Introduction to Aben Resources ...................

Post# of 1088

Aben Resources Ltd. is a publicly traded Canadian gold exploration company with significant projects in British Columbia, Yukon and Ontario. The company's operating goal is to acquire potential gold properties to discover bonanza gold deposits and sell them to gold producers seeking commercially viable gold deposits to replenish their dwindling reserves.

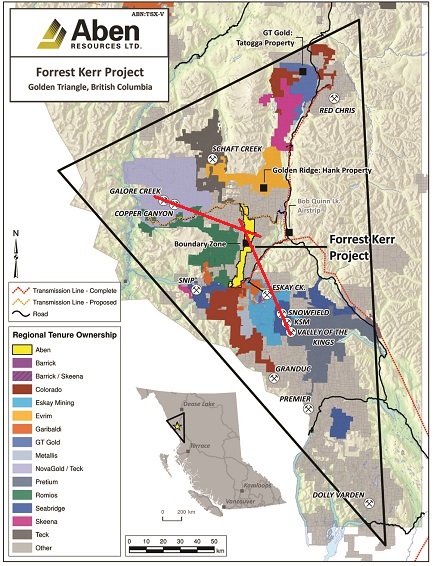

The Company's 100% owned flagship 23,000 hectares Forrest Kerr gold project is located in the heart of a region called the Golden Triangle in northwestern British Columbia. This region has hosted significant mineral deposits including: Pretium (Brucejack), Eskay Creek, Snip, Galore Creek, Copper Canyon, Schaft Creek, KSM, Granduc, Red Chris and more.

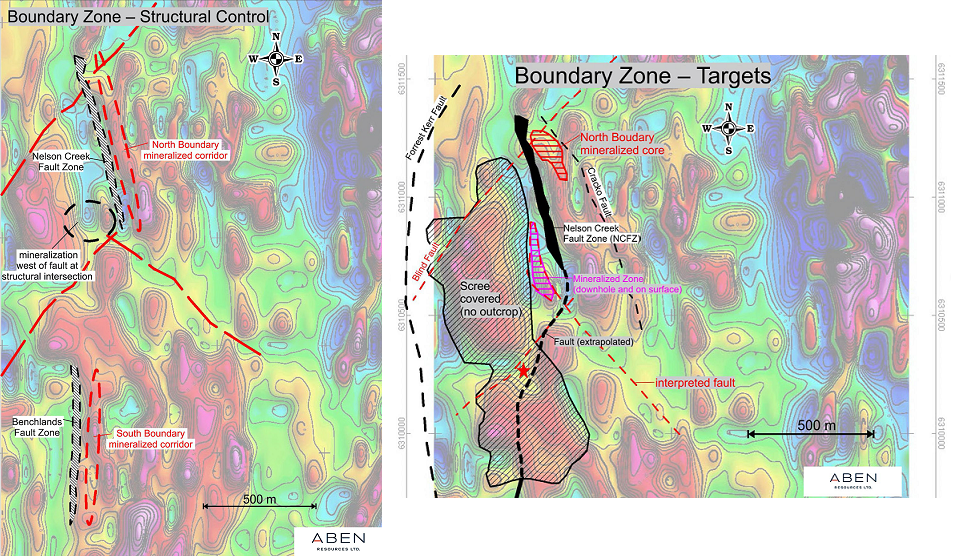

The first drill hole of 2018 at the Forrest Kerr Project discovered multiple high-grade zones with visible gold including 331 g/t gold over 1 meter, 62.4 g/t Gold over 6.0 meters within 38.7 g/t Gold over 10.0 meters starting at 114 meters downhole at the North Boundary Zone. Although the geological structure of Forrest Kerr is very intriguing that make setting priority drilling targets difficult, the Forrest Kerr Property remains an important asset to Aben Resources and geologic data collected through recent drill programs will continue to be analyzed and re-interpreted with the aim to conduct focused exploration programs. The Forrest Kerr Property is fully permitted and in good standing through March 2024.

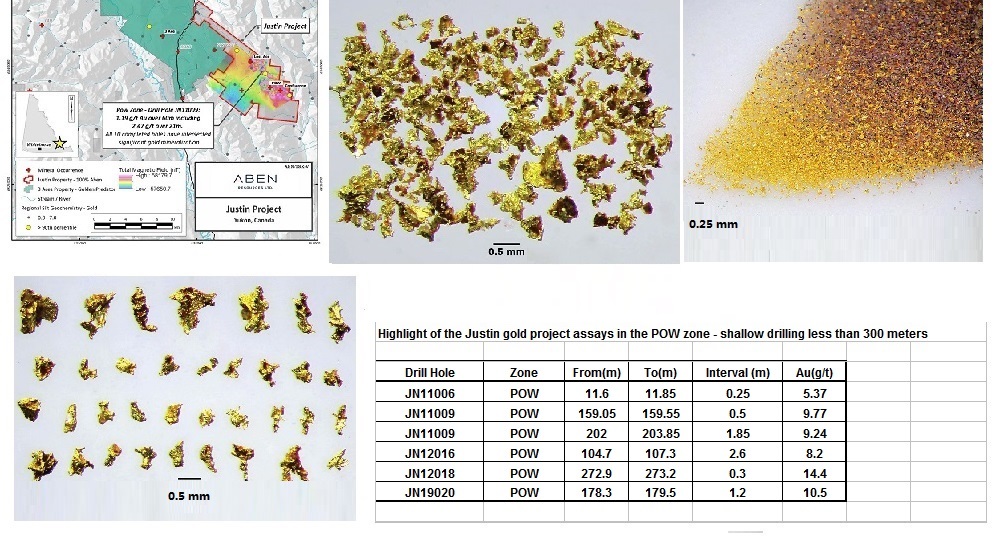

Aben also holds a 100% interest in the 7,411 hectares Justin gold project located in the southeast Yukon. Previous drilling by Aben intercepted 60 meters of 1.19 g/t Gold including 21 meters of 2.47 g/t Gold in the POW Zone. The geochemical signature of the mineralized zone is characterized by elevated Au, Bi, Cu, Mo and W supporting an Intrusion Related Gold System (IRGS).

