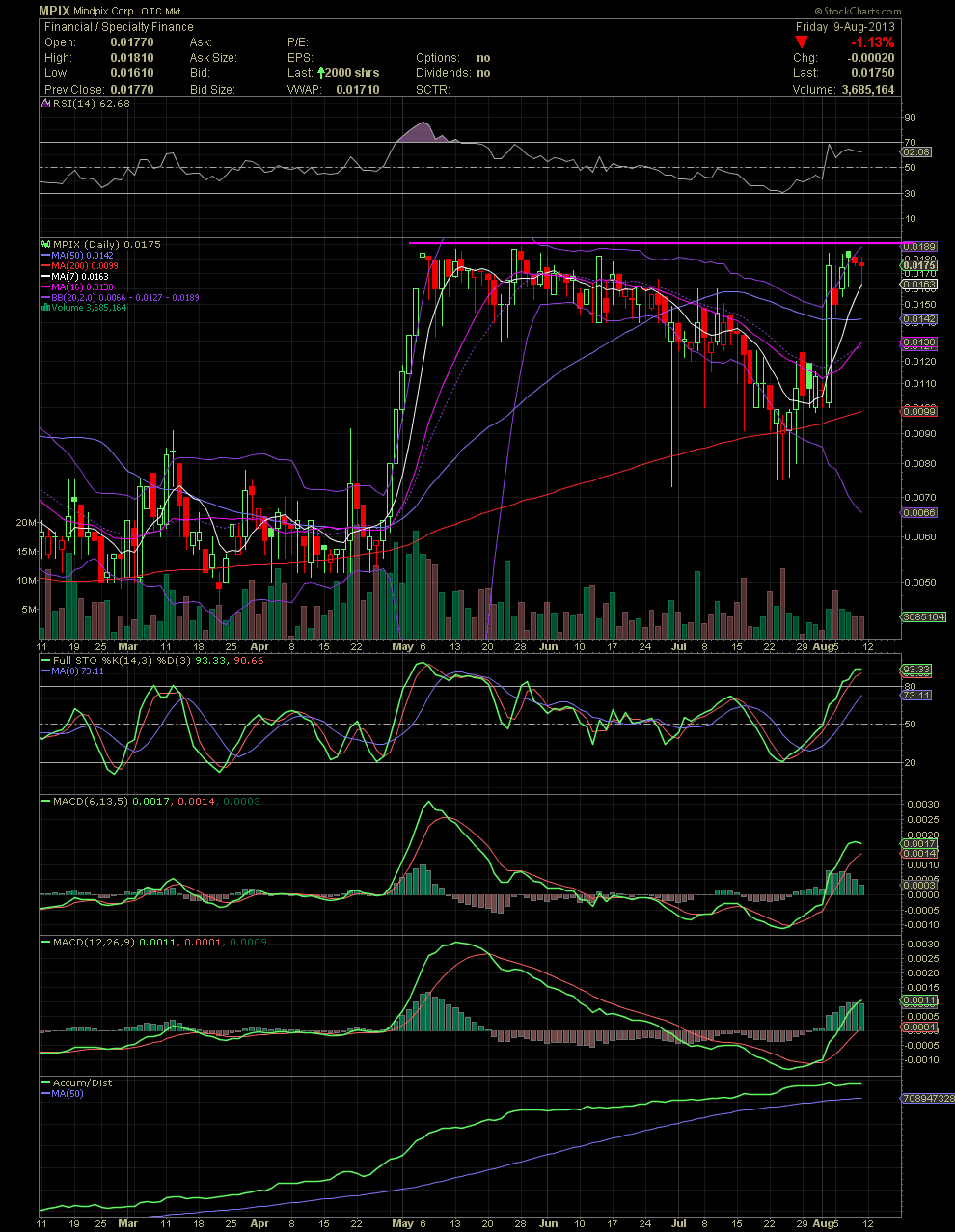

MPIX Daily Chart ~ Everything is Coming Together

Post# of 5570

In just over 3.5 months, Victor Siegel and Saul Federman have taken MPIX from a DTC Chill to Fully Reporting. We have seen MPIX restate and correct its financial statements. We have seen 400 million shares recovered and returned to treasury. All this while most wrote the company off and left it for dead just a few months ago. Now that MPIX is current, T.E.A.M. management can now begin to move forward and execute their business plan. As mentioned previously by CEO Victor, he first needed a clean slate and a strong foundation so that MPIX can move forward to become a global entertainment monster. It will take time but a lot of previous garbage had to be cleaned up before that could happen. It always looks like ex management can only sell 5 million shares per month as we move forward. Why they are allowed to sell anything is unknown to me. But I'll let the new guys continue to deliver as they already have accomplished more in 3.5 months than the previous crew did for years. MPIX is just about there now, and I can't wait to see what is about to happen.

As to the chart, last week simply saw some consolidation and churning after a huge Friday, August 2. As always occurs after a sharp advance, the indicators need to catch up. The RSI is holding near 60. The longer term MACD showed continued movement to the upside despite five days of churning. The FullSto and shorter term MACD are reflecting the consolidation. The A/D line moved sideways as 25.32 mil shares changed hands this week. There is no doubt MPIX does not trade like a stock with a 1.23 billion OS. A large portion of the float has been accumulated by strong believers (see A/D line) and is not being sold. The share price came back inside the upper bollie and bounced off the MA7 during Friday's intraday dip. The move from .01 to .0184 a week ago is now a bull flag setup and a week-long pennant formation. We'll see if the stock needs more consolidation or will MPIX to new 18 month highs with any material news. GLTA

(0)

(0) (0)

(0)