50k 7/22/19 30k 7/23/19 12k 7/24/19 Took

Post# of 158095

30k 7/23/19

12k 7/24/19

Took advantage of low volume to figure out ALPS trades

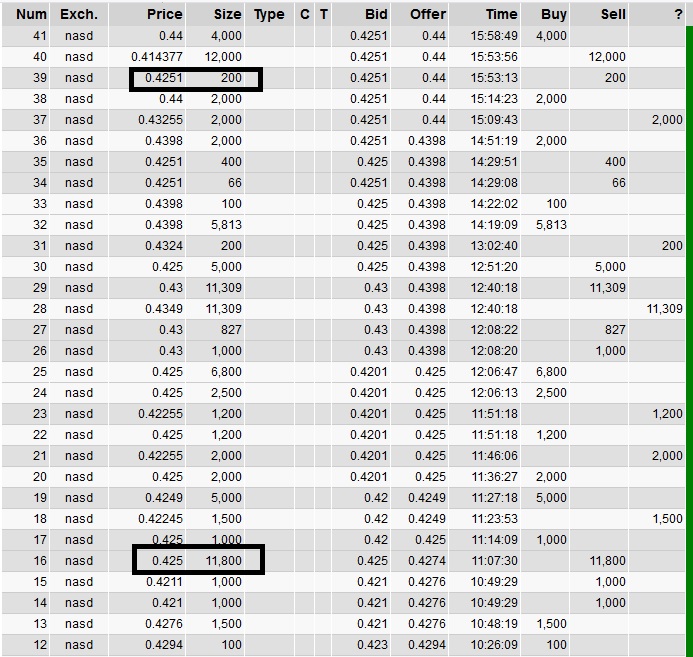

200 at .4251 right before crosstrade posted was very likely them

so the 11,800 trade at .425 matches probably the other giving 12k

12000 x .414377/ (200x.4251 + 11800 x .425)= .97500000

Math looks to match, nice round number, so alps charges a 2.5% fee.

What they did is sell 12000 shares short and got $5100.02. They charge a 2.5% fee, so the noteholder gets 4972.52. Divide $4972.52 by 12000, gives the price .414377 average price. So they buy 12000 shares from the noteholder to cover their short after deduction 2.5% for their services and post that trade (which normally happens all the time when you sell, the MMs do the same thing but don't usually post their trade buying your shares to cover their short from your order). This is why you can't trust short sale data. Those 12000 will show up as short sales, but really they were covered during the day.

(1)

(1) (0)

(0)