In July, 2021 Aben acquired the Pringle North property in Red Lake, Ontario, in the vicinity of Great Bear Resources and Trillium Gold which have bonanza gold discovery. Magnetic Survey has been completed for mineralization study. The Red Lake Mining District enables a year-round mining activities due to its mild winter temperature. The region has produced over 22 million ounces of gold through 2004, worth over $US 35 billion at 2014 prices. The two principal mines, Campbell and Red Lake, both have historic ore grades averaging about 0.57 oz/ton (22 g/tonne) gold.

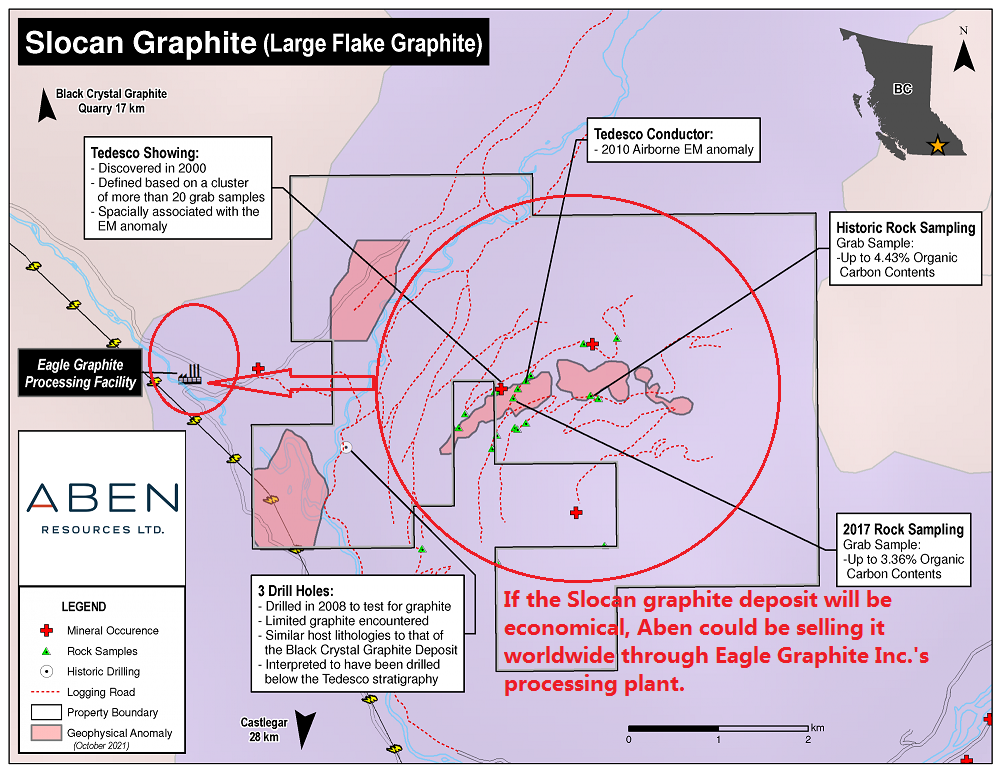

In November, 2021 Aben executed a formal option agreement with Eagle Plains Resources Ltd. for exclusive right to earn a 100% interest in the Slocan Graphite Project located 34km northwest of Castlegar, British Columbia. The Slocan Graphite project consists of 2,387 hectare (23.87 square kilometer) hosting several large flake graphite-bearing outcrops and float occurrences known as the Tedesco Zone which is interpreted to extend over 2.0 km. The property is in the vicinity of the graphite processing plant and facilities 1.5 Km to the west owned by Eagle Graphite Corporation. The facilities can process graphite at an annual capacity of 4,000 tonnes and ship it to US and worldwide.

Aben Resources website

https://www.abenresources.com/

PowerPoint Presentation

https://abenresources.com/site/assets/files/3...y_2022.pdf

Financial filings and official news release

https://sedar.com/DisplayCompanyDocuments.do?...o=00005652

Insider trading record

https://www.canadianinsider.com/company?ticker=ABN

===============

Stock Information

===============

Ticker Symbols:

TSX Venture, Canada: ABN.V

United States of America: OTCQB Market: ABNAF

Frankfurt Exchange, Germany: E2L2

===============================

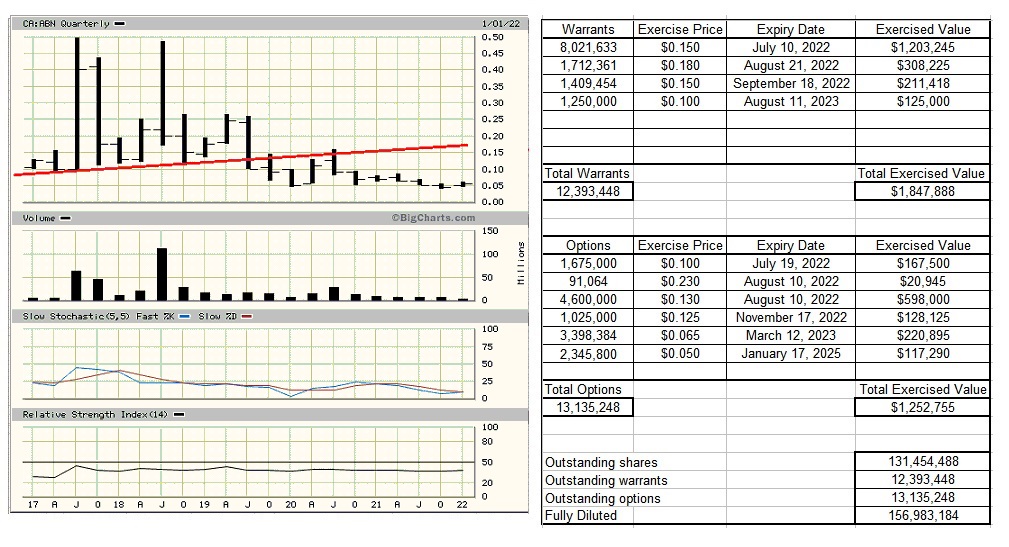

Outstanding Shares, Warrants, Options

===============================

https://investorshangout.com/images/MYImages/...ptions.jpg

=========================

Mining properties Information

=========================

Flagship Forrest Kerr gold project, The Golden Triangle of British Columbia

https://investorshangout.com/images/MYImages/...tlines.jpg

Forrest Kerr property covers 23,397 hectares or 234 square Km (6.1 Km x 38.3 Km)

