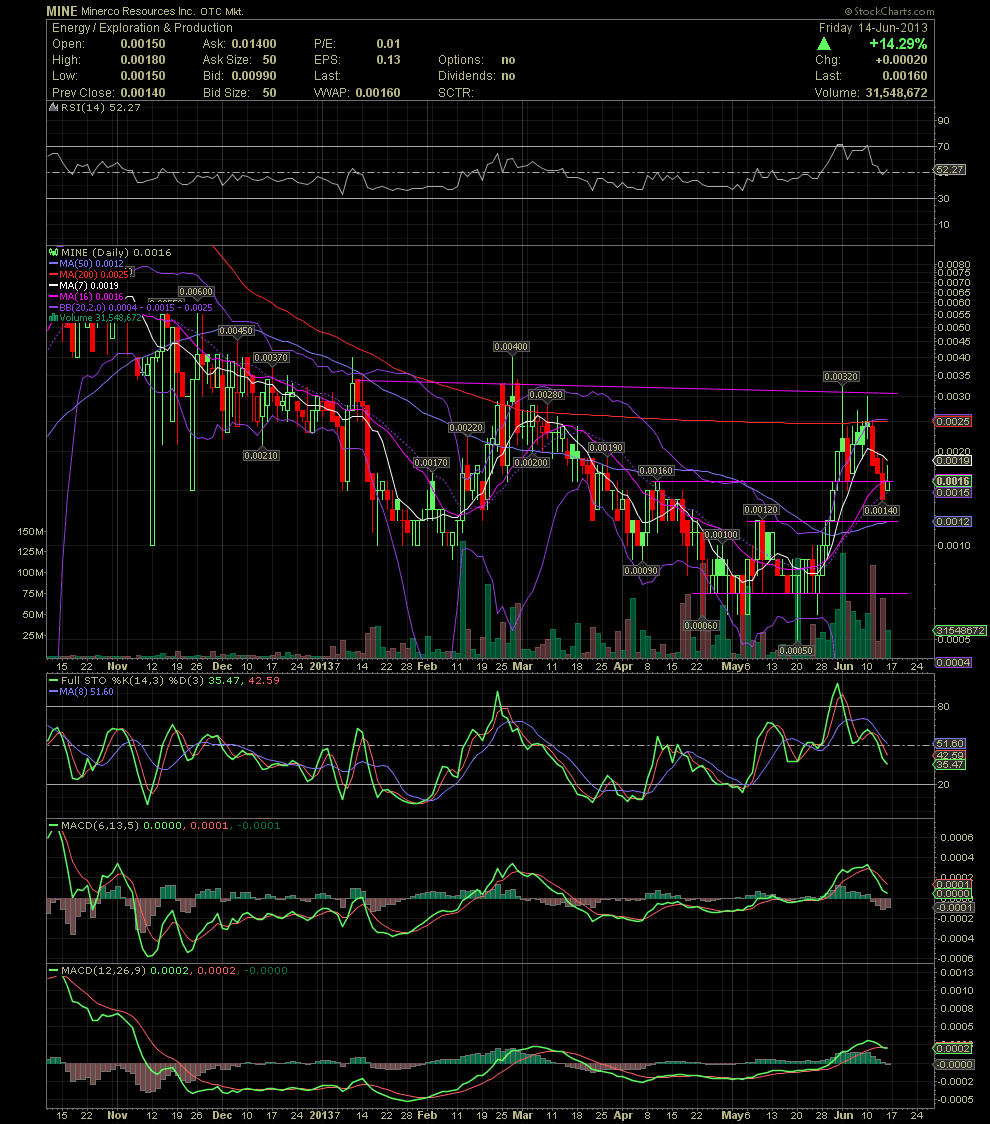

MINE Daily Chart ~ A Bright Future but a Tough One

Post# of 2561

MINE Daily Chart ~ A Bright Future but a Tough One to Hold

MINE has been a tough stock for investors unless you've been flipping it, which I have to admit I haven't done hardly enough of. A number of us have simply been accumulating for weeks from .0007 to the high teens after beginning our investments in the high .002s prior to a lot of debt conversions which resulted in a large increase in the OS and float. There will come that day soon where the .003/.0032 resistance is taken out. The MA200 near .0025 has also been a bugger for close above. There have been two attempts, late Feb and early June, to close above the MA200 but both failed. It's not unusual to see the MA200 finally taken out on the third attempt. Those that flipped a few near .003 did well the last two weeks as the stock collapsed with large volume profit taking along with more debt conversion. Support levels are at .0012, .0014 and .0016. Until the indicators reset and begin to crossover to the green again, we'll be accumulating the mid teens. Rumors have it of major news coming this week as shareholders await word from the company that their partner, Power Brands, has started to market Level 5 and place it in retail outlets. Once that occurs, I think MINE could easily move into the low pennies which could happen in July and August should all go well. GLTA

(0)

(0) (0)

(0)