DUE DILIGENCE: Blueprint True & Fair Value $0.10+

Post# of 7572

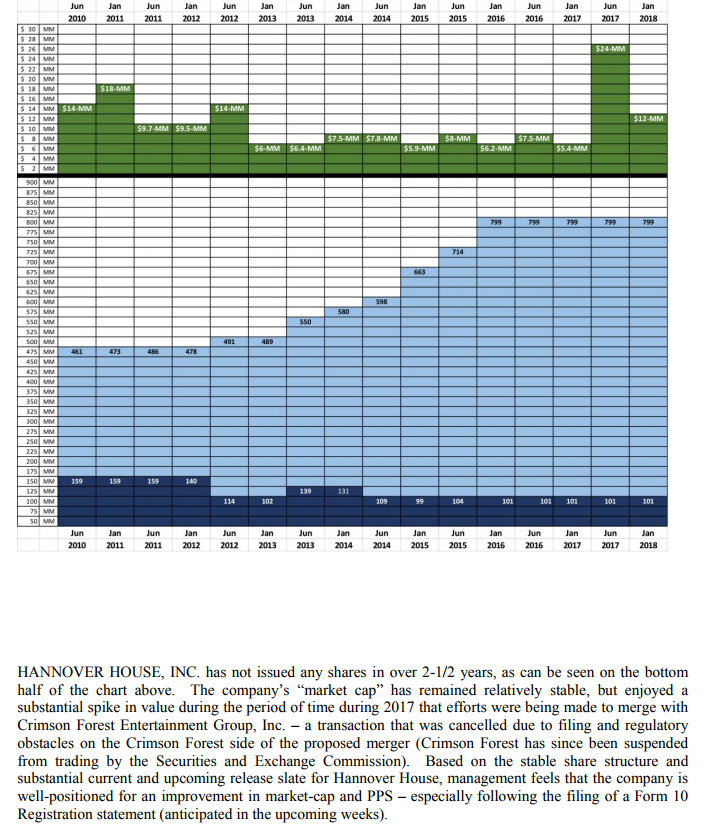

Per Yahoo Finance right now HHSE has a Book Value of $0.04. Though extremely hard to quantify, the HHSE Audits and Form 10 add further significant value to HHSE. Not to mention HHSE Uplist to OTC:QB (get off the Pinks) with a broader base of more sophisticated and knowledgeable investors. This partly explains why accredited investors are willing to pay premium prices (S-1) for HHSE.

Not sure what it will look like yet, But I will be keeping a Due Diligence post here based somewhat on the blueprint below. It is a work in progress that will be changing frequently as info becomes available. Will try to maintain as a Sticky Post.

**** Steps To HHSE Uplisting, $0.10+ ****

Step 1.) AUDITED FINANCIALS

https://investorshangout.com/post/view?id=5276715

Step 2.) FORM 10 REGISTRATION

https://investorshangout.com/post/view?id=5277367

Step 3.) S-1 SHELF REGISTRATION

https://investorshangout.com/post/view?id=5277788

Step 4.) TRANSITION TO TWO PRONGED BUSINESS MODEL

https://investorshangout.com/post/view?id=5279134

Step 4 a.) MYFLIX

https://investorshangout.com/post/view?id=5279441

Step 4 b.) FOUR MAJOR FILMS PER YEAR

https://investorshangout.com/post/view?id=5279814

Step 5.) UPLIST OTC:QB

https://investorshangout.com/post/view?id=5280526

Step 6.) HHSE/SONY/RANDOM DISTRIBUTION PARTNERSHIPS

https://investorshangout.com/post/view?id=5280538

* Need to mention this item. HHSE Updated Film Library Evaluation. Have not included yet, because not sure how it plays in to HHSE new business model. Updated Film Library Evaluation should be completed. Stated in OTCMarkets Document the new HHSE Film Library Evaluation equals at least $28,000,000

.gif)

HHSE

(5)

(5) (0)

(0)