1911 Gold - Operation update June 20 .............

Post# of 1032

================

Latest News Release

================

1911 Gold Intersects up to 58.66 g/t Gold over 1.40 m on San Antonio West Zone at True North

https://1911gold.com/news/press-releases/1911...true-north

Highlights:

Drilling has continued to expand the near-surface quartz vein hosted gold (“Au”) mineralization on the new San Antonio West (“SAM West”) target along strike and to depth

San Antonio West Target

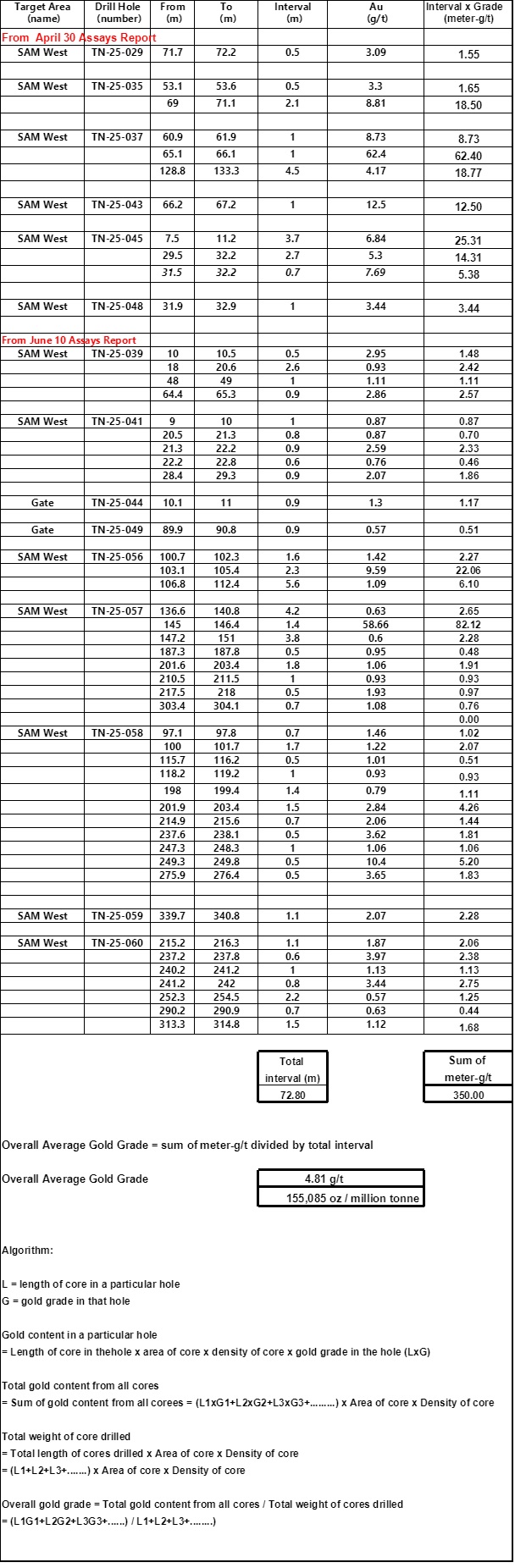

Drill results confirmed the western and down dip extensions of gold mineralization within the prolific San Antonio mafic unit up to 350 m down dip and 500 m along strike, including:

TN-25-057: Intersected 58.66 grams per tonne (g/t) Gold (Au) over 1.40 m at a downhole depth of 145.00 m, including 63.20 g/t Au over 0.90 m and 50.50 g/t Au over 0.50 m

TN-25-056: Intersected 9.59 g/t Au over 2.30 m at a downhole depth of 103.10 m, including 11.25 g/t Au over 1.80 m, including 21.30 g/t Au over 0.50 m

