1911 Gold - Operation Update July 18 .............

Post# of 1032

1911 Gold Closes C$13.2 Million “Bought Deal” Life Offering Including Increased Investment by Eric Sprott

https://1911gold.com/news/press-releases/1911...ric-sprott

Highlights:

Eric Sprott, through 2176423 Ontario Ltd., a corporation beneficially owned by him, acquired 9,288,734 common shares pursuant to the Offering for total consideration of $1,857,746.80. Prior to the Offering, Mr. Sprott beneficially owned or controlled 33,333,334 common shares of the Company representing approximately 16.7% on a non-diluted basis. As a result of the Offering, Mr. Sprott now beneficially owns or controls 42,622,068 common shares representing approximately 17.2% on a non-diluted basis. The securities are held for investment purposes.

Summary of the Flow-Through equity financing (no warrants issued)

3,750,000 shares at 20 cents per share

2,924,000 shares at 34.2 cents per share

31,163,633 shares at 28.8 cents per share

10,163,000 shares at 24.6 cents per shares

================================

Total 48,000,633 shares at average 27.55 cents per share

Previous Share Outstanding: 199,087,519

Updated Share Outstanding: 247,088,152

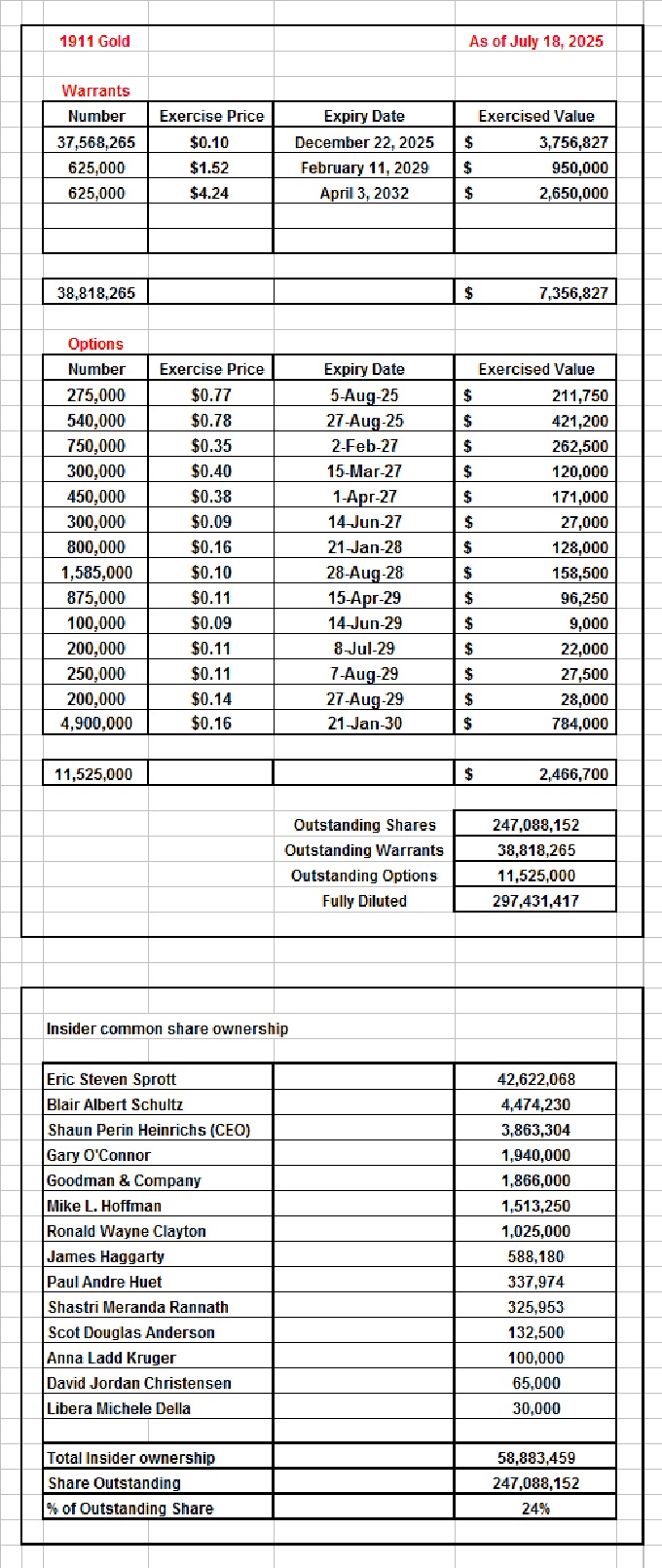

Warrants, Options and Insider Ownership

https://investorshangout.com/images/MYImages/...ership.jpg

Insider trading record

https://www.barchart.com/stocks/quotes/AUMB.V...der-trades

=================================================================

Monthly High, Low, Close, Volume, Trade Value, Market Capitalization, Short Volume

=================================================================

As of July 18, 2025

https://investorshangout.com/images/MYImages/...July18.png

================

Technical Analysis

================

Gold, XAU, AUMB weekly juxtaposition

https://investorshangout.com/images/MYImages/...U,AUMB.gif

AUMB quarterly

https://investorshangout.com/images/MYImages/..._AUMBQ.gif

AUMB quarterly (live chart)

https://bigcharts.marketwatch.com/advchart/fr...e=320&

===============

Vision for the future

===============

Operation Schedule

https://investorshangout.com/images/MYImages/...rategy.png

CEO Shaun Heinrichs reckons that the company can produce 80,000 ounces of gold annually at ore throughput rate of 1,300 tonnes per day, ramping up to 150,000 ounces annually within 5 years at throughput rate of 3,000 tonnes per day. By this time next year there will be significant gold resources delineated.

