting profit within a relevant period that can last even for months.

-

The aim and objective of penny stock pump and dump schemes are to scam investors from their conceptions while on the other hand the Ponzi schemes occasional results into investment vehicles although the original intention was to be legitimate but failed to perform as expected.

In the above reasons, you will realize that Ponzi schemes will leave a more extensive trail having evidence. Moreover, they are easy to prosecute after discovering and will result in a much stiffer criminal penalty.

However, you have also noted that penny stock pump and dump differs from the rest form of spam because it will not require the recipient to visit or call a spammer so that he or she can collect the supposed “winnings” or even transfer their money from the supposed bank accounts. It is therefore difficult for an investor to track the source of the pump and dump scammer causing the rise of the “minimalist” scams that consist of the small and untraceable image file containing a picture of the stock symbol.

Penny Stock Pump and Dump Regulations

One of the methods that can be used to regulate and restrict the penny stock pump and dump scheme from the manipulators is when the investors target the stocks categories that are mostly associated with this scheme. Besides, these penny stocks are the highest target that is enforced by the scammers’ efforts. In some countries such as the United States, the regulators define penny stocks as the security that need to meet specific standards. The market criteria include price, minimum shareholder equity and market capitalization. Securities that trade on a national stock exchange, regardless of their price, are exempt from the designation and called penny stocks because the traded securities are much less vulnerable to scammer’s manipulation.

However, the Citigroup and NYSE list these securities that trade with less than $5 during the market downturn and adequately called “low price” securities. However, currently, these penny stocks that trade in the United States are primarily controlled through regulations and rules that are enforced by the SEC and FINRA and the control can be found in securities law.

However, this law is upheld in the country where the statute becomes a template of laws that other states are enacting. The penny stocks regulations have shown effectiveness in restricting the brokers that specialize in these penny stocks. Moreover, the sanctions under regulations lack an effective means that can address pump and dump schemes that are perpetrated by individuals and unregistered groups.

Conclusion

When you hear about penny stock pump and dumps, know that it’s an illegal scheme according to security law and can, therefore, lead to hefty fines when you get involved in this scheme. Moreover, this pump and dump scheme can involve exciting an organization’s stock so that they can boost the cost of each stock via recommendations that are based on exaggerated, false and misleading statements. Besides, a group or individual that are involved in this penny stock pump and dump scheme establishes a position by purchasing thousands if not millions of the company’s shares stock. Later, they start “pumping” the stock through various statements to make it sound exciting, but they are misleading. Do your research!

About The Author

Contact Samuel privately here. Or send an email with ATTN: Samuel as the subject to contact@investorshangout.com.

About Investors Hangout

Investors Hangout is a leading online stock forum for financial discussion and learning, offering a wide range of free tools and resources. It draws in traders of all levels, who exchange market knowledge, investigate trading tactics, and keep an eye on industry developments in real time. Featuring financial articles, stock message boards, quotes, charts, company profiles, and live news updates. Through cooperative learning and a wealth of informational resources, it helps users from novices creating their first portfolios to experts honing their techniques. Join Investors Hangout today: https://investorshangout.com/