(Total Views: 823)

Posted On: 01/13/2022 6:31:18 PM

Post# of 157842

While we wait for news ....

The global market for nonalcoholic steatohepatitis (NASH) treatment estimated to reach $20 billion in 2027, expanding at a CAGR of 34.1% over the forecast period.

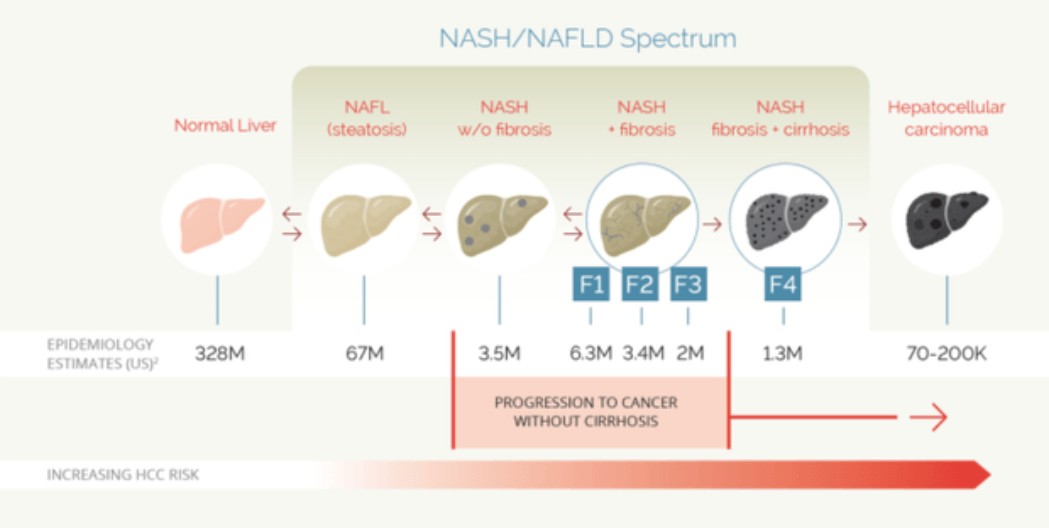

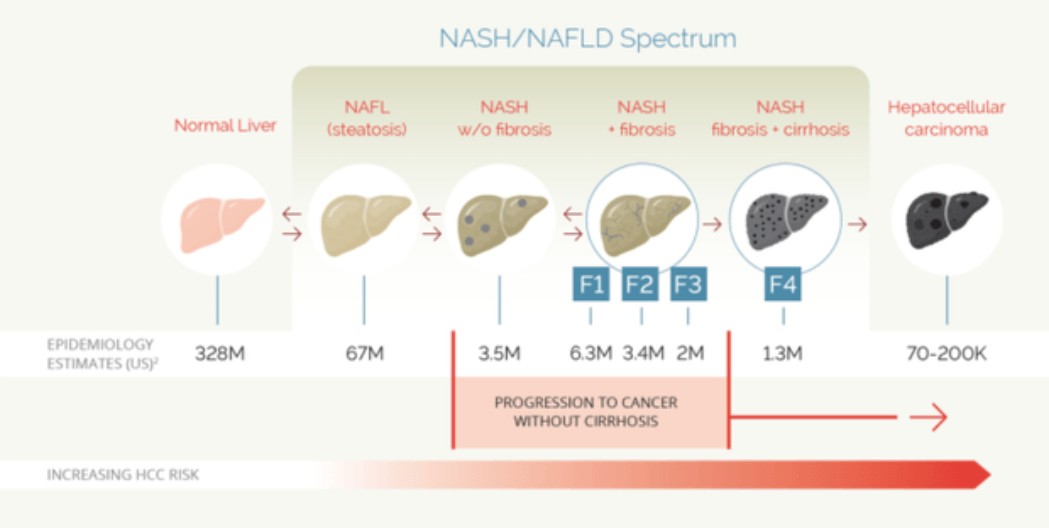

NASH is an extreme form of NAFLD nonalcoholic fatty liver disease. The figure below (borrowed from SA) shows the progression.

The market is huge and currently, there are no approved drugs for NAFLD or NASH.

In any case, all this is well and good. What is important is that we apparently got very positive results in humans . Murine results are telling/important but with the experience with Maraviroc, that initially ameliorated the development of steatosis in a mouse model and then failed to control NAFL in people with HIV, one needs to be careful.

