MPIX Daily Chart........... The Setup for Major

Post# of 5570

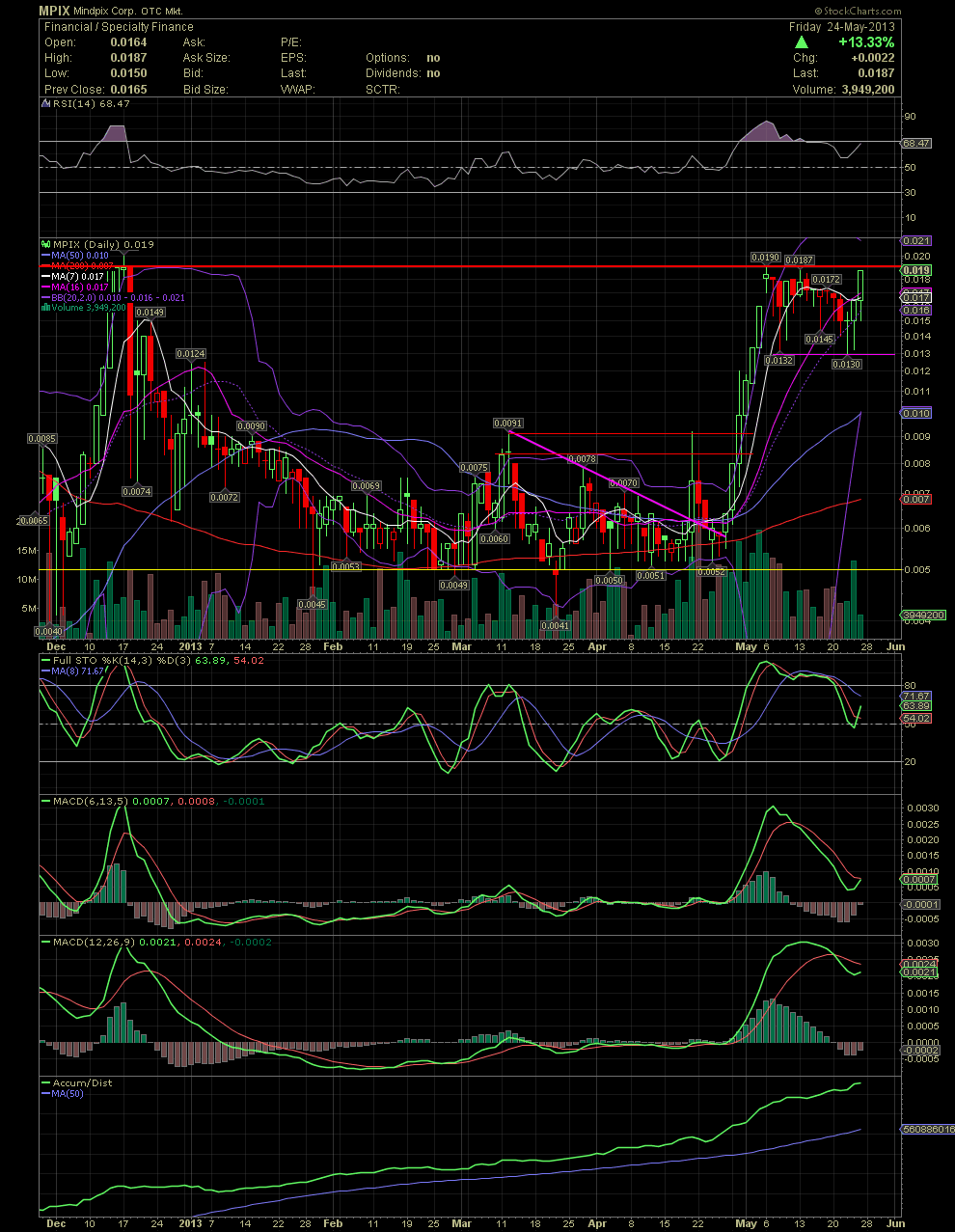

MPIX Daily Chart........... The Setup for Major Breakout

Good Morning MPIXers! I hope everyone had a great Memorial Day Holiday. As the saying goes, every picture tells a story. Please link back to a few of my previous posts if you are new and not aware of how MPIX got here.

Over the last three weeks, MPIX consolidate after a strong move from the .005s to a high of .019. While everyone wants a 10 bagger over night, it's also a recipe for disaster for those joining near the top of a big move in most cases. The three weeks of pullback and churning was exactly what the stock needed to build a base for the next leg up. As you can see, the .013s that I mentioned looked like a possible support level, turned out to be just that. It's been easy to see the intraday dips, but the stock closed at or above .015 everyday during this three week period. So anyone who was fortunate enough to get some .013s and .014s did well in entering and/or adding at that level while the nervous, uninformed, and profit takers moved on. The move on Friday, closing near the .019/.02 double top, was done on just under 4 mil shares. That's a sign that the selling has dried up. The share price is now over all the moving averages while the other indicators, such as the RSI, FullSto and MACDs are once again moving up. Friday's close was the highest close since Dec 17. We all know what old management did to their shareholders on Dec 18, and all can see how long it took to absorb the selling of almost 550 mil shares since that time (check the accumulation figures). As to the share price, my opinion is we see MPIX moving over .02 this week and possible a quick shot to .03. GLTA

(0)

(0) (0)

(0)