Introduction to Aben Resources .................

Post# of 1088

Introduction to Aben Resources ..................................................................

Aben Resources Ltd. is a publicly traded Canadian GOLD exploration company with significant projects in BRITISH COLUMBIA and the YUKON TERRITORY.

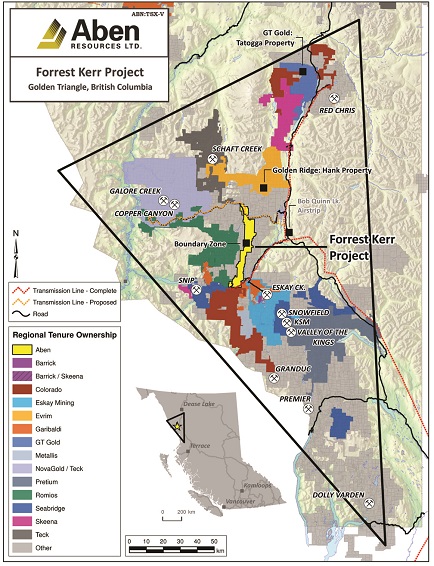

The Company's 100% owned flagship 23,000 hectares FORREST KERR GOLD PROJECT is located in the heart of a region called the GOLDEN TRIANGLE in northwestern British Columbia. This region has hosted significant mineral deposits including: Pretium (Brucejack), Eskay Creek, Snip, Galore Creek, Copper Canyon, Schaft Creek, KSM, Granduc, Red Chris and more.

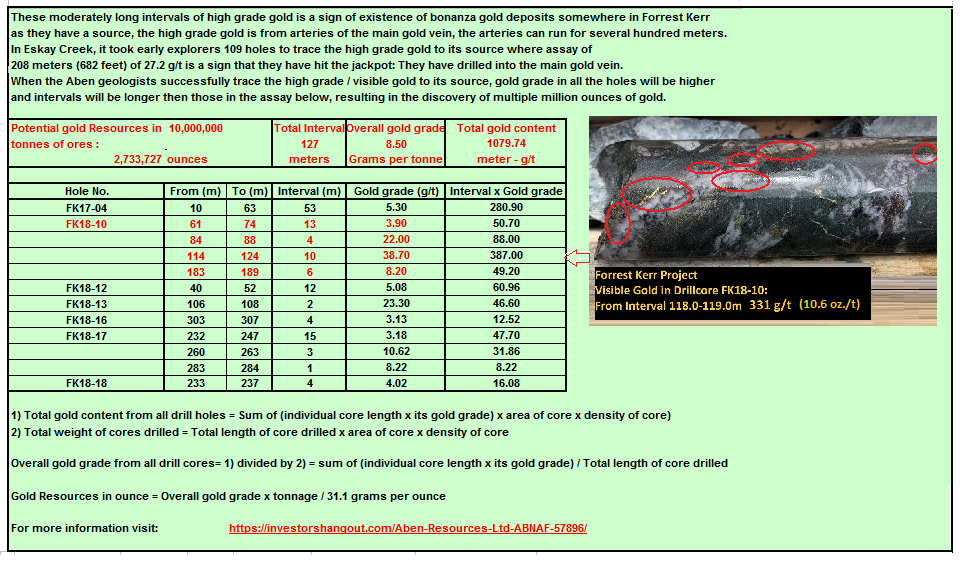

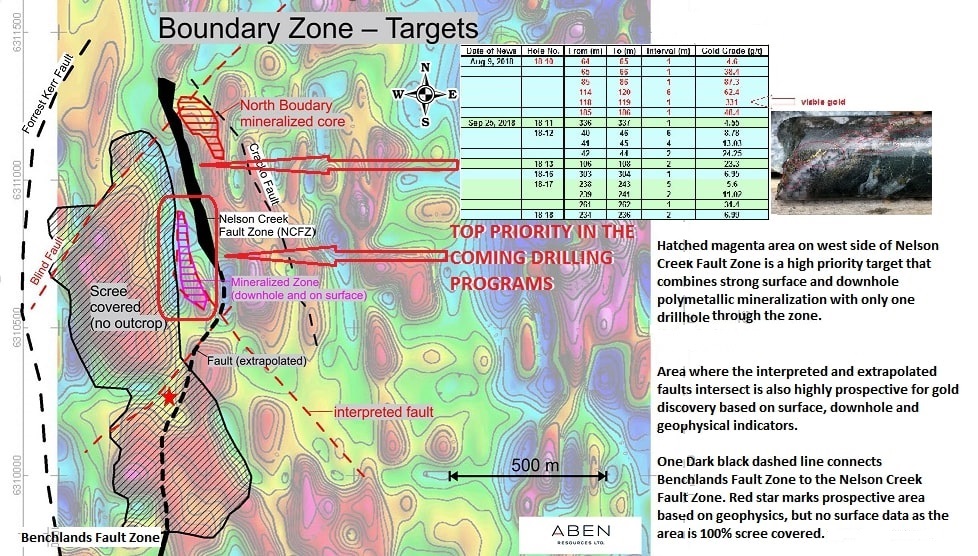

The first drill hole of 2018 at the Forrest Kerr Project discovered multiple high-grade zones including 62.4 g/t Gold over 6.0 meters within 38.7 g/t Gold over 10.0 meters starting at 114 meters downhole at the North Boundary Zone.