NASH/NAFLD is a tough condition to address, which explain why there is no current approved treatment. However, the prize is large (very). There are millions of people living with anything from steatosis to HCC and many companies trying hard to get a medicine to market.

From Recknor own words: "Given 5% of the world population is estimated to have NASH with 20% progressing to cirrhosis, this signal gives hope for a therapeutic intervention for this disease.”

So, who would be interested in something that works (such as Leronlimab)??? : Allergan (Tobira), Bristol-Myers Squibb, Conatus, Galectin, Galmed, Genfit, Gilead, Immuron, Intercept Pharmaceuticals, Inventiva, MediciNova, Novartis, Novo Nordisk, Pfizer, Zydus Cadila are in trials in different phases.

We have a big advantage by being able to go into the race directly in phase II, NP comment of talking with 1000’s of companies is a bit exaggerated, but he was making the point in that there must be a large interest in a positive signal with Leronlimab.

We need to remember that Maraviroc (CCR5 antagonist as well) has been in this space for some time with very mixed results (to put it in some way). The fact that there are no adverse effects with LL is a big plus.

Another problem is that of “measuring” NAFLD; liver biopsies are expensive (apart from invasive, semi-quantitative and prone to sampling variability), PDFF is a (the) leading MR-based biomarker of liver fat content and has shown good accuracy in classifying steatosis grades. So, we need the PDFF numbers of both, 350mg (open label) and 700mg (blinded) trials. If the numbers are good we have a gold nugget in our hands (as many as 100 million Americans have NAFLD, including an estimated 18 million with NASH).

Are we talking three fingers ??? Maybe if we could address the whole range of severity from steatosis to cirrhosis. But, being conservative any other liver-related condition can easily call for two fingers “hands down” (pun intended).

However, this is so large than we need to partner. Why ??? Because these trials are expensive and we do not have money, also, lots of expertise is needed (I don’t think we have it in the liver space). Trials are normally lengthy and tricky, and the FDA has been particularly reluctant to approve.

The global market for nonalcoholic steatohepatitis (NASH) treatment estimated to reach $20 billion in 2027, expanding at a CAGR of 34.1% over the forecast period.

NASH is an extreme form of NAFLD nonalcoholic fatty liver disease. The figure below (borrowed from SA) shows the progression.

The market is huge and currently, there are no approved drugs for NAFLD or NASH.

In any case, all this is well and good. What is important is that we apparently got very positive results in humans . Murine results are telling/important but with the experience with Maraviroc, that initially ameliorated the development of steatosis in a mouse model and then failed to control NAFL in people with HIV, one needs to be careful.

NASH/NAFLD is a tough condition to address, which explain why there is no current approved treatment. However, the prize is large (very). There are millions of people living with anything from steatosis to HCC and many companies trying hard to get a medicine to market.

From Recknor own words: "Given 5% of the world population is estimated to have NASH with 20% progressing to cirrhosis, this signal gives hope for a therapeutic intervention for this disease.”

So, who would be interested in something that works (such as Leronlimab)??? : Allergan (Tobira), Bristol-Myers Squibb, Conatus, Galectin, Galmed, Genfit, Gilead, Immuron, Intercept Pharmaceuticals, Inventiva, MediciNova, Novartis, Novo Nordisk, Pfizer, Zydus Cadila are in trials in different phases.

We have a big advantage by being able to go into the race directly in phase II, NP comment of talking with 1000’s of companies is a bit exaggerated, but he was making the point in that there must be a large interest in a positive signal with Leronlimab.

We need to remember that Maraviroc (CCR5 antagonist as well) has been in this space for some time with very mixed results (to put it in some way). The fact that there are no adverse effects with LL is a big plus.

Another problem is that of “measuring” NAFLD; liver biopsies are expensive (apart from invasive, semi-quantitative and prone to sampling variability), PDFF is a (the) leading MR-based biomarker of liver fat content and has shown good accuracy in classifying steatosis grades. So, we need the PDFF numbers of both, 350mg (open label) and 700mg (blinded) trials. If the numbers are good we have a gold nugget in our hands (as many as 100 million Americans have NAFLD, including an estimated 18 million with NASH).

Are we talking three fingers ??? Maybe if we could address the whole range of severity from steatosis to cirrhosis. But, being conservative any other liver-related condition can easily call for two fingers “hands down” (pun intended).

However, this is so large than we need to partner. Why ??? Because these trials are expensive and we do not have money, also, lots of expertise is needed (I don’t think we have it in the liver space). Trials are normally lengthy and tricky, and the FDA has been particularly reluctant to approve.