2) Spanish Mountain Gold - Operation Update .....

Post# of 129

https://investorshangout.com/images/MYImages/...uction.jpg

==============

Operation Update

==============

The 2024 and 2025 exploration drill program identified opportunities to improve the average grade of the mineral resources and potentially grow the in-pit and near pit resources.

The Company’s current strategy remains focused on optimizing, de-risking and advancing its Spanish Mountain Gold Project towards a build decision before the end of 2027.

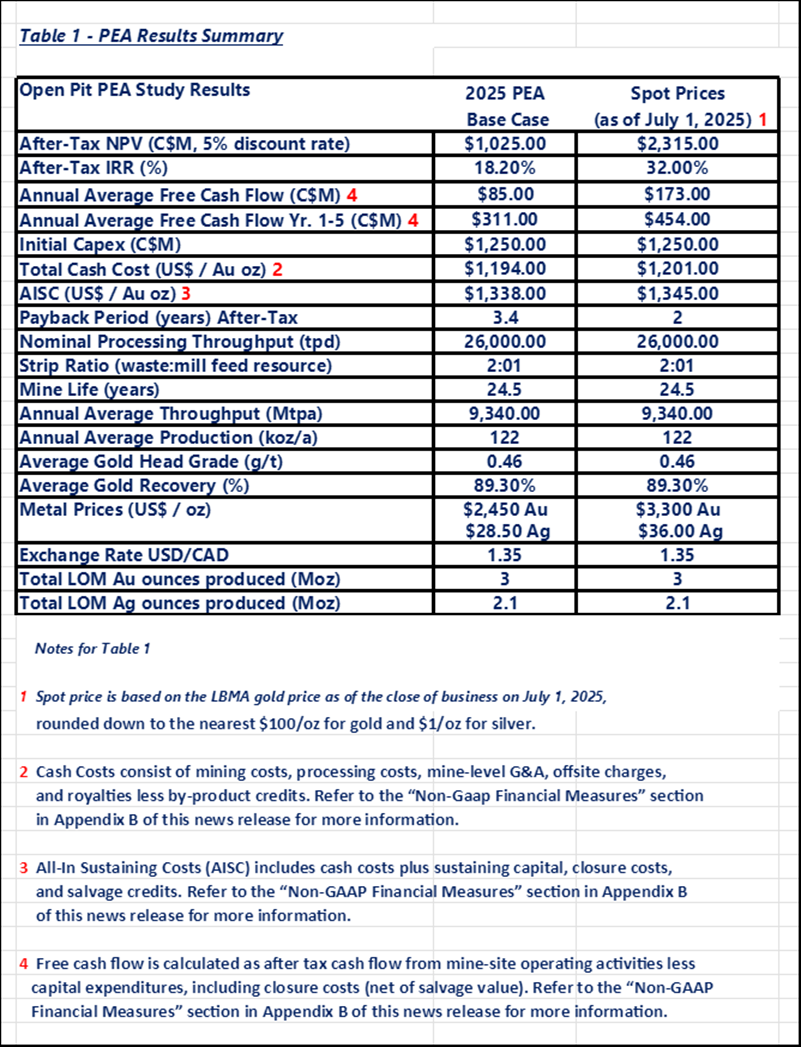

Preliminary Economic Assessment and NI-43-101 Technical Report has been published. The PEA envisions a conventional open pit mining and milling capacity of 26,000 tonnes per day with a projected 24.5-year mine life producing 4 million ounces of gold.

$7,199,968 equity financing has been closed. $4 million of the funds will be used for a 10,000 meter drill program to be commenced in the fall of 2025.

With the completion of the 2025 PEA, the Company anticipates beginning a new Pre-Feasibility Study (PFS) in 2025, or potentially advancing directly to a Feasibility Study (“FS”).

The company has engaged the services of Atrium Research Corporation, a leading company sponsored research firm. Atrium will produce a range of research services to the Company and present the Company’s investment case to potential investors. Atrium will also host video interviews with the Company’s management team to present the investment case in an interview format.

Atrium Research coverage on Spanish Mountain Gold

https://mcusercontent.com/4bc421505c66d079778...rogram.pdf

=============

Future Prospect

=============

Spanish Mountain Gold's market capitalization is around C$83 million, with analysts providing price targets suggesting it is undervalued, potentially offering significant growth. The company's undervaluation stems from factors like a pending resource update, potential high-grade discoveries, and a unique "green gold" opportunity from available hydroelectric power.

Upcoming Catalyst: A new preliminary economic assessment and resource estimate are expected to re-evaluate the stock's price.

