Copper down to 2010 levels; China and record-high

Post# of 4018

Copper down to 2010 levels; China and record-high inventories to blame

Cecilia Jamasmie | June 24, 2013

Copper plunged to its the lowest level since July 2010 in New York on Monday as worries over an intensifying slowdown in China and fears over an end to the Federal Reserve’s asset purchase program weighed.

Today’s market reaction comes on the heels of investment bank Goldman Sachs’s comments, as the Wall Street lender cut its estimate for China’s gross domestic product in 2013 to 7.4% from 7.8%, due to weaker economic indicators and tightening of financial conditions.

China, the world’s largest copper consumer, accounts for almost 40% of global copper consumption, but the country’s recent and ongoing cash squeeze is worrying investors about the impact on the copper market.

New York-traded copper prices fell by as much as 3.3% earlier in the session, hitting a daily low of $2.994 a pound.

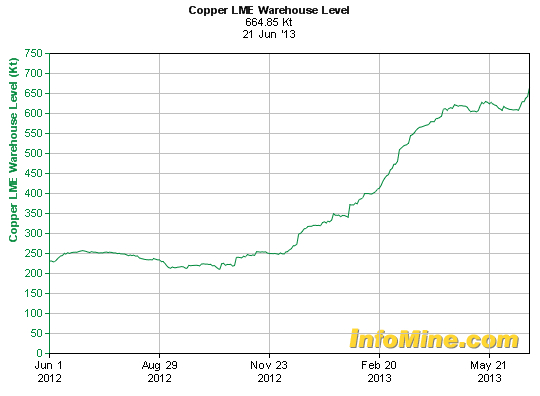

Meanwhile, copper inventories have climbed to 10-year highs, according to MetalMiner’s weekly price index.

The red metal has stayed at relatively lofty levels thanks to largely static supply in global markets for a number of years.

But a slew of new mines in Indonesia, Peru and Mongolia coming on stream and expansion at existing mines in number one producer Chile this year will result in a 6.4% jump in mine output the International Copper Study Group estimates.

In March, Australia's closely watched official forecaster also pointed to a growing surplus and a decline in prices.

The Bureau of Resources and Energy Economics predicts average copper price to decline 4% to around $7,778 a tonne in 2013 and continue to slide to reach $7,100 five year from now.

(0)

(0) (0)

(0)