Introduction to The Golden Triangle of British Columbia

https://www.youtube.com/watch?v=rBY6t3FHu7I

Overview of Aben's Forrest Kerr project

https://www.youtube.com/watch?v=egG5OWpTq0s

Aben Resources - gold contents in drill cores

https://www.youtube.com/watch?v=rUuDeaYt5ew

Gold resources in Aben's neighbors

https://www.youtube.com/watch?v=eQpWgPJKln0

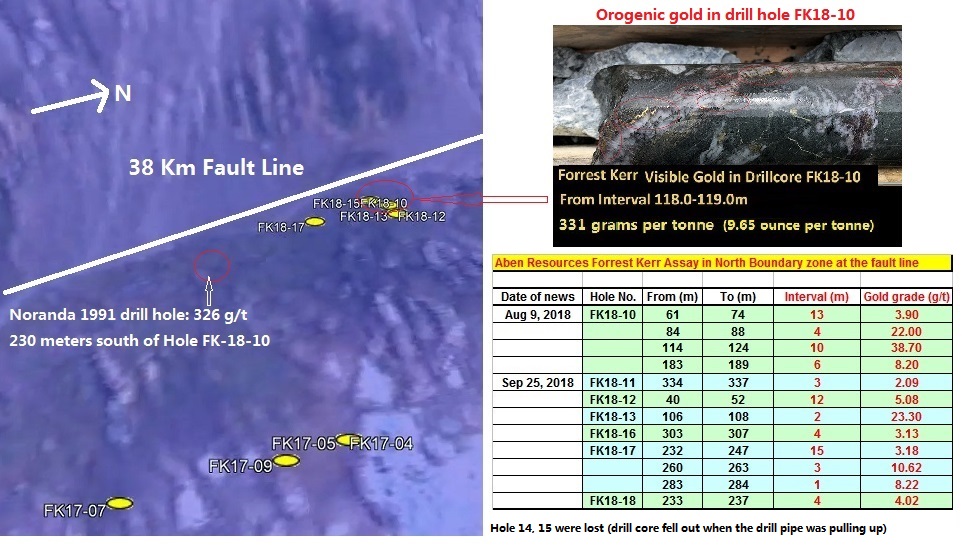

2018 drill site in the North Boundary zone

https://investorshangout.com/images/MYImages/...assays.jpg

In the 2018 drilling program 7 holes drilled at the fault line in the North Boundary zone encountered high grade gold, especially Hole FK18-10 with visible gold assayed 38 g/t over 10 meters including 331 g/t over 1 meter, corroborated with Noranda's 1991 discovery of 326 g/t located at 230 meters south of Hole FK18-10. Both Aben and Noranda had drilled into a gold artery and the gold in the drill core is orogenic gold originated from the Forrest Kerr fault line.

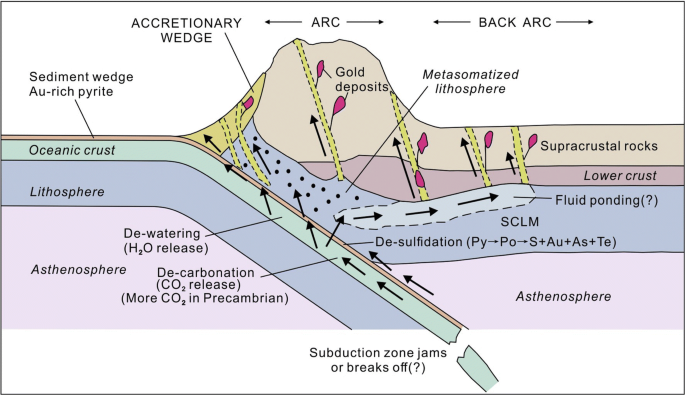

Facts about orogenic gold

Heated seawater deep in the Earth's crust circulated in the crust and dissolved gold and other minerals to form hydrothermal fluid with super-saturated gold and other minerals, when gold precipitated on rocks, they formed hydrothermal gold deposits. 2 Billions years ago, collision between the Pacific tectonic plate and North America tectonic plate with the phenomenon of subduction generated tremendous heat and pressure in the Earth's crust, forcing the hot gold-rich hydrothermal fluid to surge upward towards the surface through fault lines and precipitated the gold mineral on rocks while the Pacific coast buckled and was forced upward and skyward, forming the Rocky Mountain. The hydrothermal fluid could travel hundreds of meters from the fault lines, forming gold veins and gold arteries and precipitated gold on rocks, gold deposits formed this way had many names but eventually it was agreed that the name orogenic gold should be used in place of other names, 75% of the world's gold deposits are orogenic gold, others are volcanic in nature as lava eroded into soil, releasing gold and other minerals. The word orogeny is derived from Greek, meaning mountain creation. There is a high probability of finding gold vein(s) along the 38 Km fault line in Forrest Kerr just as the Stikine Resources did at a fault line in Eskay Creek as well as Great Bear Resources did along the LP fault line in its Dixie project in Red Lake.

https://investorshangout.com/images/MYImages/...posits.png

Eagle Plains Resources's Youtube video on orogenic gold

https://www.youtube.com/watch?v=YEtfOGY5CWM

Map of Forrest Kerr and the Boundary Zone.

https://investorshangout.com/images/MYImages/...yzones.png

Forrest Kerr is a close neighbor to Eskay Creek mine with similar geology. Stikine Resources which owned the Eskay Creek took 50 years to discover bonanza gold deposits due to the intriguing geology of high grade gold discontinuity puzzle. James Pettit emphasized in the interviews that the geologists must conduct targeted drilling as random drilling is a waste of money, for this reason, the company will forego ground exploration activities at the Forrest Kerr in 2022 and concentrate on Pringle North gold project and Slocan Graphite project with exploration on both properties carrying out simultaneously soon, but the Forrest Kerr Property remains an important asset to Aben Resources and all geologic data collected through recent drill programs will continue to be analyzed and re-interpreted with the aim to conduct focused exploration programs in the future. The Forrest Kerr Property is fully permitted and in good standing through March 2024. James Pettit remarked: “We are re-evaluating all of the old and new data from ground, geophysics, and drill programs conducted between 2016 and 2020. We intend to utilize the data to generate future drill targets within and beyond the North and South Boundary Zones.”