Mineralization Potential: The project has high-grade mineralization across a significant length, suggesting the potential for future discoveries.

Green Gold Opportunity: The company's access to clean hydroelectric power presents a unique "green gold" investment prospect.

Analyst Sentiment: Analysts anticipate an average target price of C$0.45 within 12 months, indicating potential for growth from the current price.

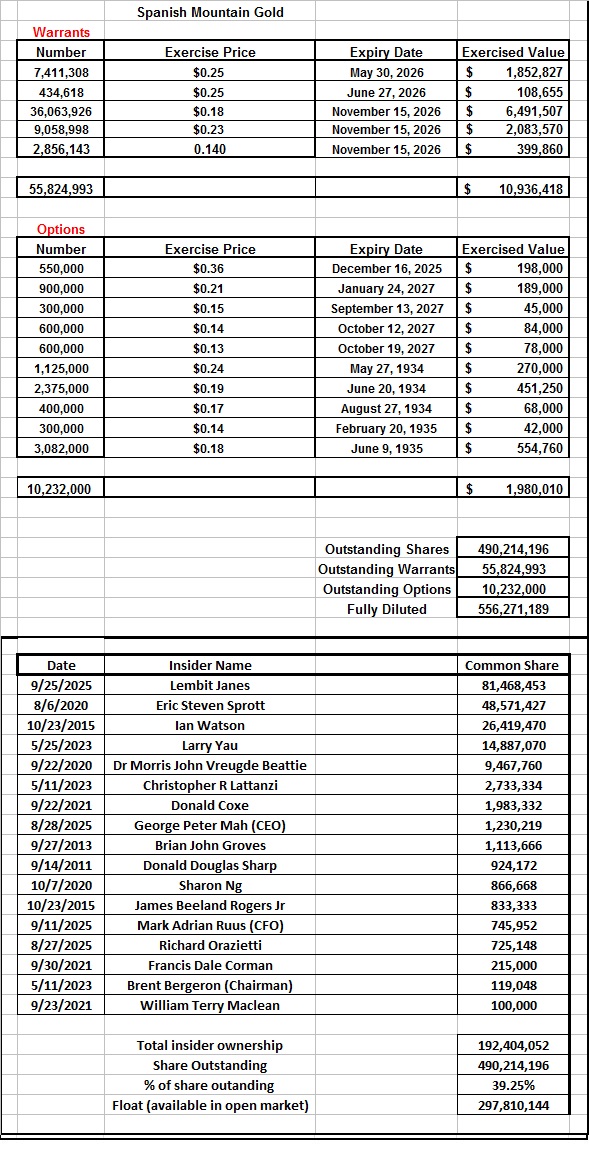

Warrant Financing: The exercise of outstanding warrants would bring C$10.5 million into the treasury, helping to fund the project's progression.

==============================

Recent drilling news and assays results

==============================

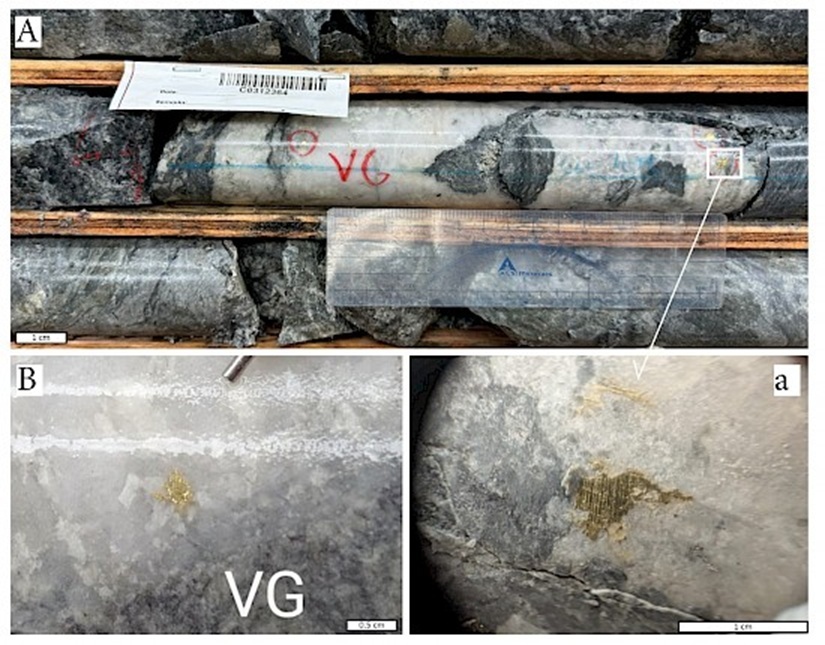

April 24, 2025 - Spanish Mountain Gold Reports Near Surface High Grade Gold Intercepts in the K - Zone

https://spanishmountaingold.com/news/2025/spa...he-k-zone/

Visible gold is sighted in several drill holes, supporting the potential for significant new high-grade mineralization on the project.

