Q2 2024 Group Adjusted EBITDA of $3.2 Billion, Up 28% Year-on-Year & Up 12% Quarter-on-Quarter

Announced Interim Dividend of $0.50 Per Share Payable in October 2024

Announced Capella at Galaxy Macau to Open in Mid-2025

HONG KONG, Aug. 15, 2024 (GLOBE NEWSWIRE) -- Galaxy Entertainment Group (“GEG”, “Company” or the “Group”) (HKEx stock code: 27) today reported results for the three-month and six-month periods ended 30 June 2024. (All amounts are expressed in Hong Kong dollars unless otherwise stated).

Dr. Lui Che Woo, Chairman of GEG said:

“I would like to provide you with a broad market overview and review of GEG’s financial performance for the second quarter and first half of 2024. For the first half of 2024, Group Net Revenue up 37% year-on-year to $21.5 billion and Adjusted EBITDA up 37% year-on-year to $6.0 billion. In Q2 2024, Group Adjusted EBITDA of $3.2 billion, up 28% year-on-year and up 12% quarter-on-quarter. We continued to drive every segment of our business and further improve our resorts. We are very pleased to report that for both Q2 and the first half 2024, our resort hotels reported virtually 100% occupancy.

“Our balance sheet continued to be healthy and liquid with total cash and liquid investments of $29.0 billion and the net position was $25.2 billion after debt of $3.8 billion. Our strong balance sheet allows us to return capital to shareholders through dividends and to fund our longer-term development plans and international ambitions. Subsequently the Group announced an interim dividend of $0.50 per share to be paid on or about 25 October 2024. These dividends demonstrate our confidence in the positive long-term outlook for Macau and for the Company.

“During the quarter, the Central Government continued to show support for Macau by expanding the Individual Visit Scheme (IVS) to 59 eligible cities with a total combined population of approximately 500 million people. Additionally, the Government relaxed visa requirements to allow multiple entries into Macau for group tour visitors from Hengqin and for people from various sectors.

“We are well advanced with the implementation of smart tables. Recently we completed the backend systems integration and customer database transfer. We also successfully completed live back-of-house pilot testing of smart tables. And in early July, we commenced the rollout of smart tables across Galaxy Macau ™ ’s main gaming floor. We anticipate to complete the full rollout by year end.

“On the development front, we continue to move forward with the fitting out of the Capella at Galaxy Macau and Phase 4, which has a strong focus on non-gaming, primarily targeting entertainment, family facilities and also includes gaming.

“We are very pleased to welcome the 75 th anniversary of the founding of the People’s Republic of China and the 25 th anniversary of Macau’s return to the Motherland this year. We hope that the industry will continue to receive the full support of the Central Government and the Macau SAR Government. As always GEG will support these important milestones with a range of supportive promotional activities and events.

“Last but not least, I would like to thank all of our team members who deliver ‘World Class, Asian Heart’ service each and every day and contribute to the success of the Group.”

Q2 & INTERIM 2024 RESULTS HIGHLIGHTS GEG: Well Positioned for Future Growth

|

Macau Market Overview

Based on DICJ reporting, Macau’s Gross Gaming Revenue (“GGR”) for the first half of 2024 was up 42% year-on-year to $110.4 billion. Q2 2024 GGR was up 24% year-on-year and down 2% quarter-on-quarter to $54.8 billion.

In the first half of 2024, visitor arrivals to Macau were 16.7 million, up 44% year-on-year, in which overnight visitors grew at 29% year-on-year and same-day visitors grew by 59% year-on-year. Mainland visitor arrivals to Macau were 11.5 million, up 53% year-on-year. Visitors from overseas were a combined 1.2 million, up 146% year-on-year. In Q2 2024, visitor arrivals to Macau were 7.8 million, up 17% year-on-year and recovering to 79% of Q2 2019. Mainland visitor arrivals were 5.2 million, up 22% year-on-year.