History of Eskay Creek mine, the world's massive high grade gold mine

In 1932 a prospector named Tom Mackay of Consolidated Stikine Resources was the first to recognize the area's unique geological setting after spotting an alluring rock outcrop from his single-engine bush plane. After staking the property he discovered a boulder broken free from its source higher up on the mountain, rolling several dozen meters down slope, assays from the boulder returned a spectacular five ounces of gold per tonne. Mackay explored the property for over 50 years but bonanza gold deposit was never found. In 1988 after investing in Consolidated Stikine Resources which held rights to Eskay Creek, geologist Ron Netolitzky became Stikine’s technical person and one of five controlling shareholders. He teamed up with Murray Pezim of Calpine Resources to raise $900,000 for a drill program and started exploring the area in the summer of 1990. After drilling 108 holes and with momentum building, they hit a fault line. Chet Idziszek, Pezim’s geologist with a M.Sc. degree from McGill University observed gradually increasing gold grade and increasing interval length of high grade gold in the assays, he had an intuition that he must be very close to the main gold vein, he studied the maps and analysed the terrain then he ragged the drill rig to a spot 350 meters from the last hole drilled and drilled hole #109. Bingo, assays from hole 109 returned spectacular 27.2 g/t gold, 30.2 g/t silver over 208 meters (682 feet), they have drilled into a massive gold vein. In 1994 Eskay Creek went into production that lasted 14 years, finally ended in 2008. Eskay Creek had the highest grade gold on the planet and produced 3.3 million ounces of gold at a breathtaking 45 g/t Au, also 160 million ounces of silver at 2,224 g/t. Stikine Resources was acquired by Placer Dome and International Corona for $67 per share. Ron Netolitzky has had a very successful career in mining and mineral exploration with decades of experience and having been directly associated with three major mineral discoveries in Canada that have subsequently been put into production: Eskay Creek, Snip and Brewery Creek. Ron Netolitzky was inducted into the Canadian Mining Hall of Fame in 2014.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Slocan Graphite project, southern British Columbia

In November, 2021 Aben executed a formal option agreement with Eagle Plains Resources Ltd. for exclusive right to earn a 100% interest in the Slocan Graphite Project located 34km northwest of Castlegar, British Columbia. The Slocan Graphite project consists of 2,387 hactre (23.87 square kilometer) hosting several large flake graphite-bearing outcrops and float occurrences known as the Tedesco Zone, which is interpreted to extend over 2 km.

Graphite is a naturally occurring form of carbon and is an excellent conductor of both electricity and heat. It is becoming increasingly important as a critical strategic component in advancing alternative energy solutions including wind and solar power, hybrid vehicles and other alternative energy uses. It is also a mainstay of the steel production industry. Canada is currently ranked as the 5th largest supplier of graphite.

Past workers in the area concluded that geological, assay, and geophysical data indicate significant potential to form an economic deposit” (BC Assessment Report 26537). Eagle Plains geologists also confer that the high-quality, large flake graphite, spatial extent of conductivity from a 2010 airborne electromagnetic survey in the prestine unexplored region, excellent proximity to infrastructure and the favorable economic outlook for graphite as a strategic commodity make Slocan Graphite a compelling project for exploration and discovery.

The Slocan Graphite Project benefits from excellent infrastructure including a high-voltage transmission line within 1.2 km of the property boundaries, an extensive network of forestry roads on and around the property, and an existing graphite processing plant and facilities located 1.5 km west of the property, owned by Eagle Graphite Corporation. The processing plant has historically operated at a throughput rate of 20 tonnes of feed per hour, a rate roughly equivalent to an annual output of 4,000 tonnes of high carbon natural flake graphite. The facility is strategically located close to the US city of Spokane, Washington and the Canadian port of Vancouver, British Columbia, Eagle Graphite offers efficient and economical shipping of high grade material to destinations worldwide.

If the Slocan Graphite will be commercially economical as conferred by geologists of Eagle Plains Resources and local workers, Aben will be selling it to US and Canada EV industry through Eagle Graphite Corporation's processing facilities and at minimum graphite price of $1,000 per tonne, it will generate annual revenue of $4 million for Aben. ( Graphite pricing: https://www.northerngraphite.com/about-graphi...e-pricing/ )

Graphite has long established itself as the dominant anode material in commercial lithium-ion batteries. Graphite market was valued at US$137.3 million in 2020 and is projected to reach $219.6 million by 2027 at a CAGR of 6.9%. Every million electric vehicle require around 75,000 tonnes of natural graphite. In 2020, spherical graphite demand in China alone was 240,000 tonnes, demand for graphite is forecasted increasing to 1.9 million tonnes by 2028 and 4.5 million metric tonnes by 2050, according to World Bank data released in 2020, the International Energy Agency (IEA) reached a similar conclusion, estimating that global graphite production would have to increase 25-fold by 2040 to meet demand projections.

