A Bullish Case For Fannie Mae J

Post# of 145489

Disclosure: I have no positions in any stocks mentioned, but may initiate a long position in FNMA.OB over the next 72 hours.

It has been a rollercoaster ride for Fannie Mae's ( FNMA.OB ) common stock holders this year. FNMA, along with Freddie Mac ( FMCC.OB ), has registered record profits in recent quarters, thanks to the recovery in the housing market. This has enabled FNMA, as well as FMCC, to return a significant portion of the bailout money the mortgage giants received at the peak of the financial crisis.

Record profits at FNMA also led to speculation that the mortgage giant will eventually exit government control. Not surprisingly, FNMA shares have seen a huge rally since the start of 2013. Year-to-date, the stock has gained more than 535%. However, the party was recently spoiled after a bipartisan group of senators presented a plan that would eventually wind down FNMA and FMCC. The question FNMA investors are asking right now is whether the bill will go through or will the rising profit at FNMA and FMCC force government to let some value flow back to shareholders.

Fannie Mae and the improving housing market

Fannie Mae's record profit is being driven by the ongoing improvement in the housing market. Most recent data from the housing market showed that sale of new U.S. single-family homes climbed to the highest level in almost five years. Meanwhile, housing starts have also been rising at a steady pace.

The recovery in the housing market began early last year, and accelerated after the Federal Reserve announced a third round of quantitative easing in September 2012.

Under the QE3 program, the Fed pledged to buy $40 billion a month in mortgage backed securities until there is a sustained recovery in the housing market. This immediately pushed mortgage rates to record low levels and aided the recovery in the housing market. Although mortgage rates have risen sharply in recent weeks amid speculation over an early end to Fed's QE3 program, they are relatively low . Therefore, the housing market recovery remains on track. In addition, low mortgage rates are just one of the factors that have aided the recovery. The housing market has also benefited from tight supply. With the housing market recovery expected to continue, Fannie Mae is expected to continue to post record profits.

Fannie Mae's record profit

Given the recovery in the housing market, it is not surprising that Fannie Mae has been posting record profits. FNMA, which along with FMCC was set up to buy mortgages from banks and package them into securities in order to boost mortgage lending activity, reported a record $58.7 billion in earnings in the quarter ended March 31, 2013. The company's earnings before taxes totaled $8.1 billion. This was the fifth straight profitable quarter for the mortgage giant.

In addition, Fannie said that it will pay a dividend of $59.4 billion to the U.S. Treasury. More importantly, the company said that it requested no additional aid from the government.

Fannie Mae, along with Freddie Mac, was bailed out by the U.S. Treasury with taxpayers' money after the two companies suffered significant losses on subprime mortgages. Both companies were on the verge of collapse when they were bailed out. FNMA received approximately $116 billion from the Treasury. However, with the latest dividend, the mortgage giant has already repaid $95 billion.

This has led to increasing speculation that Fannie Mae might eventually exit government control. If that happens, it could unlock enormous value for FNMA shareholders, given the ongoing recovery in the housing market.

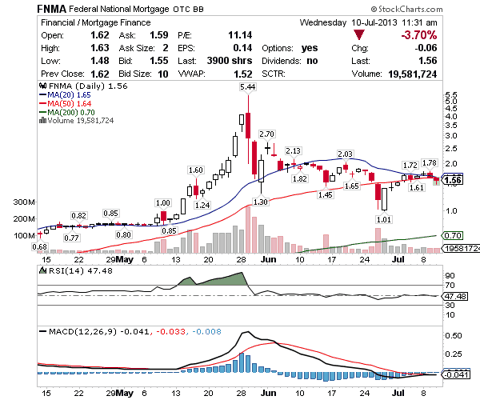

The chart above shows how expectations of a government exit sparked a huge rally in FNMA this year, with the stock hit $5.44 in late May. However, the party for FNMA common stockholders ended after the introduction of a bipartisan bill that seeks to wind down FNMA and FMCC.

Winding down Fannie and Freddie

Fannie and Freddie were set up by the U.S. government to boost mortgage lending and home ownership. For years, the idea worked perfectly, with FNMA and FMCC providing liquidity and stability to the secondary mortgage market. However, the housing market collapse of 2008 highlighted some flaws in the system.

With FNMA and FMCC on the verge collapse, the government was forced to intervene and bailout the mortgage giants with taxpayers' money. Since bailing out the two companies, there has been growing debate in Washington on whether the government should play a role in the mortgage market. Many in Washington are in favor of winding down Fannie Mae and Freddie Mac in order to avert a situation like the one seen during the peak of the financial crisis.

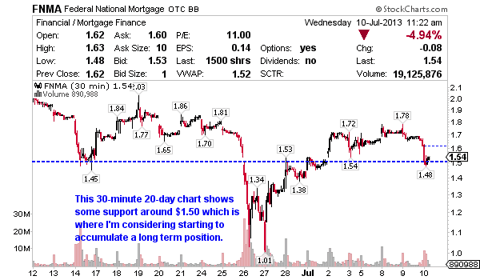

A recent bill proposed by a bipartisan group of senators seeks to wind down Fannie Mae and Freddie Mac over the next five years, and introduce more private capital into the mortgage market. The introduction of the bill sparked a sell-off in Fannie Mae shares. In the last one month, the stock has fallen more than 18% as shareholders fear that they will be left with no value if the proposed bill is passed by the Congress. However, I think the sell-off may be an overreaction.

Bullish case for Fannie Mae

Lawmakers have been looking to overhaul the housing finance system ever since Fannie and Freddie were bailed out during the financial crisis. However, very little has actually been done. Initially, lawmakers feared that any plans to overhaul the system could have a negative impact on the housing market. However, with the housing market now showing signs of robust recovery, lawmakers feel this is the right time to implement reforms. But they may still back out.

While the housing market is recovering, we are still some way from a full recovery. In addition, the housing market is one of the strongest areas of an overall moderately improving economy. Lawmakers would certainly not want to derail the recovery at this stage by passing a bill that seeks to liquidate FNMA and FMCC.

Also, when Fannie Mae and Freddie Mac were bailed out, the government did not expect them to recover the way they have. In fact, the bailout agreement includes no provision for both companies to repay the taxpayers' money and become independent once again. However, the way Fannie Mae and Freddie Mac have bounced back, there is still significant value in both companies. Not surprisingly, several investors have urged lawmakers to keep Fannie and Freddie alive.

At the moment, under the terms of a revised agreement, Fannie Mae has been paying the Treasury all of its profits as dividends. This has made rebuilding capital impossible for the company. However, if the mortgage giant continues to post record profit, which I believe it will given the ongoing recovery in the housing market, then the government might have to think about giving up control and scrap any plans to wind down FNMA and FMCC. If that happens then FNMA shareholders stand to make substantial profit.

(0)

(0) (0)

(0)My Favorite Paid chat room with amazing chart setups is The Trading Stock Lounge http://www.thetradingstocklounge.com/