Aben also holds a 100% interest in the 7,411 hectares JUSTIN GOLD PROJECT located in the southeast Yukon. The Justin property is located on the Tintina Gold Belt to the immediate southeast of Golden Predator's 3 Aces gold project. Previous drilling by Aben intercepted 60 meters of 1.19 g/t Gold including 21 meters of 2.47 g/t Gold in the POW Zone. The geochemical signature of the mineralized zone is characterized by elevated Au, Bi, Cu, Mo and W supporting an Intrusion Related Gold System (IRGS).

Recent exploration at the Justin Project discovered the Lost Ace Zone located within 2 km of the POW Zone and bears striking similarities to Golden Predators adjacent 3 Aces project. 2018 trenching at the Lost Ace Zone returned values ranging from trace to 20.8 g/t Gold over 4.4 meters including 88.2 g/t Gold over 1.0 meter. Lost Ace is interpreted to be orogenic-style quartz-gold veins pointing towards the existence of a multi-phase hydrothermal system with the potential for overprinting mineralizing with the POW Zone.

===============

Stock Information

===============

Share Outstanding: 128 million

Ticker Symbols:

TSX Venture, Canada: ABN.V

United States of America: OTCQB Market: ABNAF

Frankfurt Exchange, Germany: E2L2

============================================

Level 2: Daily High, Low, Last Trade, Volume, Bid, Ask

============================================

Vancouver Venture Exchange: ABN.V

http://www.stockwatch.com/Quote/Detail.aspx?s...p;region=C

U.S. OTCQB: ABNAF

https://www.otcmarkets.com/stock/ABNAF/quote

===============================

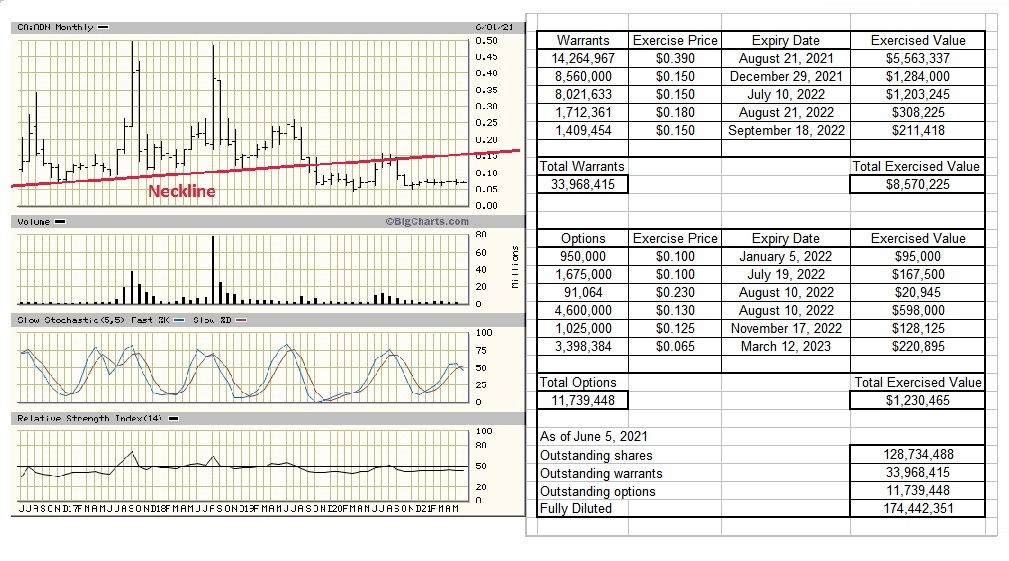

Outstanding Shares, Warrants, Options

===============================

Click for enlarge view

https://investorshangout.com/images/MYImages/...ptions.jpg

=======================================

Financial filing and official company news release

=======================================

https://sedar.com/DisplayCompanyDocuments.do?...o=00005652

====================================

Company website and Corporate Presentation

====================================

https://www.abenresources.com/

========================================================

Video presentation - Golden Triangle and Forrest Kerr mining property

========================================================

Introduction to The Golden Triangle of British Columbia

https://www.youtube.com/watch?v=rBY6t3FHu7I

Overview of Aben's Forrest Kerr property

https://www.youtube.com/watch?v=egG5OWpTq0s

Aben Resources - gold contents in drill cores

https://www.youtube.com/watch?v=rUuDeaYt5ew

Gold resources in Aben's neighbors

https://www.youtube.com/watch?v=eQpWgPJKln0

=========================

Mining properties Information

=========================

Justin Property, Yukon

https://www.abenresources.com/projects/justin/

Flagship Forrest Kerr property in the Golden Triangle of British Columbia

Forrest Kerr property covers 23,397 hectares or 234 square Km (6.1 Km x 38.3 Km)

