1911 Gold - Operation Update July 31 .............

Post# of 1032

.jpg)

======================

Recent drill assay results

======================

1911 Gold Intersects 62.40 g/t Au over 1.00 m on San Antonio West Zone at True North

https://1911gold.com/news/press-releases/1911...true-north

1911 Gold Intersects up to 58.66 g/t Gold over 1.40 m on San Antonio West Zone at True North

https://1911gold.com/news/press-releases/1911...true-north

=================================

Current event and timeline of future events

=================================

- Drilling in the San Antonio Mine Southeast and San Antonio Mine West has completed with 51 surface drill holes for a total of 11,695.4 meters. The exploration drilling plan includes up to 30,000 meters of drilling by the end of 2025.

- Drilling in the Cohiba area is put on hold as the management is busy preparing for underground drilling which will begin in early September.

- $13.2 million financing has closed (no warrants are issued).

- Additional $3.7 million will be added to the coffer within the next 5 months from the exercising of the remaining 37 million 10-cents warrants.

- Underground drilling data will provide the basis for the Preliminary Economic Assessment (PEA) to be conducted towards the end of 2025.

- "Property Wide" new Mineral Resource Estimate (MRE) will be released in April, 2026.

- After the acquisition of mining equipment, ore mining will begin in the second half of 2026.

- Gold pouring will commence towards end of 2026, hopefully in time for Christmas.

- Shortly into the production phase Ogama-Rockland and Central Manitoba projects will join in, feeding high grade gold ores to the mill.

===========

Photo gallery

===========

360 degree view of the True North gold mine as viewed at the junction of San Antonio Street and Ross Avenue .....................................

https://www.google.ca/maps/place/Nopiming+Pro...FQAw%3D%3D

Miners at work in underground Level 16

Video Presentation on underground operation in the Truth North mine complex

https://www.youtube.com/watch?v=XOmEYouBqMU

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Corporate Presentation

https://1911gold.com/investors/presentations/

Board of Directors

https://www.1911gold.com/corporate/board-of-directors/

Financial Reports

https://1911gold.com/investors/financial-reports/

Warrants, Options, Insider Share Ownership

https://investorshangout.com/images/MYImages/...ership.jpg

Insider Trading Record

https://www.barchart.com/stocks/quotes/AUMB.V...der-trades

=================================================================

Monthly High, Low, Close, Volume, Trade Value, Market Capitalization, Short Volume

=================================================================

As of July 31, 2025

https://investorshangout.com/images/MYImages/...July31.png

===============

Technical Analysis

===============

Gold, XAU, AUMB weekly juxtaposition

https://investorshangout.com/images/MYImages/...U,AUMB.gif

Gold weekly (live chart)

https://bigcharts.marketwatch.com/advchart/fr...=2&tim

Gold MONTHLY (live chart) Gold will break above $3500 and make new historical high, heading for $4000

https://bigcharts.marketwatch.com/advchart/fr...320&si

XAU weekly (live chart)

https://bigcharts.marketwatch.com/advchart/fr...amp;size=2

XAU MONTHLY (live chart) The Mining Index will break above 225 and make new historical high into uncharted territory

https://bigcharts.marketwatch.com/advchart/fr...mp;state=8

AUMB weekly (live chart)

https://bigcharts.marketwatch.com/advchart/fr...mp;state=8

AUMB MONTHLY (live chart) AUMB will break out from the Quarterly convergence to over 40 cents

https://bigcharts.marketwatch.com/advchart/fr...mp;state=8

AUMB monthly

https://investorshangout.com/images/MYImages/...MBM4yr.gif

Rising Neckline with the Right Shoulder higher then the Left Shoulder indicates a strong bullish Head & Shoulder and vise versa.

AUMB monthly (live chart)

https://bigcharts.marketwatch.com/advchart/fr...mp;state=8

Bullish Head & Shoulder pattern - Case history

https://investorshangout.com/images/MYImages/...tterns.png

Impatient shareholders do not have unlimited shares to sell

Short sellers cannot afford to hold unlimited short positions

As the operation gets closer to production and as selling dries up while buying accelerates unlimited losses among the short sellers will incur. The longer the consolidation, the more explosive the breakout.