Group Financial Results

1H 2024

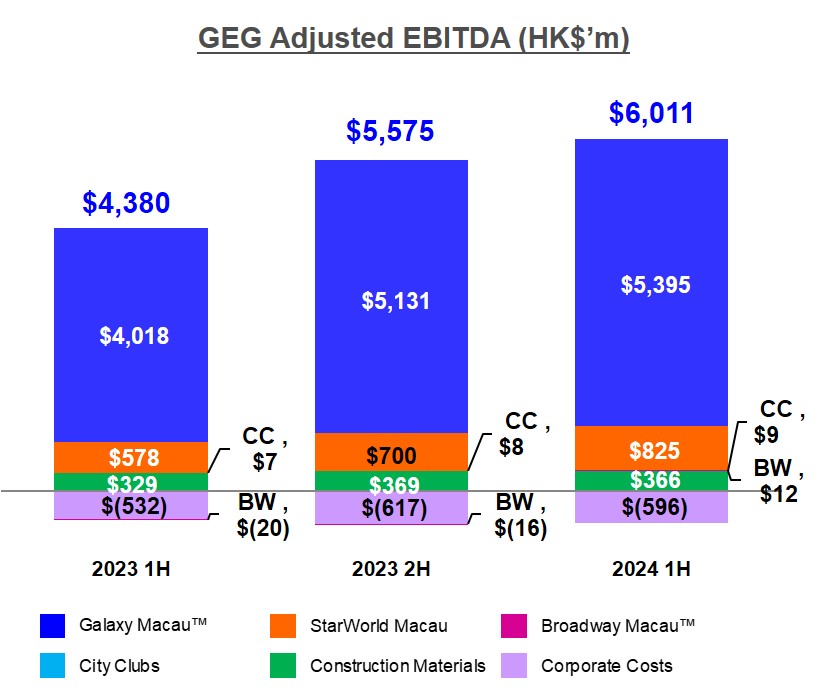

In 1H 2024, Net Revenue was $21.5 billion, up 37% year-on-year. Adjusted EBITDA was $6.0 billion, up 37% year-on-year. NPAS was $4.4 billion, up 52% year-on-year. Galaxy Macau™’s Adjusted EBITDA was $5.4 billion, up 34% year-on-year. StarWorld Macau’s Adjusted EBITDA was $825 million, up 43% year-on-year. Broadway Macau™’s Adjusted EBITDA was $12 million, versus $(20) million in 1H 2023.

In 1H 2024, GEG experienced good luck in its gaming operation, which increased its Adjusted EBITDA by approximately $43 million. Normalized 1H 2024 Adjusted EBITDA was $6.0 billion, up 38% year-on-year.

The Group’s total GGR in 1H 2024 was $20.0 billion, up 45% year-on-year. Mass GGR was $16.0 billion, up 43% year-on-year. Rolling chip GGR was $2.7 billion, up 56% year-on-year. Electronic GGR was $1.3 billion, up 61% year-on-year.