=====================================

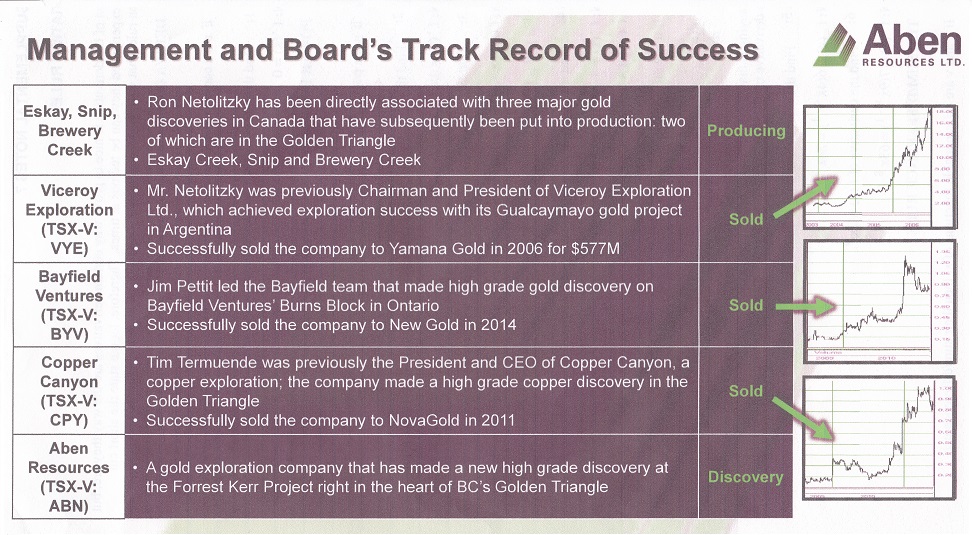

Track record of past and current explorations

=====================================

Forrest Kerr is a pristine territory with many unexplored area, Aben will likely encounter Measured and Indicated Resources leading to Proven and Probable Reserves. Gold producers are eagerly looking for properties with Proven Reserves to replenish their dwindling mineral reserves, when bonanza gold deposits are discovered in Forrest Kerr the company will be sold for $$ a share.

5 gold/copper mines (Eskay Creek mine, Snip mine, Burns Block mine and Copper Canyon mine in the Golden Triangle, Gualcamay mine in Argentina) were discovered by the 3 experienced, subtle and strategic geologists affiliated with Aben Resources with the corresponding companies sold to other mining companies.

Click for enlarged view

https://investorshangout.com/images/MYImages/...essold.jpg

CEO James Pettit sold Bayfield Ventures to New Gold Inc.

https://m.marketscreener.com/quote/stock/BAYF...-19365314/

Geologists:

Ron Netolitzky

https://www.mininghalloffame.ca/ronald-k-netolitzky

Tim J. Termuende, P. Geo, Preseident & CEO of Eagle Plains Resources

Tim is a professional geologist with over 35 years’ experience in the mineral exploration industry. Since leaving Cominco in the late 1980’s, Tim has worked on exploration projects throughout North and South America and currently oversees a broad range of projects targeting various commodities throughout British Columbia, Saskatchewan, Yukon and Northwest Territories. He has been involved with numerous publicly-traded corporations since 1994, including Copper Canyon Resources Ltd., which was acquired by NovaGold in 2011 for approximately $65M.

https://www.eagleplains.com/sites/default/fil...k=t2-IWDGx

Timothy Termuende sold Copper Canyon Resources to NovaGold Resources

https://www.northernminer.com/news/copper-can...000404723/

Cornell McDowell P. Geo, V.P. of Exploration

Interview with Aben VP Exploration Cornell McDowell at Forrest Kerr, Golden Triangle, BC, Gold Project

https://www.facebook.com/abenresources/videos...392516340/

======================================================

Historical news of buyout in the Golden Triangle of British Columbia

======================================================

Imperial Completes Acquisition of Minority Interests in American Bullion Minerals at $2.45 a share

https://www.imperialmetals.com/for-our-shareh...an-bullion

Newmont to Acquire GT Gold for C$456 million ($3.25 a share) on a fully diluted basis

https://www.gtgoldcorp.ca/_resources/news/nr_2021_03_10.pdf

Historical share price of GT Gold ( It could be Aben Resources's "Vision For The Future" ! )

