" CWRN "DD" Summary Updated 2012 " . . . This i

Post# of 8059

" CWRN "DD" Summary Updated 2012 " . . .

This is a Summary of all the "DD" i gathered and from other DD sources of the previous CWRN board and to show proof that this is a producing mine in Ensenada Mexico and on our planet ;-P

>> Fly Over View of Baja 14 Mine ( CWRN/PanAm - Longitude & Latitude 31.31200,-116.325000 )

>> 3D Map views/ (need Google 3D addon for your browser to be able to view)

- East to West 3D View

- 3D View from the North

--------------------------------------------------------------------------------------------------------------

> "MAPS" OVERLOAD & AERIAL MINE VIEWS of CWRN/PanAm mining concessions

> 3 Members Visits CWRN-PanAm in 2011 ( Surogateson Visits in DEC 2011 + Johnynothumb & Temeku in March 2011 & Temeku in Nov 2010 )

> CWRN and Bao Steel Pics 2012 at the Baja 14 mine in Ensenada - Colosso Vein (end of 2011 early 2012)

> Sept/Oct 2011 "VIDEO" Mining & Drilling Operations - http://videobam.com/dinTd

> SOS Corp Amendments June 8 2012 Changes in Officers

> CWRN and BOB - SEC/FBI Charges INFO

> Loreto's FE% "SGS Certificate of Analysis"

> 1st ever EXPORT PERMIT issued in Mexico for CWRN "PanAm"

> 2nd Export Permit issued for CWRN 2012 (with RFC # DD Proof Validation included)

> The 2nd Permit RFC # above is VALID. Here's proof (posted by TLC2)

(Click the link Above to the official Mexican government site and enter the RFC # PMV080912SN9 from the permit into the "RFC Importador o Patente" box, then click Buscar)

===== CWRN & PanAM (USA) & PanAM (Mex) =====

> SOS Corp Nevada COTTON & WESTERN MINING, INC (A/S 6 bil) (Public co)

* President - SHIRLEY LEE / Treasurer - ROBERT L COTTON III / Director - SHARON XCARET VAZQUEZ MONROY / Secretary - SHARON XCARET VAZQUEZ MONROY

- Entity Actions for "COTTON & WESTERN MINING, INC

* Amendments June 8 2012 Changes in Officers > Action Type:.....Amended List / Document #:.....20120407841-69 / File Date:.....6/8/2012

> SOS Corp Texas "COTTON & WESTERN MINING, INC"

https://ourcpa.cpa.state.tx.us/coa/servlet/cpa.app.coa.CoaGetTp?Pg=tpid&Search_Nm=COTTON%20%26%20WESTERN%20MINING%20&Button=search&Search_ID=12030670884

> SOS Corp PAN AMERICAN MINERAL VENTURES, INC

*Director & Secretary - SHARON XCARET VAZQUEZ MONROY / President - SHIRLEY LEE / Treasurer - MAY LIN WONG

*Amendments June 8 2012 Changes in Officers > Action Type:.....Amended List / Document #:.....20120405902-65 / File Date:.....6/8/2012

> SOS Corp PAN AMERICAN MINERAL VENTURES, LLC (Private co)

*Manager - ROBERT L COTTON / Manager - SHARON XCARET VAZQUEZ MONROY

> Panamerican Minerals Ventures S.A. de C.V "Mina Guadalupe" in Ensenada,under contract and held in trust for/with CWRN (private company created to comply with Mexican mining laws - Pres. Sharon Vazquez / V.Pres. Robert L.Cotton)

Sharon Vazquez -CEO Bob Cottons wife and Pres of sub to conform w Mex law which required co's to form a sub headed by a Mex national-Sharon is a Mex national and degree reportedly in international business from Madrid University and Univ of Mex

> Other Affiliations: SOS Corp Geo JS Tech Group USA / Geotech Group S.A de C.V Mexico (Agent - EDWARD MUI)

- http://www.ferroalloynet.com/search/geotech.html - http://web.archive.org/web/20110710101417/http://geotechgroup.org/

- https://ourcpa.cpa.state.tx.us/coa/servlet/cpa.app.coa.CoaGetTp?Pg=tpid&Search_Nm=GEO%20JS%20TECH%20GROUP%20&Button=search&Search_ID=32041636336