| Group Key Financial Data | ||

| (HK$'m) | 1H 2023 | 1H 2024 |

| Revenues: | ||

| Net Gaming | 11,912 | 16,776 |

| Non-gaming | 2,296 | 3,089 |

| Construction Materials | 1,507 | 1,605 |

| Total Net Revenue | 15,715 | 21,470 |

| Adjusted EBITDA | 4,380 | 6,011 |

| Gaming Statistics 1 | ||

| (HK$'m) | 1H 2023 | 1H 2024 |

| Rolling Chip Volume 2 | 50,602 | 84,612 |

| Win Rate % | 3.4% | 3.2 % |

| Win | 1,725 | 2,690 |

| Mass Table Drop 3 | 46,929 | 63,841 |

| Win Rate % | 23.9% | 25.1 % |

| Win | 11,219 | 16,019 |

| Electronic Gaming Volume | 20,203 | 41,413 |

| Win Rate % | 3.9% | 3.0 % |

| Win | 780 | 1,258 |

| Total GGR Win 4 | 13,724 | 19,967 |

Q2 2024

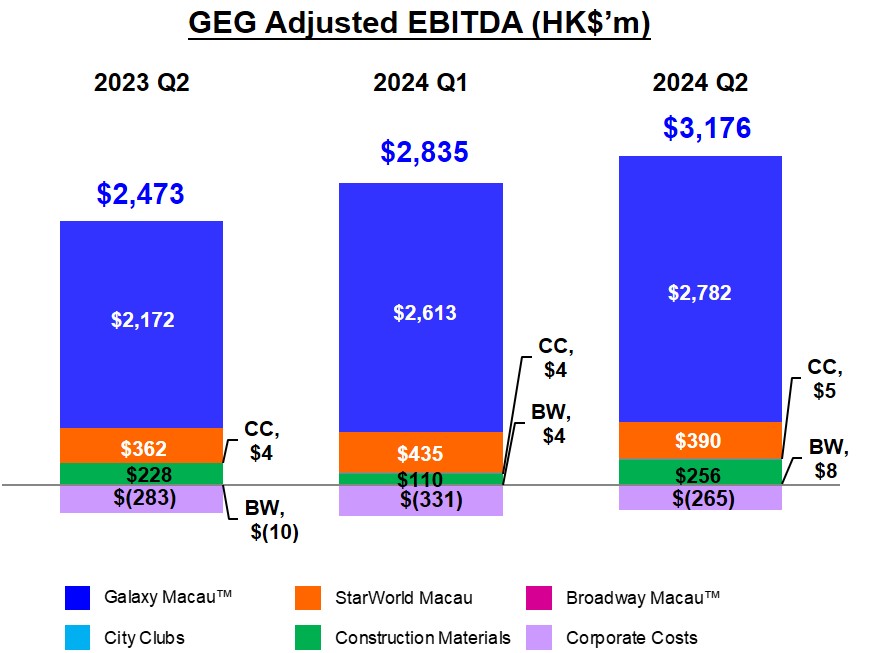

In Q2 2024, Group Net Revenue was $10.9 billion, up 26% year-on-year and up 3% quarter-on-quarter. Adjusted EBITDA was $3.2 billion, up 28% year-on-year and up 12% quarter-on-quarter. Galaxy Macau™’s Adjusted EBITDA was $2.8 billion, up 28% year-on-year and up 6% quarter-on-quarter. StarWorld Macau’s Adjusted EBITDA was $390 million, up 8% year-on-year and down 10% quarter-on-quarter. Broadway Macau™’s Adjusted EBITDA was $8 million versus $(10) million in Q2 2023 and $4 million in Q1 2024.

Latest twelve months Group Adjusted EBITDA was $11.6 billion, up 219% year-on-year and up 6% quarter-on-quarter.

In Q2 2024, GEG experienced bad luck in its gaming operations which decreased Adjusted EBITDA by approximately $20 million. Normalized Q2 2024 Adjusted EBITDA was $3.2 billion, up 29% year-on-year and up 15% quarter-on-quarter.

Summary Table of GEG Q2 & 1H 2024 Adjusted EBITDA and Adjustments:

| in HK$'m | Q2 2023 | Q1 2024 | Q2 2024 | YoY | QoQ | 1H 2023 | 1H 2024 | |

| Adjusted EBITDA | 2,473 | 2,835 | 3,176 | 28 % | 12 % | 4,380 | 6,011 | |

| Luck 5 | 4 | 63 | (20 ) | - | - | 63 | 43 | |

| Normalized Adjusted EBITDA | 2,469 | 2,772 | 3,196 | 29 % | 15 % | 4,317 | 5,968 | |