AUMB quarterly

https://investorshangout.com/images/MYImages/..._AUMBQ.gif

AUMB quarterly (live chart)

https://bigcharts.marketwatch.com/advchart/fr...e=320&

Future Scenario based on past characteristic

https://investorshangout.com/images/MYImages/...enario.jpg

https://investorshangout.com/images/MYImages/...ection.jpg

=================================================

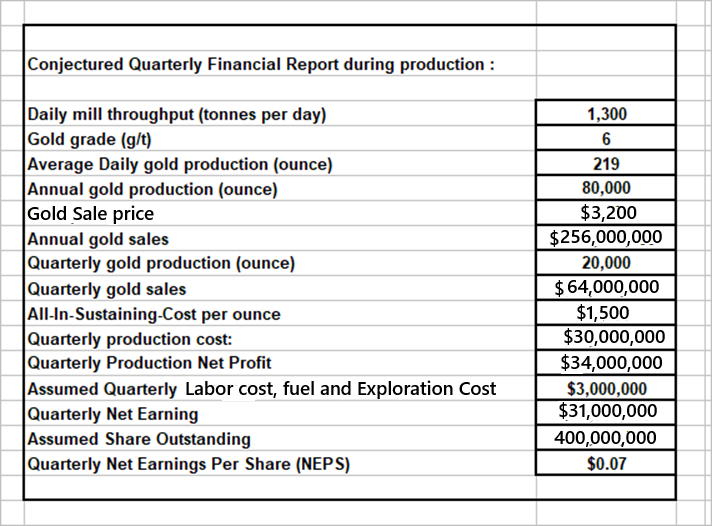

A conjectured quarterly financial report during initial production

=================================================

https://investorshangout.com/images/MYImages/...ancial.png

Future share price = P/E ratio x Earnings Per Share

About P/E ratio:

https://www.google.ca/search?q=P%2FE+ratio+fo...CwfCtLKIl-

=====================

Potential future share price

=====================

With annual production of 80,000 ounces and at gold price of US$3200, annual sales will be US$256 million. At the industry's average All-In-Sustaining-Cost (AISC) of $1500 per ounce, profit will be US$1,700 per ounce or higher as 1911 Gold is debt free and royalty free, it translates into net profit of US$3400 million (CAN$4760 million @exchange rate of 1US$=1.4 CAN$) over the 10 years of mine life, producing in excess of 2 million ounces of gold Future share price is projected to be CAN$4760 million / 400 million shares = CAN$12 per share, a 5000% return from current price of 20 cents, assuming future share outstanding at 400 million shares.

Since share price is forward looking, with consistent positive earnings, especially increasing earning, the P/E ratio can accelerate and share price could hit $12 within 5 years, long before the company's peak resource potential is achieved.

Gold price

https://bigcharts.marketwatch.com/advchart/fr...320&si

=============================

All-In-Sustaining-Cost of gold producers

=============================

https://www.mining.com/wp-content/uploads/202...31425A.gif

What is All In Sustaining Costs (AISC)

All-in Sustaining Costs (AISC) in the mining industry, particularly for gold, includes all operating costs, sustaining capital expenditures, and other costs associated with maintaining current production. This includes cash costs, sustaining capital expenditures, general and administrative (G&A) expenses, and environmental and closure costs.

Breakdown on AISC:

Cash Costs:

These are the direct costs of mining and processing, including labor, energy, consumables, and royalties (net of by-product credits).

Sustaining Capital Expenditures:

These are investments required to maintain current production levels, such as equipment replacement, mine development, and other costs to keep the mine operating at its current capacity.

General and Administrative (G&A) Expenses:

These are the costs associated with running the corporate office and other administrative functions that support the mine's operations.

Environmental and Closure Costs:

These include costs related to environmental remediation and mine closure, such as reclamation and decommissioning.

Exploration Expenses (Sustaining):

These are exploration costs that are needed to maintain current production levels and replace depleted resources.

