Strengthening Business Platforms Against Fraudulent User Activity

The rapid rise of technology and online platforms has led to an increase in fraudulent activities targeting businesses across various sectors. Organizations may expose themselves to a higher risk of scams and unethical practices.

Look into the tactics employed by fraudsters and implement robust security measures to minimize risks. By strengthening business platforms against these threats, companies can protect their reputation, secure their assets, and maintain customer trust. Organizations must employ a systematic approach that encompasses technology, policy, and user education.

How to Identify Vulnerabilities with Risk Assessment

A thorough risk assessment can identify potential vulnerabilities in business platforms. This assessment encompasses user authentication mechanisms, data protection measures, and transaction processes. By pinpointing weaknesses, organizations can develop targeted strategies to mitigate risks. If the assessment uncovers lax screening processes for new accounts, this will indicate a need for stronger verification protocols.

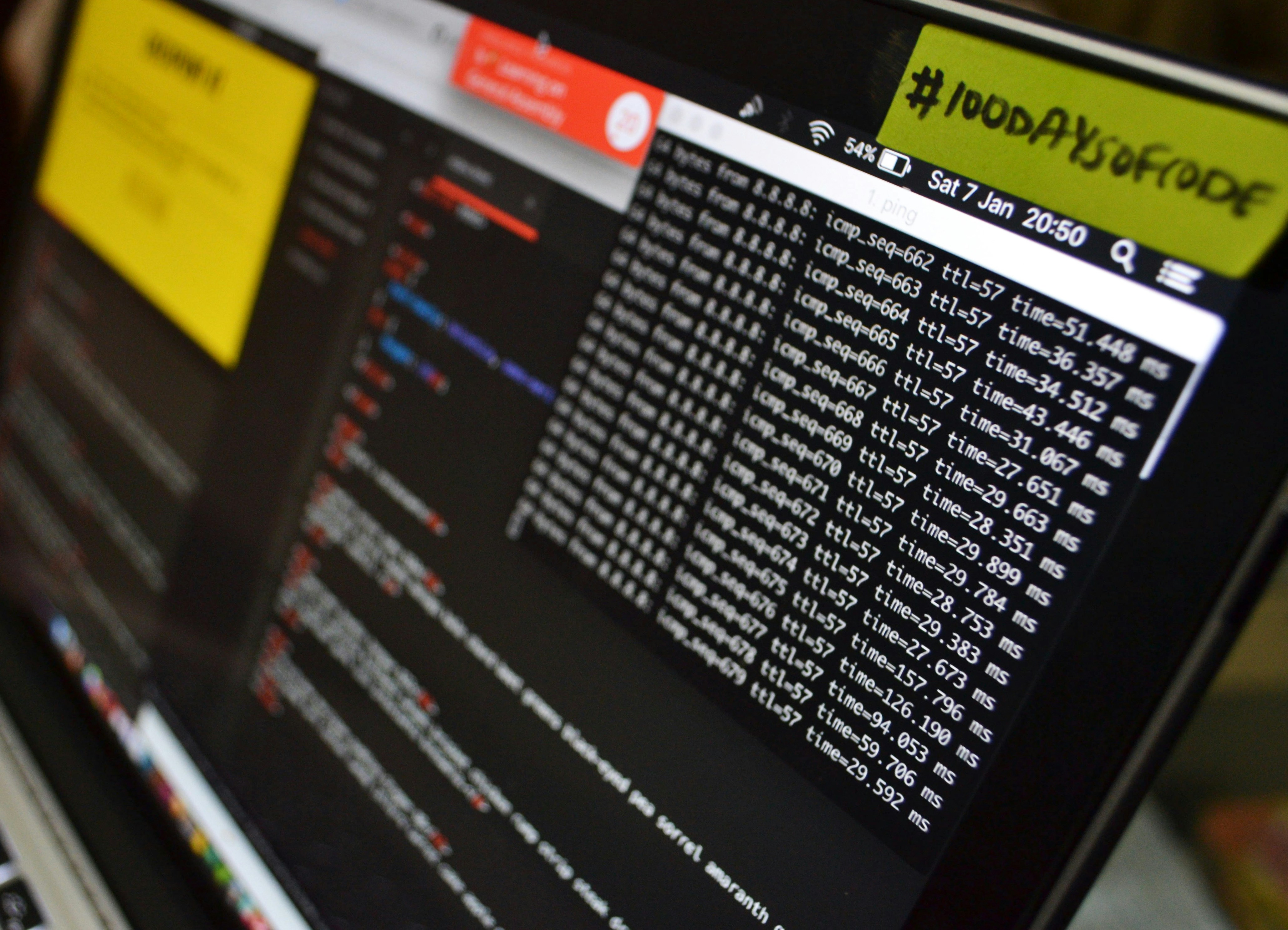

Businesses should regularly conduct penetration testing to investigate their systems' susceptibility to hacking and fraud attempts. Engaging with cybersecurity professionals can provide external insights, helping organizations better prepare for unforeseen vulnerabilities. Risk assessment will strengthen a company's defenses against fraudulent activities.