The Group’s total GGR in Q2 2024 was $10.3 billion, up 35% year-on-year and up 7% quarter-on-quarter. Mass GGR was $8.3 billion, up 32% year-on-year and up 7% quarter-on-quarter. Rolling chip GGR was $1.4 billion, up 49% year-on-year and up 7% quarter-on-quarter. Electronic GGR was $657 million, up 48% year-on-year and up 10% quarter-on-quarter.

| Group Key Financial Data | |||||||||

| (HK$'m) | |||||||||

| Q2 2023 | Q1 2024 | Q2 2024 | 1H 2023 | 1H 2024 | |||||

| Revenues: | |||||||||

| Net Gaming | 6,589 | 8,181 | 8,595 | 11,912 | 16,776 | ||||

| Non-gaming | 1,263 | 1,606 | 1,483 | 2,296 | 3,089 | ||||

| Construction Materials | 809 | 765 | 840 | 1,507 | 1,605 | ||||

| Total Net Revenue | 8,661 | 10,552 | 10,918 | 15,715 | 21,470 | ||||

| Adjusted EBITDA | 2,473 | 2,835 | 3,176 | 4,380 | 6,011 | ||||

| Gaming Statistics 6 | |||||||||

| (HK$'m) | |||||||||

| Q2 2023 | Q1 2024 | Q2 2024 | 1H 2023 | 1H 2024 | |||||

| Rolling Chip Volume 7 | 29,054 | 38,457 | 46,155 | 50,602 | 84,612 | ||||

| Win Rate % | 3.2% | 3.4% | 3.0 % | 3.4% | 3.2 % | ||||

| Win | 931 | 1,299 | 1,391 | 1,725 | 2,690 | ||||

| Mass Table Drop 8 | 26,254 | 31,471 | 32,370 | 46,929 | 63,841 | ||||

| Win Rate % | 23.9% | 24.6% | 25.6 % | 23.9% | 25.1 % | ||||

| Win | 6,285 | 7,728 | 8,291 | 11,219 | 16,019 | ||||

| Electronic Gaming Volume | 11,627 | 19,043 | 22,370 | 20,203 | 41,413 | ||||

| Win Rate % | 3.8% | 3.1% | 2.9 % | 3.9% | 3.0 % | ||||

| Win | 443 | 600 | 658 | 780 | 1,258 | ||||

| Total GGR Win 9 | 7,659 | 9,627 | 10,340 | 13,724 | 19,967 | ||||

Balance Sheet and Dividend

The Group’s balance sheet remains healthy and liquid. As of 30 June 2024, cash and liquid investments were $29.0 billion and the net position was $25.2 billion after debt of $3.8 billion. Our strong balance sheet combined with substantial cash flow provides us with valuable flexibility in managing our ongoing operations and allows us to continue investing in our longer-term development plans and fund our international development ambitions. Subsequently the Group announced an interim dividend of $0.50 per share to be paid on or about 25 October 2024. Galaxy Macau™

Galaxy Macau™ is the primary contributor to the Group’s revenue and earnings. Net Revenue in 1H 2024 was $17.0 billion, up 43% year-on-year. Adjusted EBITDA was $5.4 billion, up 34% year-on-year. In 1H 2024, Galaxy Macau™ experienced bad luck in its gaming operations which decreased its Adjusted EBITDA by approximately $5 million. Normalized 1H 2024 Adjusted EBITDA was $5.4 billion, up 37% year-on-year.

In Q2 2024, Galaxy Macau™’s Adjusted EBITDA was $2.8 billion, up 28% year-on-year and up 6% quarter-on-quarter. In Q2 2024, Galaxy Macau™ experienced bad luck in its gaming operations which decreased its Adjusted EBITDA by approximately $53 million. Normalized Q2 2024 Adjusted EBITDA was $2.8 billion, up 31% year-on-year and up 11% quarter-on-quarter.