- http://investorshangout.com/post/view?id=60743 or Post # 52874 ( by balihi )

> SOS Corp TMT Global Corp / TMT GLOBAL CORP S.A. DE C.V (Agent - EDWARD MUI)

http://www.tmtglobalcorp.com/ - http://www.dandb.com/businessdirectory/tmtglobalcorp-statenisland-ny-23969720.html

TMT GLOBAL CORP OFFICES: 6360-D Corporate Drive. Houston, TX 77036 USA /

Ensenada is Blvd. Teniente Azueta No.130 Int. 222, Col. Recinto Portuario, Ensenada, B.C. Mex., C.P. 22800

Suite 255 Valero Plaza, Valero Street Makati City, Philippines

Flat/rm 2605. 26/fl. Island Place Tower, 510 Kings Road, North Point Hong Kong, China

http://www.otcmarkets.com/stock/CWRN/company-info

> a/o "News of June 25 2012" (SS included)

A/S: 6 Bil (per otcmarkets + PR + SOS corp)

Current O/S: 4,361,635,980 Bil

Restricted: 2,056,610,879 Bil

Free Trading Float: 2,305,025,101 Bil

Free Trading Float Held Close: 550 Mil

Free Trading Float on the street: 1,755,025,101 Bil

What Does Closely Held Shares Mean ?

The shares held by individuals closely related to a company and/or maybe some shares are part of the buyback in progress

============== RECENT NEWS ==============

>> June 25 2012 @ 8:30AM CWRN: "Qin Hai Sails with 43.8k/mt Iron Ore for Bao Steel"

PRNewswire/ -- Cotton & Western Mining, Inc. (OTC/Pinksheets: CWRN) -- The Qin Hai Bulk Cargo Vessel sailed out of the Pacific Ocean Port of Ensenada, Baja California, Mexico on June 13, 2012, with a full maximum load 43,829 WMT of Raw Crude Iron Ore sized 1-10mm under contract with Bao Steel. 45,000 WMT remains stockpiled at the port pending dispute resolution with the Mexican Authorities over time lapse in customs. The company began trucking on Oct 24, 2011 through Nov 11, 2011 for a shipping date of Dec 21, 2011; during the month of December, 2011, all iron ore export permits were canceled country wide, and new export regulations became effective overnight. The new iron ore export regulations not only required an iron ore export permit from the Secretary of Economy, but also included a Customs iron ore exporters listing; this entailed a series of Government audits, from the Tax Office, Mining Office, Environmental Agency and from Customs if the company had any prior exports of Iron Ore. Panamerican Minerals Ventures, S.A. de C.V., the Mexico Iron Mining Operator, begin the process of re-qualification to meet the stringent and rigorous new regulations. The Company received the new Secretary of Economy Export Permit in January 2012; however, the audits and other time consuming efforts for Customs listing resulted in the Company becoming one of only a few mining companies authorized to export iron ore from Mexico, on March 6, 2012.

Company News: On June 7, 2012 Robert L. Cotton, resigned as the President of Cotton & Western Mining, Inc. On June 8 2012, Shirley Lee became the new President of the Company. Ms. Lee was formerly a mine owner and operator and was with another company involved in mining and commodity trading. Ms. Lee is very knowledgeable in International Trade and will be of great value to the Company operations. The Company will be applying to NASDAQ for a name change to Pan American Mineral Ventures, Inc. to better reflect is current Mexico mining operations.

Change of Address: Cotton & Western Mining, Inc.1406 Santa Margarita StreetUnit DLas Vegas, Nevada 89146Ph: + 1 718 666 3820

Mining Update: Production at the Guadalupe Mining Concession Continues with emphasis on 1-10mm raw crude iron ore products; together, with screening of Sinter Fines from the under sizes of pervious production in form of 0.5-1mm, materials less the 0.5mm will be a by-product for Organic Mineral Fertilizer.

