Subscribers have been having fun accepting our challenge to guess which tout we are going to proclaim as the one, who day in and day out, creates the most losers with the largest losses. We eliminated Awesome Penny Stocks from contention for the title, as those scumbags are on a planet all there own.

Of the 201 guesses we received over the last two days, almost 75% guessed correctly. Which, of course, begs the question, if you all know that this guy is crap, why do you still buy his so-called "picks"? We put quotation marks around "picks" because touts do not give researched picks at all, as they have either been well compensated for their touting or have devised some other devious scheme intended to line their pockets. Much like our winner does.

Anyway, without further ado, we proclaim The Biggest Losers to be the pigeons who follow the picks of:

Darth Trader ( DailyPennyStocks.com )

aka

The Penny Stock Psycho ( PennyStockAlerts.com )

Both newsletters, are identical and written by the same guy operating as IPR Agency. We believe the publisher to be Ryan Franks of Marina Del Rey, California.

Seriously! Why would anybody buy into this guy's (we'll just call him Darth Trader) crap? Let's take a look.

We summarized all of Darth Trader's "picks" since the end of January in a Daily Trades Report we've created especially for him by gleaning the records from our popular end-of-day Pump & Dump trading summary, The Nightly , and which you can open in a new window by clicking here .

THE SET UP

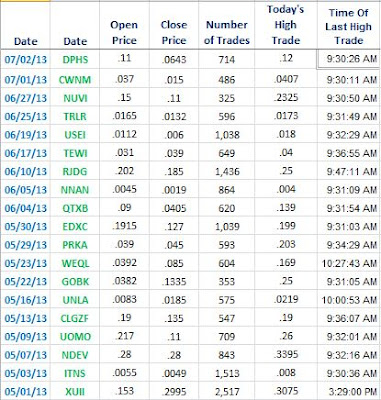

As we can see, with a few exceptions, Darth Trader's picks tend to set day highs significantly above both the opening and closing trade prices. In the chart below, we've taken a subset of Darth Trader's Daily Trades Report, to look at the open, close, and high trades of the last couple of month's worth of "picks" and added in a column to illustrate the time of day at which the last trade at the high price occurred.

|

Darth Trader/Penny Stock Psycho - Time of High Trade

|

Notice a pattern? With few exceptions, The high trade of the day occurred within a couple of minutes of the opening trade. The notable exceptions on this chart are: WEQL , which also had Research Driven Investors' nine or so newsletters touting the stock concurrently with Darth Trader and even then, the stock hit its high within an hour of the open; UNLA , for which Darth Trader's emailed newsletters began to hit Inboxes 15 minutes after the open, which is later than usual; and, XUII , which was "picked" by Darth Trader concurrently with Victory Mark (Select Penny Stocks among others) and was already correctly rumored to be Awesome Penny Stocks next pick.

Now you'll have to take us at our word that almost all of Darth Trader's picks generally follow the same pattern here, but feel free to do the work for yourself if you need further reassurance. The Daily Trades Report already provides you with the picks' symbol, date and high trade price, so all you have to do is look up the time of that high trade.

THE THEORY

So why does this happen? The popular theory by experienced penny players is that Darth Trader sets a gap and trap, whereby in the opening minutes or even seconds of the trading day, little stock is made available for sale, making it necessary for an eager beaver to gap the share price up. Darth Trader may even help this along by buying a little stock himself. By setting the bar considerably higher, suckers, participating in follow-through buying at lower prices, think that they are getting a bargain relative to the high, imagining that the share price should easily retrace its way back to the high. The theory goes on to surmise that Darth Trader then shorts the stock through partner or otherwise complicit market makers, providing an all-you-can-eat buffet to believers. Shares rarely, if ever, reach the high again, because that would likely reduce interest in further buying. It is in Darth Trader's best interest to have believers think that they are not to late to get in, which is accomplished by not letting the share price get away. Of course by the end of the day, when the day traders and then the believers capitulate, Darth Trader is free to cover his short position, probably without having to carry one overnight and certainly not for more than one night.

The theory seems plausible, as Darth Trader often discloses that his "picks" are uncompensated and that he holds no position in the stock. For these campaigns, the Pump and Dump's purpose is to create the temporary hype to present the opportunity to profit from just such an intra-day short and cover program. It even appears that he is not beyond executing this program on dead companies which are nothing more than empty shells, as in a scheme we detailed two years ago in an advisory on CapitalSouth Bancorp ( CAPB ) and another on Independent Bancshares ( IBFL ). If Darth Trader has not been compensated and does not own any stock, his disclosure could be argued to be truthful, even though in the spirit of SEC Rule 17(b), Darth Trader would be required to disclose his intent to short the stock.

THE RESULT

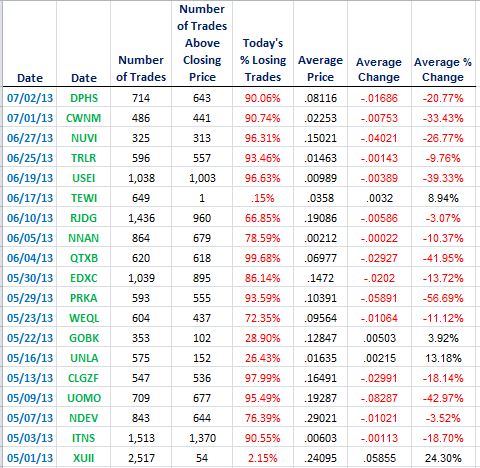

When the high trade of the day occurs so early, it should not be difficult to imagine that devious things are afoot and probably have taken place, as we see by examining this next subset of the Daily Trades Report.

|

Darth Trader/Penny Stock Psycho - Losing Trades

|

With the exception of TEWI , GOBK , UNLA and XUII , the number of losing trades, which we define as the number of trades above the closing price, is astounding. 15 of the last 19 Darth Trader "picks" all resulted in what should be an embarrassing number of losing trades of at least 66%, with ten of the "picks" at better than 90% losing trades. The average price per share paid for these stocks is considerably higher than the closing price, resulting in a significant per share percentage loss as well. These numbers remain pretty consistent throughout the rest of the "picks" listed on the Daily Trades Report. There are a few exceptions, as with those mentioned above, but then there are usually exceptions to any rule, especially in the penny stock world; and, as we pointed out earlier, XUII is an entirely different animal, having been promoted by both Victory Mark and Awesome Penny Stocks. The important thing to take out of this analysis is what you can expect more often than not, and that is that a Darth Trader "pick" will almost always create many more losers than winners, and that those losers will see a significant reduction in the value of their "investment".

Occasionally, Darth Trader will cop to a bad "pick", but only when he has no choice, such as was the case with DPHS , which had very little gap up, and in fact, practically went straight south. But at the end of the day, he generally hypes the gap up in the share price, making it seem that everybody was able to gain maximum profits. He does this out of a need to replenish his list of followers as he loses believers after every scheme.

|

(0)

(0) (0)

(0)

(0)

(0) (0)

(0)