Spanish Mountain Gold reports numerous high-grade gold assays from its 2025 drilling programs, particularly in the K Zone and at the new Phoenix Target, with notable results including:

Hole 25-DH-1286 (K Zone):

====================

719.26 g/t Au over 0.75 m

156.80 g/t Au over 3.50 m

4.18 g/t Au over 139.00 m from 56.00 m

Hole 25-CCR-062 (Phoenix Target):

==========================

17.28 g/t Au over 4.00 m

To follow up on the April 24 high grade result, the company will conduct a 10,000 meter program in the Fall of 2025

September 12, 2025 - Spanish Mountain Gold Announces 10,000 Meter Drill Program commencing in the Fall

https://spanishmountaingold.com/news/2025/spa...l-program/

=========================================================================

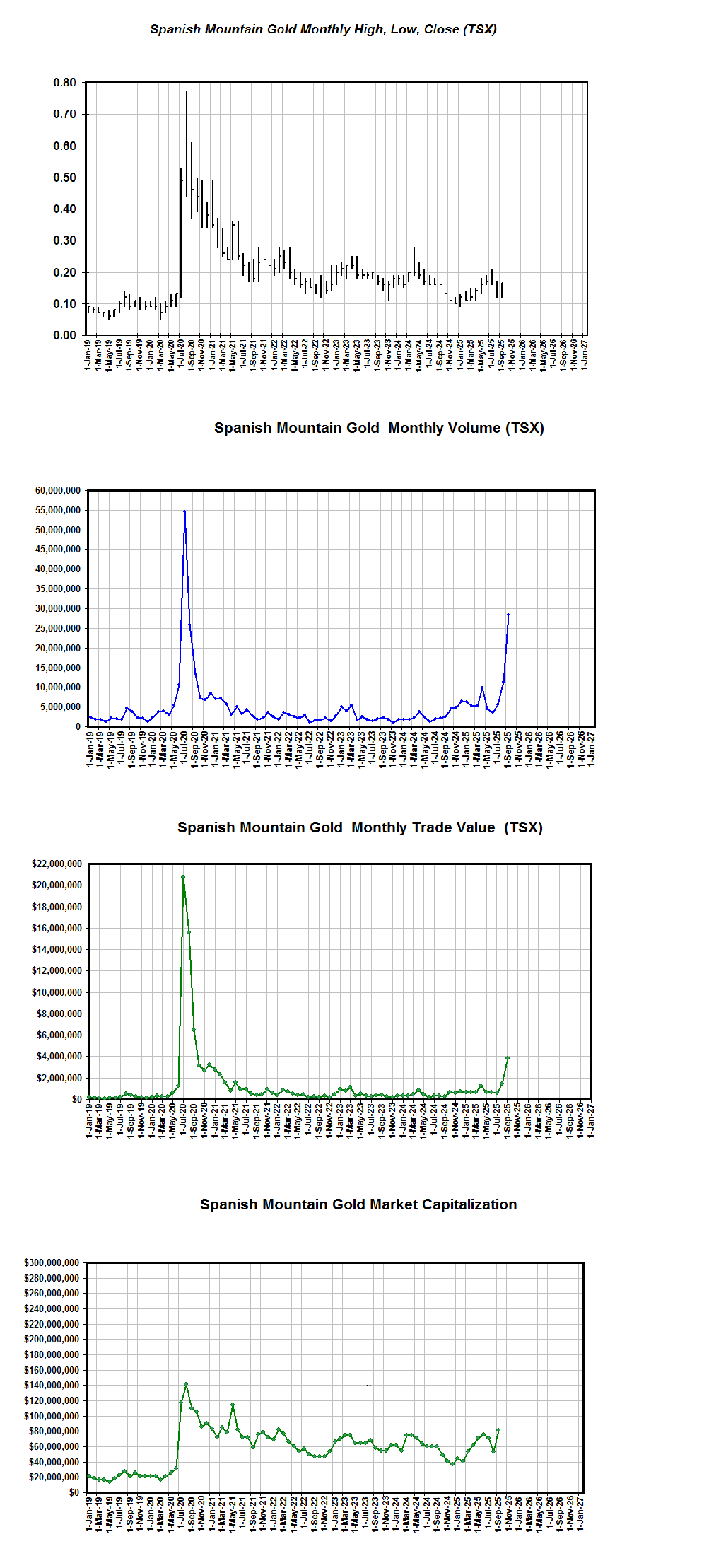

Spanish Mountain Gold - Monthly High, Low, Close, Volume, Trade Value, Market Capitalization

