Commodity prices, inflation, gold and XAU .......

Post# of 1088

https://investorshangout.com/post/view?id=6376301

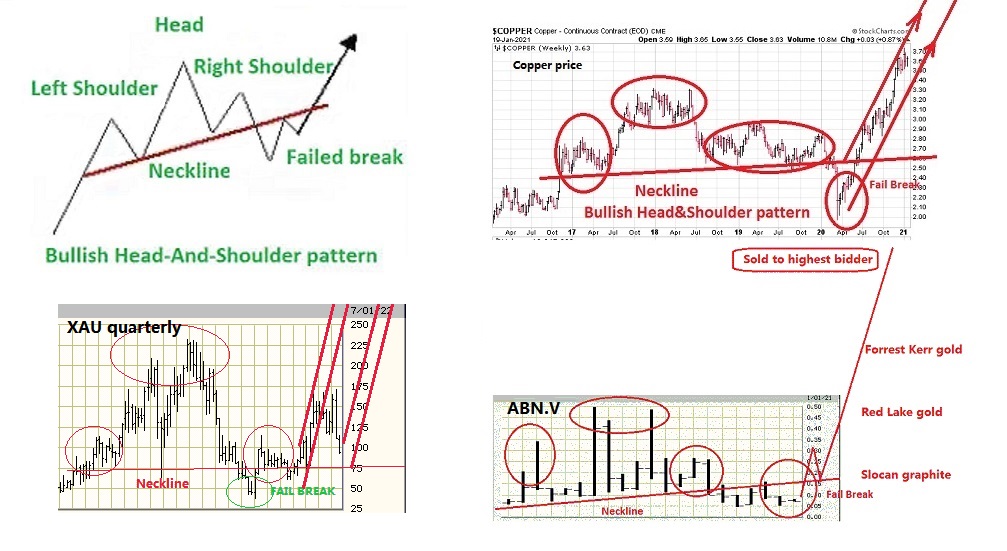

Commodity prices topped out and plunged in March as supplies proliferate. Inflation rate in US and Canada is expected to decline towards the Fed's target of 2% to 3% next year. Majority of gold experts forecast the Fed will start lowering interest rate in the second half of 2023 while at the same time gold price will rise back to $1,900 level. With this forecast, gold price will meet support above $1,600, the breakout point in 2020 while the Mining Index XAU will meet support at 75, the Neckline of the 20-year Head&Shoulder formation and start an uptrend in Q4 or in the new year.

https://investorshangout.com/images/MYImages/...attern.jpg

Based on above forecast, the scenario for Gold price and US Dollar Index for 2023 will be as follow:

