Freddie Mac (FMCC), the government sponsored agency that backs mortgage loans for millions of American home buyers reported all time record annual profit of $11 billion for 2012. Freddie Mac has been in the black now for five consecutive quarters as the housing market improves and loan delinquencies decrease.

Freddie Mac has been operating under government control ever since it was placed under government conservatorship in September 2008 after incurring huge losses related to the housing crash. The government bailout of Freddie Mac resulted in the U.S. Treasury acquiring 80% ownership of Freddie Mac. In addition, Freddie Mac was required to issue senior preferred stock paying a 10% dividend. As of December 31, 2012, the outstanding amount of preferred stock totaled $72.3 billion.

Including the latest payment, dividends paid to the U.S. Treasury since 2008 total $29.6 billion. Starting this year, the Treasury modified the bailout agreement whereby instead of a 10% dividend payment, Freddie Mac will be required to pay all profits to the Treasury in excess of required capital reserves.

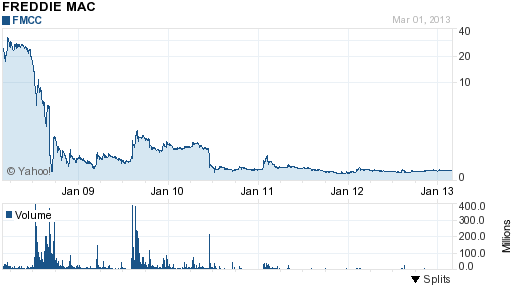

With Freddie Mac now gushing profits, will the outstanding stock still owned by the public ever have a chance of recovering? Shareholders, who own 20% of the company, seemed optimistic after release of the earnings news and Freddie Mac’s stock (FMCC) rose by over 3%. Over the past year, FMCC has increased by over 100% from a low of $0.14. After being delisted by the NYSE as the price slid below $1, the shares now trade on the over the counter pink-sheets. FMCC has a current market value of almost $1 billion.

Will FMCC gradually recover like so many other large financial institutions that once seemed hopelessly insolvent? In the December 31, 2012 10K , management talks about the challenges facing Freddie Mac.

We continue to operate under the direction of FHFA, as our Conservator. We are also subject to certain constraints on our business activities imposed by Treasury due to the terms of, and Treasury’s rights under, the Purchase Agreement. We are dependent upon the continued support of Treasury and FHFA in order to continue operating our business. Our ability to access funds from Treasury under the Purchase Agreement is critical to keeping us solvent and avoiding the appointment of a receiver by FHFA under statutory mandatory receivership provisions. The conservatorship and related matters have had a wide-ranging impact on us, including our regulatory supervision, management, business, financial condition, and results of operations.

There is significant uncertainty as to whether or when we will emerge from conservatorship, as it has no specified termination date, and as to what changes may occur to our business structure during or following conservatorship, including whether we will continue to exist. We are not aware of any current plans of our Conservator to significantly change our business model or capital structure in the near-term. Our future structure and role will be determined by the Administration and Congress, and there are likely to be significant changes beyond the near-term. We have no ability to predict the outcome of these deliberations.

As our Conservator, FHFA succeeded to all rights, titles, powers and privileges of Freddie Mac, and of any stockholder, officer or director thereof, with respect to the company and its assets. FHFA, as Conservator, has directed and will continue to direct certain of our business activities and strategies. FHFA has delegated certain authority to our Board of Directors to oversee, and to management to conduct, day-to-day operations. The directors serve on behalf of, and exercise authority as directed by, the Conservator.

On February 11, 2011, the Administration delivered a report to Congress that lays out the Administration’s plan to reform the U.S. housing finance market, including options for structuring the government’s long-term role in a housing finance system in which the private sector is the dominant provider of mortgage credit. The report recommends winding down Freddie Mac and Fannie Mae, and states that the Administration will work with FHFA to determine the best way to responsibly reduce the role of Freddie Mac and Fannie Mae in the market and ultimately wind down both institutions. The

report states that these efforts must be undertaken at a deliberate pace, which takes into account the impact that these changes will have on borrowers and the housing market.

The aggregate liquidation preference of the senior preferred stock was $72.3 billion and $72.2 billion at December 31, 2012, and 2011, respectively. Beginning January 1, 2013, the remaining funding commitment from Treasury under the Purchase Agreement is $140.5 billion. This amount will be reduced by any future draws. Under the Purchase Agreement, our ability to repay the liquidation preference of the senior preferred stock is limited and we will not be able to do so for the foreseeable future, if at all. The aggregate liquidation preference of the senior preferred stock will increase further if we receive additional draws.