=========================================================================

As of September 30

https://investorshangout.com/images/MYImages/...ASep30.png

==============

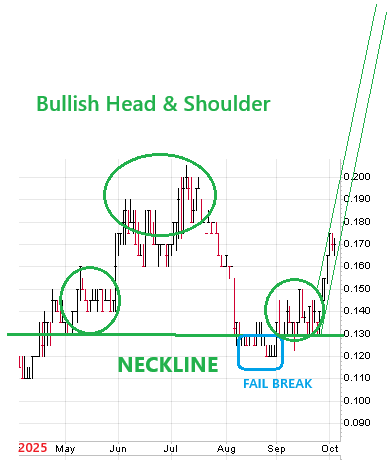

Technical Analysis

==============

https://investorshangout.com/images/MYImages/...1yr-TA.png

SPA.V daily (live chart)

https://stockcharts.com/h-sc/ui?s=SPA.V&p...1572059125

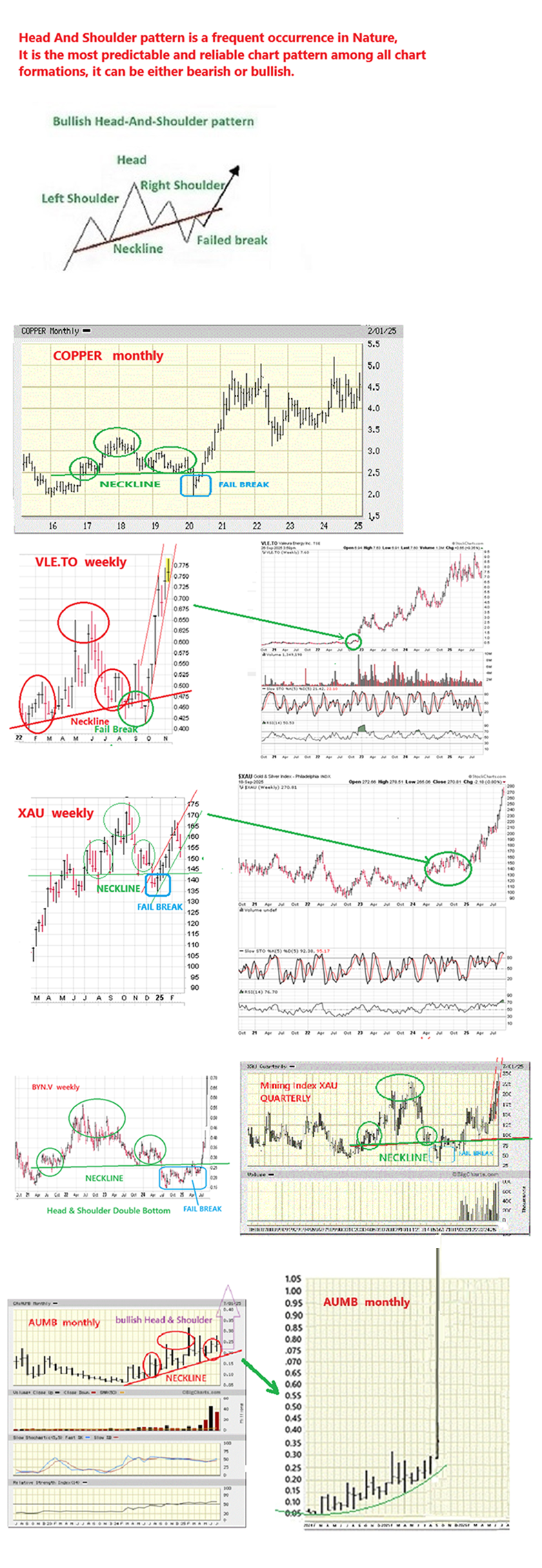

Case history of bullish Head & Shoulder

https://investorshangout.com/images/MYImages/...istory.png

======================

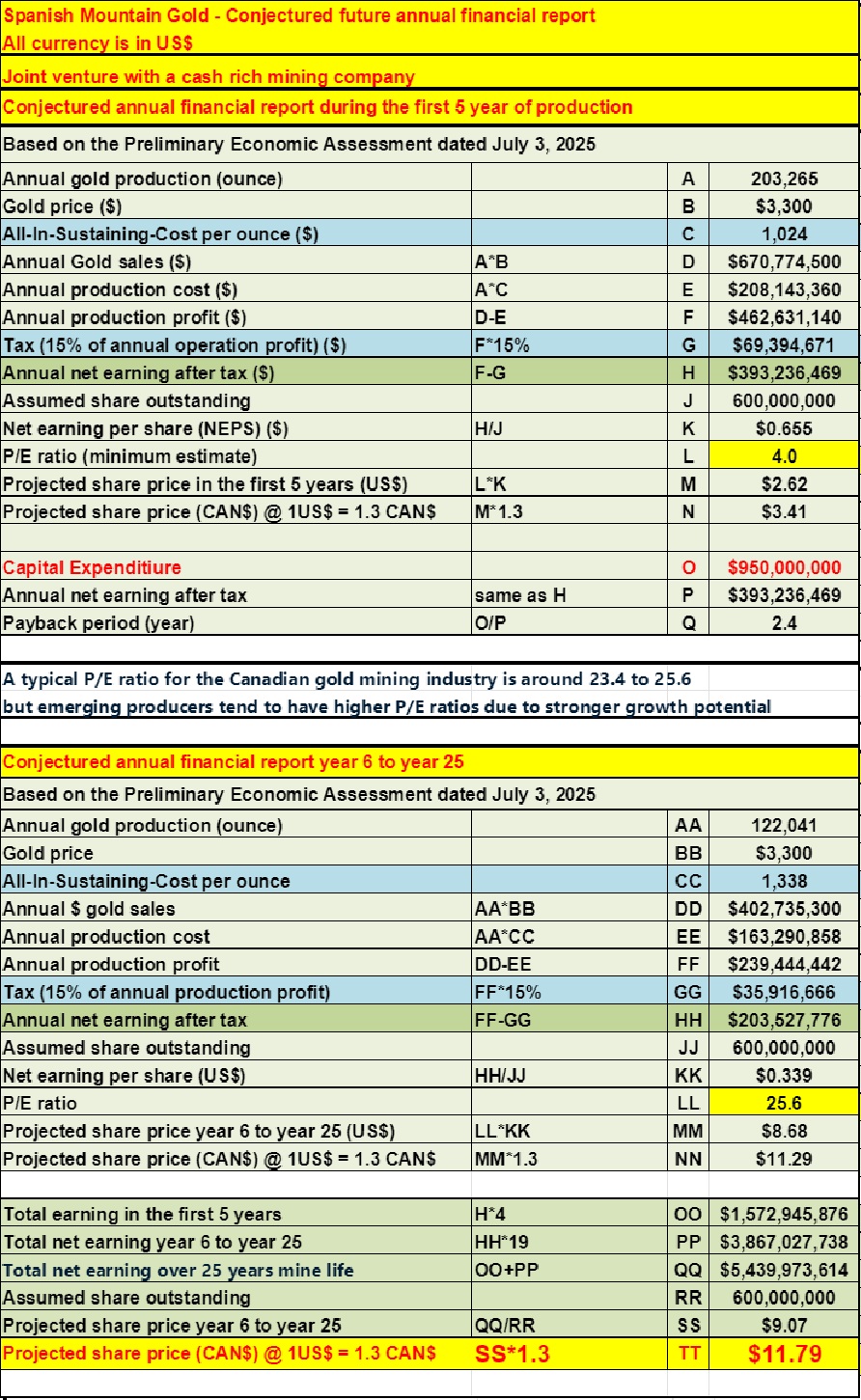

Future share price projection

======================

https://investorshangout.com/images/MYImages/...enture.jpg

If the current drill program confirms drilling in the gold veins zone with massive long intervals of high grade gold, the annual gold production will increase significantly resulting in further acceleration of future share price.

=======================

Potential return on investment

=======================

Since share price is forward looking and equal to P/E ratio x Earning per share, it could hit $11 long before the end of mine life is reached.

At share price of $10, billionaire Eric Sprott's holding of 48.5 million shares will return him $1/2 Billion while director Lembit Janes will be a billionaire. Even small investor's $20K investment will buy themself a million dollar house or condo, no more stress in perpetual rent hike.