CWRN Current Share Structure: The Company has stated that it is not currently providing any Market Awareness nor is it involved with the market in any way. The share price of the Company's stock is solely dictated by the market further to that the share structure has not changed since year 2010, nor does the company intend to participate in any trade programs designed to offer company share

-A/S: 6 Bil -Current O/S: 4,361,635,980 Bil -Restricted: 2,056,610,879 Bil -Free Trading Float: 2,305,025,101 Bil

Notes: The Baja Pacific No. 14 – "Mina Guadalupe" is operated by affiliate Panamerican Minerals Ventures, S.A. de C.V., Ensenada, Baja California, Mexico. Cotton & Western Mining, Inc. (Pink Sheets: CWRN) a Nevada Corporation that is engaged in metal mineral exploration, development and operations for "Iron Mineral Mining". For more information, please visit the company's website at www.cottonwestern.com

>> Jun 04 2012 (2:36 PM) SEC Charges Company Officers and Penny Stock Promoters in Kickback and Market Manipulation Schemes

>> April 13 2012 @ 8:30AM Wide Area Deep Drilling Underway

Cotton & Western Mining, Inc. CWRN , Panamerican Minerals Ventures, S.A. de C.V. Mexico, the operators of the "Guadalupe Iron Mineral Concession," drilled three deep conformation holes 300 meters apart in the center line of the 1,500 meter long Coloso Iron Mineral Vein, (one of four major iron mineral veins located on the concession); the purpose of those drill-holes was to explore the depth of the Coloso Vein, since the original drill program of 68 holes was shallow at 20-meters depth. Drill-hole 69 at 44-meters revealed continuous iron minerals mixed Magnetite and Hematite down to an elevation point of 81-meters above sea level, where the drilling was suspended without punching through the iron minerals as the iron content became lower and the mineral became solid magnetite. Drill-hole 70 at 84-meters depth on the lower elevation of the concession revealed the same mineral structure as drill-hole 69, hitting iron mineral at 4-meters down and continuous to 84-meters where the drilling was suspended at 2-meters above sea level; the third Drill-hole number 71 at 54-meters depth revealed continuous magnetite as well, the drilling was suspended pending simulated concentration testing of the lower grade materials to better understand the percentage of Fe304 (Magnetite Iron Oxide) uplift that could be anticipated if the materials were processed through a series of beneficiations. Results from those analytical studies indicated that the iron minerals can be processed to a Grade-A iron mineral status. Management has been discussing the feasibility of building a concentration plant on site with the corporation of Bao Steel Group of China, provided that there is enough magnetite mineral reserve to justify the investment; therefore, the company has begun a series of new and deeper drilled-holes on a wide-area bases to establish parameters for an accurate calculation of available mineral reserves. The company is continuously mining the near-surface iron minerals which require dry magnetic separation to achieve the clients specifications.

Other noteworthy news: the Company has contracted PowerScreen of California to build a heavy-duty 8ft x 30ft x 0.05mm cylindrical Trommel screening plant capable of screening out the small iron chips accumulated since the project went into production in November 2010. This equipment should be on-site and ready to begin processing a shipload of sinter fines within the next couple weeks. The balance of iron minerals less than 0.05mm in size shall be sold into the organic mineral fertilizer industry.

CWRN Current Share Structure: The Company has stated that it is not currently providing any Market Awareness nor is it involved with the market in any way. The share price of the Company's stock is solely dictated by the market further to that the share structure has not changed since year 2010, nor does the company intend to participate in any trade programs designed to offer company share

-A/S: 6 Bil -Current O/S: 4,361,635,980 Bil -Restricted: 2,056,610,879 Bil -Free Trading Float: 2,305,025,101 Bil

>> Nov 17 2011 Iron Ore Market Up 3rd Shipment Contract To Be Executed

CWRN The resent down trend in Spot Pricing for the China Sea Borne Trade for Iron Ore caused some companies to hold off on shipping, (including CWRN) this lead to a reduction in immediate raw material stocks for some steel makers. Over the last 12 consecutive trading days, the market has rebounded and some Iron Ore Sellers are now executing sales contracts. The Company has been trucking materials to the Pacific Ocean Port of Ensenada, Baja California, Mexico and has stepped up trucking by adding more trucks. The Company sells Raw Crude Iron Ore based on the Platt's Steel Index at landing on a 6 day average price, 3 days prior and 3 days after landing with a negotiated discount off Spot Pricing. It is anticipated that the landing price will be somewhat higher than the contract signing day Spot Market Price.