The combined seven hotels occupancy was 97% for 1H 2024 and 98% for Q2 2024.

| Galaxy Macau™ Key Financial Data | |||||

| (HK$'m) | Q2 2023 | Q1 2024 | Q2 2024 | 1H 2023 | 1H 2024 |

| Revenues: | |||||

| Net Gaming | 5,430 | 6,887 | 7,347 | 9,872 | 14,234 |

| Hotel / F&B / Others | 726 | 1,056 | 971 | 1,196 | 2,027 |

| Mall | 394 | 371 | 326 | 830 | 697 |

| Total Net Revenue | 6,550 | 8,314 | 8,644 | 11,898 | 16,958 |

| Adjusted EBITDA | 2,172 | 2,613 | 2,782 | 4,018 | 5,395 |

| Adjusted EBITDA Margin | 33% | 31% | 32 % | 34% | 32 % |

| Gaming Statistics 10 | |||||

| (HK$'m) | Q2 2023 | Q1 2024 | Q2 2024 | 1H 2023 | 1H 2024 |

| Rolling Chip Volume 11 | 29,054 | 37,433 | 44,577 | 50,602 | 82,010 |

| Win Rate % | 3.2% | 3.3% | 2.9 % | 3.4% | 3.1 % |

| Win | 931 | 1,243 | 1,287 | 1,725 | 2,530 |

| Mass Table Drop 12 | 19,146 | 24,472 | 24,647 | 34,270 | 49,119 |

| Win Rate % | 26.3% | 26.2% | 28.6 % | 26.3% | 27.4 % |

| Win | 5,038 | 6,406 | 7,047 | 9,008 | 13,453 |

| Electronic Gaming Volume | 8,414 | 12,779 | 14,772 | 14,704 | 27,551 |

| Win Rate % | 4.5% | 3.8% | 3.5 % | 4.6% | 3.7 % |

| Win | 379 | 487 | 524 | 670 | 1,011 |

| Total GGR Win | 6,348 | 8,136 | 8,858 | 11,403 | 16,994 |

StarWorld Macau

StarWorld Macau’s Net Revenue was $2.7 billion in 1H 2024, up 25% year-on-year. Adjusted EBITDA was $825 million, up 43% year-on-year. In 1H 2024, StarWorld Macau experienced good luck in its gaming operations which increased its Adjusted EBITDA by approximately $48 million. Normalized 1H 2024 Adjusted EBITDA was $777 million, up 34% year-on-year.

In Q2 2024, StarWorld Macau’s Adjusted EBITDA was $390 million, up 8% year-on-year and down 10% quarter-on-quarter. In Q2 2024, StarWorld Macau experienced good luck in its gaming operations which increased its Adjusted EBITDA by approximately $33 million. Normalized Q2 2024 Adjusted EBITDA was $357 million, down 1% year-on-year and down 15% quarter-on-quarter.

Hotel occupancy was 100% for 1H 2024 and 100% for Q2 2024.

