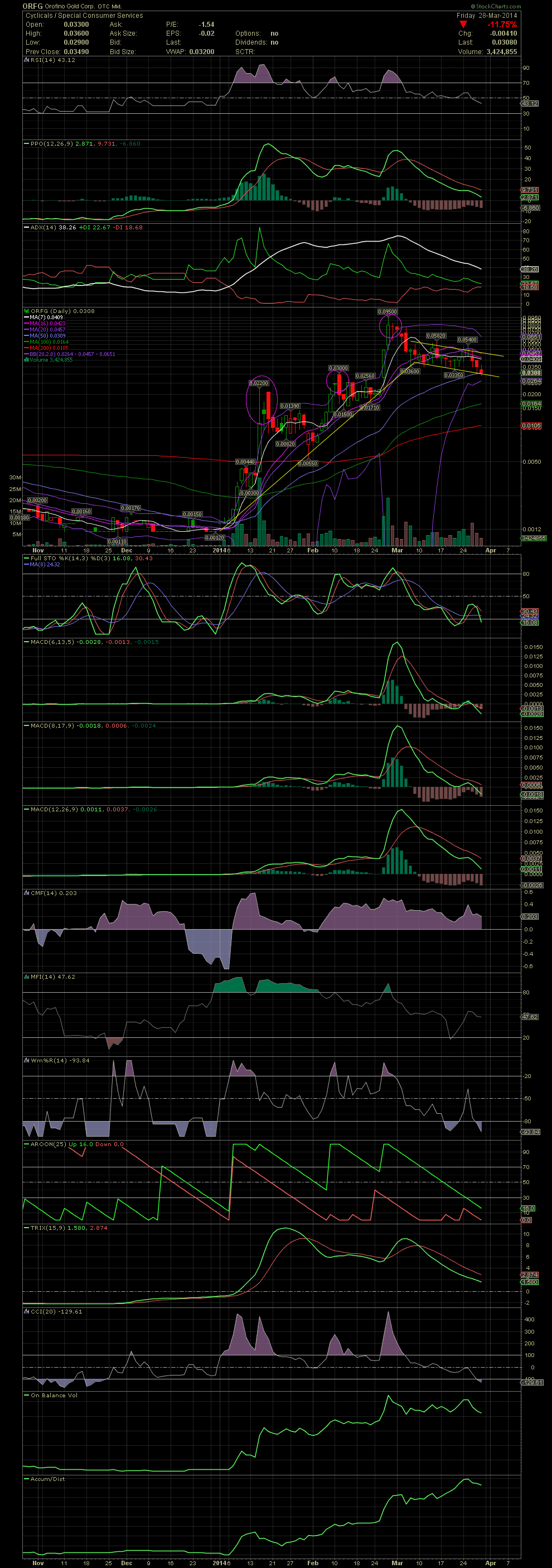

ORFG Daily Chart ~ A Loss of 28.3% for the Week as

Post# of 2561

As is the case almost with all stocks whose FullSto and MACDs are in a negative position, ORFG sold off this last week because no news was announced. During the previous week, many were looking for news as they were this last week. The chart and indicators have been in decline and the momentum had shifted towards the downside almost one month ago. As I've stated often, news will always trump the technicals, but in the face of no news, one needs to prepare for a continuation of a trend, which with ORFG, it was to the downside. Note my comments of March 24 regarding the FullSto and MACD. Check their positions on that post and compare them today. The FullSto and two faster MACDs are barely entering oversold levels while the 20d MACD still has a way to go. Without news, the downside will continue especially if the minor support of the MA50 doesn't hold. The basing near the .0335/.035 level was broken on Friday although the selling volume was the lowest volume day of the week. That said, because I'm believing in the news that is coming, even though it's 1-2 weeks late, I've been attempting to catch the falling knife and not listening to what the chart is telling me. I added all week from the .036s down to .0311. The games played on Friday, when I entered orders at the ask and was filled at the bid and even under the bid twice, is suggesting to me that the stock is being manipulated downwards in the hopes of shaking out weak hands. That's typical of a reversal. If the news over the next few days/weeks is what we are hearing, then a huge move to the upside is near, possibly to the .30s. In order to break the declining channel, a close of .046 would be close. Bring on the news to negate the trend! GLTA

(0)

(0) (0)

(0)