Carnage among gold stocks as gold price rally evap

Post# of 130

Carnage among gold stocks as gold price rally evaporates

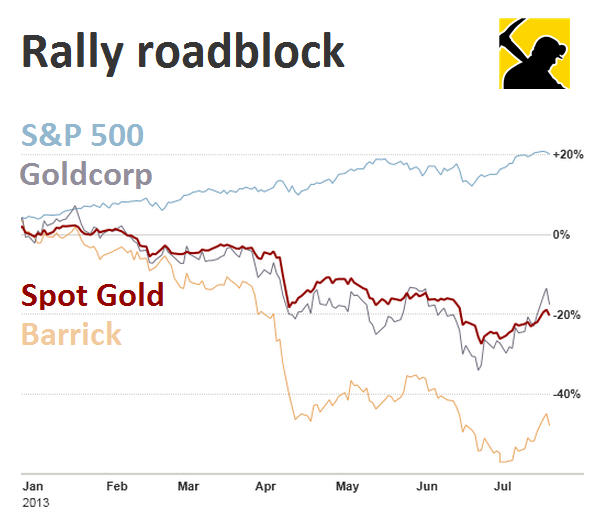

The rally in the gold price reversed on Wednesday with the metal falling more than $20 to a day low of $1,313 after better than expected economic news in the US and a stronger dollar dented confidence.

The gold price seemed to have turned a corner in July fighting back from near 3-year lows of $1,200 hit at the end of June, but it remains 21% cheaper than at the start of the year.

Gold stocks have suffered a worse fate than the metal and recent gains in the sector were looking in danger of evaporating on Wednesday.

In afternoon trade Barrick Gold Corp (TSX:ABX) lost 6.2% falling, well off 21-year lows struck in June, but still down 50% so far this year.

Barrick is now worth $17.6 billion on the TSX, nowhere near its market capitalization just two years ago of more than $54 billion.

The global number one gold company in terms of output has been dogged by problems this year with work at its massive Pascua-Lama project straddling the border between Chile and Argentina, halted due to protests and legal challenges .

Denver-based Newmont Mining Corp (NYSE:NEM) with a market value of $15.7 billion, down from $30 billion last year, shed 5.8%.

The world's third largest gold producer behind Newmont, AngloGold Ashanti (NYSE:AU) also gave up more than 5.3%. AngloGold announced last week it will take as much as a $2.6 billion charge as it comes to grips with a lower gold price.

Th Johannesburg-based company's ADRs listed in New York are down 56% year to date as it struggles with unrest in the its home country's mining sector and falling gold output.

Fellow South African miner Gold Fields (NYSE:GFI) fared better, with losses limited to 4.8%. The fourth largest gold producer has had its value slashed 54% in 2013.

Canadian gold counters Goldcorp (TSX:G) and Kinross Gold (TSX:K) – which this year overtook Goldcorp as the world fifth largest gold miner in terms of output – lost 5.8% and 6.3% respectively.

Goldcorp's market value peaked in 2011 at $30 billion and thanks to a relatively robust share price amid the general carnage – year to date losses are 'only' 20% – the Vancouver-based company is the most valuable gold stock.

Goldcorp's market value peaked in 2011 at $30 billion and thanks to a relatively robust share price amid the general carnage – year to date losses are 'only' 20% – the Vancouver-based company is the most valuable gold stock.

Australia's Newcrest Mining's (ASX:NCM) gained on the Sydney bourse and avoided much of the carnage in in New York as gold fell.

The company in June announced $6 billion in writedowns and a dividend cut, but suspicious price movements ahead of the news prompted an investigation by Australian market regulators and possible class action lawsuits on behalf of shareholders, who have seen their investment in the Melbourne-based company decline 45% this year.

Kinross, like all the majors, took multi-billion charges against the value of its operations with the Toronto firm writing down its ill-fated acquisition in Mauritania and abandoning a huge project in Ecuador. Kinross was one of the worst performers on the day is now worth 45% less than at the start of the year.

Kinross, like all the majors, took multi-billion charges against the value of its operations with the Toronto firm writing down its ill-fated acquisition in Mauritania and abandoning a huge project in Ecuador. Kinross was one of the worst performers on the day is now worth 45% less than at the start of the year.

Ever volatile Harmony Gold Mining (NYSE:HMY) shed 6.5% in New York – the Johannesburg-based company is still almost 60% cheaper than at the start of the year giving the dubious distinction of being the worst performer in the sector year to date as it reassess operations in South African and Papua New Guinea.

Canada's Yamana Gold (TSX:YRI) lost 6.4%, while Agnico Eagle Mines (TSX:AEM) gave up 7.8% after two brokerages downgraded the stock.

Eldorado Gold Corp (TSX:ELD) declined 6.3%. Last week Eldorado announced 2013 capital expenditure cuts of 35%, as well as minimum yearlong delays at three key European gold mining projects.

(0)

(0) (0)

(0)