No joke: The economy is surging Despite a

Post# of 99623

No joke: The economy is surging

Despite a modest stock-market pullback and mediocre job and income gains, global manufacturing is growing at a pace not seen since early 2011.

Investors aren't paying attention because they're worried about Syria and the potential for Russian/Iranian/Hezb?ollah retaliation to any airstrike, as well as the specter of a spike in oil prices. They're worried about the looming budget negotiations in Washington as we once more approach the debt ceiling. And they're worried that the Federal Reserve will pull back its cheap money stimulus.

If we can clear those hurdles, the real economy is poised for a big rebound. Here's why.

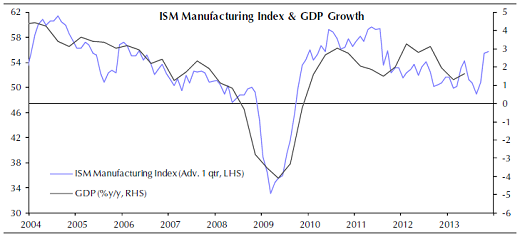

Just look at the U.S. ISM Manufacturing index that was released on Tuesday. The reading for August came in at 55.7, following on July's 55.4 result (any reading over 50 indicates month-over-month growth in manufacturing activity). Compare that to the sub-50 reading we saw back in May.

(Post continues below video.)

The surge has been driven by a bounce in new orders -- pointing to ongoing growth in output. The new orders subindex came in at 63.2 vs. 58.3 previously and a 48.8 reading in May.

According to the folks at Capital Economics, the current level of activity suggests overall GDP growth will increase to a 3% annual rate in the current quarter. Again, this is a level of strength we haven't seen since early 2011.

It's a similar story globally. Europe is exiting its recent recession, with the Eurozone Manufacturing PMI increasing to 51.4 for the best result since May 2011. German activity hit a 25-month high. The U.K. Manufacturing PMI came in at 57.2 with the manufacturing output subinde x posting its best performance since July 1994.

x posting its best performance since July 1994.

In China, the manufacturing sector is finding its footing again after Beijing's efforts to crack down on excessive lending dampened growth over the summer. China's HSBC Manufacturing PMI returned to growth last month with a 50.1 reading -- recovering from an 11-month low of 47.7 in July. Japan's JMMA Manufacturing PMI posted its sixth successive month of month-over-month growth on an acceleration in both production and new orders.

Earlier this year, the stock market soared while the economy struggled. Now, the relationship has reversed. While that's great news for middle class families waiting for a better job market or a long delayed raise, it means that investors face an even more treacherous market this autumn as a long list of catalysts are poised to buffet stock prices.

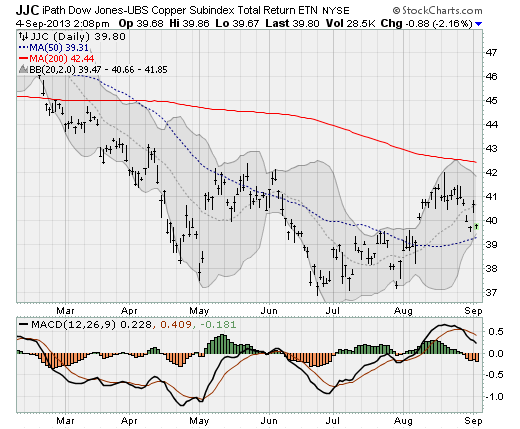

That's why you're seeing stocks in key economically-sensiti?ve areas like steelmakers and key industrial commodities like copper struggle to get traction. Just look at the Market Vectors Steelmakers ( SLX +1.24% ) and the iPath Copper ( JJC -1.99% ), and compare to the chart of manufacturing activity above. Clearly, the market believes the manufacturing rebound will prove short lived.

If we can get past Syria, the budget battle and the Fed taper with limited dramatics, the economy could finally achieve the "escape velocity" we've been waiting years for and return to a more normal growth rate, ending the long post-recession slog.

But until then, investors need to remain cautious with larger-than-normal cash allocations.

Check out Anthony's new investment newsletter, the Edge , and his money management service, Mirhaydari Capital Management . A two-week free trial has been extended to MSN Money readers. Click the link above to sign up. Mirhaydari can be contacted at anthony@edgeletter.c? ??? ????????????????????? ??? ??????????????????om? ??? ????????????????????? ??? and followed on Twitter at @EdgeLetter . You can view his current stock picks here . Feel free to comment below.

MSN Money on Twitter and Facebook

Like us on Facebook: MSN Money and Top Stocks

Follow us on Twitter: @msn_money and @topstocksmsn

(0)

(0) (0)

(0)NASDAQ DIP and RIP

Here is the best word that describes what i do here.

Intuitive;

means having the ability to understand or know something without any direct evidence or reasoning process.

I was born with it, I'm truly blessed!

Alway's searching for winners'