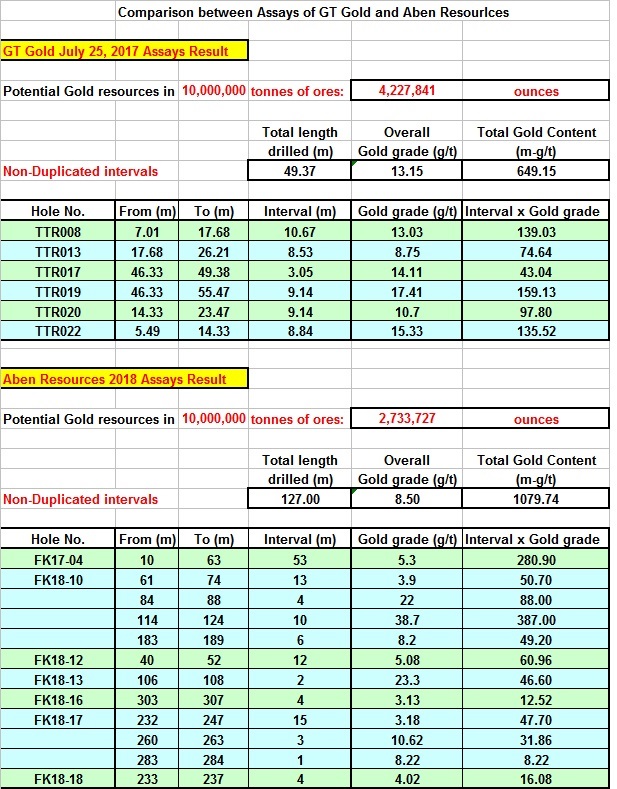

Assays comparison between GT Gold and Aben Resources (gold resources estimate is for reference only and should be less as the total lengths of drill core are unknown)

==================================

Aben Resources - Potential gold resources

==================================

The significance of long intervals of consistent low grade gold

https://investorshangout.com/images/MYImages/...degold.jpg

Aben Resources's assays and potential gold resource

Click for enlarged view

https://investorshangout.com/images/MYImages/...ential.png

=============================================

Media commentary and interview with CEO James Pettit

=============================================

Equity.Guru video: Aben Resources' (ABN.V) golden triangle opportunity explained by Fabiana Lara

https://www.youtube.com/watch?v=-Mj2R4jvb0A

2018 - Silver and Gold Summit - High grade gold and copper discovery in Forrest Kerr

https://cambridgehouse.com/video/8213/highgra...ources-ltd

2019 - Massive gold nuggets found in outcrop of Aben's Justin property in Yukon

https://www.youtube.com/watch?v=13goOuptl_w

2020 - CEO James Pettit's update on the company's exploration and drilling in Forrest Kerr

https://www.facebook.com/abenresources/videos...326774690/

=============

Media Coverage

=============

The Resource Maven on Aben Resources

http://www.321gold.com/editorials/preston/preston111418.html

https://miningfeeds.com/2018/11/07/aben-resou...le-winner/

https://investingnews.com/company-profiles/ab...-triangle/

http://energyandgold.com/2018/05/08/aben-reso...-triangle/

https://www.investorideas.com/news/2019/main/...ources.asp

=============================

Aben Resources in the social media

=============================

https://ca.linkedin.com/company/aben-resources-tsx-v-abn-

https://twitter.com/Aben_ABN/

======================

Insider Trading Information

======================

Canadian Insider

https://www.canadianinsider.com/company?ticker=ABN

==================================================================

Aben Resources - The potential of bonanza precious metal and base metal discovery

==================================================================

Great Bear Resources's long intervals of high grade gold is contributed by bonanza gold deposits along the LP fault zone in its Dixie property in Red Lake, Ontario.