| StarWorld Macau Key Financial Data | |||||

| (HK$’m) | Q2 2023 | Q1 2024 | Q2 2024 | 1H 2023 | 1H 2024 |

| Revenues: | |||||

| Net Gaming | 1,103 | 1,235 | 1,190 | 1,931 | 2,425 |

| Hotel / F&B / Others | 115 | 128 | 128 | 220 | 256 |

| Mall | 5 | 6 | 5 | 10 | 11 |

| Total Net Revenue | 1,223 | 1,369 | 1,323 | 2,161 | 2,692 |

| Adjusted EBITDA | 362 | 435 | 390 | 578 | 825 |

| Adjusted EBITDA Margin | 30% | 32% | 29 % | 27% | 31 % |

| Gaming Statistics 13 | |||||

| (HK$'m) | Q2 2023 | Q1 2024 | Q2 2024 | 1H 2023 | 1H 2024 |

| Rolling Chip Volume 14 | NIL | 1,024 | 1,578 | NIL | 2,602 |

| Win Rate % | NIL | 5.5% | 6.5 % | NIL | 6.1 % |

| Win | NIL | 56 | 104 | NIL | 160 |

| Mass Table Drop 15 | 6,842 | 6,756 | 7,467 | 12,131 | 14,223 |

| Win Rate % | 17.6% | 19.0% | 16.2 % | 17.6% | 17.5 % |

| Win | 1,206 | 1,283 | 1,207 | 2,132 | 2,490 |

| Electronic Gaming Volume | 2,250 | 5,045 | 6,325 | 3,656 | 11,370 |

| Win Rate % | 2.1% | 1.8% | 1.8 % | 2.2% | 1.8 % |

| Win | 48 | 93 | 113 | 80 | 206 |

| Total GGR Win | 1,254 | 1,432 | 1,424 | 2,212 | 2,856 |

Broadway Macau™

Broadway Macau™ is a unique family friendly, street entertainment and food resort supported by Macau SMEs. Broadway Macau™’s Net Revenue was $100 million for 1H 2024, up 144% year-on-year. Adjusted EBITDA was $12 million for 1H 2024 versus $(20) million in 1H 2023. In Q2 2024, Broadway Macau™’s Adjusted EBITDA was $8 million, versus $(10) million in Q2 2023 and $4 million in Q1 2024.

City Clubs

City Clubs contributed $9 million of Adjusted EBITDA to the Group’s earnings for 1H 2024, up 29% year-on-year. Q2 2024 Adjusted EBITDA was $5 million, up 25% year-on-year and up 25% quarter-on-quarter.

Construction Materials Division (“CMD”)

CMD contributed Adjusted EBITDA of $366 million in 1H 2024, up 11% year-on-year. The results were predominantly driven by the strength in demand for construction materials in Hong Kong and Macau. In Q2 2024, CMD’s Adjusted EBITDA was $256 million, up 12% year-on-year and up 133% quarter-on-quarter.

The demand for ready-mixed concrete in Hong Kong and Macau was strong due to the accelerating demand to catch up on the completion timeline of the Hong Kong International Airport’s three runway project and the development works in Macau’s Zone A reclamation area. Demand for construction materials in Mainland China remained weak due to the soft property market and slow infrastructure investment. Oversupply in cement resulted in high levels of inventory which depressed prices. It is anticipated that CMD’s businesses in Mainland China will remain challenging in 2H 2024.

Development Update

Galaxy Macau™ and StarWorld Macau

We continue to make ongoing progressive enhancements to our resorts to ensure that they remain competitive and appealing to our guests with a particular focus on adding new and innovative F&B and retail offerings. At StarWorld Macau we are evaluating a range of major upgrades, that includes the main gaming floor, the lobby arrival experience and increasing the F&B options.

Cotai – The Next Chapter

The targeted opening of Capella at Galaxy Macau is in mid-2025. The 17-storey property offers approximately 100 ultra-luxury sky villas and suites. Each Sky Villa features a light-filled balcony with a transparent infinity-edge pool, outdoor lounge, sunroom and hidden winter garden, among others. Capella at Galaxy Macau promises to bring a new level of elegance and luxury to Macau.

We are ramping up GICC, Galaxy Arena, Raffles at Galaxy Macau and Andaz Macau. We are now firmly focused on the development of Phase 4, which is already well under way. Phase 4 will include multiple high-end hotel brands new to Macau, together with an up to 5000-seat theater, extensive F&B, retail, non-gaming amenities, landscaping, a water resort deck and a casino. Phase 4 is approximately 600,000 square meters of development and is scheduled to complete in 2027. We remain highly confident about the future of Macau where Phases 3 & 4 will support Macau’s vision of becoming a World Centre of Tourism and Leisure.