Shipping Update: Bulk vessel shipping Cost is expected to be $9.00 cheaper per wet metric ton than the August Shipment Cost, the Company is now in the market for the 3rd shipment dry bulk carrier in the HandyMax size range, 40 to 45 thousand metric tons.

CWRN Current Share Structure: The Company has stated that it is not currently providing any Market Awareness nor is it involved with the market in any way. The share price of the Company's stock is solely dictated by the market further to that the share structure has not changed since year 2010, nor does the company intend to participate in any trade programs designed to offer company shares

>> Sept 29 2011 Remedial Drilling Underway at Mina Guadalupe

CWRN Management stated today that the original drilling program consisted of 68 shallow drill holes into the Guadalupe iron ore bodies; 66 of the 68 drilled holes contained iron ore lenses varying in thickness from 2 to 14 meters thick. The deepest drilled hole was 20 meters in depth. The last shipment of iron ore and the current stockpiles of finished products have all come from a small section of the 1,500 meters long Coloso Vein (one of four long iron ore veins on the mineral concession) and 26 meters of overburden and iron ore have been extracted out of the section. Currently the company has begun a remedial drilling program to extend the drilling depth to a minimum of 25 meters under the previously discovered iron ore lenses and up to 100 meters deep should the ore body continue at greater depth. In the first of a series of mini drilling programs, four drill sites were chosen approximately 300 meters apart along the 275 degree Northwest Coloso strike in areas of confirmed heavy ore bodies. The results of the program will be made available to our shareholders and the general public upon completion.

Shipping Update: Bulk vessel shipping is currently on hold, pending the evaluation of cost savings on shipment size. The first two shipments of Guadalupe raw crude iron ore were delivered via HandyMax at 38,500 and 36,000 dry metric tons of ore, the latter shipment ended at a cost of $43.00 per wet metric ton of product. Shipping cost has recently decreased, primarily on larger capacity vessels; therefore, Management has asked the John F. Dillon & Company, LLC., to assist in finding and negotiating the best Seaborne dry bulk freight rates available. A decision will be make within the next couple weeks to either ship numbers 3 and 4 separately in HandyMax or combine the two shipments into a SuperMax at 58,000 WMT or a PanaMax at 70-75,000 WMT shipment.

CWRN Current Share Structure: The Company has stated that it is not currently providing any Market Awareness nor is it involved with the market in any way. The share price of the Company's stock is solely dictated by the market.

-A/S: 6 Bil -Current O/S: 4,361,635,980 Bil -Restricted: 2,056,610,879 Bil -Free Trading Float: 2,305,025,101 Bil

>> Aug 8th 2011 Loreto Sailing with 2nd Bulk Iron Ore Shipment

Due to the river draft at the Port of Jiangyin on the Yangtze River, some 750 metric tons of iron ore was removed from the MV Loreto Bulk Vessel.. Remaining ore on the dock will go out on the next shipment. Here is a site with some good pictures in and around the City and river port: The Loreto is a 45k/mt carrier, it was chosen for its width and shallow draft only 36,000 metric tons can be offloaded there, the final draft survey was 36,002 mt.

http://ports.com/china/port-of-jiangyin/photos/#/show-gallery?o=photo-0

Loreto pulled out at 6:00am PST this morning and is scheduled to arrive on Aug 27 at 18:00 hours.

Operations Update: The Company will now begin preparations of its stockpiled 1-3mm Sinter Feedstock Fines for the 3rd shipment of iron ore to China this year, anticipated sailing between the 10th and 15th of September, 2011.

CWRN Current Share Structure: The Company has stated that it is not currently providing any Market Awareness nor is it involved with the market in any way. The share price of the Company's stock is solely dictated by the market.

