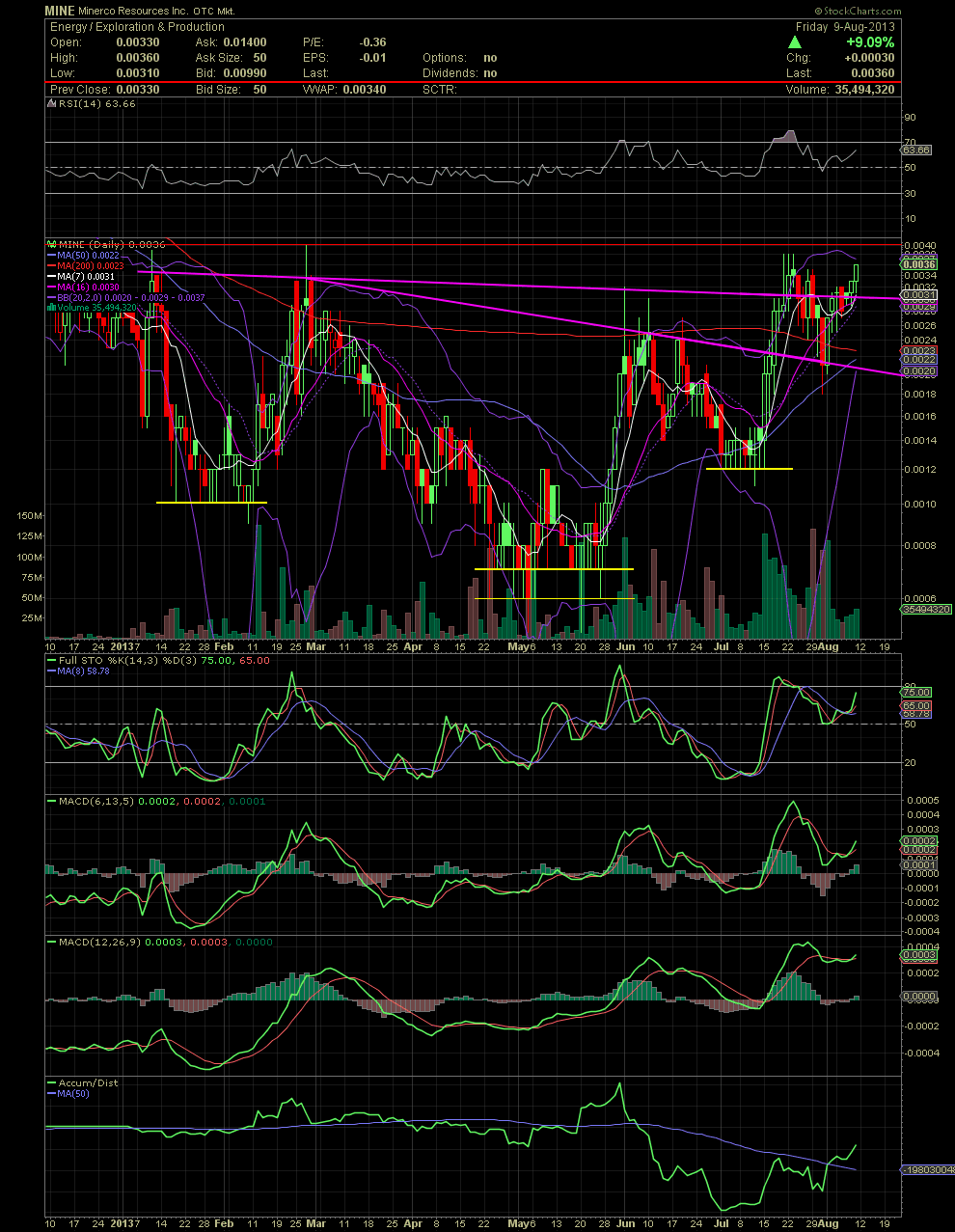

MINE Daily Chart ~ Higher Highs and Higher Lows Si

Post# of 2561

MINE has been a favorite of my for a few months now. We've been buying MINE to as low as .0006, and although it's been frustrating with the price swings, those simply holding are up almost 500% now from those lows. Once MINE has product on the shelf, informs the investing world what they are producing and selling, I would hope to see a much higher share price. As management gets closer and closer to releasing their Level 5 product line, the share price continues to trend up. The debt conversion to shares clearly took its toll on the share structure and price over the last many months. But as a startup company, the financing options aren't many. Last week, Asher's note, due on Aug 6, was paid off before that debt was converted to stock. The share price reacted favorably as no additional dilution occurred. My opinion is that MINE will easily surpass the .0038/.004 tops (red horizontal line) going back to January. The share price held onto the support of the MA50 last month and again bounced off it again last week. The Golden Cross, which many tech traders follow, will probably occur on Tuesday. So those waiting for the longer term Golden Cross event before investing will be paying a higher price. This cross may or may not bring in additional buyers, but I'm expecting .004 to be surpassed tomorrow anyway. Just as the declining tops were taken out at the .0021 and .0031 levels, I expect the same for the horizontal resistance at .004. The next levels of resistance should be .006 and .0095. You can see that on the Weekly Chart that I will post next. GLTA

(0)

(0) (0)

(0)