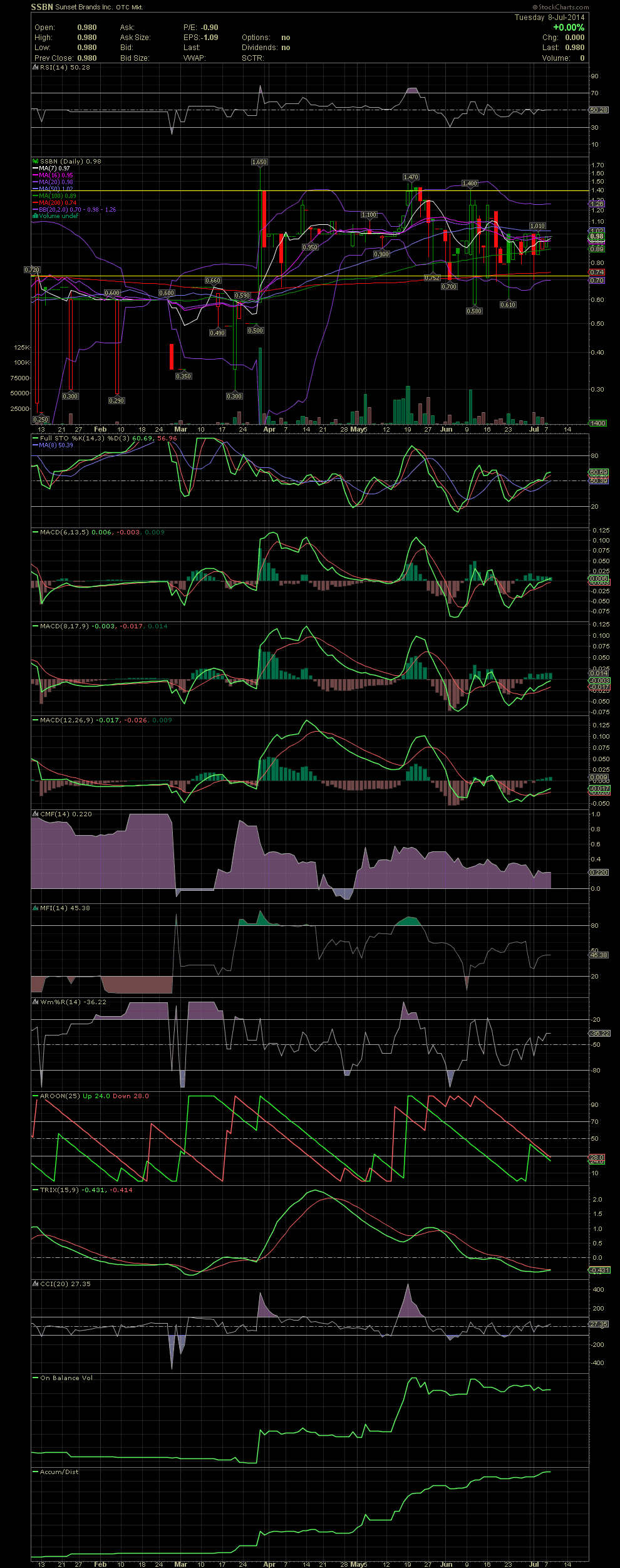

SSBN Daily Chart ~ Tighter Trading Range as of Lat

Post# of 2561

As I've mentioned previously, SSBN is not a chart play for me at this time. The stock has nonetheless been trading in a range defined by the yellow horizontal lines. But for those reaching for some technical indicators, one can see the MA50 at 1.02. A break and close over that would bring into play a retest of the previous run to 1.40. The FullSto and MACDs have crossed over to the positive from oversold levels. What is of interest to me is that the daily trading range is beginning to narrow. What that represents to me is that the selling pressure is easing while bidders are having to increase their bids from the previous levels of .50s and .60s to the more recently seen bids from the .70s into the .80s. For those looking to accumulate some size in SSBN, it appears to be getting a bit more difficult. Fundamentally, we are waiting for news from the company that the LOI to acquire MotorMax and Motor Acceptance has been executed. One might want to review management's releases regarding the projected revenues, which are to exceed $65,000,000. So with an OS of 8.05 mil and a float of 1.89 mil, my opinion is that SSBN will move sharply to the upside upon completion of those acquisitions. I might point out that back in late March the stock exploded from .59 to 1.65 in just one trading session, and that was only on the LOI announcement. Crunch the numbers and come to your own conclusions of where this stock might go over the next 6-12 months based on revenues of more than $86 million which includes Sunset Capital Assurance announced in May. GLTA

(0)

(0) (0)

(0)