Okay, Havenstein, I can answer the bottom line que

Post# of 40992

[If anyone doesn't know - to see the images below in full size, right click and "open image in new tab" (or similar, depending on your browser/OS/device)]

The problem here is two-fold: first, many are spouting off about their own "opinions" (bullshit lies and/or misunderstandings) without presenting facts with source references and/or links; and second, many shareholders don't understand what they need to understand before letting these "opinions" sway them (into selling their shares or joining the circus).

All of this is anwered here, clearly and definitively, but you or anyone interested must read the details. It's all here - below - with references to the sources.

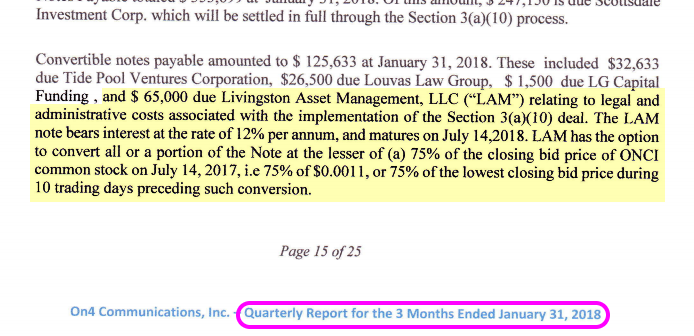

Just note that there are two things here that involved LAM. Though related, they are completely different. The first is a 3(a)10 debt restructuring transaction. The second is a convertible note. Unfortunately, several who are perpetuating lies and twisting everything Steve states, are well aware of this, but they are taking advantage of those who do not understand.

(I'll let you in on a "secret" - there are many who are - or were - holding pretty good positions, who've posted in the past, and recently, as well as many on the sidelines, who know very well what's been going on and how it all works with first, the 3(a)10 and, second, the LAM note... and they're quiet, not offering to clarify the situation and how Steve is NOT lying about these things. Why do you think that is? It couldn't be because they're also benefiting by picking up cheaper shares at the bottom... could it? Some would like to see it go lower, obviously. And of course there are many that are just fed up with that board "over there," don't read it, and probably aren't even aware of the long list of fake news "lies" that they could help to clear up. Frankly, I stopped reading the board for a month or two, and I wasn't aware that there was any strength in this particular fake news lie about LAM and the 3(a)10 transaction)

You provided this clarification of the issue:

Quote:

@MFN

Letter to Shareholders on the State of the CompanyPress Release | 03/16/2018

3A10

The 3A10 is 99.9 percent done and will be completed shortly. We were able to write off over 1.8 million of old debt that was choking us monthly. We are done with that debt and are moving forward to complete and reduce all old debt and we will do this shortly.

https://www.otcmarkets.com/stock/ONCI/news/Le...?id=186387

After the 16 March 99.9 percent comment LAM continued to sell into the market and people used these combined details to claim SB had lied about being nearly done.

Okay, so here is everything step-by-step...

Letter to Shareholders on the State of the Company | Press Release | 03/16/2018

https://www.otcmarkets.com/stock/ONCI/news/Le...?id=186387

Quote:

The 3A10 is 99.9 percent done and will be completed shortly. We were able to write off over 1.8 million of old debt that was choking us monthly. We are done with that debt and are moving forward to complete and reduce all old debt and we will do this shortly.

On4 Communications, Inc. Announces Letter to Shareholders, Update 2 | Press Release | 03/23/2018

https://www.otcmarkets.com/stock/ONCI/news/On...?id=187059

Quote:

LET ME SAY THIS IN CAPS: THERE ARE NO PLANS TO DO ANOTHER 3A1O. THE FIRST ONE SHOULD BE DONE EITHER TODAY OR MONDAY AND THAT’S IT.

And then, finally, in a tweet on March 27, 2018

https://twitter.com/on4company/status/978609464759734272

Quote:

On4 Communications

@on4company

The 3A10 is done and as i have said numerous times there is NOT another one coming nor is there a reverse split Its not even a conversation that has ever been discussed.

Yes, this is EXACTLY how it went down.

Yes, Steve said it was DONE: "The 3A10 is done" . I know, he didn't make any fanfare about it, he said it was done and then continued the sentence to say: "...and... there is NOT another one coming... nor is there a reverse split It's not even a conversation that has been discussed."

The 3(a)10 was completed just before the end of March (see below).

10completed.png)

...and the Q2 financial report for the period ending April 30, 2018 (filed on 6/15/2018) spelled out all the details of the results (see below).

10wrap-up.png)

By the way the prior Q1 report (filed 3/15/2018), as well as the 2017 Annual report (filed 1/31/2018), gave updates on the status of the 3(a)10 transaction execution, like a play-by-play report. Steve made it pretty DAMN CLEAR was going on with these status updates in the Q reports.

And the 3(a)10 transaction started last year, and it was laid out very clearly in a disclosure on October 16, 2018:

10disclosure.png)

NOW... LAM also had a convertible note. That is SEPARATE from the 3(a)10 transaction. It's "related" because it paid for the costs associated with SETTING UP the 3(a)10 transaction.

As I've laid out in other posts, the shares associated with that note were restricted for 360 days from the funding of the note, which was July 14, 2017 - per the description given in the Q1 financial report for the period ending January 31, 2018 (filed 3/15/2018)... as shown here:

So those shares began selling in mid-July and just finished a week ago.

Steve did NOT lie.

In MANY cases, OTHERS lied and twisted Steve's statements as they've done with NUMEROUS others - INCLUDING the whole bullshit debacle about fake Mazars letters and crap - to take advantage of those who don't follow the filings or know how to make sense of them, and/or understand the ins and outs of how things work for startup venture.

In other cases, SOME of those saying that Steve lied simply misunderstand it all, themselves.

But as I stated, it's my strong opinion - from experience, reading carefully between the lines, as well as the obvious evidence of post history telling the story - many if not most are lying and twisting every statement Steve makes in such way to take advantage of the ignorance (not understanding well the details of transactions, financials, or how things work in an entrepreneurial venture) of other shareholders for their own interests (flipping down, channel-flipping, and getting shaky hands to sell to them when they call their "new bottom entry price," etc.).

(16)

(16) (0)

(0)