TN-25-058: Intersected 10.40 g/t Au over 0.50 m at a downhole depth of 249.30 m

Figure 4: Expanded Long Section (AA') of San Antonio West with drill intercepts (View to NE)

https://1911gold.com/_resources/news/nr-20250610-image4.jpg

1911 Gold has completed fifty-one (51) surface drill holes, for a total of 11,695.4 m on the current drill program , which commenced in October 2024 on new exploration targets located within the True North Gold mine footprint. The results of seven (7) new drill holes for 1,928.0 m from the San Antonio West target and five (5) initial drill holes for a total of 1,280.00 m from the Gate target are included in this release. New targets have been generated and drill tested within prospective host rocks and mineralized structural settings, including significant historical drill results. The results from nine (9) additional exploration drill holes are currently pending. Additional drill planning is underway on the San Antonio West and San Antonio Southeast targets and will commence when access to the Mine site is permitted (see press release entitled “1911 Gold Temporarily Suspends Operation at True North Complex due to Bissett Evacuation Order”, dated May 30, 2025). The exploration drilling plan includes up to 30,000 m of drilling by the end of 2025 .

Next Steps

Building on the strong results achieved to date on new exploration targets and the compelling targets to expand the current resource, 1911 Gold is advancing plans to initiate underground exploration drilling. Once site access is re-established, the Company will continue preparing multiple underground levels to facilitate this next phase of work. Targeting is well underway, focusing on high-priority areas that offer meaningful resource expansion potential and support the mine plan currently under development. Mobilization of drill rigs to key underground levels is expected later this summer. Concurrently, the Company is actively evaluating additional targets across the property and advancing the redevelopment of the high-grade, near-surface Ogama-Rockland 43-101 mineral resource, located 25 km by road east of the True North complex.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

===========

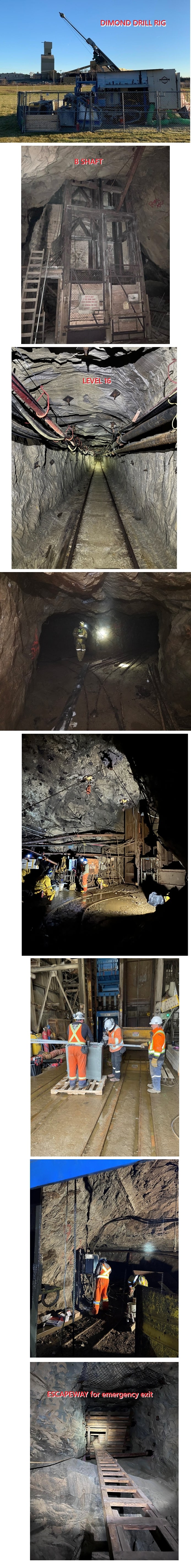

Photo Gallery

===========

360 degree View at True North gold mine .....................................