AISC is a comprehensive metric designed to provide a more complete picture of the total cost of mining an ounce of gold, beyond just the direct cash costs.

=====================================

1911 Gold - Net Asset Value per Share (NAVPS)

=====================================

The ore processing mill with a replacement value of $300 million + 2 million ounces of gold resource at minimum Enterprise Value of $50 per ounce contributes to the company's NAVPS of US$1.60 per share (CAN$2.20) at fully diluted basis.

1911 Gold had generated cashflow from historic tailings, producing between 5,000 and 5,500 ounces of gold annually to support the exploration effort and to maintain the existing facilities.

.jpg)

https://investorshangout.com/images/MYImages/...arged).jpg

==========================

Potential return on investment

==========================

Junior Mining companies that billionaire Eric Sprott invests in:

https://www.juniorminingnetwork.com/mining-st...prott.html

At share price of $12, billionaire Eric Sprott's holding of 42 million shares will return him $1/2 Billion. Also Director Blair Schultz and CEO Shaun Heinrichs will be $54 million and $46 million richer respectively. 1911 Gold will also create many millionaires / multi-millionaires among other patient long term shareholders. Even for small retail investors, a $20K investment could buy them a million dollar house or condo within 5 years, no more stress from the never ending rent increase amid the inevitable global hyperinflation as predicted by rising gold price towards $60K or $100K. Bitcoin, which has no gold content, no monetary value and is backed by no government already priced in excess of $100K, why should gold, which is recognized as the Real Money around the world, be more inferior?

=======================

1911 Gold - Operation goal

=======================

1911 Gold's primary operational goal is to restart the high-grade True North gold mine in Manitoba, with current plans for a late 2026 restart. This timeline could be expedited if market conditions and exploration results are favorable. The company also aims to expand the gold resource potential at True North and build a multi-million ounce gold camp at the site.

True North Mine Restart:

1911 Gold is actively working towards restarting the True North mine, which has a history of high-grade gold production.

2026 Timeline:

The current plan is to have the mine operational by late 2026, but the company is flexible and could accelerate this timeline.

Resource Expansion:

A key part of their strategy is to aggressively grow the gold resource at True North through drilling programs and exploration of new targets both within and outside the mine lease area.

District-Scale Potential:

1911 Gold owns a large land package of 630 square kilometers in the Rice Lake greenstone belt and aims to develop a mining district centered around the True North complex, including exploration of the Ogama-Rockland resource.

Long-Term Strategy:

The company is focused on building a multi-million ounce, high-grade gold camp at True North, leveraging its existing infrastructure and exploring new targets.

Sustainable Operations:

1911 Gold is committed to sustainable mining practices, minimizing environmental impact, and working with local communities.

====================================

1911 Gold - Operation strategy and timeline

====================================

https://investorshangout.com/images/MYImages/...rategy.png

With the closed over-subscribed $13.2 million Flow-Through equity financing (no warrants issued) plus the $3.7 million from the exercising of the remaining 10-cents warrants expiring on Dec 22, 2025, there will be $17 million in the coffer, it will be sufficient to last till the Test Mining stage which will occur in early 2026.

End of 2025 - Preliminary Economic Assessment (PEA)

First half of 2026 - Test Mining (bulk sampling)

Second half of 2026 - Acquisition of mining equipment to replenish the $40 million worth of mining equipment that Paul Huet of Klondex took away. I assume that the fund will be obtained from $60 million equity financing at share price over 60 cents or from debt financing which can be paid off within 6 months of gold production as I reckon the annual net profit will be CAN$136 million or quarterly net profit of CAN$34 million.

Production begins. Shaun Heinrichs reckons that the company can produce 80,000 ounces of gold annually at ore throughput of 1,300 tonnes per day, ramping up to 150,000 ounces annually within 5 years at throughput of 3,000 tonnes per day.

The management pledged to grow the company organically. Shaun Heinrichs said during the production phase, the company will be stepping out of the regional footprint for accretive acquisition in North America.

==================================================

Government extending support for mineral exploration in Canada

==================================================

https://www.canada.ca/en/department-finance/n...anada.html

(0)

(0) (0)

(0)