(Total Views: 429)

Posted On: 09/28/2021 2:43:47 PM

Post# of 156692

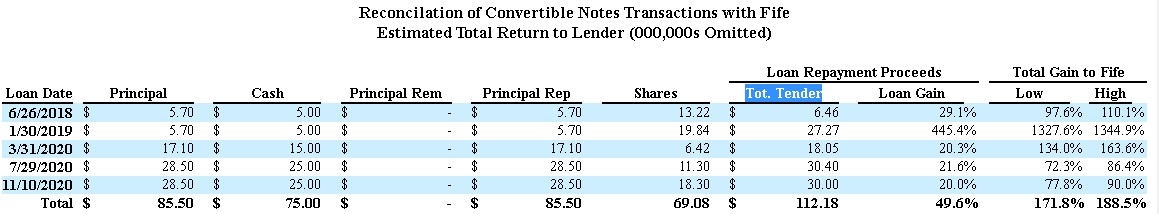

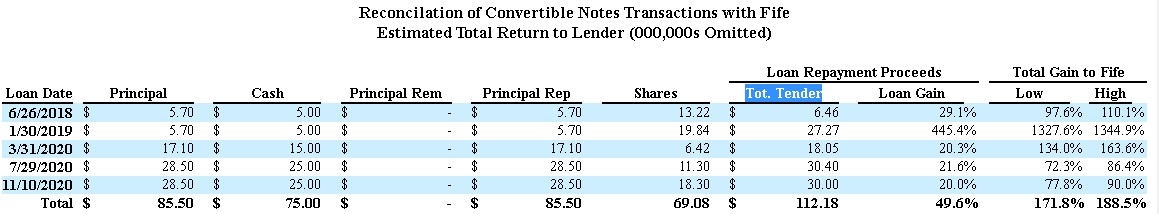

I see that the 13d have no breakdown of their calculations for the Fife loans. Another thing to not trust from the 13d. If you look at the calculations for the January 30,2019 note You have $27.7 million tendered and the $700k in fees which means Fife had a total gain of 559.4% so where are they getting 1327.6% + from.

There's also the imputation that Fife dumped the 4 million shares on June 30th. Those would be unregistered shares with a legend that brokers would be unwilling to accept. Also in violation of SEC regulations of a 6 month holding period. Now take into account 56.3 million shares traded that day and the starting dump of 15 -20 million (?) shares we know Citron was the culprit. But what's a few more lies from the 13d.

There's also the imputation that Fife dumped the 4 million shares on June 30th. Those would be unregistered shares with a legend that brokers would be unwilling to accept. Also in violation of SEC regulations of a 6 month holding period. Now take into account 56.3 million shares traded that day and the starting dump of 15 -20 million (?) shares we know Citron was the culprit. But what's a few more lies from the 13d.

Quote:

WHAT HAPPENED ON JUNE 29, 2020?

The convertible note issued on January 30, 2019 was particularly enriching to Fife. We estimate that Fife’s total return for this single note ranged from 1327.6% to 1344.9% of the cash received by CytoDyn.11 This return is most notable because of the dubious timing of a “penalty payment” issued by CytoDyn to Fife. CytoDyn transferred 4.0 million shares valued at $22.5 million12 to Fife one day prior to June 30, 2020, when the intraday share price dropped from $10.01 per share to $4.65 per share in seven minutes. This timing is very disconcerting with the recent disclosure that both the Department of Justice and Securities and Exchange Commission have issued subpoenas to CytoDyn related to, among other things, the trading in the securities of CytoDyn.