Selected Major Awards in 1H 2024

| AWARD | PRESENTER |

| GEG | |

| Sustainability Award | International Gaming Awards 2024 |

| Casino Operator of the Year | Global Gaming Awards Asia-Pacific 2024 |

| 2024 Macao International Environmental Co-operation Forum & Exhibition - Green Booth Award | Macau Fair & Trade Association |

| GALAXY MACAU™ | |

MICHELIN One-Star Restaurant

| The MICHELIN Guide Hong Kong Macau 2024 |

Five Star Hotel

| 2024 Forbes Travel Guide |

| Black Pearl Restaurant Guide 2024 – One Diamond – 8½ Otto e Mezzo BOMBANA | Mei Tuan |

| Macau Energy Saving Activity 2023 – Energy Saving Concept Award – Galaxy Macau | CEM - Companhia de Electricidade de Macau |

EarthCheck Gold Certification

| EarthCheck |

Tatler Dining Awards 2024 – Tatler Dining 20 Macau Awards

| Tatler Dining |

| Macao Green Hotel Awards – Gold Award – Galaxy Hotel™ | Environmental Protection Bureau of the Macau SAR Government |

Wine Spectator’s 2024 Restaurant Best of Award of Excellence (Two Glasses)

| Wine Spectator’s Restaurant Awards |

| STARWORLD MACAU | |

| MICHELIN Two-Star Restaurant – Feng Wei Ju | The MICHELIN Guide Hong Kong Macau 2024 |

| Black Pearl Restaurant Guide 2024 – One Diamond – Feng Wei Ju | Mei Tuan |

| SCMP 100 Top Tables 2024 – Feng Wei Ju | South China Morning Post |

| Tatler Dining Awards 2024 – Tatler Dining 20 Macau Awards – Feng Wei Ju | Tatler Dining |

| Broadway Macau™ | |

| Macau Energy Saving Activity 2023 – Energy Saving Award (Hotel Group B) – 1st Runner Up – Broadway Macau | CEM - Companhia de Electricidade de Macau |

| Construction Materials Division | |

| Caring Company Scheme – 20 Years Plus Caring Company Logo | The Hong Kong Council of Social Service |

Outlook

Macau continues to collect accolades as a destination of choice which will continue to drive tourism demand. Since the border reopened in 2023, the Macau Government Tourism Office (MGTO) and the six concessionaries have jointly promoted Macau’s diverse “tourism +” offerings and status as a UNESCO Creative city of Gastronomy across Mainland China and Asia. This collaborative effort has resulted in Macau being voted the number one destination of choice for Mainland Chinese travelers in the Chinese Tourism Academy’s latest satisfaction survey.

GEG continues to collaborate closely with MGTO to actively promote Macau and further develop international tourism to support this initiative we have opened overseas business development offices in Tokyo, Seoul and Bangkok. This demonstrates our commitment to the Macau Government’s initiative to increase the number and flow of high value international visitors.

The Macau Government continues to work hard to diversify Macau’s economy. To attract a more diverse tourism base they are planning to develop a 50,000 seat, open air venue that can host a range of large-scale entertainment and sporting events. It is anticipated that the arena will be opened in the first quarter of 2025.

We remain confident in the outlook for Macau. The reasons for this confidence include the ongoing improvement in transportation infrastructure making it easier to travel to and from Macau, as well as within it. The Central Government recently transferred a land site from Zhuhai to Macau to enable construction of transportation infrastructure adjacent to the Gongbei checkpoint that will facilitate a connection to the Macau’s light rail network. Furthermore, the newly opened Jinhai Bridge directly connects Zhuhai Airport to Hengqin and Macau by both car and rail. The train journey takes approximately 15 minutes and the Zhuhai airport will have capacity of 27.5 million passengers per annum by the end of 2024. Lastly, the fourth Macau-Taipa bridge is expected to open later this year, further improving travel within Macau.