https://www.google.ca/maps/place/Nopiming+Pro...FQAw%3D%3D

Miners at work in underground Level 16

https://investorshangout.com/images/MYImages/...ST.jpg.jpg

Video Presentation on underground operation in the Truth North mine complex

https://www.youtube.com/watch?v=XOmEYouBqMU

=======================

1911 Gold - All News Release

=======================

https://1911gold.com/news/press-releases/

==================

Corporate Presentation

==================

https://1911gold.com/investors/presentations/

==============

Financial Reports

==============

https://1911gold.com/investors/financial-reports/

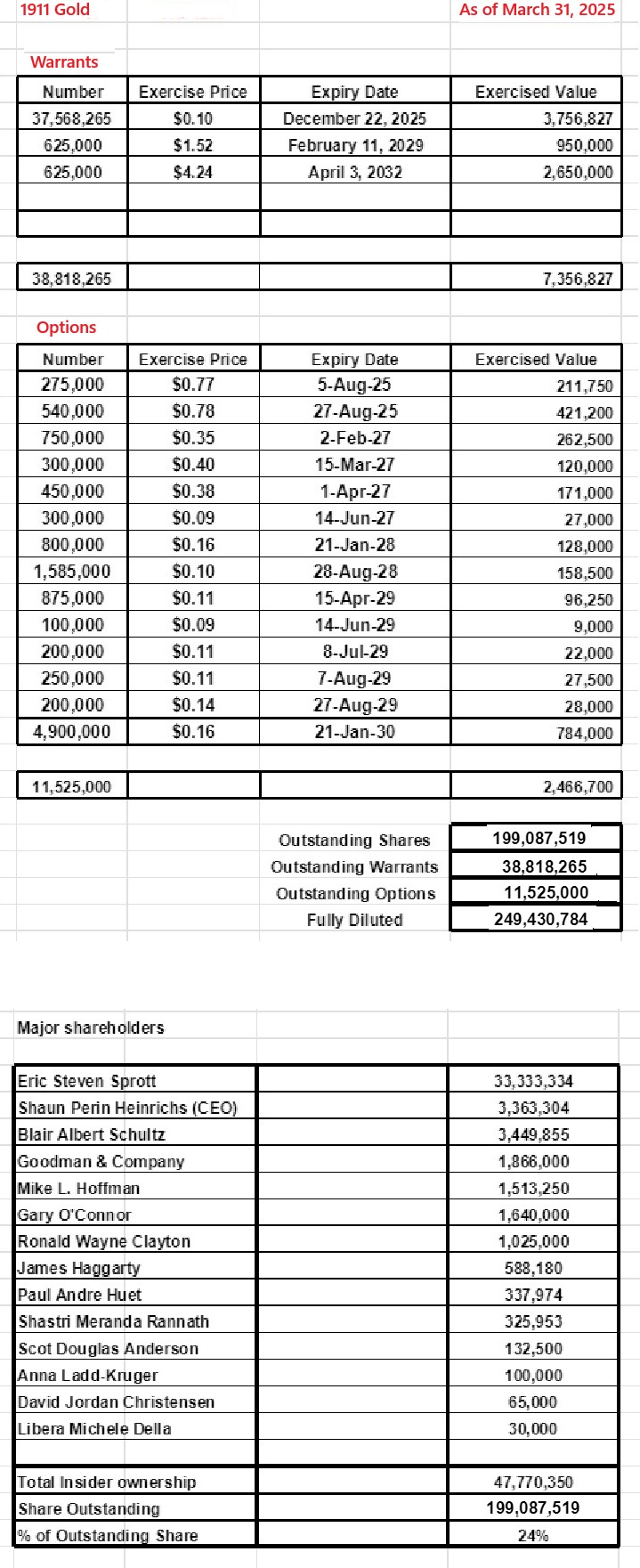

As of March 31, 2025 the company had $4.022 million cash in the coffer

The company will has $3.756 million for its working capital in the second half of 2025 from the exercising of the 10-cents warrants with expiry date of Dec 22, 2025. The proceed will be used to finance the drilling in the high grade Olgama-Rockland project. Majority of the financiers are long term holders and are supportive of the company, they will not sell their warrant converted shares.

