Only a few days ago, the leading Wall Street debate was whether central banks had too much control over the financial markets. Suddenly, the nagging notion is whether central banks are losing, or surrendering, control.

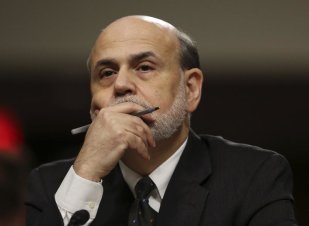

Since Federal Reserve Chairman Ben Bernanke on Wednesday set out the likelihood of curtailed “quantitative-easing” bond purchases late this year, interest rates have shot higher, with the 10-year Treasury yield surging above 2.5% Friday from 2.17% before he spoke, sparking a 560-point tumble in the Dow Jones Industrial Average in two days.

Since Federal Reserve Chairman Ben Bernanke on Wednesday set out the likelihood of curtailed “quantitative-easing” bond purchases late this year, interest rates have shot higher, with the 10-year Treasury yield surging above 2.5% Friday from 2.17% before he spoke, sparking a 560-point tumble in the Dow Jones Industrial Average in two days.

This is popularly viewed as a simple re-pricing of bonds in anticipation of the Fed backing away from its current $85 billion monthly purchase of Treasury and mortgage debt. Yet, it’s not clear the Fed wished for rates to whistle higher at this pace, given all of Bernanke’s caveats that economic data alone will steer his course.

After the Fed meeting, Michael Hartnett , chief investment strategist at Bank of America Merrill Lynch, reiterated his view that “2013 will be the high-water mark of the ‘liquidity era.’” If so, a central belief that investors have grown accustomed to has been badly disturbed.

Similar approaches

For sure, the liquidity will drain slowly, but Hartnett notes the rallying dollar suggests it’s underway. He thinks ultimately money will be reallocated into stocks, but until global asset markets settle down a bit, it appears this adjustment could be messy and nervous.

Stirring further worry, the Fed is not the only central bank that appears at risk of having its grasp on market action loosen. The People’s Bank of China has so far declined to act forcefully to ease severe stress in the interbank-lending market there, which has at times seen overnight rates shoot above 20% this week. The European Central Bank , while it has calmed fears of an outright debt meltdown, has consistently been less active than the Fed in pumping cash into the system to revive a stagnant economy. The Bank of Japan, which has been maximally aggressive in printing yen to push inflation and growth higher, has largely refused to respond as Japanese bond and stock markets are tossed around in turbulence.

Finally, emerging-market central banks are scrambling to defend against further steep declines in their currencies -- a flip side of the resurgent dollar -- for fear they will worsen inflation. This hampers their ability to cut interest rates to support struggling economies.

The velocity of the backup in rates and anxious selloff in stocks seems in part related to a fear that the Fed is growing not only less friendly, but perhaps is losing or ceding control of markets now beholden to whippy economic data and the liquidation of a crowded, complacent collection of global bond owners. A key accomplishment of the Fed and other central banks since last year has been to suppress volatility. As they potentially move toward a less-dominant role in markets, it makes sense that volatility eruptions would occur more often.

The fact that Bernanke declined perfectly good excuses to sound a more soothing tone -- by citing moribund inflation trends and the overhang of federal spending constraints -- without dramatically or convincingly raising his view of growth prospects, spread plenty of unease. He conveyed his seriousness about summoning the inflection point when the Fed can step back. And markets have so far taken him seriously.

The coming tone

When things calm down is a matter of how much baseless froth was in assets, and whether some sort of “financial accident” is triggered by all the jumpiness in huge markets packed with ill-positioned fast money. While not the likeliest scenario, there is a dark thought occurring to some investors that the Fed might implicitly say, by the middle of next year, “we’ve done all we can, or want to, do” at a moment when the economy is not obviously performing all that well. Put another way, investors are not comfortable with policy makers who are acting as if they’re more confident in the growth outlook than they are.

The comments Friday that St. Louis Fed President James Bullard objected to Bernanke’s detailing of possible plans for phasing out bond-buying at a time when the Fed wasn’t lifting its economic sights could mean a change in tone from Fed speakers to come, especially if Treasury yields don’t settle back.

True, the stock market can tolerate higher rates for the “right reason,” meaning better confidence in the economic picture. Yet at minimum, the bond-like dividend stocks such as consumer staples, real-estate investment trusts and utilities, which dragged the market to new highs early this year, are being enduringly re-valued lower. That said, a Wall Street Journal report Friday emphasizing that the Fed is sensitive to negative market interpretations suggests officials don't want investors to extrapolate the hints of less-easy policy too far.

If the indexes are to prove resilient and rebuild upside momentum, either before a full-fledged correction washout or not, stocks more attuned to the economic pace will need to find plausible reason in the data to take the lead.

The Fed and other central banks likely got too much credit as the “only” reason stocks galloped higher early this year, and perhaps will get more blame than merited on the downside. But this is now becoming a real-world test of just how much they’ve been responsible for.