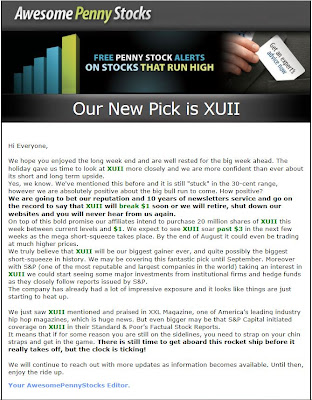

Today, Awesome Penny Stocks and its sister newsletters began sending out emails swearing up and down that their current scheme, Xumanii ( XUII ) was going to hit a dollar or they would be retiring. The newest price target is considerable lower than APS's previous guarantees of a two, three and even four dollar XUII share. You'll notice, of course, that they don't say what will happen once it does hit that buck, or to the eventual bag holders who may be buying shares at that price. It's a moot point, as shares are unlikely to ever come close to that price.

After previous emails, in which they all but called those not purchasing XUII shares "stupid", APS has now resorted to begging the public to buy its remaining shares. The pleading continues with the blatant lie that it will be buying 20 million shares out of the market up to that dollar level. In reality, the only stock APS may be buying will be to cover whatever short positions they may have. According to FINRA, as of June 14, there are 4,484,218 shares short in XUII .

For those of you who think they've seen this film before, you have.

|

Awesome Penny Stocks Retiring If XUII Doesn't Hit A Dollar

(click to enlarge)

|

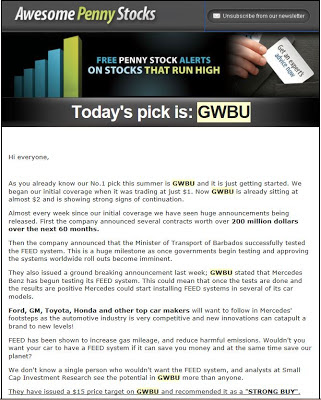

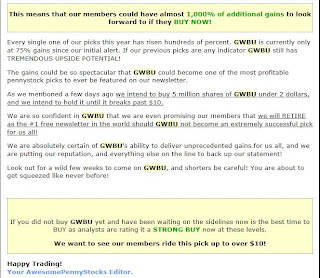

It was just over a year ago, that APS tried this same stunt with Great Wall Builders, Ltd. ( GWBU ), when they promised to retire if shares did not hit two dollars. They supported their attempts to reassure the street with the promise to buy 5 million shares up to that two buck level and that they would be holding that stock until GWBU reached ten dollars. Of course GWBU never quite made it to two bucks, is currently trading under a penny, and APS is still around without so much as an apology or explanation for reneging on that empty promise. And if you believe that they are holding onto 5 million shares of GWBU , well then you might as well consider yourself too stupid to live.

|

Awesome Penny Stocks Retiring If GWBU Doesn't Hit Two Dollars pt. 1

(click to enlarge)

|

|

Awesome Penny Stocks Retiring If GWBU Doesn't Hit Two Dollars pt. 2

(click to enlarge)

|

After the GWBU debacle, APS did go quiet for a bit, while they pretended to change ownership. What actually happened was that they scrambled to stay one step ahead of the law, by setting up new mail servers and moving them around the world, after 3rd party email service provider, iContact , cut them off for spam emailing, an accusation against APS that has once again reared its ugly head. More about that in a bit.

By September, APS was at it again with PRTN (now tickered ESSI ) and still scamming the life savings out of retirees with visions of riches.

Well it's now two months into the XUII campaign and the stock cannot seem to get out of its own way no matter what APS tries or says. Shares cannot get to the dollar level unless APS is prepared to buy every share out there and we all know that is not going to happen. Quite to the contrary, in fact. APS and its co-conspirators still have plenty of shares to unload.

This time, however, the story might be different. This time we may be actually seeing the end of the line for APS.

While everyone knew that APS was full of it with their promise to retire after the GWBU Pump & Dump, it is plausible that we could be witnessing APS' last hurrah and for two very good reasons.

SEC AND FINRA ACTIONS

The regulatory bodies are on a "too little too late" rampage the last couple of months, putting the "Whoa Nellie" on several stocks subjected to Pump & Dump schemes. Since just this past spring, the SEC and FINRA have suspended or halted trading on BOPT , BIZM , NORX , POLR and other major schemes, not after the fleecing of the public, as they usually do, but as the promotions were ongoing. The regulators have justified their actions with a variety of concerns involving the best interests of the public at large, including the improper issuance of Rule 144 shares, unconfirmed and/or inaccurate statements, and questionable promotions. Well with APS' history and clandestine existence, they must be wondering if and when their schemes will become the next matter of interest to these authorities.

GEORGE SHARP

Love him or hate him, and the only serious detractors he has are those affected by his interference in their nefarious schemes, George Sharp is having a serious effect on the pimping of the penny stock market. Just days after he announced and made a case for his litigation against Eco-Trade Corporation ( BOPT ), FINRA suspended trading in the stock. It is worth noting that Mr. Sharp has publicly stated that he doesn't believe that he had anything to do with FINRA's decision, but at a minimum, FINRA's actions give his litigation credibility. Several whistle blowers, including this newsletter, thoroughly documented both BOPT 's and its former CEO, William Lieberman's penchant for scams. Still, every Pump & Dump scheme that Mr. Sharp set his sights on, and there have been plenty, has had a struggle continuing with its ability to fleece the public.

On May 14, 2013, Sharp set his sights on APS and associate penny stock newsletter publisher Victory Mark, who is also pimping XUII , when he announced litigation for spam email violations against the newsletters' publishers and the companies they promote, including XUII . The is similar to the one that grounded siblings Wall Street Penny Stock Advisors and Stock Castle (among others) and their Pump & Dump promotions USGT , BRND , MSTG , IDOI , and EMPM . The effect of Mr. Sharp's litigation has kept those newsletters from issuing a "pick" since January.

Sharp's effort to ground APS and the XUII Pump & Dump campaign has been unlike any other of his past legal endeavors, in that he has made a concerted effort to educate the public about the trials and tribulations of investing in APS "picks". He has issued numerous press release updates to his litigation and the class action case that Xumanii initiated against him, presumably to keep his legal efforts in front if the public and ward off additional unsuspecting dupes. His website, AwesomePennyScams.com details the end result of past APS promotions, complete with charts and testimonials from past victims.

APS knows by Sharp's past activities in the legal arena, that he is likely to add any company who would become APS' next "pick" as a defendant in his litigation, as he did with Victory Mark's short-lived African Copper Corporation ( ACCS ) Pump & Dump, and that he will re-publicize his efforts and heeds of vigilance. APS' inability to significantly move XUII 's as a result of Sharp's efforts, limits the viability of their next "pick", as was the case with ACCS .

WHERE DOES IT END FOR XUII ?

APS promises that the XUII promotion will last through the summer and it's possible for it to continue for a while. The company's last quarterly financials were filed on April 30 , one day before the Pump & Dump campaign began. The next financials will be due on or about July 30, 2013 , although we fully expect a notice of late filing in order to buy the company 10 more days. So on the outside, we'll expect the financials by August 15, 2013 . APS will end its promotion of XUII sometime before that, as it will be impossible for them to explain how this "second coming of NetFlix" will still be without revenues or significant assets. Assuming that the regulators don't put an abrupt end to all of this first, expect a quick retreat of the share price into the annals of the penny market soon after that happens. And with it, we'll see a whole new slew of suckers who didn't learn from the mistakes of so many others.

|

(0)

(0) (0)

(0)

(0)

(0) (0)

(0)