Slocan graphite project, 34 Km northwest of Castlegar, British Columbia

https://www.google.ca/maps/place/Castlegar+Ca...17.6632064

https://investorshangout.com/images/MYImages/...roject.png

2017 BC Government Geological Survey Assessment Report 37398 in the Slocan Graphite region

https://aris.empr.gov.bc.ca/ARISReports/37398.PDF

(Excerpt from Page 18 to 20 of above Report: Minerals found in the Slocan Graphite property)

Graphite

The BCGS Mineral Deposit Model for Crystalline Flake Graphite (PO4: Simandl and Kenan, 1996) is interpreted to “... describe a geological setting ... identical to the Tedesco graphite deposits. Although in the early stages of exploration, geological, assay, and geophysical data indicate significant potential to identify an economic deposit. The host rocks (Units 2, 3) form conspicuous rusty graphitic gneiss with interbedded 5-10 metre thick graphitic marble layers. Average thickness of the mineralized section is unknown at this time, but the pattern of outcrops and float indicate that it may be 50 metres thick. Graphitic outcrops have been found for more than 2 kilometres across the grid, and a broad area of float occurrences of identical material can be traced on strike for a significant distance.

Seven assay samples of altered graphitic surface material were analysed using the CANMET recommended procedures. Assays varied up to 3.5% Carbon / Graphite, low-grade but with large crystalline graphite flakes. The geophysical surveys tend to support the overall trend and dimensions as given. Fraser-Filtered VLF-EM data consistently shows anomalous conductive zones and magnetometer anomalies associated with the graphitic outcrops and the hanging wall of the deposit. Pyrite, pyrrhotite, chalcopyrite, and sphalerite are known to occur within this sequence as stratiform layers or disseminations, and are the probable cause of several spot high geophysical readings.

Petrographic examination of samples Jgr-5 and Jgr-8 shows these rocks to be pyroxenebearing quartz monzonite or monzodiorite gneiss composed of calcic plagioclase (labradorite), clinopyroxene (diopside), K-feldspar, quartz, and phlogopite or muscovite, with accessory pyrrhotite, graphite, sphene, apatite, pyrite, and rare sphalerite and chalcopyrite: carbonate is virtually absent. Graphite is slightly more abundant at location Jgr-8 than Jgr-5 (Leitch, 2000).

The Tedesco graphite deposits are fortunate to have a large nearby graphite deposit under development at IMP mining’s (now owned by Eagle Graphite Corp.) Black Crystal graphite deposit on Hoder Creek. The IMP graphite test mill is located a few kilometres west of the property boundary. Regionally, the sequence of rocks present on the Tedesco grid has been correlated with the Rinda Ridge composite unit of Schaubs and Carr (1998) which hosts the inferred 88 million tonne Black Crystal flake graphite deposit, grading 4- 5% crystal graphite. Given the economic potential of the large Hoder Creek graphite deposit and the correlative geology, the Tedesco graphite occurrences are an important exploration target. …” (AR 26537). From May 16-29, 2012, a two person crew managed by John Demes completed prospecting for graphite on the southwest flank of Perry Ridge in an area covered by the current EPL tenure (AR33540 – Appendix C). Demes reported finding graphite-bearing float and outcrops all the way from about 850m elevation to about 1440m. A total of 20 samples were collected and analyzed for total carbon content (Figure 4). All rocks were “gneissic” containing 2-5% graphite. Outcrops strike east approximately AZ 270 with dips 64-88o (direction not stated).

Tedesco Garnet

A flat-lying garnetiferous pegmatite sill (Unit 4), varying from 30 to 50 centimetres in thickness, is exposed for 30 metres along a logging road on Tedesco grid (AR 33540). Handtrenching exposed at least four metres in width ... and the sill remains open in all directions. The garnetiferous sill is adjacent to a graphitic schist outcrop and a feldspar pegmatite sill, but the stratigraphic relationships are unclear due to shallow overburden cover.

Garnet occurs as irregularly distributed single crystals up to 10 centimetres in diameter and in crystalline masses up to 30 centimetres in width. The variety of garnet is almandine- pyrope of unknown proportions and the colour is described as an intense fiery red. The average weight content of garnet to host rock is approximately 10%, based on the recent bulk sample results. The large garnet crystals occasionally display a regrowth of garnet in a parasitic internal crystal of the same colour, and which is often more transparent than the host garnet.

Sample TGAR ... consists of coarse red garnet enclosed or encased in green biotite, in a matrix of quartz diorite (albite-oligoclase, quartz, K-feldspar). Fractures in this garnet are widely spaced (about l mm apart on average, with areas of lower density in some places, especially towards the core of the crystal). Inclusions of quartz, biotite, and plagioclase are common, but are mainly restricted to the margins of the crystals (Leitch, 2000). Minor amounts of graphite, pyrite and chalcopyrite are also locally present in the pegmatite host rock.

Aquamarine

Aquamarine beryl crystals of gem grade were discovered on the greater Blu Starr property in 1995. Aqua crystals are a light green-blue colour and occur within a quartz-feldspar-muscovitetourmaline pegmatite dike with miarolitic cavities. The main occurrence (Peg 1; AR 33540) and other lesser occurrences are located near the southwest corner of the property on the Slocan 2 claim. The sinuous and irregular dike is exposed for about 10 metres along strike and 2 metres in width, and is hosted by quartz-feldspar-biotite gneiss.

Approximately 20-25 aquamarine crystals were extracted from the Peg 1 pegmatite dike in 1996. The crystals can reach 5 centimetres long by 1.5 centimetres in width (100-125 2017 carats), and contain clear areas that would produce 0.5 carat gemstones (Gauthier and Dixon, 1996). Smokey and clear quartz, schorl tourmaline, and garnet are also found in Peg 1. The Peg 1 dike outcrops approximately 100 metres uphill from an old logging road and could be explored with non-explosive extraction methods such as compressor and jackhammer.

Quartz-tourmaline pegmatite dikes are of relatively common occurrence throughout the property often associated with 110° azimuth-trending, narrow sub-vertical zones of folding and fracturing. Non-gem aquamarine beryl crystals up to 4 centimetres by 5 centimetres in size have been found in large pegmatite float blocks located on the talus slope near the south iolite showing (I2) on the Blu Starr / Iolite grid.