-A/S: 6 Bil -Current O/S: 4,361,635,980 Bil -Restricted: 2,056,610,879 Bil -Free Trading Float: 2,305,025,101 Bil

" " The loading of the vessel went very smooth requiring only one move due to scheduled container vessels. Below is the load-out break down; All shipping documents have been completed, the last document required to draw down the Domumentary Letter of Credit is the product analysis, which will require about two weeks.... Next shipment will be 1-3mm sinter feedstock fines...... Bob " "

> June 30 2011 "Trucking for 2nd Bulk Iron Ore Shipment Underway"

PanAmMex dispatched Road Runner Trucking on June 29th, 2011 for the heavy haul trucking of processed iron minerals to the Ensenada International Terminal, Baja California, Mexico on the Pacific Ocean. An anticipated load-out date of July 26, 2011 has been set with the execution of a bulk cargo vessel fixture note. The Company will be shipping two grades of raw crude iron ore and two sizes, 1-3mm fines and 3-18mm mixed fines and lump ores in five cargo vessel holds.

> May 26 2011 "Revenues Distributed, 2nd Bulk Shipment Close"

the company under Irrevocable Assignment of Documentary Letter of Credit Proceeds, distributed the revenues from its first bulk shipment of iron ore under the following percentages; 60% to ongoing operations, 30% to Project Investors and 10% to Management. The Project Investors recovered approximately 75% of their cash contributions; The Ensenada International Terminal was paid approximately $320,000.00 for receiving, storage, material handling and cargo loading, $356,000.00 was paid to Road-Runner Trucking, $1,115,000.00 was paid to COSFAR Bulk Cargo Shipping, $220,000.00 was paid in royalty fees and surface rights. The Company was also able to meet its obligations to PowerScreen of California paying a balance of $975,000.00 for the crushing equipment. We would like to thank PowerScreen for their ability to provide us with over $1,500,000.00 in equipment that was paid off under settlement of DLC proceeds, without their help it would have been very difficult to secure the equipment we had specified for the production. The Company will be receiving more equipment from PowerScreen shortly.

" " " Note: Pan American Mineral Ventures, LLC. Officers, Directors, Insiders and Affiliates control over 50% of the Company's Outstanding Shares, Robert L. Cotton and Sharon Vazquez are co-managers of Pan American Mineral Ventures, LLC., State of Nevada, both are Officers and Directors of CWRN.

OTC:PK Status: CWRN is no longer a developing company and as such the non-reporting SEC status in not desirable to maintain a healthy share value for the shareholders; therefore, the Board of Directors have agreed to move on. The company will be merging into a new mining company that will be involved with several other iron ore mining projects and will be an SEC reporting company listed on the OTC:QB; this process shall take some time and will require shareholder's voting approval. A Shareholders meeting will be held, all shareholders of record will be given a 45 day written notice of the time and place of the meeting. A news release will also be issued with the Shareholders notice.

> April 05 2011 M.V. Kriton Sailing Under 1st Ever MexSecEcon Iron Export Permit

The Company announced today that the Bulk Carrier M.V. Kriton loaded out and departed the Ensenada International Terminal at 8:30pm PDT April 2nd on its 24 day journey to The People's Republic of China. This landmark voyage has been marked by two distinctions: the Mexico Secretary of Economy's first ever issued 45,000 metric ton iron mineral export permit following the new iron mineral export law enacted on March 18th, 2011, and the first ever bulk cargo shipment of iron minerals from the Ensenada Pacific Ocean Port. The permit was issued in the name of Subsidiary Panamerican Minerals Ventures, S.A. de C.V.

> March 25 2011 "M.V. Kriton Landed and Loading Iron Ore" (Ship Arrival + CE issue + New Mining Project included)

advises CWRN shareholders that the 42,000 dead weight ton bulk cargo vessel M.V. Kriton has berthed at the Ensenada International Terminal on the Pacific Ocean and that continuous loading is under way of the multimillion dollar iron ore cargo bound for the People's Republic of China.

" " CWRN is currently in talks with the HyVista Corporation (www.hyvista.com) for the acquisition of surface mineral mapping over the 21,000 hectare (52,500 acres) Nazarena Mineral Concession located in south central Baja California. The project is expected to be on line before the end of year 2011 and shipping out of the Sea of Cortez.

> Nov 22 2010 Share buyback after 1st shipment

2." " The Company is contemplating a treasury buy back program for sixty (60%) percent of the public free trading common shares in year 2011.

