Big Board Stocks ~ Most Will Follow the Trend of t

Post# of 2561

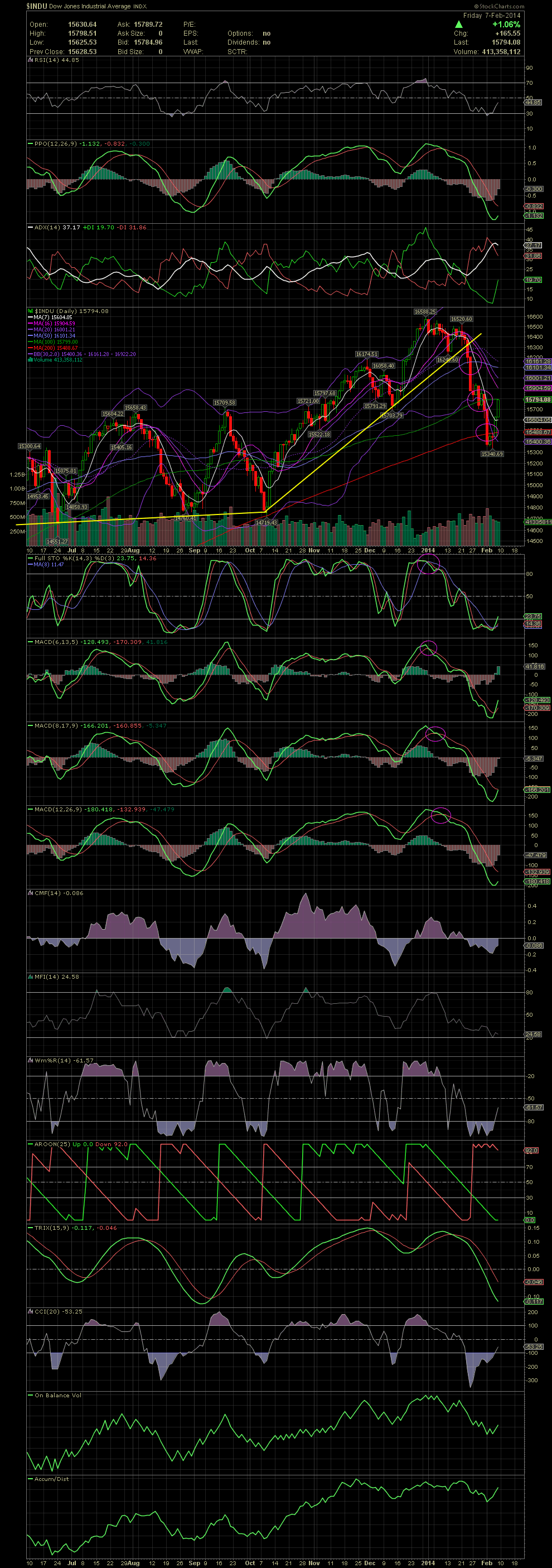

With the Big Boards, a good thing to do every day is to check the overall trend of the markets with a quick look at the INDU and SPX to get a feel of the direction. It's my opinion that the fund sheeple run in herds, and when the word leaks that when a few begin selling or buying, the rest will stampede blindly.

As I mentioned previously in early January when the INDU began to curl, use the indicators to your advantage. The FullSto and MACDs broke long before the rising support line was broken. The MA20 was violated next. Once that happened, one then needs to look for other possible support lines. The MA50 fell quickly as the selling increased. There was some support for a few days at the MA100. When that support level failed, the next obvious point was the MA200. After three days of churning, the market snapped back and regained the 200. Friday saw the INDU rally back to the MA100. The FullSto and faster MACDs have already crossed to the positive sides where the 20d MACD is curling off a bottom. Now we'll see what happens this coming week. Apply what you see below to many of the Big Board stocks and you'll see a very similar pattern. GTLA

(0)

(0) (0)

(0)