Let's say you had $150 to invest Stock or Warra

Post# of 33188

Stock or Warrants?

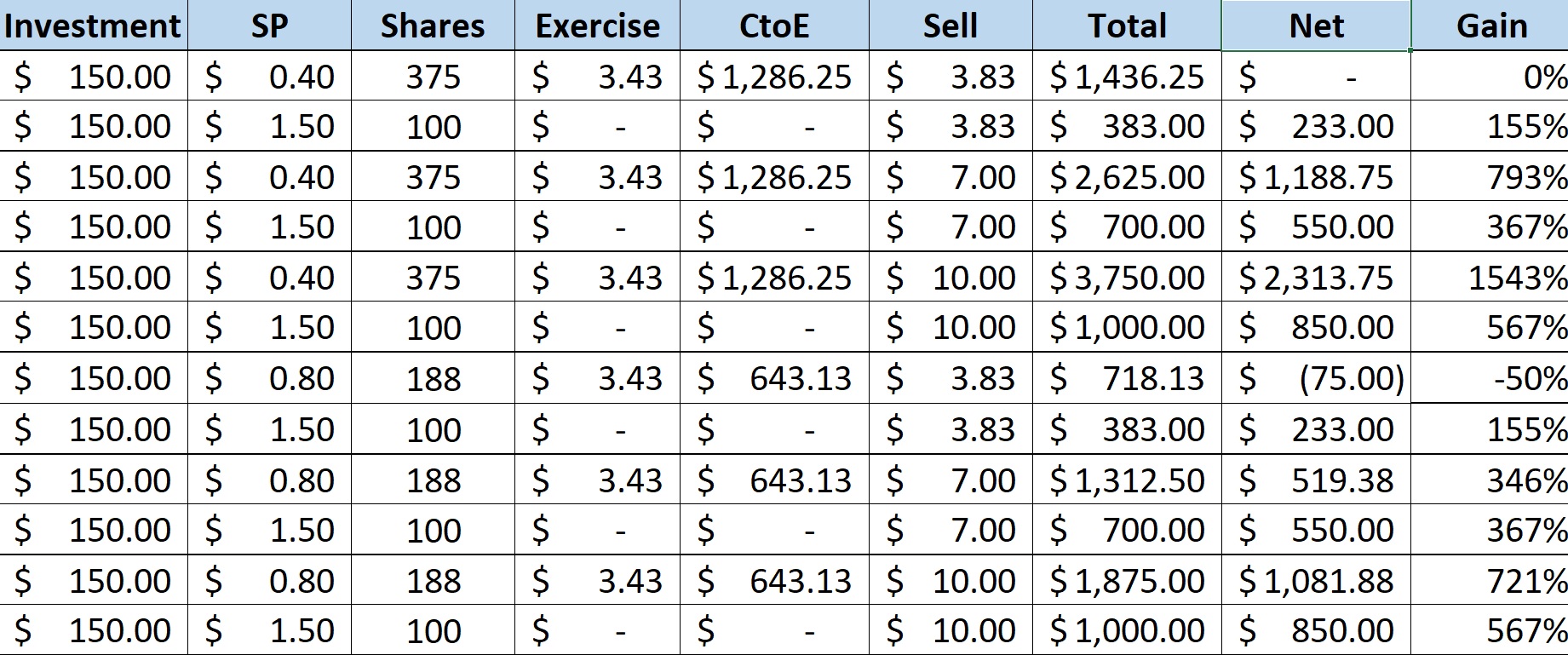

Let's say the sp is at $1.50 and the warrant price is at $.40

The sp would need to get to $3.83 within 4 more years to break even on the warrants. With stock, you'd have a nice gain. But if the stock got to $7, warrants seem to be the better deal.