================================

Charts - Gold, Silver, XAU, SPA.V, SPAUF

================================

Gold Price

https://stockcharts.com/h-sc/ui?s=$GOLD&p...e_vignette

50-year gold price

https://mrci.com/pdf/gc.pdf

Silver Price

https://stockcharts.com/h-sc/ui?s=$SILVER&...e_vignette

50-year silver price (in cents)

https://mrci.com/pdf/si.pdf

Mining Index (XAU)

https://stockcharts.com/h-sc/ui?s=%24XAU&...9099899440

SPA.V weekly

https://stockcharts.com/h-sc/ui?s=SPA.V&p...e_vignette

SPA.V - daily

https://stockcharts.com/h-sc/ui?s=SPA.V&p...1572059125

SPA.V - News, trade data

https://www.stockwatch.com/Quote/Detail.aspx?C:SPA.V

SPAUF.OTCQB weekly chart

https://stockcharts.com/sc3/ui/?s=SPAUF&p...e_vignette

SPAUF.OTCQB daily

https://stockcharts.com/h-sc/ui?s=SPAUF&p...1572059125

SPAUF Level 2

https://www.otcmarkets.com/stock/SPAUF/overview

============================

Spanish Mountain Gold and its peers

============================

Blue Lagoon Resources - Dome Mountain Mine project, located about 400 Km northwest of Spanish Mountain Gold

https://www.google.ca/maps/place/Dome+Mountai...FQAw%3D%3D

Mineral Resource Estimate: https://bluelagoonresources.com/wp-content/up...slides.pdf

BLLG.CA weekly

https://stockcharts.com/h-sc/ui?s=BLLG.CA&...7291241482

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Banyan Gold - AurMac Project in Yukon

https://www.google.ca/maps/place/Banyan+Gold+...FQAw%3D%3D

Mineral Resource Estimate: https://banyangold.com/projects/aurmac/

https://stockcharts.com/h-sc/ui?s=BYN.V&p...7291241482

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

1911 Gold - True North gold mine, Manitoba

https://www.google.ca/maps/place/True+North+G...FQAw%3D%3D

Mineral Resource Estimate: https://1911gold.com/news/press-releases/1911...ld-project

AUMB.V weekly

https://stockcharts.com/h-sc/ui?s=AUMB.V&...2963243620

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Spanish Mountain Gold

Mineral Resource Estimate: Page 12 of August 18 NI-43-101 Technical Report

https://spanishmountaingold.com/site/assets/f...-final.pdf

https://stockcharts.com/h-sc/ui?s=SPA.V&p...2963243620

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

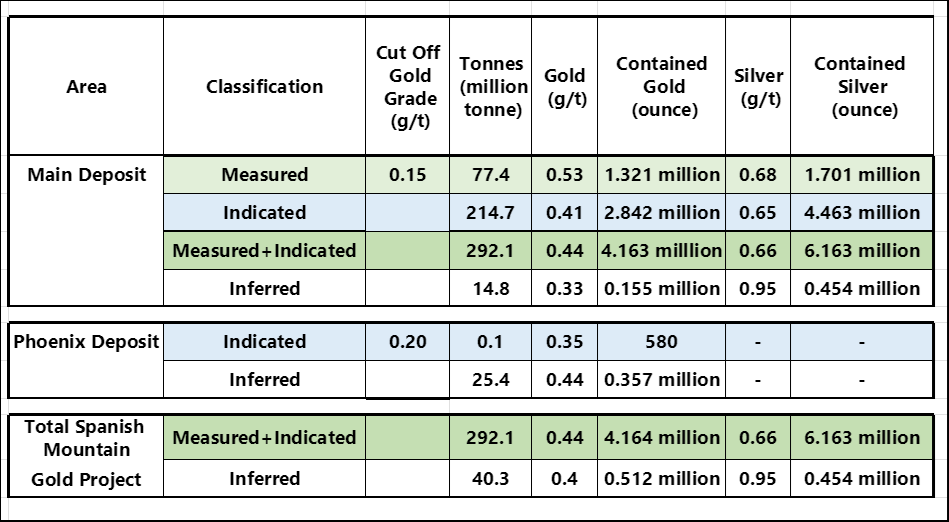

==========================

Mineral Resource Estimate (MRE)

==========================

https://investorshangout.com/images/MYImages/...timate.png

.jpg)

Where did Spanish Mountain Gold's massive placer gold come from: Placer gold is fine gold fragments that were broken from original gold veins in geological upheaval and eroded by weather over 200 million years. It is heavier then the surrounding materials and deposited in river gravels, floodplains, and hillsides. Placer gold can be in the form of dust, flakes, or nuggets which have been diluted from visible gold. Finding placer gold is a strong indicator that a source, most likely gold veins exist somewhere upstream or nearby.

