Took a crack at it using minimums https://inves

Post# of 33169

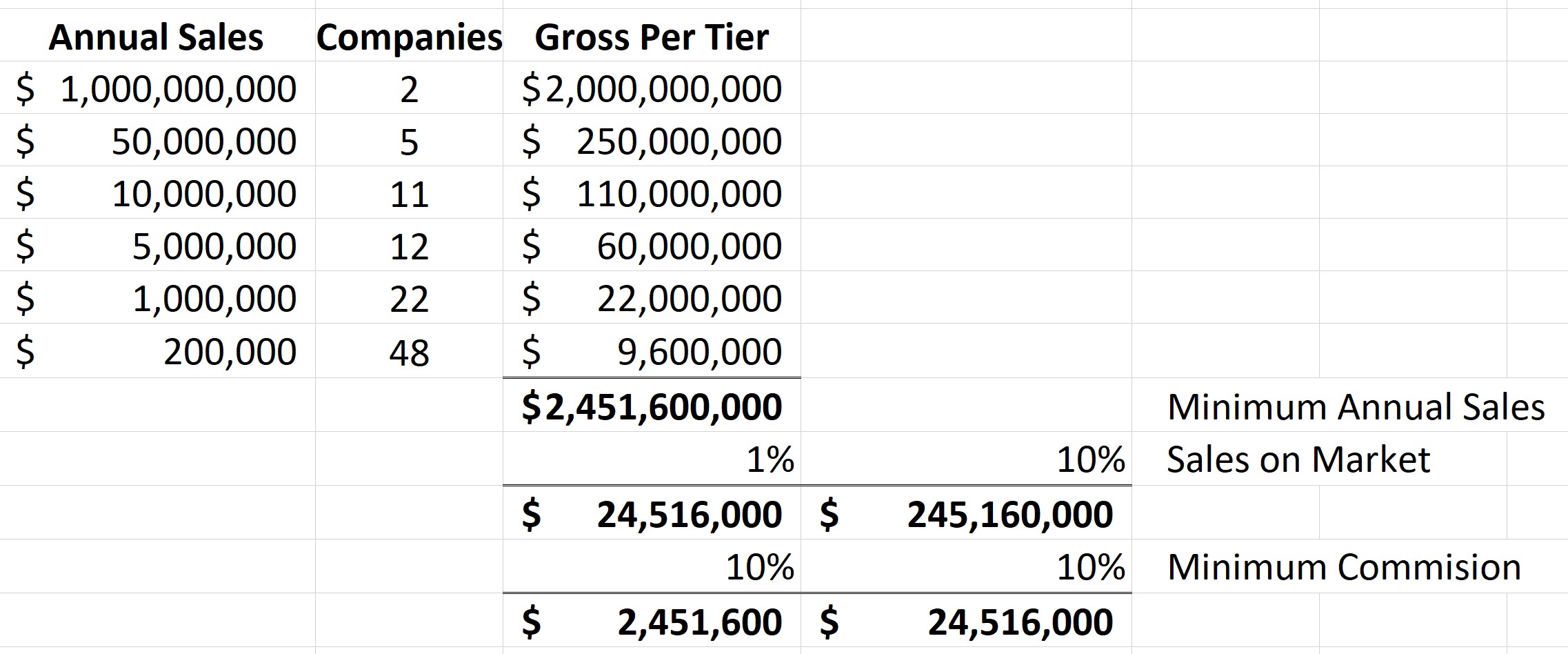

Let's say Verb captures 1% of all sales from the top 100 companies

That would be $2.5M for starters

If it was 10%, that would be $25M

What is more likely in the short-term is Verb adds 10x as many companies. Then 100 times.

100x more companies - 10,000 would be $250M using minimum numbers. Valuation of Verb at that point would be billions.

Customers sales will likely also go up incremental too. 1%, 2%, 3%, etc.

This model is using very conservative numbers and doesn't include any other fees & services.

What institutions will notice is however you want to work the model, exponential grow is achievable.

While with Direct Sales customer there is a ceiling (i.e. there are only so many companies), there isn't one for Market. Upside is unlimited in my view.

This model also doesn't assume some companies will end up ONLY using Market as their online sales too. In that case instead of 1%, it's 100%. Something to think about. Will the $1B companies do that? No, but some of the other size companies would.

(13)

(13) (0)

(0)