==============================

Warrants, Options, Major Shareholders

==============================

https://investorshangout.com/images/MYImages/...olders.jpg

Source of information

https://1911gold.com/investors/financial-reports/

https://www.barchart.com/stocks/quotes/AUMB.V...der-trades

========

Interviews

========

https://www.youtube.com/results?search_query=...p=CAI%253D

=================================================================

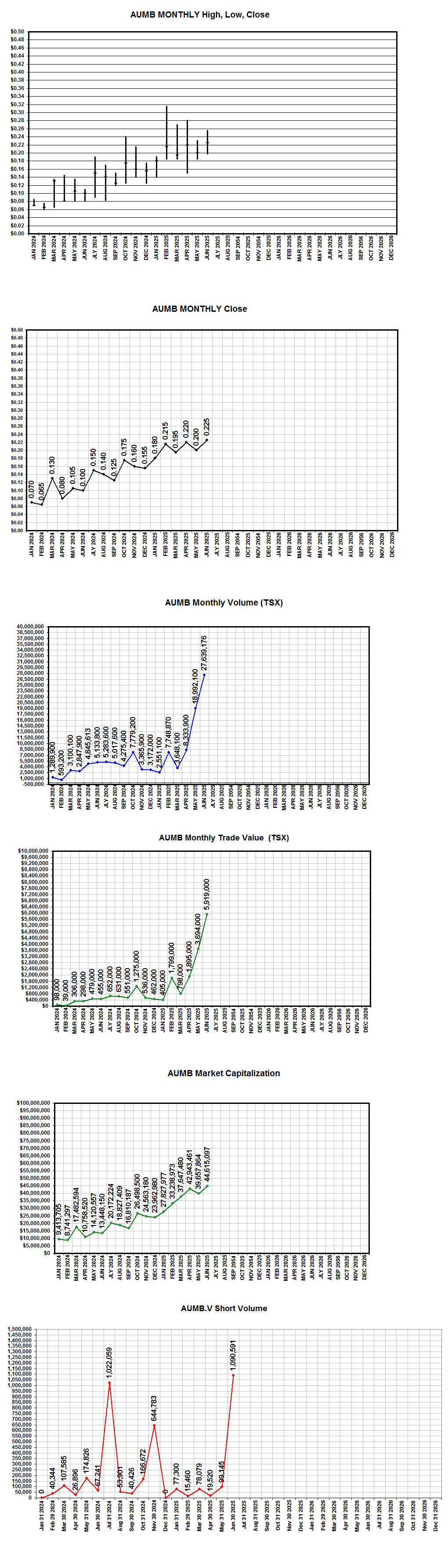

Monthly High, Low, Close, Volume, Trade Value, Market Capitalization, Short Volume

=================================================================

As of June 20, 2025

https://investorshangout.com/images/MYImages/...June20.png

Source of information:

https://www.stockwatch.com/Quote/Detail.aspx?C:AUMB.V

https://money.tmx.com/en/quote/AUMB

================

Technical Analysis

================

AUMB quarterly

https://investorshangout.com/images/MYImages/..._AUMBQ.gif

AUMB quarterly (live chart)

https://bigcharts.marketwatch.com/advchart/fr...e=320&

AUMB weekly

https://investorshangout.com/images/MYImages/...kly-TA.png

AUMB weekly (live chart)

https://stockcharts.com/h-sc/ui?s=AUMB.V&...2963243620

AUMB daily (share price has gone into a sideway consolidation, the longer the consolidation, the stronger the breakout)

https://investorshangout.com/images/MYImages/..._AUMBD.png

AUMB daily (live chart)

https://stockcharts.com/h-sc/ui?s=AUMB.V&...1855118363

Possible future scenario ( just for fun, don't take it seriously )

===============

Vision for the future

===============

CEO Shaun Heinrichs reckons that the company can produce 80,000 ounces of gold annually at ore throughput rate of 1,300 tonnes per day, ramping up to 150,000 ounces annually within 5 years at throughput rate of 3,000 tonnes per day. By this time next year there will be significant gold resources delineated.

Source of information (16 minutes towards end of the video)

1911 Gold in the March 27, 2025 GCFF Virtual Conference sponsored by NAI Interactive Ltd.

https://www.youtube.com/watch?v=LM0rIsEQtkE&t=312s

Gold price

https://bigcharts.marketwatch.com/advchart/fr...320&si

With annual production of 80,000 ounces and at discounted gold price of US$3000, annual sales will be US$240 million. At the industry's average All-In-Sustaining-Cost (AISC) of $1500 per ounce, profit will be US$1,500 per ounce or higher as 1911 Gold is debt free and royalty free, it translates into net profit of US$3000 million (CAN$4200 million) over the 10 years of mine life, producing in excess of 2 million ounces of gold. Future share price is projected to be CAN$4200 million / 400 million shares = CAN$10 per share, a 5000% return from current price of 20 cents, assuming future share outstanding at 400 million shares. Even adding extra $10 million expense per quarter over the 10 year mine life, share price will only be reduced by 50 cents per share.