The case of Aurelian Resources 2006: After years of exploration in Ecuador and discovering only insignificant gold mineralization, geologist Stephen Leary joined Aurelian Resources in 2024 and in 2026 he traced the placer gold in the stream up stream to a place called Fruta del Norte and drilled some holes there, by then the company was nearly out of money. But high grade gold emerged in the drill cores. Subsequent drilling turned into a bonanza discovery. After delineating 13.7 million ounces of gold Aurelian Resources was bought out by Kinross Gold for $1.2 billion.

https://www.youtube.com/watch?v=4vLwL5sOl04

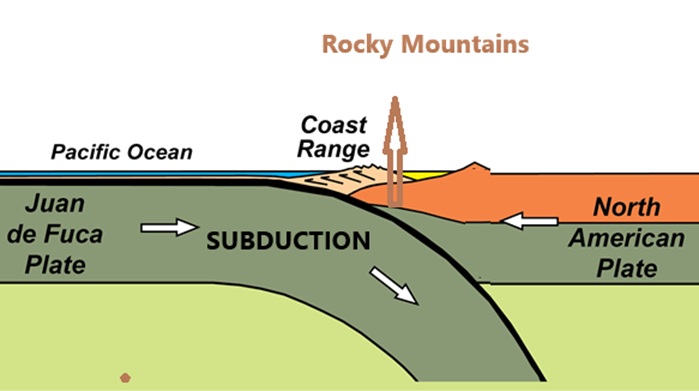

How gold veins are formed: 200 million years ago, during the collision of the world's tectonic plates, tremendous heat and pressure was generated, forcing metamorphic hydrothermal fluids containing dissolved gold and quartz to migrate upwards through fractured rocks and faults, forming channels. As the fluids cooled, gold and quartz was deposited in the rocks. Gold deposits formed this way is called orogenic gold, 75% of the gold mined in the world are orogenic gold, 25% are found in magma rocks.

Why gold is found in quartz veins: Quartz is a piezoelectric material, meaning it generates an electric charge when subjected to stress of high temperature and pressure, these electric charges act on the dissolved gold in the hydrothermal fluid, causing it to solidify onto gold grains, leading to the formation of large gold nuggets embedded in quartz veins as hydrothermal fluids cooled and precipitated gold and quartz in the rocks.

Why gold and fossil of marine life are found on top of the Rocky Mountain: In the collision between the Pacific tectonic plate and the American tectonic plate, the denser Pacific plate submerged beneath the less denser American plate and the west coast from British Columbia to Peru buckled and was pushed upward and skyward, forming the Rocky Mountain as high as 12,970 feet at Mount Robson and the Andes Mountain in South America as high as high as 6,961 feet, bringing along with it gold deposits and fossils of marine life from the bottom of the ocean. The geological process is called Subduction.

===================================================

Preliminary Economic Assessment and NI-43-101 Technical Report

===================================================

https://investorshangout.com/images/MYImages/...67_PEA.png

Preliminary Economic Assessment Economics

https://spanishmountaingold.com/project/preli...economics/

August 18, 2025 - NI-43-101 Technical Report

https://spanishmountaingold.com/site/assets/f...-final.pdf

=================================

All-In-Sustaining-Cost of 25 gold producers

=================================

https://www.mining.com/wp-content/uploads/202...31425A.gif

What is All In Sustaining Costs (AISC)

All-in Sustaining Costs (AISC) in the mining industry, particularly for gold, includes all operating costs, sustaining capital expenditures, and other costs associated with maintaining current production. This includes cash costs, sustaining capital expenditures, general and administrative (G&A) expenses, and environmental and closure costs.

Breakdown on AISC:

Cash Costs:

These are the direct costs of mining and processing, including labor, energy, consumables, and royalties (net of by-product credits).

Sustaining Capital Expenditures:

These are investments required to maintain current production levels, such as equipment replacement, mine development, and other costs to keep the mine operating at its current capacity.

General and Administrative (G&A) Expenses:

These are the costs associated with running the corporate office and other administrative functions that support the mine's operations.

Environmental and Closure Costs:

These include costs related to environmental remediation and mine closure, such as reclamation and decommissioning.

Exploration Expenses (Sustaining):

These are exploration costs that are needed to maintain current production levels and replace depleted resources.

AISC is a comprehensive metric designed to provide a more complete picture of the total cost of mining an ounce of gold, beyond just the direct cash costs.