Several aquamarine-bearing dikes occur on the Blu Starr Property proximal to the BQ claims on the ridge between Cowie and Airy creeks. The BQ claims are entirely contained within the Blu Starr Property, and host blue-green aquamarine beryl, almandine-pyrope garnet and smoky quartz in miarolitic cavities in a tourmaline pegmatite dike. The largest aquamarine crystal discovered to date weighs 47.2 grams (236 carats), and the largest faceted aqua weighs 5.26

carats. Garnet from this deposit has also been faceted, and the largest stone cut to date weighs 4.04 carats.

Emerald is the grass-green variety of beryl, and has not been found yet in the Slocan area. Many of the known deposits of gem emerald around the world occur within very similar geological environments to the Valhalla complex. A conceptual model of a potential emerald deposit in the Silocan Valley requires proximity to major faulting and shearing, berylbearing pegmatites, and a geochemical source of chromium or vanadium such as ultrabasic rocks to create the emerald colour in the beryl crystals. This geological environment would also support the deposition of chrysoberyl. One of the varieties of chrysoberyl is better known as alexandrite, a rare and very expensive gemstone.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Pringle North gold project, Red Lake, Ontario

In July, 2021 Aben acquired the Pringle North property in Red Lake, Ontario and completed the Magnetic Survey for mineralization study. Unlike the Golden Triangle of British Columbia where drilling is seasonal, the Red Lake Mining District enables a year-round mining operation due to its mild winter temperature. The region has produced over 22 million ounces of gold through 2004, worth over $US 35 billion at 2014 prices. The two principal mines, Campbell and Red Lake, both have historic ore grades averaging about 0.57 oz/ton (22 g/tonne) gold.

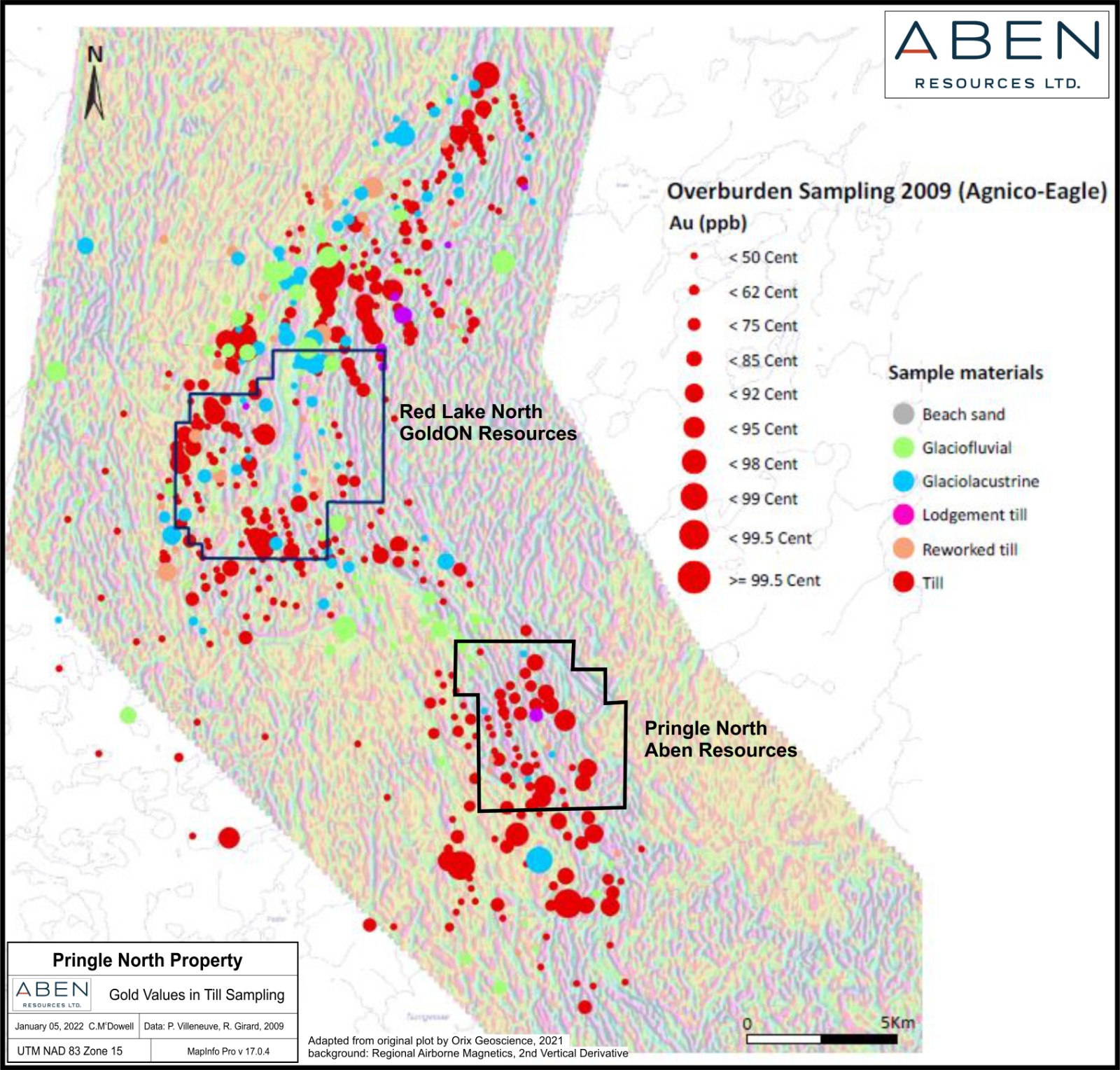

The Pringle North Property consists of 5 contiguous mining claims covering approximately 1,881 hectares (18.81 square km, approximately 4.3 km x 4.3 km), and is located 55 kilometers north of the prolific Red Lake Gold Camp. The Property sits within the ‘Red Lake Northern Extension’ corridor, an area that saw a marked increase in exploration activity in 2021. The Pringle North Property has had very limited ground exploration so the planned field exploration program in the Spring of 2022 will be an exciting advancement for the Company. The Red Lake Mining Complex is located within the Red Lake greenstone belt of the Superior Tectonic Province. This belt is host to one of Canada’s largest and richest Archean gold deposits producing more than 26 million ounces of gold since the 1930s. The Red Lake Greenstone Belt is subdivided into several rock assemblages recording magmatic and sedimentary activities that occurred from 3.0 to 2.7 billion years ago. In July, 2021 Aben Resources signed an agreement whereby they can earn-in an 100% right, title and interest in and to the Property by paying to the Optionors a total of $97,000 and issuing to the Optionors a total of 320,000 common shares. The Optionors shall retain a 1.5% Net Smelter Returns Royalty, of which the Company may purchase 0.5% at any time for $600,000.