"" Insiders Currently hold over sixty (60%) of the outstanding common shares of CWRN.

" " The B.O.D. has voted to incorporate a structured plan that will provide for a combination of buyback and retirement of CWRN common shares

3." "Currently Pan American Mineral Ventures, LLC State of Nevada, is the largest shareholder controlling 1.75 billion common shares

" "By consent; the Directors of Pan Am LLC., U.S.A. shall retire by deleting a percentage of common shares now held as new common shares that are accumulated though the public market beginning in the later part of the first quarter of 2011.

4. Review and discuss the possibility of a corporate name change from Cotton & Western Mining, Inc. to Pan American Mineral Ventures, Inc. to better reflect the Mexico In-country affiliate operations. The Company shall submit to NASDAQ the request for name change together with a new CUSIP number " "First quarter financials should be completed . . . and shall be immediately posted for the general public together with complete share structure.

==================== MEMBERS POSTS ====================

>> BaoSteel is the company apparently buying CWRN's iron products

>> Fake Buyout Offer Info Scrutinized (by maxshocker)

- BloomBerg News March 2011 CWRN: Shareholders at Option on $0.15 Buyout Tender

>> C.E & DTC issues (by microcaps1)

>> Buyback Shares explained (by microcaps1)

>> Port of Ensenada INFO: Video & Maps

>> OLDER DD compilation (from Sept 2010 till March 2011)

>> ARTICLE: For Shippers, 2012 Is a Year of Crisis: Dry Bulk Operator

>> ARTICLE: The Important Factors to Consider When Investing in Iron Ore (posted by CohibaMan)

>> ARTICLE: A change in the prices being paid for undeveloped iron ore could lead to an entirely new industry (posted by grajekk)

Put simply, undeveloped iron ore, until very recently, was valued at about $1 a tonne. Under Rinehart’s deal with Posco, the valuation is at least four times higher, at $4 a tonne.....who has been trading in this space through his interests in Iron Ore Holdings and iron ore junior Haoma Mining, which earlier this week penned a deal at $5.79 a tonne.

>> ARTICLE: The mining industry in Baja California (translated by google)

"So we went in Erendira revealed Garzon, where we now have two large foreign companies with mining concessions to extract iron (iron)." " These are the companies Panamerican Minerals Ventures, SA de CV, a subsidiary of another American Cotton & Western Mining Incorporation ....

Posted by Microcaps1: The most used port in China for iron imports as per what I've seen is Qingdao--36 deg 6" N lat, 120 deg 22" E long

Ensenada is 31 deg 52" N lat, 116 deg 37" W long using a great circle calculator(www.nhc.noaa.gov/gccalc)gives us a distance of 5647 nautical miles from Ensenada to Qingdao.

FYI… In-ground iron minerals are valued at $1.00 per metric ton x total estimated tons – 65%, meaning average usable iron is given at 45%... This was the standard for many years; however, recently with the rust rush in progress, some iron deposits have been bought by anxious Chinese investors at $5.00 per mt In-ground…. (post # 10957 by bullit69)

==================== PICS & VIds ====================

> Sept/Oct 2011 "VIDEO" Mining & Drilling Operations

> Sept 2010 Day at the Mine Video w/bob source (www.cottonwestern.com/iron_mines.php)

.

<object width="640" height="360"><param name="movie" value="http://www.youtube.com/v/T5hTYeNBLyc?version=3&hl=en_US&rel=0"></param><param name="allowFullScreen" value="true"></param><param name="allowscriptaccess" value="always"></param><embed src="http://www.youtube.com/v/T5hTYeNBLyc?version=3&hl=en_US&rel=0" type="application/x-shockwave-flash" width="640" height="360" allowscriptaccess="always" allowfullscreen="true"></embed></object>

> Pic Compilation Video CWRN

.

<object width="640" height="360"><param name="movie" value="http://www.youtube.com/v/BxcFCjKd7OU?version=3&hl=en_US&rel=0"></param><param name="allowFullScreen" value="true"></param><param name="allowscriptaccess" value="always"></param><embed src="http://www.youtube.com/v/BxcFCjKd7OU?version=3&hl=en_US&rel=0" type="application/x-shockwave-flash" width="640" height="360" allowscriptaccess="always" allowfullscreen="true"></embed></object>

.