https://greatbearresources.ca/news/great-bear...-step-out/

GBR.V weekly chart

https://stockcharts.com/h-sc/ui?s=GBR.V&p...5415822585

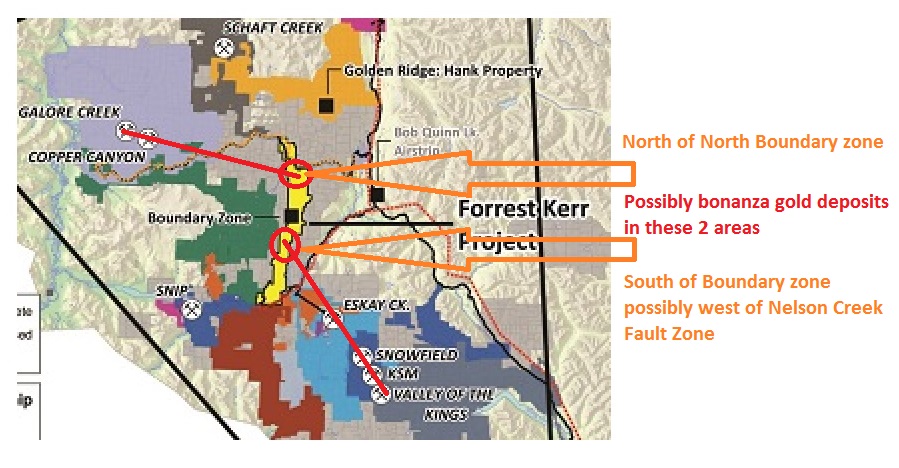

What do Aben Resources and Great Bear Resources have in common? They both have fault lines in their property where most of massive gold deposits are found. Aben has even longer fault lines which traverse the entire property of Forrest Kerr in the North-South direction. CEO James Pettit likes Forrest Kerr because of presence of the fault lines. The moderately long intervals of high grade gold in the North Boundary Zone is a sign of existence of bonanza gold deposits somewhere in Forrest Kerr. Being in between the Eskay Creek mine and Snip mine, the prospect of bonanza gold deposits in Forrest Kerr is very promising due to similar geology in the area. Constructive share price chart pattern stands out among its peers, reflecting investors' strong confidence in the company's bonanza gold discovery as some experienced investors are super keen in their clairvoyance, they believe bonanza gold deposits are there just as in the neighboring mines, it is only a matter of time the geologists will find them. North Boundary zone hosts high grade gold while the South Boundary zone hosts massive tonnage of low grade gold, so potential long intervals of high grade gold does exist as the geology of Forrest Kerr is similar to that of Eskay Creek Mine 30 Km to the southeast.

A famous idiom states that Rome is not built in one day, it took early explorers in Eskay Creek 50 years to trace the sporadic high grade gold to its source - a massive gold vein. Backward mining technology and arduous exploration conditions due to lack of basic infrastructure like roads and power line culminated hiatus in exploration leading to lengthy period of discovery.

History of Eskay Creek mine, the world's massive high grade gold mine

In 1932 a prospector named Tom Mackay of Consolidated Stikine Resources was the first to recognize the area's unique geological setting after spotting an alluring rock outcrop from his single-engine bush plane. After staking the property he discovered a boulder broken free from its source higher up on the mountain, rolling several dozen meters downslope, assays from the boulder returned a spectacular five ounces of gold per tonne. Mackay explored the property for over 50 years but bonanza gold deposit was never found. In 1988 after investing in Consolidated Stikine Resources which held rights to Eskay Creek, geologist Ron Netolitzky became Stikine’s technical person and one of five controlling shareholders. He teamed up with Murray Pezim of Calpine Resources to raise $900,000 for a drill program and started exploring the area in the summer of 1990. After drilling 108 holes and with momentum building, they hit a fault. Chet Idziszek, Pezim’s geologist with a M.Sc. degree from McGill University observed gradually increasing gold grade and increasing interval length in the assays, he had an intuition that he must be very close to the main gold vein, he studied the maps and analysed the terrain then he ragged the drill rig to a spot 350 meters from the last hole drilled and drilled hole #109. Bingo, assays from hole 109 returned spectacular 27.2 g/t gold, 30.2 g/t silver over 208 meters (682 feet). In 1994 Eskay Creek went into production that lasted 14 years, finally ended in 2008. Eskay Creek had the highest grade gold on the planet and produced 3.3 million ounces of gold at a breathtaking 45 g/t Au, also 160 million ounces of silver at 2,224 g/t. Stikine Resources was acquired by Placer Dome and International Corona for $67 per share. Ron Netolitzky has had a very successful career in mining and mineral exploration with decades of experience and having been directly associated with three major mineral discoveries in Canada that have subsequently been put into production: Eskay Creek, Snip and Brewery Creek. Ron Netolitzky was inducted into the Canadian Mining Hall of Fame in 2014.

Several gold mines lining up in the Eskay Creek area because fault line occurs in a straight line underground and can run for hundreds or thousands of meters. Corroborated by James Pettit's encouraging intuition that the area west of the Nelson Creek Fault Zone and the area north of the North Boundary Zone are top priority drilling targets, possible locations of bonanza gold deposits in Forrest Kerr through extrapolation is as follow:

For enlarged view

https://investorshangout.com/images/MYImages/...posits.jpg

======================================

Drilling targets in the coming drilling programs

======================================

Page 17 of Presentation

Click for enlarged view

https://investorshangout.com/images/MYImages/...argets.jpg

==================

Outlook for gold price

==================

https://youtu.be/d0ZBpZV4EIs

https://www.youtube.com/watch?v=l8RauDwklyY

====================================

Outlook for commodities prices and inflation

====================================

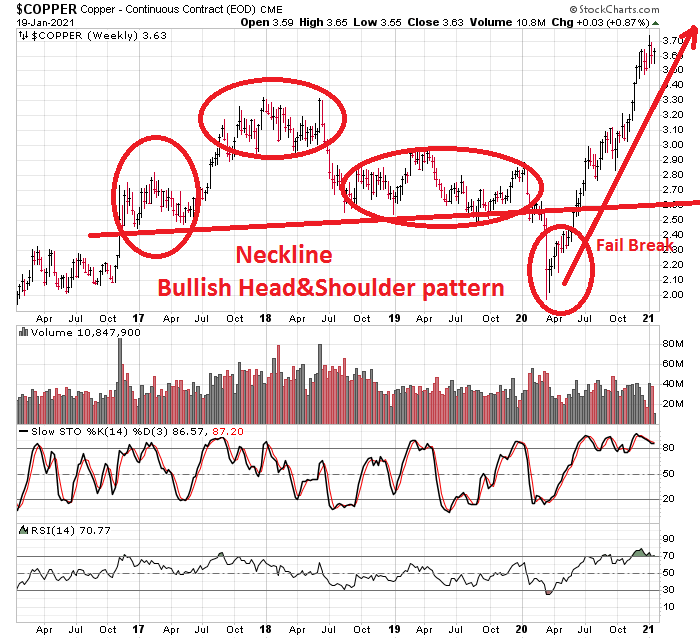

Continuous economic stimulus and weak US Dollar are needed amid weak economic growth. Strong bond prices reflects that interest rate will remain low. The US Dollar Index will likely decline to level 80 in the coming months followed by a side way consolidation. Gold and mining stocks will strive as the economy improves with rising inflation expectation.