https://abenresources.com/site/assets/files/4...22_map.jpg

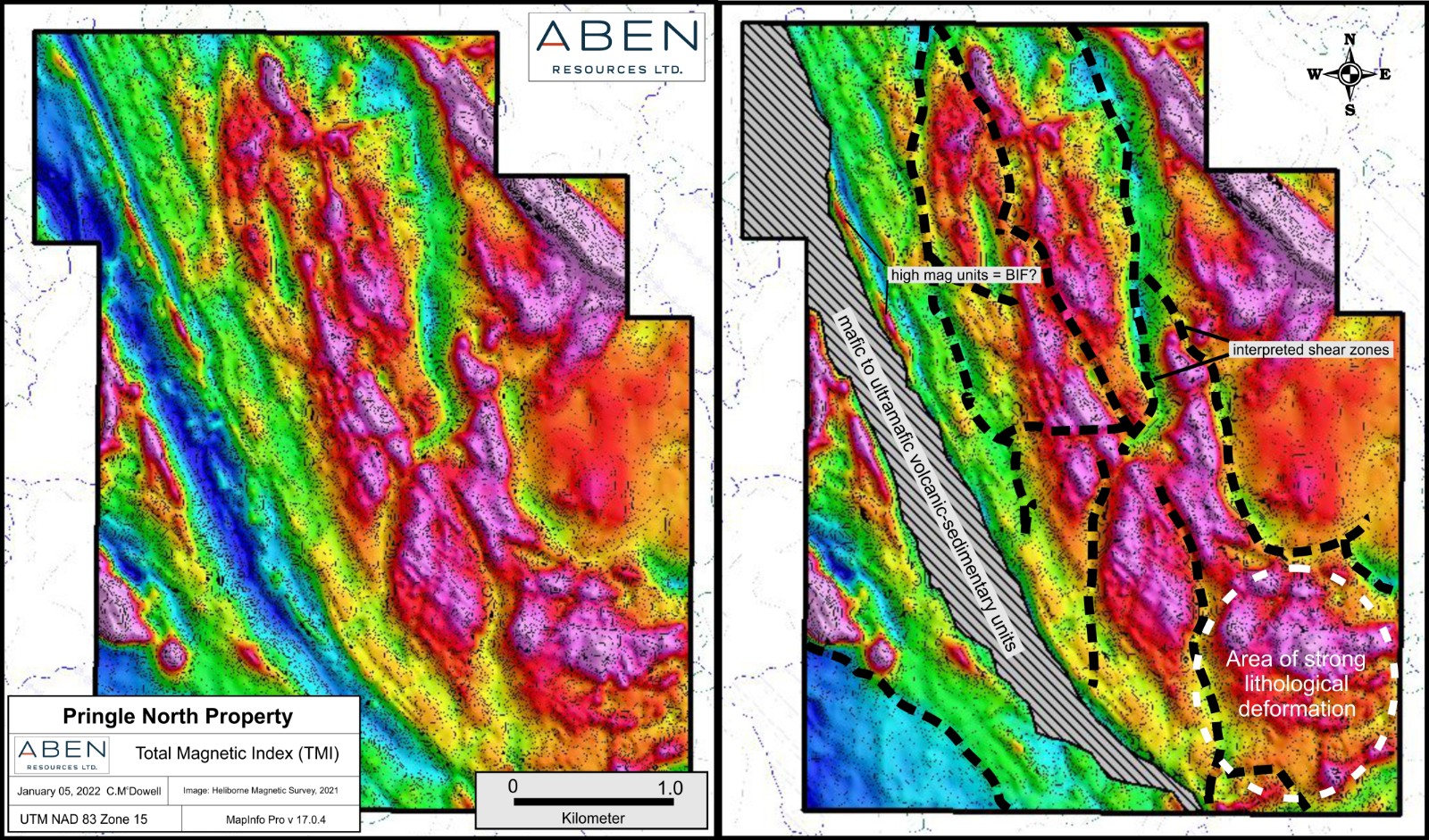

Aben geologic personnel have been compiling and interpreting geophysical and geologic data from several sources from across the Red Lake Gold Belt, including the finalized results from a high-resolution airborne magnetic survey completed over the Pringle North Property in the Fall of 2021. The magnetic geophysical maps illustrate several apparent convergent structural breaks and extensional features that are common to all gold deposits in the Belt. The structural complexity illustrated by the magnetic survey offers strong evidence of wide-spread shearing, folding and faulting, structural controls that can provide fluid pathways and traps for gold mineralizing fluids in potentially economic concentrations.

https://abenresources.com/site/assets/files/4...-_2022.jpg

In addition to the full spectrum of structural controls present on the Property, Pringle North is host to several surface samples that tested at or above the 95th percentile from an overburden sampling program by Agnico Eagle in 2009. A substantial belt of mafic to ultramafic rocks that parallel the Nungesser Deformation Zone (NDZ) have been mapped on the property. Age determination by Sanborn et al, 2004, dates this volcanic-sedimentary belt at 2.94 billion years old and assigns it to the Balmer Assemblage, which is host to the gold mines in the Red Lake

Camp.