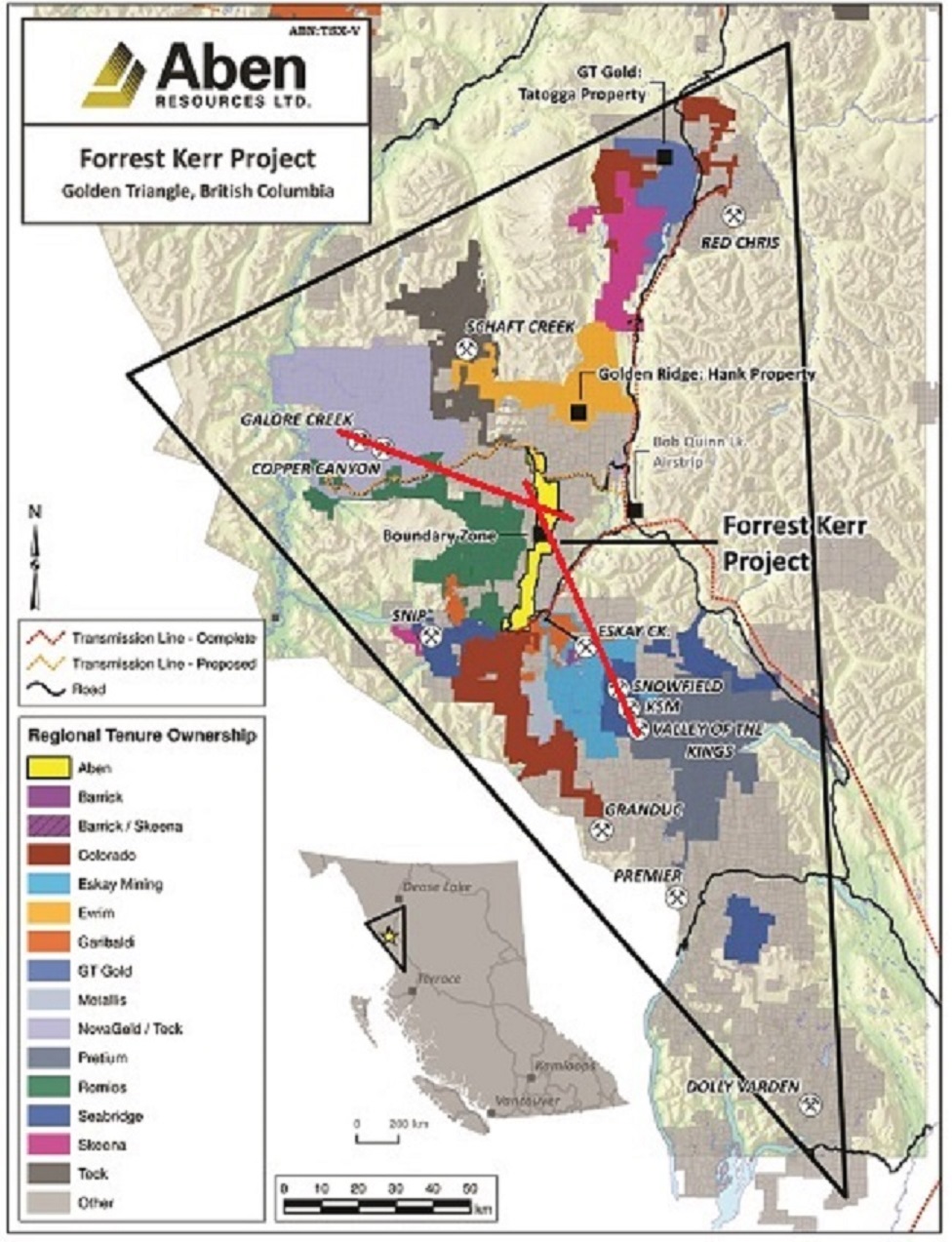

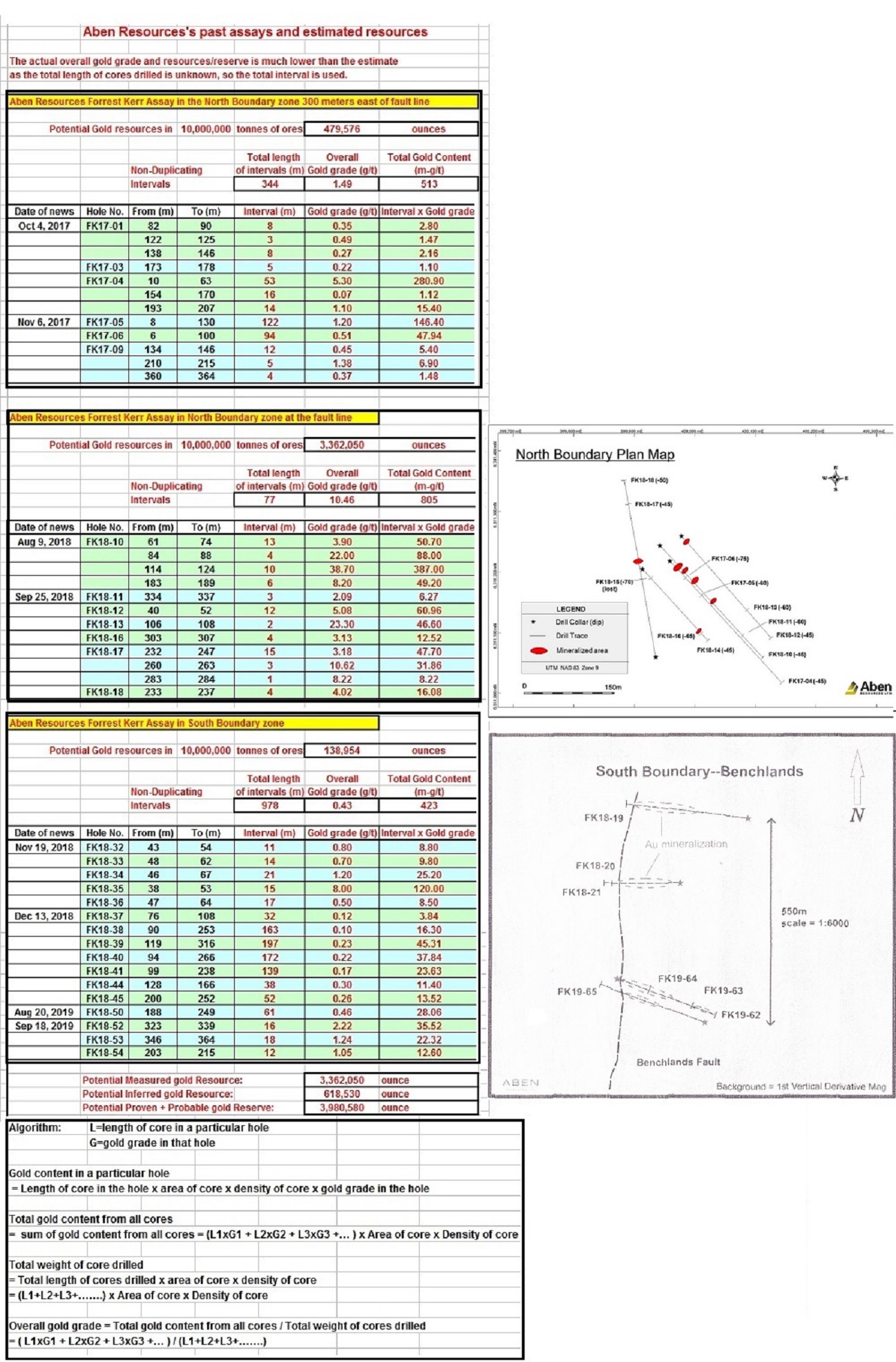

James Pettit and his geologists better start working on the Forrest Kerr, solve the "High Grade Gold Discontinuity puzzle" and set top priority drill targets for 2023. Drilling permit is good till March 2024. The sale of the Justin gold project for $4 million to $9 million will enable drilling some 109 holes in the prolific North Boundary zone, hopefully discovering the massive gold vein that may rival that in Eskay Creek mine.

Aben Resources - Potential gold resources

https://investorshangout.com/images/MYImages/...ources.jpg

Live charts:

2023 June Gold Futures quarterly

https://bigcharts.marketwatch.com/advchart/fr...ize=2&

Mining Index XAU quarterly

https://bigcharts.marketwatch.com/advchart/fr...0&size

(0)

(0) (0)

(0)