Technically US Dollar Index has peaked out at 104, it is in a long term down trend towards level 80, commodities prices are rising as they are inversely related to the strength of U.S. Dollar

https://bigcharts.marketwatch.com/advchart/fr...&indic

Organization for Economic Co-operation and Development - Inflation forecast 2021 - 2022

https://data.oecd.org/price/inflation-forecast.htm

Goldman Sach - The outlook for commodities bull market in 2021

https://www.youtube.com/watch?v=y9yuyAAn5Dc

Potential supercycle bodes well for precious metals in 2021, says analyst

https://www.cnbc.com/video/2020/12/18/potenti...alyst.html

Economic boom in China will lead to another commodities supercycle similar to that between the year 2000 to 2008.

https://www.theguardian.com/business/2021/jan...supercycle

Here's Why Commodities are Worth Investing in Right Now

https://www.nasdaq.com/articles/heres-why-com...2021-01-19

Scotiabank’s Marc Desormeaux looks at 2021 and the continuing impact of Covid-19 on metals markets

https://www.northernminer.com/commodities-mar...003825843/

==================

Global Economic Data

==================

US annual inflation

https://tradingeconomics.com/united-states/inflation-cpi

Canada annual inflation

https://tradingeconomics.com/canada/inflation-cpi

China annual inflation

https://tradingeconomics.com/china/inflation-cpi

Germany annual inflation

https://tradingeconomics.com/germany/inflation-cpi

France annual inflation

https://tradingeconomics.com/france/inflation-cpi

UK annual inflation

https://tradingeconomics.com/united-kingdom/inflation-cpi

Brazil annual inflation

https://tradingeconomics.com/brazil/inflation-cpi

Russia annual inflation

https://tradingeconomics.com/russia/inflation-cpi

India annual inflation

https://tradingeconomics.com/india/inflation-cpi

South Africa annual inflation

https://tradingeconomics.com/south-africa/inflation-cpi

==============

M1 money supply

==============

US (currently at 18.6 trillion US Dollar)

https://d3fy651gv2fhd3.cloudfront.net/charts/...1=19210323

https://tradingeconomics.com/united-states/money-supply-m1

CANADA (currently at 1.4 trillion Canadian Dollar)

https://d3fy651gv2fhd3.cloudfront.net/charts/...1=19210323

CHINA (currently at 60 trillion Yuan)

https://d3fy651gv2fhd3.cloudfront.net/charts/...1=19210323

Germany (currently at 2.6 trillion Euro)

https://d3fy651gv2fhd3.cloudfront.net/charts/...1=19210323

France (currently at 1.7 trillion Euro)

https://d3fy651gv2fhd3.cloudfront.net/charts/...1=19210323

UK (currently at 2.1 trillion Pound Sterling - GBP)

https://d3fy651gv2fhd3.cloudfront.net/charts/...1=19210323

BRAZIL (currently at 580 billion Brazilian Real - BRL)

https://d3fy651gv2fhd3.cloudfront.net/charts/...1=19210323

Russia (currently at 31 trillion Russian Ruble - RUB)

https://d3fy651gv2fhd3.cloudfront.net/charts/...1=19210323

INDIA (currently at 43 trillion Indian Rupee - INR)

https://d3fy651gv2fhd3.cloudfront.net/charts/...1=19210323

South Africa (currently at 2.1 trillion South Africa Rand - ZAR)

