Another Oil Price Shock, Another Global Recessio

Post# of 41436

Another Oil Price Shock, Another Global Recession?

By EconMatters

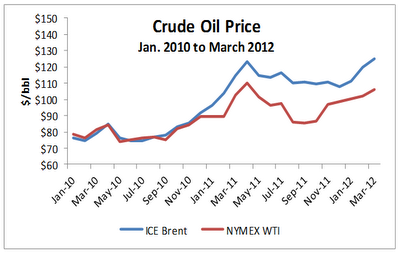

Brent crude ended trading above $120 a barrel on Friday, April 13, while WTI crude on NYMEX for May delivery settled at $102.83 a barrel. Oil has traded above $100 for all but a couple of days in the past year (see chart below). This persistent high oil price has many concerned to start threatening a nascent recovery of the global economy.

Studies show that historically, around 90% of US recessions post World War II were preceded by oil price shocks. The most recent occurrence took place when oil more than doubled in price from January 2007 to July 2008 due to a sharp increase in Chinese demand. The pullback of US consumer and corporate spending already put a drag on economic growth before the subprime-induced financial crisis closed the deal on the Great Recession.

Analysts generally see the $120-130 level as a price that would prompt consumer and corporate to cut back on spending sharply, and hurt the recovery and growth of key economic sectors. A recent Reuters survey of 20 equity strategists put $125 a barrel as the point economy and stock markets could start to suffer.

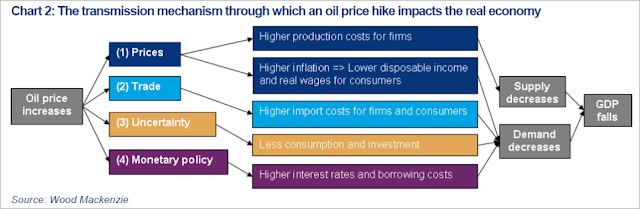

The most recent study on the link between oil price and economic recession came from energy industry consultancy Wood Mackenzie ![]() WoodMac) published earlier this month. The chart below from WoodMac illustrates "the mechanism" of how an oil price shock would derail the global economy.

WoodMac) published earlier this month. The chart below from WoodMac illustrates "the mechanism" of how an oil price shock would derail the global economy.

According to WoodMac's model,

".... the US will fall into recession within 12 months if WTI increases to $130 per barrel and the price remains elevated. If WTI reaches $150 per barrel and remains elevated, recession will be more pronounced with US GDP estimated to contract 0.4% in 2013."

U.S. domestic petroleum products are priced off of Brent since WTI has become a less relevant oil price marker due to the inventory glut at pipeline-capacity-challenged Cushing, OK depressing the WTI price. So using the current spread between WTI and Brent of around $15-$20, WTI $130 would suggest Brent at about $150 range. Brent futures already hit $128.40 a barrel, the highest since 2008, in early March, but has since given back some of the gains..

However, the difference between now and 2008 is that when oil spiked to almost $150 in 2008, there was a strong demand from China and a real shortage of supply, whereas the current world oil market is a lot more balanced than the current Brent oil price suggests.

IEA (International Energy Agency) said in its monthly report that there had potentially been a rise in global oil stocks of 1 million barrels per day (bpd) over the last quarter, and the impact on prices had not yet been fully realised. Reuters quoted the IEA that:

"Easing first quarter 2012 fundamentals have seen prices recently lose most of the $5 per barrel they gained in March. The muted impact so far is partly because much of this extra supply has been stockpiled on land or at sea."

Rather than reflecting market fundamentals, dollar prices for Brent crude, up more than 15% this year, has been pushed up mainly by fears about Iran, and the loss of supply from three relatively small oil producing countries--Syria, Yemen and South Sudan--adding to the supply worries. In other words, the oil price is bid up primarily by trading actions on the geopolitical factors ( chiefly Iran ).

Meanwhile, Saudi Oil Minister Ali Al Naimi said on Friday, April 13 in a statement during a visit to Seoul that

“We are seeing a prolonged period of high oil prices. We are not happy about it. (The Kingdom of Saudi Arabia) is determined to see a lower price and is working towards that goal.”

“Fundamentally the market remains balanced — there is no lack of supply. Saudi Arabia has invested a great deal to sustain its capacity, and it will use spare production capacity to supply the oil market with any additional required volumes.”

Naimi earlier this year indicated $100 a barrel as an ideal price for producers and consumers earlier this year.

|

| Chart Source: Reuters.com |

Typically, oil price shock occurs when price goes out of the normal range. Currently, oil is not trading at an unprecedented level as in the case of 2008, which is hard to hit given the projection of a subdued global GDP, weak oil demand outlook, and an eventual resolution of the Iran situation .

Thus we believe oil has gotten way ahead of itself, and could experience a correction later this year and in the next three years or so. End user behavior change is starting to manifest, and the latest CFTC trading position reports already showed that money managers cut their net-long position roughly 12% in light, sweet crude-oil futures and options (see chart above). ![]() Brent already went down to $118.57 on Monday, April 16.)

Brent already went down to $118.57 on Monday, April 16.)

So no, unless something totally unexpected shocks the oil price into no man's land, WTI and Brent are unlikely to hit the levels that could possibly bring about a global recession any time soon. In fact, among the major possible drivers of a global recession, European economic and debt crisis looks to be the greater risk than an oil price shock.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of The NASDAQ OMX Group, Inc.

(0)

(0) (0)

(0)