Multi-Account Management

Many platforms face challenges from individuals who create multiple accounts to take advantage of promotions or to engage in deceptive activities. Properly addressing this issue involves scrutinizing account creation processes and implementing verification steps to block fraudulent accounts before they proliferate. Effective systems can utilize algorithms that track user behavior across accounts and recognize patterns of fraud.

Identity verification protocols during registration can even deter potential fraudsters at the outset. For businesses that face a high volume of user accounts, investing in specialized software solutions designed to identify and purify suspicious accounts is financially prudent. Companies can apply different account limits based on verified user profiles to discourage deceitful behavior.

Implementing Strong User Authentication

Traditional username and password combinations are no longer sufficient to secure sensitive information and transactions. Businesses should consider adopting multi-factor authentication, which requires users to verify their identity through multiple methods before gaining access. This could include biometric verification in the form of facial recognition, fingerprint scans, and generating temporary codes sent to registered devices.

Companies need to inform users about the importance of maintaining unique passwords and recognizing phishing attempts. Regularly updating security measures and encouraging users to stay vigilant further safeguards business platforms. Thanks to advanced authentication techniques, organizations can substantially reduce unauthorized access from cybercriminals.

Monitoring and Analyzing User Activity

Ongoing monitoring of user activity can deter and deter fraudulent behavior. Businesses can implement tools that analyze patterns and identify anomalies, suggesting suspicious activity. Sudden changes in account behavior, such as multiple logins from different geographic locations or unusual transaction volumes, might indicate potential fraud.

Advanced analytics combined with artificial intelligence improves the accuracy of detection systems, and businesses can respond before significant damage occurs. Opting for a centralized dashboard can streamline the monitoring process and consolidate various data points for easier analysis. Regularly reviewing user activity logs can identify high-risk accounts, assisting in formulating strategies to prevent fraud.

Engaging Users in Fraud Prevention

Educating users on potential threats and preventative measures can fortify a business's defenses against fraud. When users understand the risks associated with their online activities, they become active participants in safeguarding their accounts. Organizations can provide guidance on identifying phishing links, using strong passwords, and monitoring their account activity regularly. Businesses should encourage users to report suspicious behavior or fraud attempts.

Clear communication regarding how the business handles security issues empowers users to take an active role in their online security. Hosting webinars or creating informative content around fraud prevention can further engage users so that they are equipped to recognize and combat fraud. Creating an informed user base is a powerful strategy in the collective fight against online fraudulent activities.

Utilizing Advanced Technology Solutions

Implementing machine learning and artificial intelligence can help analyze data patterns and predict fraudulent behaviors effectively. These intelligent systems learn from past incidents and adapt to newly emerging threats. Technology can automate workflows related to account verification and transaction monitoring, improving efficiency and accuracy while reducing the burden on human resources.

Tools focusing on real-time fraud detection can minimize risks at the moment of transaction, preventing unwanted activities before they manifest. The integration of these technologies requires ongoing assessments to guarantee their effectiveness and adaptability. By prioritizing technological integration, organizations create a robust framework to combat fraud decisively.

Compliance with Regulations and Standards

Adhering to regulatory standards and compliance requirements is necessary for businesses operating in online spaces. Organizations must understand the legal frameworks that govern data protection and user privacy. Compliance with laws such as the General Data Protection Regulation (GDPR) or California Consumer Privacy Act (CCPA) protects consumers and fortifies a company's integrity against fraud attempts.

Implementing compliance measures promotes better data handling practices, making it harder for fraudsters to exploit information. Regular audits and reviews of compliance policies will create a culture of accountability within the organization. Demonstrating strong compliance can strengthen customer trust and loyalty. Businesses that commit to compliance can create a comprehensive strategy to manage user activity ethically and safely.

Engaging Law Enforcement and Cybersecurity Experts

Collaboration with law enforcement and cybersecurity experts can elevate a business’s efforts in combating fraudulent activities. Establishing strong relationships with local authorities can enable quicker responses to fraud incidents. These partnerships can gather critical data and insights into common fraud tactics observed across different sectors.

Cybersecurity firms can provide specialized services, including threat assessments and damage mitigation strategies. Businesses can implement tailored solutions that address specific vulnerabilities. Hosting joint training or information-sharing sessions can further bolster proactive fraud prevention measures. As awareness around fraud increases, creating a network of support with relevant stakeholders will boost the resilience against fraudulent user activity.

A collective approach can deliver better outcomes for businesses working to strengthen their platforms. Understanding and addressing fraudulent user activity protects business platforms. Utilizing advanced security measures, engaging users, and promoting partnerships can create a multi-layered defense against these activities. An informed strategy will help organizations build a robust foundation that protects their interests and promotes user trust and satisfaction.

About The Author

Contact Caleb Price privately here. Or send an email with ATTN: Caleb Price as the subject to contact@investorshangout.com.

About Investors Hangout

Investors Hangout is a leading online stock forum for financial discussion and learning, offering a wide range of free tools and resources. It draws in traders of all levels, who exchange market knowledge, investigate trading tactics, and keep an eye on industry developments in real time. Featuring financial articles, stock message boards, quotes, charts, company profiles, and live news updates. Through cooperative learning and a wealth of informational resources, it helps users from novices creating their first portfolios to experts honing their techniques. Join Investors Hangout today: https://investorshangout.com/