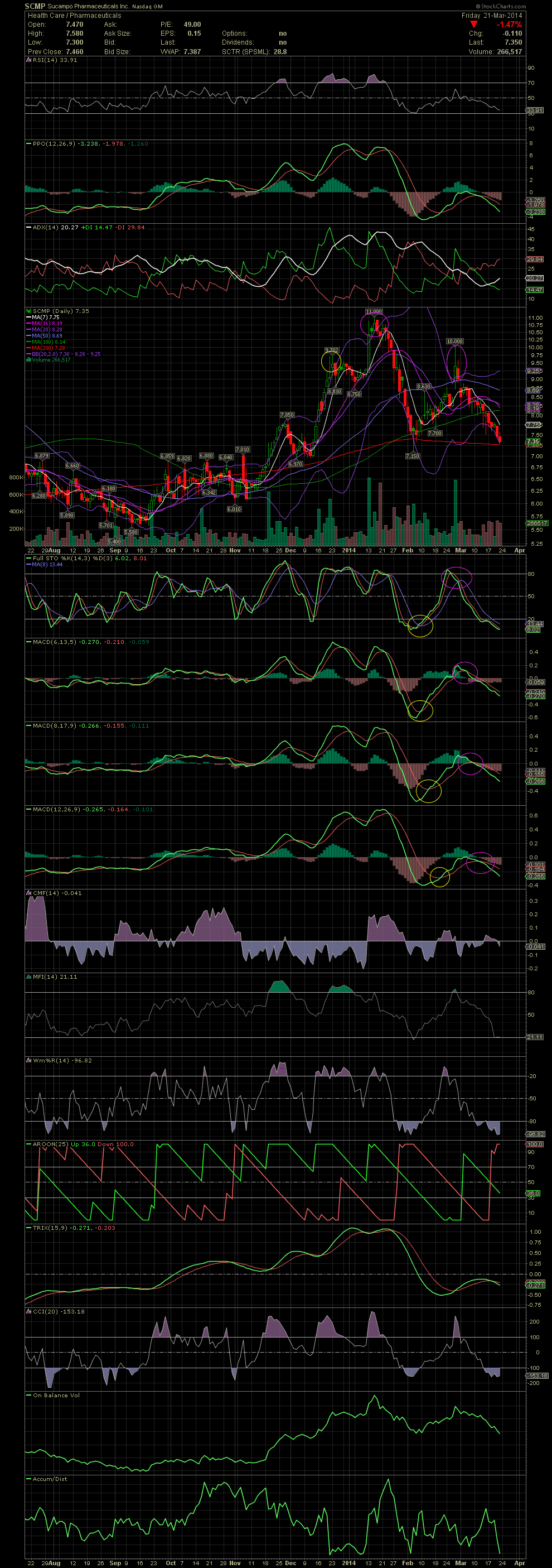

SCMP Daily Chart ~ Hello MA200 In my last chart

Post# of 2561

In my last chart update for SCMP on March 16, I mentioned patience while we wait for another entry for a swing trade. Since then, the stock has fallen from 8.04 to 7.35. Will the MA200 at 7.34 offer the necessary support for a reversal as was seen in early February? What also assisted the stock back then was the MA100. Nothing that I'm aware of with the fundamentals changing for SCMP but stocks go up and down all the time. Currently, the biotech sector is very week, so SCMP is participating until the next catalyst helps to reverse the trend. For those that used the move in late February to exit when the candles shot outside the upper bollie, great move. For those that waiting for the FullSto and MACDs to confirm, you received that negative crossover just a few days later. The difference, though, was approx 1.50 lower than the peak in the 'pop outside'. Currently, the FullSto and MACDs are in a strong angular decline. So there's probably not much of a chance for the MA200 to hold in the next couple of days. Keep in mind, though, any strong news would override the technicals. So a small entry near the 200 would be a calculated entry and hugely better than those that entered during the gap and trap to 10.00 three weeks ago. GLTA

(0)

(0) (0)

(0)