Now let's say you'll buy warrants at any price because you believe they are such a great deal and you waive the risk mentioned above, Let's say you pay .80 when the sp is $1.50, The sp would need to get to $7.50 before warrants start to pull head. So 5x where the sp is right now at $1.50

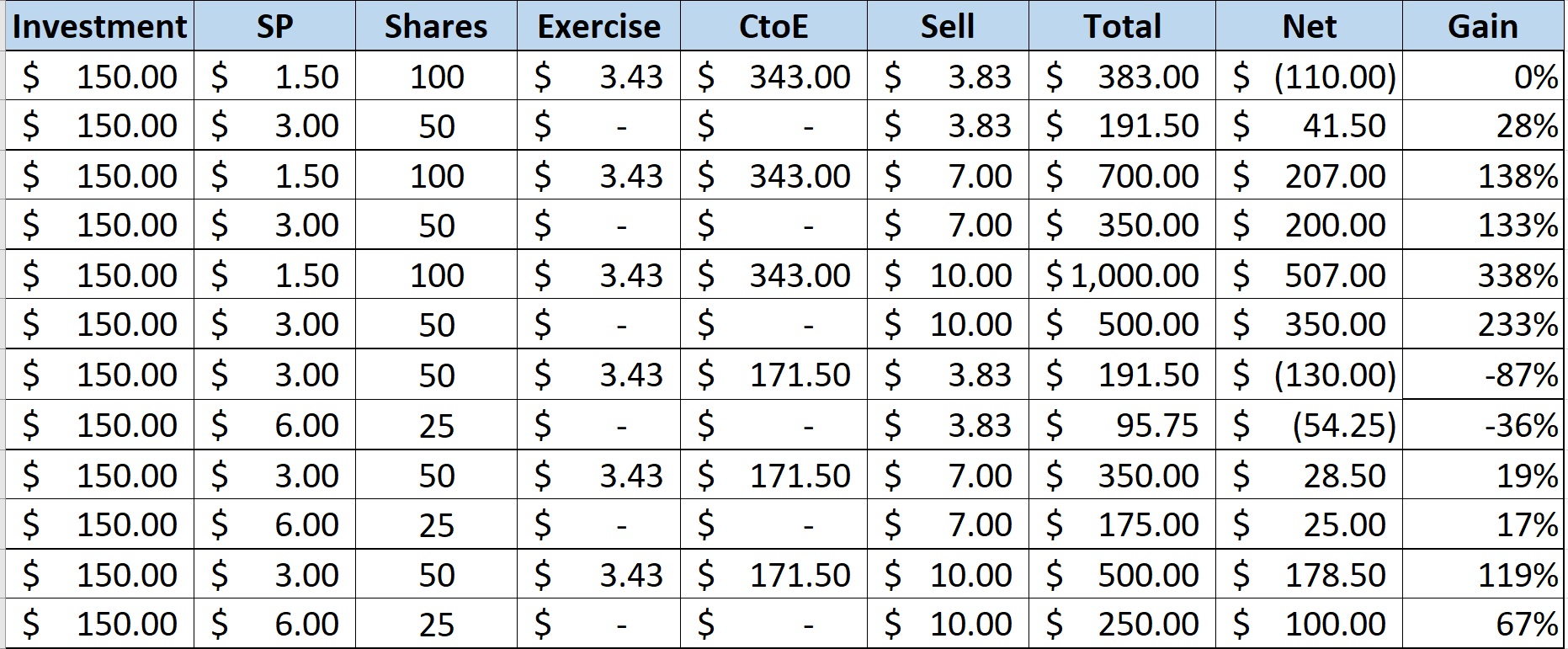

Now lets say the sp and warrants go up this quarter to $1.50 and $3.00 respectively or even $3.00 and $6.00.

One again at that ratio, about $7 something makes the warrants seem like a better deal. Now you can and will likely have the opportunity to buy at different ratios. I just picked some points out of the air. The market and institutions will factor in the risk of warrants. That's for sure.

What I didn't show in these examples in the ratio of warrant price to share price and which is a better deal can also is a factor of your cost of money. If you can borrow money cheaply, then the stock may become a far better investment. I think I've posted examples before and a similar concept of buying on margin. Leverage can be a good thing, but not a sure thing.

If someone is trying to decide which to buy, it's best to put your own numbers together or talk to a financial adviser. Takes about 10 minutes.

(19)

(19) (0)

(0)