State regulators closed down the Sunrise Bank of Arizona, Phoenix, Arizona, and appointed the FDIC as receiver. To protect depositors, the FDIC sold the failed bank to First Fidelity Bank, N.A., Oklahoma City, Oklahoma, which will assume all deposits of Sunrise Bank.

State regulators closed down the Sunrise Bank of Arizona, Phoenix, Arizona, and appointed the FDIC as receiver. To protect depositors, the FDIC sold the failed bank to First Fidelity Bank, N.A., Oklahoma City, Oklahoma, which will assume all deposits of Sunrise Bank.

The failure of Sunrise Bank of Arizona is noteworthy since it is the fifth banking failure in the past three month of banks owned by giant bank holding company Capitol Bancorp Ltd. At December 31, 2012, Capitol Bancorp operated nine state chartered banks, one federal savings bank and one national bank that have combined total assets of $1.6 billion. All of the 11 banks controlled by Capitol Bancorp are on the unofficial Problem Bank List and eight are operating under Prompt Corrective Action notices.

Since May 10, 2013, four other banks owned by Capitol Bancorp have collapsed – Pisgah Community Bank , Sunrise Bank (Georgia) , Central Arizona Bank , and 1st Commerce Bank . Total assets of the five failed banks owned by Capitol Bancorp amounted to $336.7 and total losses to the FDIC deposit insurance fund total $61.2 million.

As previously discussed , the prospects for Capital Bancorp to continue as an ongoing banking enterprise appear to be quite low.

Capitol Bancorp is a uniquely structured affiliation of community banks. Local banks controlled by Capitol Bancorp have local authority to make loans. The parent company provides administrative and operational support services which, in the view of the parent company, allows each banking unit to perform more efficiently.

Unfortunately, Capitol’s theories on running banks did not work in the really world and many of its banks faced huge losses as loan defaults soared during the financial collapse and ensuing recession.

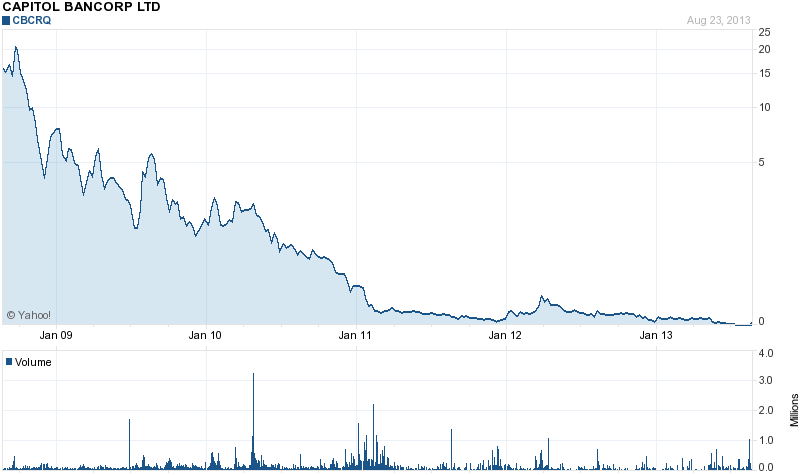

Capitol Bancorp has been attempting to either recapitalize or sell the various banks it controls without success. Given the seriously undercapitalized condition of the banks owned by Capitol Bancorp, buyers are hard to find. Serious buyers are more likely to wait until the banks are closed by regulators when FDIC assisted financing on favorable terms would be available. On August 9, 2012, Capitol Bancorp filed for reorganization under Chapter 11. Investors seem to be taking a dim view on a potential recovery by Capitol Bancorp and the stock has fallen from the $50 range in 2008 to a mere one cent per share after declining by 54% in Friday trading.

The FDIC seems to have given Capitol Bancorp an extreme amount of latitude considering the dire financial condition that the company is in and the lack of success in disposing of its banking units. Unless Capitol Bancorp can pull off a miracle, it seems likely that regulators will eventually be forced to close the other banks owned by Capitol Bancorp.

The banks controlled by Capitol Bancorp at 2012 year end are listed below.

Arizona | |

|

|

Georgia | |

| |

Indiana | |

| |

Michigan | |

| |

Missouri | |

|

|

Nevada | |

|

|

New Mexico | |

|

|

North Carolina | |

|

|

Ohio | |

|

|

All six branches of Sunrise Bank will reopen as branches of First Fidelity Bank and deposit insurance will continue uninterrupted up to the applicable limits. Over the weekend, depostors of Sunrise Bank of Arizona will have access to their money through checking accounts, debit cards and ATMs.

As of June 30, 2013, Sunrise Bank had total assets of $202.2 million and total deposits of $196.9 million. First Fidelity Bank, in addition to assuming all deposits of the failed bank, also agreed to purchase all of the assets of Sunrise Bank.

Sunrise Bank of Arizona becomes the nation’s 20th banking failure of 2013 and the third in Arizona. The cost to the FDIC deposit insurance fund for the failure of Sunrise Bank comes in at $17.0 million.

Since the financial meltdown of 2008 a total of 485 banks have failed. Despite the large number of banking failures, the number of banks on the FDIC’s confidential Problem Bank List amount to almost 9% of all FDIC insured banks. As of March 31, 2013, there were 612 banks on the Problem Bank List . The FDIC currently insures deposits at 7,019 banks and savings associations.

Banking Failures Since 2008

Year Number of Bank Failures

2008 25

2009 140

2010 157

2011 92

2012 51

2013 20

Total 485