> CWRN Morning Operations *March 2011 (johnynothumb & Temeku999 road trip)

.

<object width="640" height="360"><param name="movie" value="http://www.youtube.com/v/fwS24LxkTH8?version=3&hl=en_US&rel=0"></param><param name="allowFullScreen" value="true"></param><param name="allowscriptaccess" value="always"></param><embed src="http://www.youtube.com/v/fwS24LxkTH8?version=3&hl=en_US&rel=0" type="application/x-shockwave-flash" width="640" height="360" allowscriptaccess="always" allowfullscreen="true"></embed></object>

.

> User Pics vs Google maps Pics with view points detailing area of mine

> CWRN Listed on the Mexican Geological Survey Site http://portalweb.sgm.gob.mx/economia/en.html

CWRN Mines Listings in Mexico (view by clicking the Company Column on p.6 -Lastest updates: 10/25/2011 - 15:30)

Companies with mining projects in Mexico (Lastest updates: 03/13/2012 - 15:00)

--------Companies with mining in mexico-------- (Pic June 2012)

--------List of Mining projects in Mexico-------- (Pic June 2012)

--------older Pic late 2011--------

Quote:

Phone 711-3165 Ext. 1295, Fax. 711-4266 e-mail: economiaminera@sgm.gob.mx

Blvrd. Felipe Angeles km. 93.50-4, Col Venta Prieta, Pachuca, Hidalgo, Mexico

> "RENTAS JC ENSENADA" Rental Equip Verification" BC TEL:177-76-96 (Real company to rent Tools and Equipement)

-Source http://directorios-mexico.blogspot.com/2010/09/maquinaria-para-construccion-ensenada.html

Cotton & Western Mining, Inc U.S.A.

Web: http://www.cottonwestern.com

PanAmerican Minerals Ventures, INC U.S.A.

Pres. Shirley Lee / Dir. Sharon Vazquez

1406 Santa Margarita Street Unit D

Las Vegas, Nevada 89146

Ph: + 1 718 666 3820

Fx to e-mail: + 1 702 387 2347

Pres. Sharon Vazquez / V.Pres & Dir Robert Cotton of Mining Operations PanAmerican Minerals Ventures, S.A. de C.V. Mexico

Home Ph: Ensenada Baja Mex + 52 646 173 3663

Ph: Mobile Mexico: + 52 (1) 646 121 0442 From outside Mex, inside Mex drop the 1

Ph: Mobile U.S.A. : + 1 832 692 3542

E-mail: cottonwestern@yahoo.com

Investor Relations emilycotton@cottonwestern.com

Just in case "Baja commercial plates do start with 2 letters"

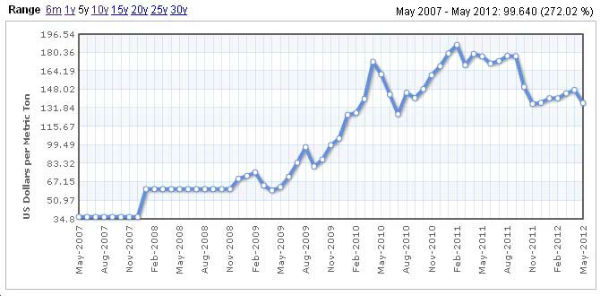

======================= 5yr/10yr IRON ore prices on the Rise =============================

This is to give a perspective why CWRN is way undervalued and the demand of IRON ore is on the Rise.

> Metal Bulletin Iron Ore Index Link http://www.mbironoreindex.com/

> MBIO Index 7 June 2012; Index sees second biggest increase of the year

- To view MBIO's outlook please see the link below:

http://www.metalbulletin.com/Assets/pdf/MBIO/Are_We_Set_To_See_Further_Weakness_In_Iron_Ore.pdf

Derivatives traders dive into iron ore market as prices triple .. Frik Els | August 23, 2011/MINING.COM (#51929 posted by johnsync)

New York brokerage GFI’s announcement on Tuesday that it now offers on-screen iron ore swap trading is the latest indication that the economics of the world’s foremost dry bulk commodity are being changed fundamentally.