All-In-Sustaining-Cost of gold producers

https://www.mining.com/wp-content/uploads/202...31425A.gif

What is All In Sustaining Costs (AISC)

All-in Sustaining Costs (AISC) in the mining industry, particularly for gold, includes all operating costs, sustaining capital expenditures, and other costs associated with maintaining current production. This includes cash costs, sustaining capital expenditures, general and administrative (G&A) expenses, and environmental and closure costs.

Breakdown on AISC:

Cash Costs:

These are the direct costs of mining and processing, including labor, energy, consumables, and royalties (net of by-product credits).

Sustaining Capital Expenditures:

These are investments required to maintain current production levels, such as equipment replacement, mine development, and other costs to keep the mine operating at its current capacity.

General and Administrative (G&A) Expenses:

These are the costs associated with running the corporate office and other administrative functions that support the mine's operations.

Environmental and Closure Costs:

These include costs related to environmental remediation and mine closure, such as reclamation and decommissioning.

Exploration Expenses (Sustaining):

These are exploration costs that are needed to maintain current production levels and replace depleted resources.

AISC is a comprehensive metric designed to provide a more complete picture of the total cost of mining an ounce of gold, beyond just the direct cash costs.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

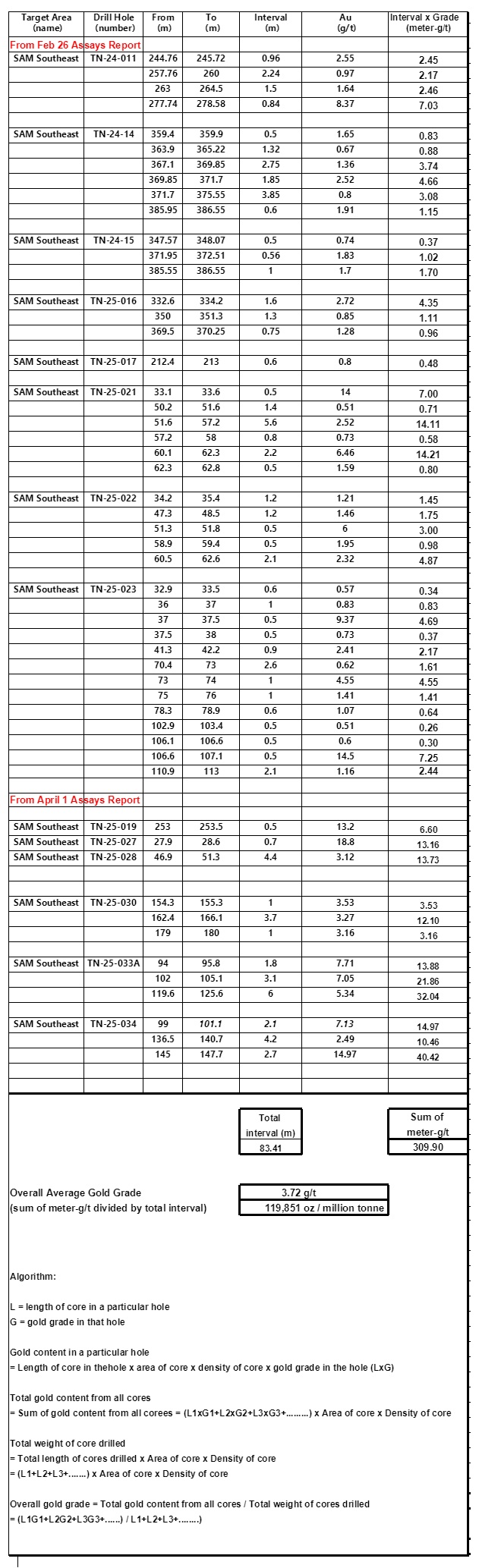

Anticipated additional gold resources from current drill program:

SAM Southeast area: 0.12 million ounces

https://investorshangout.com/images/MYImages/...astSAM.jpg

SAM West area: 0.16 million ounces

https://investorshangout.com/images/MYImages/...REPORT.jpg

Cohiba area: Anticipated 0.12 million ounces (drill assays is pending)