Source of information (16 minutes towards end of the video)

1911 Gold in the March 27, 2025 GCFF Virtual Conference sponsored by NAI Interactive Ltd.

https://www.youtube.com/watch?v=LM0rIsEQtkE&t=312s

Gold price

https://bigcharts.marketwatch.com/advchart/fr...320&si

With annual production of 80,000 ounces and at gold price of US$3200, annual sales will be US$256 million. At the industry's average All-In-Sustaining-Cost (AISC) of $1500 per ounce, profit will be US$1,700 per ounce or higher as 1911 Gold is debt free and royalty free, it translates into net profit of US$3400 million (CAN$4760 million @exchange rate of 1US$=1.4 CAN$) over the 10 years of mine life, producing in excess of 2 million ounces of gold. Future share price is projected to be CAN$4760 million / 400 million shares = CAN$12 per share, a 5000% return from current price of 20 cents, assuming future share outstanding at 400 million shares. At share price of $12, Eric Sprott's holding of 42 million shares will return him $1/2 Billion.

Junior Mining companies that billionaire Eric Sprott invests in:

https://www.juniorminingnetwork.com/mining-st...prott.html

Mining Companies operating in Manitoba

https://www.juniorminingnetwork.com/mining-st...tocks.html

Market Cap of 1911 Gold is moving up the ladder from $8 million in early 2024 to $44 million towards the $1 billion mark within 2 years among mining companies operating in Manitoba.

There will be $3.7 million cash added to the company's coffer in the second half of 2025 from the exercising of the remaining 37 million 10-cents warrants with expiry date of December 22. Shaun Heinrichs said the total $17 million working capital will be sufficient to complete the drilling program, Feasibility Study and Pre-Economic Assessment (PEA), leading to the exciting Test Mining stage prior to gold production. Shaun Heinrichs said the company needs around $40 million to replenish the mining equipment that Paul Huet of Klondex took away in 2018 to enhance its $462 million buyout by Hecla Mining. So after another financing at over 60 cents and the acquisition of the mining equipment the company will be ready to mine the ores and start gold production. Fully diluted share is expected to be about 400 million shares.

All-In-Sustaining-Cost of gold producers

https://www.mining.com/wp-content/uploads/202...31425A.gif

What is All In Sustaining Costs (AISC)

All-in Sustaining Costs (AISC) in the mining industry, particularly for gold, includes all operating costs, sustaining capital expenditures, and other costs associated with maintaining current production. This includes cash costs, sustaining capital expenditures, general and administrative (G&A) expenses, and environmental and closure costs.

Breakdown on AISC:

Cash Costs:

These are the direct costs of mining and processing, including labor, energy, consumables, and royalties (net of by-product credits).

Sustaining Capital Expenditures:

These are investments required to maintain current production levels, such as equipment replacement, mine development, and other costs to keep the mine operating at its current capacity.

General and Administrative (G&A) Expenses:

These are the costs associated with running the corporate office and other administrative functions that support the mine's operations.

Environmental and Closure Costs:

These include costs related to environmental remediation and mine closure, such as reclamation and decommissioning.

Exploration Expenses (Sustaining):

These are exploration costs that are needed to maintain current production levels and replace depleted resources.

AISC is a comprehensive metric designed to provide a more complete picture of the total cost of mining an ounce of gold, beyond just the direct cash costs.

Government extending support for mineral exploration in Canada

https://www.canada.ca/en/department-finance/n...anada.html

In my opinion, as the company grows with accretive earnings and as the name 1911 Gold becomes ubiquitous in the mining community, this rising young star will graduate to the main board of TSX and its stock will be chosen as a component of the mining index XAU amid ageing senior gold producers. The company will be recognized for its success in achieving accretive earnings, in creating jobs and in enriching the wealth of Canada as statistics shows the likelihood of a discovery leading to a mine being developed is very low, less than 0.1% of prospected sites will lead to a productive mine.

https://www.gold.org/gold-supply/gold-mining-...ive%20mine.

=====================================

1911 Gold - Net Asset Value per Share (NAVPS)

=====================================

The ore processing mill with a replacement value of $300 million + 2 million ounces of gold resource at minimum Enterprise Value of $50 per ounce contributes to the company's NAVPS of US$1.60 per share (CAN$2.20) at fully diluted basis.

1911 Gold had generated cashflow from historic tailings, producing between 5,000 and 5,500 ounces of gold annually to support the exploration effort and to maintain the existing facilities.

.jpg)

https://investorshangout.com/images/MYImages/...arged).jpg

All information on 1911 Gold:

https://investorshangout.com/1911-Gold-Corp-AUMBF-94051/

(0)

(0) (0)

(0)