Note:

We are adopting a policy

of barring and deleting paid humps and the like !!

I will delete any paid promo. They come here to make

some use of our casual stock sharing environment.

They are self important and noisy. Good riddance, again.

Those deletes start with the next offending post.

Sign in the entrance window:

The reason for banning paid humps

is that they are after your money - they would

hope you would even slap the ask. Then with

the stock they were likely 'given' for services

sell it without saying they are going to leaving

us to hold the bag. Next to criminal, abusive at

the very least. Such behavior is not welcome in

our Coffee Shoppe once we see it happening.

And those who continue to attempt to treat us

that way will be banned. The humps are not any

good - and they stink. In a way they depend on

your failure - hoping you give up your money

long enough for them to quietly sell. They clearly

deserve a bad taste in your mouth.

Legit advertisers or market listing exchanges are not

given stock in order to sell out from under you.

We will also delete any so-called market research

advertisement or any post fronting such off-site or

email sign-up hustlers or company solicitations.

Repeat offenders will be banned !!

< Nasdaq Website

All Market statistics

< We are expanding this board to include all big board stocks.

We will entertain any big board stock for a 'look-see' and trade.

Will delete tickers that are not on the big boards, thank you.

< updating chart: S & P 500 stocks.

< updating chart: DJIA 30 stocks.

< updating chart: The Nasdaq Composite 3,300 stocks.

< updating chart: The Nasdaq 100 companies / 104 stocks.

< The NASDAQ 100, whose components are a subset of the NASDAQ

Composite's, accounts for over 90% of the NASDAQ Composite's

movement, and there are many ETFs tracking its performance.

< Flash Quotes for Nasdaq 100

< Top Nasdaq ETF's: QQQ / ONEQ / IBB / QTEC .

Analysts' Recommendations today (open) $AMTX

< FinViz futures

< Roll over Maps all

< Listing on Nasdaq

The IPO Playbook :

< All foreign exchange stocks are welcome so long

as their exchange is clearly shown each posting.

...........................................................................................

Level ll from jonny_red & Smasher_Troll

(iBox) Jonny Red's Cafe

What Is Level II?

Smasher_Troll

Level II is essentially the order book for Nasdaq stocks. When orders are placed, they are placed through many different market makers and other market participants. Level II will show you a ranked list of the best bid and ask prices from each of these participants, giving you detailed insight into the price action. Knowing exactly who has an interest in a stock can be extremely useful, especially if you are day trading.

What Are Level 2 Quotes & How To Use It Like A Pro | Penny Stock Investing

Why Use Level II?

Level II quotes can tell you a lot about what is happening with a given stock:

You can tell what kind of buying is taking place - retail or institutional - by looking at the type of market participants involved. Large institutions do not use the same market makers as retail traders.

If you look at ECN order sizes for irregularities, you can tell when institutional players are trying to keep the buying quiet (which can mean a buyout or accumulation is taking place). We'll take a look at how you can detect similar irregularities below.

By trading with the ax when the price is trending, you can greatly increase your odds of a successful trade. Remember, the ax provides liquidity, but its traders are out there to make a profit just like anyone else.

By looking for trades that take place in between the bid and ask, you can tell when a strong trend is about to come to an end. This is because these trades are often placed by large traders who take a small loss in order to make sure that they get out of the stock in time.

Learn How to Read Level 2 : Trading Terminology & Definitions

Understanding Level 2 Quotes

jonny_red

Introduction

Fully understanding level 2 quotes is vital to successful day trading. Many novice traders are intimidated by the plethora of information presented to them in a level 2 window. The endless stream of constantly changing numbers and quotes can be quite daunting and make keeping up seem like an effort in futility. There is hope, however, as It is very straight forward and easy to understand.

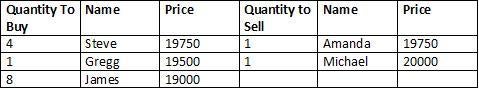

Simply put, a level 2 window is split in to two sections - the bid and the ask side. The bids, which are located on the left, show the total number of shares that buyers wish to purchase at the corresponding price. The bid side is arranged in descending order, with the highest bids on the top and lower bids following below. The “ask side,” located on the right, shows the total number of shares that sellers wish to sell at corresponding prices. The ask side is arranged in an ascending order with the lowest ask on the top with higher prices below. Below is an example of a standard level 2 window.

