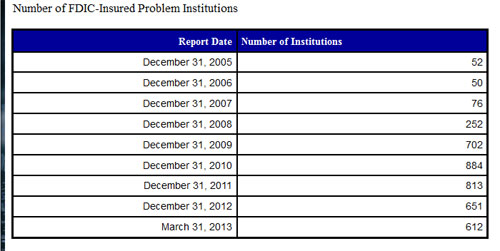

The number of problem banks declined slightly during the first quarter of 2013. According to the latest Quarterly Banking Profile released today by the FDIC, the number of problem banks declined from 651 to 612, for a net reduction of 39 banks.

Although profits for the overall banking industry have increased for the past 15 consecutive quarters, the number of problem banks remains stubbornly high compared to past banking recoveries. As of March 31, 2013, 8.7% of all banks were still classified as problem banks by the FDIC.

While profits for the banking industry during the first quarter hit an all time record high of $40.3 billion, many smaller banks are still struggling to survive. The high cost of increased regulatory burdens, a slow lending environment, difficulty in raising additional capital and low interest rates have prevented many smaller banks from recovering.

The average total assets of institutions on the problem bank list is only $348 million. Based on the recovery in the banking industry and the amount of average assets of problem banks, it is safe to say that no large size banks are on the FDIC Problem Bank List.

Although the Problem Bank List is kept confidential by the FDIC, it is highly probable that most of the banks currently losing money are included on the Problem Bank List. During the first quarter of 2013, the proportion of banks that lost money amounted to 8.4% of all banks, a number that correlates very closely to the percentage of banks on the problem bank list. Of 7,019 banks insured by the FDIC, 612 or 8.7% of all banks are on the problem bank list.

Although the Problem Bank List is kept confidential by the FDIC, it is highly probable that most of the banks currently losing money are included on the Problem Bank List. During the first quarter of 2013, the proportion of banks that lost money amounted to 8.4% of all banks, a number that correlates very closely to the percentage of banks on the problem bank list. Of 7,019 banks insured by the FDIC, 612 or 8.7% of all banks are on the problem bank list.

During the first quarter of 2013 there were only four banking failures, the smallest number of closings since the second quarter of 2008 when two banks failed. During 2013 to date, there were 13 banking failures compared to 24 during the comparable period of last year.

Listed below are the banking failures by year since 2008.

Banking Failures Since 2008

Year Number of Bank Failures

2008 25

2009 140

2010 157

2011 92

2012 51

2013 13

Total 478