https://d3fy651gv2fhd3.cloudfront.net/charts/...1=19210323

===============

Commodity Prices

===============

Lumber price

https://mrci.com/pdf/lb.pdf

Soybean

https://mrci.com/pdf/s.pdf

Soybean Oil

https://www.mrci.com/pdf/bo.pdf

Soybean meal

https://www.mrci.com/pdf/sm.pdf

Corn

https://www.mrci.com/pdf/c.pdf

Canola

https://www.mrci.com/pdf/rs.pdf

Sugar

https://mrci.com/pdf/sb.pdf

Wheat

https://mrci.com/pdf/w.pdf

Oats

https://www.mrci.com/pdf/o.pdf

Lean Hogs

https://www.mrci.com/pdf/he.pdf

Crude oil

https://mrci.com/pdf/cl.pdf

Palladium

https://www.mrci.com/pdf/pa.pdf

============================================

Price chart for Gold, Silver, Copper, XAU Mining Index

============================================

Gold Price

https://stockcharts.com/h-sc/ui?s=%24GOLD&...9325303251

https://mrci.com/pdf/gc.pdf

Silver Price

https://stockcharts.com/h-sc/ui?s=%24SILVER&a...5832796445

https://mrci.com/pdf/si.pdf

Copper Price

https://stockcharts.com/h-sc/ui?s=%24COPPER&a...7009666446

https://www.mrci.com/pdf/hg.pdf

XAU Mining Index

https://stockcharts.com/h-sc/ui?s=%24XAU&...0985509425

XAU mining stock Index monthly chart (The 15-year Head-And-Shoulder pattern formed between year 2000 and 2015 signals a prolonged up trend in mining stocks to possibly new record high)

https://bigcharts.marketwatch.com/advchart/fr...62&y=4

Global mining stock Index

https://stockcharts.com/h-sc/ui?s=%24SPTGM&am...5126536165

==========================================================

Mining companies operating in the Golden Triangle of British Columbia

==========================================================

Aben Resources is a new comer to the Golden Triangle while most of the explorers have been

operating there for decades, delineating their resources and reserves to enhance shareholder

value. CEO James Pettit optioned Forrest Kerr in 2016, in the subsequent 3 years he drilled

and incurred exploration expenses to meet the option agreement, completed the Earn-In in

November 2019 and now owns 100% of Forrest Kerr property.