LEVEL 2 QUOTE WINDOW

Before moving on, it is best to use a simple story as an example. Your neighbor Michael has a group of cars he wishes to sell for $20,000 a piece. Your friend Greg wants to buy one car for $19,500. Your cousin Steve thinks that the cars are a bargain and wants to buy 4 of them at $19,750 each. Your father James thinks the cars can be re-sold for a higher profit in a year and would be willing to buy eight of them, but will not pay more than $19,000 a piece.

A level 2 quote window for this scenario will look like this

It is important to understand that a trade will only occur when a buyer and seller have identical pricing constraints. To illustrate this, Amanda, who lives a block away, is in desperate need of cash and has an identical car to sell. Seeing the level 2 quotes, she knows that there is a request to buy at $19,750 and is willing to sell at that price. Thus, Amanda will add her “ask” to the level 2, which will be reflected as such:

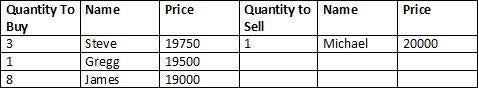

Now that Steve and Amanda have a mutually agreed upon price, a transaction will occur and the level 2 box will reflect the instance accordingly. The sale is going through at 10:30am facilitated by the Bank of Awesome. Steve has purchased 1 car and still has an open order for three additional cars. Since Amanda's order was filled, she is now removed from the level 2 box.

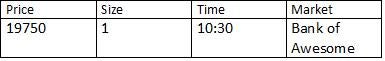

Every time a transaction occurs, it is recorded in what is referred to as the “Time & Sales” box, which lists the price, quantity, time, and market of the transaction. An example is shown below.

Now let us return to, and dissect a standard Level 2 window.

Original Window

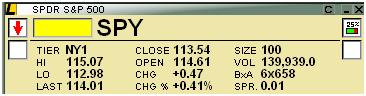

BASIC INFORMATION

This part of the level 2 window contains basic information about the stock (in this case, the SPDR S&P 500 SPY ETF). Included is the intraday high/low, the last trading price, the previous trading day's closing price, today's opening price, the current percentage change, and the total volume traded.

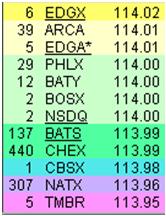

BUY SIDE (BID)

This area shows the total number of shares investors are willing to buy at the corresponding prices. The number of shares is divided by 100 for simplicity. For example, the “6” on the top left represents 600 shares.

In our previous car example, we used the individual names in our Level 2, but here the “names” are simply each individual ECN (Electronic Communication Network). In this Level 2 window, “39 ARCA 114.01” signifies that within the ARCA network, the best bid from investors is currently for 3,900 shares at a price of $114.01. ECNs are designed to facilitate trading and will automatically match buyers and sellers that have the same price criteria. Such ECN's are used by both large financial institutions and individual investors trading on a discount brokerage account alike.

Sell Side (Ask)

This area shows us the total number of shares available to sell at given prices. The structure is identical to the bid side. As an example, “388 ARCA 114.03” signifies that the ARCA network has a total of 38,800 shares to sell at $114.03.

Condensed Time & Sales Box

This box is optional and is added for convenience. Every time a transaction occurs, it is reported and each transaction is referred to as a “print.” Since this is a condensed version, each print contains a lettered code which represents a specific ECN.

Time & Sales Box

Identical to our example, the Time & Sales box presents the price, quantity, time, and ECN used in every transaction. Since there are multiple ECNs available, it is very common for many transactions to occur at the same time.

Conclusion

Since each Level 2 box updates in real time, an investor can use this feature to better determine the short term direction of a stock. For example, if many orders are being filled on the “ask” side this might be an indication the stock is heading higher since buyers are clamoring to scoop up available shares at higher prices.

Conversely, if orders are consistently being filled on the “bid” side, it may be a warning sign that the stock is ready to fall given that sellers are willing to dump their shares at lower prices.

While a level 2 screen can seem somewhat complicated at first, it is a relatively simple entity. It is merely a mechanism for matching buyers and sellers in an orderly fashion. The only thing that makes it somewhat difficult to comprehend is the speed at which it operates, which just takes getting used to.

Once mastered, comprehension of level 2 and time sales windows can be powerful tools in a trader's arsenal, and provide a better understanding of potential market direction.