In one interview Shaun Heinrichs said a total of 300,000 ounces gold resources is expected from the current drill program, 100,000 ounces from each of SAM West, SAM Southeast and Cohiba areas ( https://1911gold.com/news/press-releases/1911...-gold-mine )

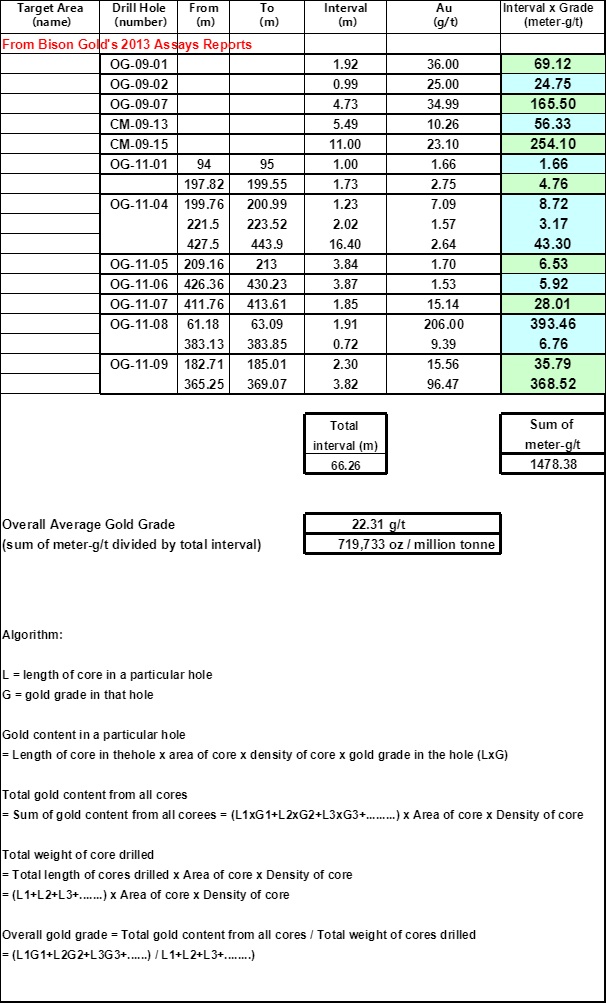

Drilling will be conducted later this year in the high grade Ogama-Rockland, Central Manitoba area where historical assays indicated 340,000 ounces of gold resources. ( Refer to posting: https://investorshangout.com/post/view?id=6754970 )

https://investorshangout.com/images/MYImages/...assays.jpg

Anticipated gold resources based on current and historical assays is about 0.74 million ounces. Current 1.1 million ounces resource estimate plus anticipated additional gold resources = 2 million ounces gold.

1911 Gold's precursor companies were hindered by lack of operating strategy, processing too much waste rocks resulting in low yield exacerbated by low gold price which hit as low as $1,050 per ounce, well below operating cost. 1911 Gold's team of experienced management has learned from the mistakes of its predecessors and has contrived a strategic plan to increase efficiency while gold price constantly making new record high will further enhance profitability. The management plans to begin gold production after 2 million ounces of gold resources is achieved. Gold pouring date is scheduled for the end of 2026 but can accelerate depending on the market conditions. The company's mill can process at least 1/2 million tonne of ore annually and has the capability of increasing to 1 million tonne annually.

=====================================

1911 Gold - Net Asset Value per Share (NAVPS)

=====================================

The ore processing mill with a replacement value of $300 million + 2 million ounces of gold resource at minimum Enterprise Value of $50 per ounce contributes to the company's NAVPS of $1.60 per share at fully diluted basis.

1911 Gold had generated cashflow from historic tailings, producing between 5,000 and 5,500 ounces of gold annually to support the exploration effort and to maintain the existing facilities.

.jpg)

https://investorshangout.com/images/MYImages/...arged).jpg

All information on 1911 Gold:

https://investorshangout.com/1911-Gold-Corp-AUMBF-94051/

(0)

(0) (0)

(0)