Mining explorers operating in the prolific Golden Triangle of British Columbia

1 HAWK.V Hawkeye Gold and Diamond $0.030 https://stockcharts.com/h-sc/ui?s=HAWK.V&...7176714740

2 RG.V Romios Gold Resources $0.045 https://stockcharts.com/h-sc/ui?s=RG.V&p=...3258189645

3 DEC.V Decade Resources $0.050 https://stockcharts.com/h-sc/ui?s=DEC.V&p...1633995508

4 ABN.V Aben Resources $0.070 https://stockcharts.com/h-sc/ui?s=ABN.V&p...7496113214

5 EPL.V Eagle Plains Resources $0.160 https://stockcharts.com/h-sc/ui?s=EPL.V&p...2069396373

6 MRO.V Millrock Resources $0.090 https://stockcharts.com/h-sc/ui?s=MRO.V&p...6836544963

7 SKYG.V Sky Gold Corp $0.170 https://stockcharts.com/h-sc/ui?s=SKYG.V&...4081325604

8 REL.V Roughrider Exploration $0.140 https://stockcharts.com/h-sc/ui?s=REL.V&p...4842327726

9 ENDR.V Enduro Metals Corporation $0.210 https://stockcharts.com/h-sc/ui?s=ENDR.V&...0889726269

10 SCOT.V Scottie Resources $0.230 https://stockcharts.com/h-sc/ui?s=SCOT.V&...5282581933

11 MTB.V Mountain Boy Minerals $0.180 https://stockcharts.com/h-sc/ui?s=MTB.V&p...5090334703

12 BBB.V Brixton Metals Corporation $0.200 https://stockcharts.com/h-sc/ui?s=BBB.V&p...4146375562

13 CMX.V Chilean Metals $0.190 https://stockcharts.com/h-sc/ui?s=CMX.V&p...3814819865

14 AMK.V American Creek Resources $0.250 https://stockcharts.com/h-sc/ui?s=AMK.V&p...4902895968

15 EVER.V Evergold Corp $0.330 https://stockcharts.com/h-sc/ui?s=EVER.V&...9306455150

16 GGI.V Garibaldi Resources Corp $0.440 https://stockcharts.com/h-sc/ui?s=GGI.V&p...6339012581

17 SASY.CA Sassy Resources $0.630 https://stockcharts.com/h-sc/ui?s=SASY.CA&...7712944421

18 MTS.V Metallis Resources $0.510 https://stockcharts.com/h-sc/ui?s=MTS.V&p...3708570676

19 DV.V Dolly Varden Silver Corp $0.640 https://stockcharts.com/h-sc/ui?s=DV.V&p=...0211663558

20 AOT.TO Ascot Resources $1.170 https://stockcharts.com/h-sc/ui?s=AOT.TO&...1773813526

21 QEX.V QuestEx Gold & Copper $1.030 https://stockcharts.com/h-sc/ui?s=QEX.V&p...7398162842

22 BNCH.V Benchmark Metals $1.580 https://stockcharts.com/h-sc/ui?s=BNCH.V&...8185217032

23 ESK.V Eskay Mining Corp $2.110 https://stockcharts.com/h-sc/ui?s=ESK.V&p...2221768177

24 TUO.V Teuton Resources Corp $2.370 https://stockcharts.com/h-sc/ui?s=TUO.V&p...1926720407

25 TUD.V Tudor Gold Corp $2.710 https://stockcharts.com/h-sc/ui?s=TUD.V&p...7186783346

26 SKE.TO Skeena Resources $3.190 https://stockcharts.com/h-sc/ui?s=SKE.TO&...2377942100

27 III.TO Imperial Metals Corp $5.250 https://stockcharts.com/h-sc/ui?s=III.TO&...2125642263

28 PVG.TO Pretium Resources $13.190 https://stockcharts.com/h-sc/ui?s=PVG.TO&...0112557228

29 ELD.TO Eldorado Gold Corp $13.150 https://stockcharts.com/h-sc/ui?s=ELD.TO&...0529029750

30 SEA.TO Seabridge Gold $21.220 https://stockcharts.com/h-sc/ui?s=SEA.TO&...9592454206

Due to lack of basic infrastructure like power line and accessible roads, exploration and discoveries have been arduous in the Golden Triangle in the past decades, it took Seabridge Gold 41 years to achieve its current mineral reserves and resources since its formation in 1979. https://www.seabridgegold.com/company/overview

Thanks to Brian Kynoch, P.Eng. and President of Imperial Metals, his desire to construct a copper mine at Red Chris prompted the government to construct highway and roads and install power line through the Golden Triangle since 2012, with the basic infrastructure in place and with the progress in modern day mineral detection technology, potential rapid discovery of bonanza gold deposits in the Forrest Kerr fault zone and accurate resources estimate through 3-D imaging can be achieved.

=====================

Share price weekly charts

=====================

Canadian Venture Exchange: ABN.V (in Canadian Dollar)

https://stockcharts.com/h-sc/ui?s=ABN.V&p...3381419340

America OTCQB:ABNAF (in US Dollar)

https://stockcharts.com/h-sc/ui?s=ABNAF&p...5868384830

Germany Frankfurt Exchange: E2L2 (in € Euro)

https://bigcharts.marketwatch.com/advchart/fr...p;state=10

===============

Chart Technicality

===============

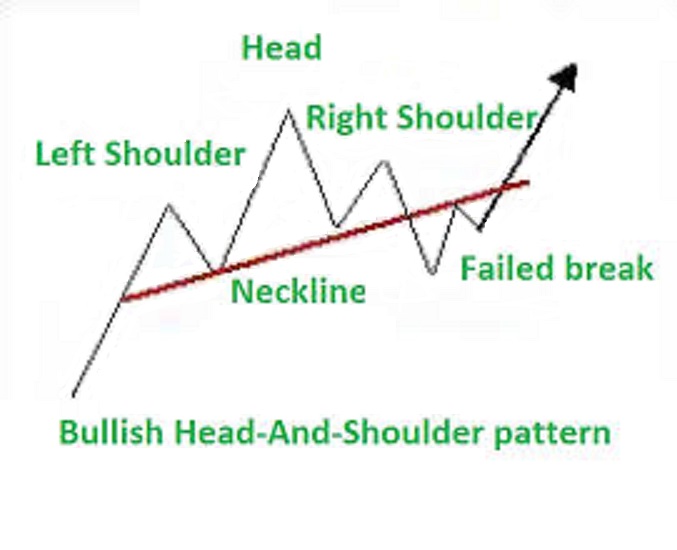

Chart is not only a historical record, quite often it can predict the future, it is an important trading tool, no investor can be successful without referring to charts. Trading without charts is like an airplane pilot flying without any navigation instrument but only by hunch and guessing, chances are he will end up in crash-and-burn. Head-And-Shoulder is a natural chart formation in Nature, it is the most reliable and predictable chart pattern among all chart formations.

Bullish Head-And-Shoulder pattern - fail break pattern

Bullish Head-And-Shoulder pattern in copper

Bullish Head-And-Shoulder pattern in XAU mining index

ABN.V future scenario

Click for enlarged view

https://investorshangout.com/images/MYImages/...M-SOLD.gif

Click for enlarged view

https://investorshangout.com/images/MYImages/...04_ABN.jpg

===================================

Testament for the Golden Triangle potential

===================================

In the year 2000 I scanned several hundred long term weekly charts of mining stock companies in my search for one with promising future as I believe in charts. One chart with a bullish Head-And_Shoulder pattern immediately caught my special interest, from my diligent research, I found out that mining company had 6 billion pound of commercially viable copper resources in its Red Chris project in the Golden Triangle of British Columbia, so I bought 200,000 shares of American Bullion Minerals at 5 cents for long term investment. In the year 2011 the company was bought out by Imperial Metals at $2.40 a share, the sale offered me an early retirement. Recently I again scanned several hundred mining stock charts and again one chart stood out among others like a star shining brightly among dark matters of the Universe and has the potential of exploding into a supernova. Based on the spectacular assays in the Forrest Kerr, I have strong confidence that there are bonanza gold deposits somewhere in the property as the saying goes: When there is smoke, there is fire, similarly, the moderately long intervals of high grade gold is a promising sign for the existence of bonanza gold deposits somewhere in Forrest Kerr.

Red Chris Mine (at the top right corner of the Golden Triangle)

https://investorshangout.com/images/MYImages/...ABNmap.jpg

(0)

(0) (0)

(0)