GEG continues to expand its capacity in Macau to match the widening tourist demand from both Greater China and Asia. We are currently fitting-out Capella at Galaxy Macau. The property will offer approximately 100 ultra-luxury sky villas and suites and is targeted to open in mid-2025. We are also firmly focused on the development of Phase 4 which is well under way. Phase 4 will include multiple high-end hotel brands new to Macau, together with an up to 5000-seat theater, extensive F&B, retail, non-gaming amenities, landscaping, a water resort deck and a casino. Phase 4 is approximately 600,000 square meters of development and is scheduled to complete in 2027.

Under the new concession, GEG has committed non-gaming investment of over MOP$33 billion to further diversify Macau’s tourism attraction. In the meanwhile, we will continue to seek opportunities in the Greater Bay Area and explore attractive overseas development opportunities, and we will evaluate international opportunities on a case by case basis. GEG is committed to supporting the Macau Government’s vision to develop Macau into the World Centre of Tourism and Leisure.

About Galaxy Entertainment Group (HKEx stock code: 27)

Galaxy Entertainment Group Limited (“GEG” or the “Company”) and its subsidiaries (“GEG” or the “Group”) is one of the world’s leading resorts, hospitality and gaming companies. The Group primarily develops and operates a large portfolio of integrated resort, retail, dining, hotel and gaming facilities in Macau. GEG is listed on the Hong Kong Stock Exchange and is a constituent stock of the Hang Seng Index.

GEG through its subsidiary, Galaxy Casino S.A., is one of the three original concessionaires in Macau when the gaming industry was liberalized in 2002. In 2022, GEG was awarded a new gaming concession valid from January 1, 2023, to December 31, 2032. GEG has a successful track record of delivering innovative, spectacular and award-winning properties, products and services, underpinned by a “World Class, Asian Heart” service philosophy, that has enabled it to consistently outperform the market in Macau.

The Group operates three flagship destinations in Macau: on Cotai, Galaxy Macau™, one of the world’s largest integrated destination resorts, and the adjoining Broadway Macau™, a unique landmark entertainment and food street destination; and on the Peninsula, StarWorld Macau, an award-winning premium property.

The Group has the largest development pipeline of any concessionaire in Macau. When The Next Chapter of its Cotai development is completed, GEG’s resorts footprint on Cotai will be more than 2 million square meters, making the resorts, entertainment and MICE precinct one of the largest and most diverse integrated destinations in the world. GEG also considers opportunities in the Greater Bay Area and internationally. These projects will help GEG develop and support Macau in its vision of becoming a World Centre of Tourism and Leisure.

In July 2015, GEG made a strategic investment in Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco (“Monte-Carlo SBM”), a world renowned owner and operator of iconic luxury hotels and resorts in the Principality of Monaco. GEG continues to explore a range of international development opportunities with Monte-Carlo SBM. GEG is committed to delivering world class unique experiences to its guests and building a sustainable future for the communities in which it operates.

For more information about the Group, please visit www.galaxyentertainment.com

__________________________________

1 Gaming statistics are presented before deducting commission and incentives. 2 Represents sum of promotor and inhouse premium direct. 3 Mass table drop includes the amount of table drop plus cash chips purchased at the cage. 4 Total GGR win includes gaming win from City Clubs. 5 Reflects luck adjustments associated with our rolling chip program. 6 Gaming statistics are presented before deducting commission and incentives. 7 Represents sum of promotor and inhouse premium direct. 8 Mass table drop includes the amount of table drop plus cash chips purchased at the cage. 9 Total GGR win includes gaming win from City Clubs. 10 Gaming statistics are presented before deducting commission and incentives. 11 Represents sum of promotor and inhouse premium direct. 12 Mass table drop includes the amount of table drop plus cash chips purchased at the cage. 13 Gaming statistics are presented before deducting commission and incentives. 14 Represents sum of promotor and inhouse premium direct. 15 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/Attach...7a06dc8ef6 https://www.globenewswire.com/NewsRoom/Attach...e368d4c466