MPIX Daily Chart ~ Appears to be Very Close to the

Post# of 5570

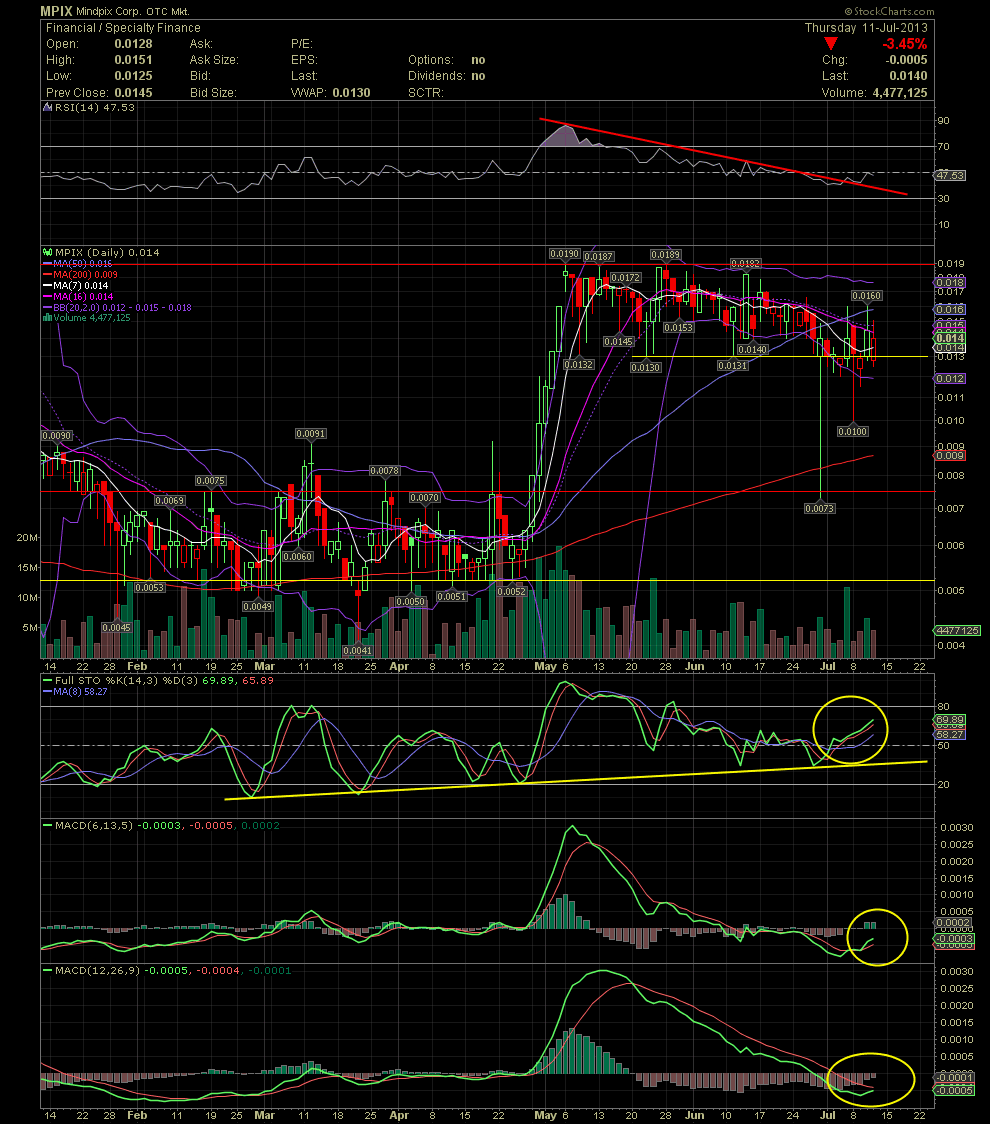

MPIX Daily Chart ~ Appears to be Very Close to the Next Move Up

Good Evening MPIX Longs. Just a quick observation on the daily for those following along. Obviously still channeling since the high of May 6 at .019. We've seen two days where the stock closed below the lower channel line, no big deal. The stock is no longer extremely overbought as in early May, and the chart is now showing that the channeling might finally be coming to an end. Please note the divergence on the RSI over the last week of weakness. It's also moved over the two month declining tops line (red) as has the FullSto. The FullSto is signaling a change of direction might be upon us. The slightly rising trend line is also showing a different direction when compared to the channeling of the candles. During the last week of weakness, of interest is the divergence also seen on the MACDs. The faster MACD has crossed over to the upside, whereas the slower MACD has leveled out and is starting to also move upwards although it hasn't confirmed the FullSto and faster MACD yet. Seeing these indicators move up on a red day is a sign that our move back up, hopefully to new highs, might be at hand. Today's news of another appointment to the board looks like another administrative step in building the foundation of the company. My guess is we'll see more appointments to the board of directors as well as management over the next few weeks and months as the company begins to execute their business plan. My opinion of the constant selling pressure remains the same, that being it's a combination of heavy selling by ex-management and probably some short selling. It's going to suck to be short MPIX once the financials are out, the OS reduction occurs, and management transforms MPIX into a capitalized and revenue producing machine. It is coming. GLTA

(0)

(0) (0)

(0)