https://abenresources.com/site/assets/files/4...22_map.jpg

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Justin gold project, Yukon

https://investorshangout.com/images/MYImages/...roject.jpg

Aben owns 100% interest in the 7,411 hectares or 74 square Km Justin project in the southeast Yukon. The Justin Property is host to rocks that have undergone multi-phase hydrothermal alteration that has produced two distinct mineralizing systems. Drilling has shown that precious metal mineralization on the Property is part of an Intrusion Related Gold System (IRGS) featuring multiple mineralization styles including sheeted vein arrays, vein breccias, stockwork veining, fault-controlled mineralization, and skarn-hosted gold horizons. Drilling at the POW Zone has returned intercepts ranging from trace values to highs of 1.19 g/t Au over 60.0 m (including 2.47 g/t Au over 21.0 m) and 1.49 g/t Au over 46.4 m. The POW Zone, along with the Confluence, Main, Kangas and POW West Zones, are potential hosts to bulk-tonnage gold mineralization and higher-grade skarn mineralization. The Lost Ace Zone, located 2 kilometers from the POW Zone, is host to high-grade near-surface mesothermal gold-arsenopyrite bearing quartz veins interpreted to be part of an Orogenic Gold System. Trenching in 2018 returned values ranging from trace to 20.8 g/t gold over 4.4 meters including 88.2 g/t gold (Au) over 1.0 m at the Lost Ace Zone.

On February 8th, 2022 Aben announced it had filed an NI 43-101 compliant Technical Report pertaining to the 100% owned 7,400 hectare Justin Gold Project in the Yukon. Since that date the Company has been in discussion with multiple potential partners regarding option deals to secure future exploration on the property. The permit application for the rights to explore the property is currently in the review stage with the Yukon Environmental and Socio-Economic Assessement Board (“YESAB”).

“We’ve just finished an NI 43-101 technical report that’s been filed on Sedar. The report is a beneficial asset and provides context to our historical work on the Justin Gold Project.,” commented Jim Pettit,Chairman and CEO of Aben, “This will enable potential interested parties to review previous work done on the property and provide data for future programs.”

Feb 8, 2022 - Justin project NI 43-101 Technical Report

https://abenresources.com/site/assets/files/3...report.pdf

=====================================

Management's track record of past explorations

=====================================

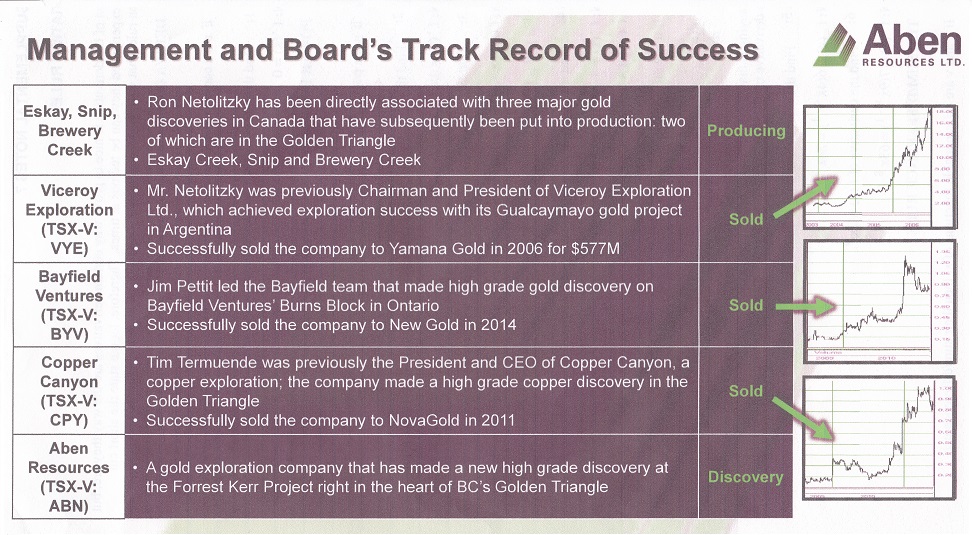

Mr. Ron Netolitzky and Mr. Timothy Termuende were appointed to the Board of Directors on March 3, 2011, they are experienced geologists with successful exploration track record.

https://sedar.com/GetFile.do?lang=EN&docC...Id=2832083

5 gold/copper mines (Eskay Creek mine, Snip mine, Burns Block mine and Copper Canyon mine in the Golden Triangle, Gualcamay mine in Argentina) were discovered by the 3 experienced, subtle and strategic geologists affiliated with Aben Resources with the corresponding companies sold to other mining companies.

https://investorshangout.com/images/MYImages/...essold.jpg

=================================================

Other buyout deals in the Golden Triangle of British Columbia

=================================================

Placer Dome and International Corona acquired Stikine Resources at Can$67 per share

https://www.northernminer.com/news/placer-sta...000178407/

Imperial Metals acquired American Bullion Minerals at Can$2.45 a share

https://www.imperialmetals.com/for-our-shareh...an-bullion

Newmont acquired GT Gold at $3.25 per share in a Can$393 million deal

https://www.newmont.com/investors/news-releas...fault.aspx

Australian gold and copper producer Newcrest Mining acquired Pretium Resources in a Can$3.84 billion deal

https://magazine.cim.org/en/news/2021/newcres...e%20region

==========================

Media coverage and commentary

==========================

https://www.youtube.com/watch?v=-Mj2R4jvb0A

http://www.321gold.com/editorials/preston/preston111418.html

https://investingnews.com/company-profiles/ab...-triangle/

https://www.marketscreener.com/quote/stock/AB...0/company/

https://www.streetwisereports.com/article/201...angle.html

=============================

Aben Resources in the social media

=============================

https://ca.linkedin.com/company/aben-resources-tsx-v-abn-

https://twitter.com/Aben_ABN/

========================================

Aben Resources - Youtube communication channel

========================================

Tune in from time to time for James Petit's update on the company's projects. Subtitle will be displayed by clicking CC in the task bar.

https://www.youtube.com/results?search_query=...p=CAI%253D

(0)

(0) (0)

(0)