=============================

Spanish Mountain Gold - Governance

=============================

Spanish Mountain Gold Corp website

https://spanishmountaingold.com/

Spanish Mountain Gold - Corporate Presentation

https://spanishmountaingold.com/site/assets/f...dpated.pdf

News Release

https://spanishmountaingold.com/news/2025/

Financial Reports

https://spanishmountaingold.com/investors/fin...y-filings/

Top Management

https://spanishmountaingold.com/corporate/management/

Board of Directors

https://spanishmountaingold.com/corporate/boa...directors/

==============================

Warrants, Options, Major shareholders

==============================

https://investorshangout.com/images/MYImages/...ership.jpg

Insider trading transaction update

https://www.barchart.com/stocks/quotes/SPA.VN/insider-trades

=============

You tube videos

=============

Webinar replay July 2025

https://www.youtube.com/watch?v=wwTCeoLABlY&t=649s

Mining Investment Event in Quebec City July 2025

https://www.youtube.com/watch?v=9MDABJPTEFU&t=160s

=============

Media coverage

=============

Government extending support for mineral exploration in Canada

https://www.canada.ca/en/department-finance/n...anada.html

Spanish Mountain Gold at LinkedIn.com

https://ca.linkedin.com/company/spanish-mountain-gold-ltd-

=============================

Key Steps Leading to a Build Decision

=============================

Spanish Mountain Gold has indicated that construction could begin following a build decision expected in 2027, after which a two-year construction phase is estimated for the production infrastructure. This timeline allows for the completion of the ongoing drill program, a new Mineral Resource Estimate (MRE) and Preliminary Economic Assessment (PEA) by the end of 2025, as well as securing all necessary reports and approvals to advance development of the project. The new PEA and MRE are crucial steps in optimizing the project for construction. Completing all technical reports and regulatory approvals is a necessary part of the process before the build decision can be made.

========

Overview

========

A mining project can pay loans before achieving revenue by using alternative financing like stream financing, royalty financing, or joint ventures, which are less restrictive than traditional debt and use future production or revenue as collateral instead of pre-existing income. Other methods include securing government grants and incentives, pre-selling a portion of future production through off-take agreements, and raising equity capital through share issues.

========================

Pre-Revenue Financing Methods

========================

Streaming Agreements: A company provides upfront capital in exchange for a percentage of the mine's future mineral production, often at a discounted price, according to Stikeman Elliott.

Royalty Financing: A financier funds a project in return for a share of the project's future revenue or profits, which can be seen as an endorsement of the project's potential, says Stikeman Elliott and Lexology.

Joint Ventures: Partnering with other mining companies or investors allows costs to be shared, spreading the financial burden, notes www.altfin.net.

Off-take Agreements: Pre-selling a portion of the future mineral output to buyers can secure upfront financing and provide lenders with confidence in the project's potential.

Government Funding: Governments and development banks sometimes offer grants, loans, or tax incentives for projects aligned with economic or environmental goals, according to www.altfin.net.

Equity Financing: Raising capital by issuing shares is often considered the simplest path for early-stage projects, as it avoids the complexities and strict requirements of debt financing.

Benefits of These Approaches

Non-Dilutive (for streams/royalties): These options don't dilute the original shareholders' equity in the company, notes Stikeman Elliott.

Flexible Terms: Stream and royalty structures can be more flexible and less restrictive than traditional bank debt, allowing for customized repayment profiles, according to Appian Capital Advisory LLP.

Market Confidence: Agreements like streaming and royalties can be seen as a market endorsement of the project, potentially leading to increased investor confidence.

==================

Promise for profitability

==================

Spanish Mountain Gold shows promise for profitability due to a recently updated Preliminary Economic Assessment (PEA) indicating strong economics with a base case NPV5% of C$1.0 billion and an IRR of 18.2%, potentially improving to C$2.3 billion NPV5% and 32.0% IRR with higher gold prices. The project's conventional open-pit, milling operation, access to infrastructure, and new management team with experience in construction and operations contribute to its potential success, although the company is still in the early development stages.

Factors supporting profitability:

Favorable Economics: The PEA projects significant financial returns, with an after-tax Net Present Value (NPV) of C$1.0 billion and an Internal Rate of Return (IRR) of 18.2% at a base gold price of US$2,450/oz, and even better results at a spot price of US$3,300/oz gold.

Strong Resource Confidence: The economic analysis is based on a high degree of resource confidence, incorporating measured and indicated resources, which are key to a successful mining project.

Experienced Management: A new board and management team, brought in since 2022, possess decades of experience in project management, construction, and operations, positioning the company for a production decision.

Developed Infrastructure: The project will benefit from established infrastructure in central British Columbia, including road access and proximity to the city of Williams Lake, reducing operational complexities and costs.

Strategic Project Design: The company plans a conventional open-pit and milling operation, which is a low-risk approach that is less complex than underground mining.

(0)

(0) (0)

(0)