Started in 2008, derivatives trading in iron ore is up fourfold this year after setting a record in July as investment banks enter the massive market in numbers.

The world’s top three miners – BHP Billiton, Vale and Rio Tinto – control nearly 70% of the 1 billion tonne annual seaborne trade and dominate price talks. The benchmark China import price for iron ore has tripled since late 2008 to $177 a tonne.

MINING.com reported on Monday strong demand in China because of the low quality of its domestic supply and India’s plans to cut exports by half over the next five years should bolster prices in the medium term before huge supplies from Australia start coming on stream from 2014 onwards.

MINING.com reported last week BHP Billiton, the world most valuable miner, is set to report a record $22 billion in annual profit on Wednesday thanks in large part to its iron business.

Credit Suisse and Deutsche Bank began offering swaps in 2008 at the instigation of BHP Billiton as the iron ore producer campaigned to end annual supply contracts and benchmark negotiations against the spot price.

Reuters reports the volume of iron ore swaps cleared reached a record annualised level of almost 50 million tonnes last month, and although it is still small compared with the physical market, it is set to double again before the end of the year.

MINING.com reported in June that pay for star metals traders were reaching $2 – $3 million a year, up 20% over last year.

Iron Ore Monthly Price - US cents per Dry Metric Ton

--- 5 years --- 272 % Rise

--- 10 years --- 975 % Rise

Posted by Grajekk: Iron ore spot prices have gone up the last 3 market days. Probably due to the Chinese lowering interest rates to heat up their sluggish economy. It could help with financing if Bao Steel and CWRN decide to build a pellet plant for processing lower grade ore at the Guataloupe mine.

Here's part of an article I read this morning on Chinese lower interest rates and the down trickle effect. Certainly bodes well for CWRN in the long run..

IRON ORE PRICES STEADY SINCE RATE CUT

Steel mills, which use iron ore as a core steelmaking ingredient, generally see lower interest rates as an incentive to encourage more borrowing in order to finance steel production, in the hopes that downstream sectors would see a boost in steel demand.

"Lower interest rates will boost the Chinese property market as the loan rate was too high in the past. Lower rates will stimulate property and thus all related industries -- iron ore, coking coal, and steel -- will be advanced," a source at a state-owned Chinese iron ore trading house said.

most IRON Jr Miners pro cost are under 25/ton and CWRN has premuim ore plus extra revenue sources from byproducts. In such a case even the large miners have low pro costs -e.g heclas cost of oz of silver is only1 .15. (by MicroCaps1)

==================== Daily & Weekly Charts =======================

== DAILY CHARTS ===

== WEEKLY CHARTS ===

GLTA

$CWRN

.

.

> CWRN/PanAm Monthly "Pics ALBUM" Sept 2010-2011" with 1st - 2nd Shipments

http://imgur.com/a/ysmmm

.

<iframe class="imgur-album" width="100%" height="550" frameborder="0" src="http://imgur.com/a/ysmmm/embed"></iframe>

.

.

> CWRN/PanAm and Bao Steel Pics 2012 at the Baja 14 mine in Ensenada - Colosso Vein (end of 2011 early 2012)

http://imgur.com/a/yhU7R

.

<iframe class="imgur-album" width="100%" height="550" frameborder="0" src="http://imgur.com/a/yhU7R/embed"></iframe>

.

.

-PICS ALBUMS CWRN/PanAm Maps and Aerial Views

http://imgur.com/a/Yms8b

.

<iframe class="imgur-album" width="100%" height="550" frameborder="0" src="http://imgur.com/a/Yms8b/embed"></iframe>

.

.

* * 3 Members Visits CWRN in 2011 Pics & Vids * *

> PICS ALBUMS CWRN/PanAm 2011 Member Visits (SurogateSon/Temeku/JohnnyNoThumb)

http://imgur.com/a/1HfjU

.

<iframe class="imgur-album" width="100%" height="550" frameborder="0" src="http://imgur.com/a/1HfjU/embed"></iframe>

.

$CWRN

(0)

(0) (0)

(0)