https://investorshub.advfn.com/boards/read_msg.asp

Post# of 6903

$AGYP Comprehensive Due Diligence Package

AGYP is an OIL PRODUCING Otc stock. The Texas Railroad Commission validates Allied’s operator status and has verified the Company’s recent oil production and oil sales. What other OTC oil stocks are actually producing and reporting production numbers?

As of March 2022 the Company holds several leases but has production interest at 3 primary locations. These locations are the GREEN LEASE, the GILMER LEASE, and the PROMETHEUS LEASE. Other projects can be found here at the corporate website: https://alliedengycorp.com/projects/

To validate information about $AGYP yourself, go to https://www.rrc.texas.gov/resource-center/res...h-queries/

AGYP Operator Number is 014357

(Please note that the Texas Railroad Commission website is difficult to navigate and you will most likely initially lose your patience with the site a few times. But stick with it. You’ll get the hang of it if you are really into discovering more about AGYP. Go to the end of this post for more Texas RR help and links look for the ***)

Allied uploaded the operator documentation that is necessary for any energy company in Texas to produce and sell oil. The Texas RR P-4 and P-5 are listed at otcmarkets under supplemental filings:

P-4 https://www.otcmarkets.com/otcapi/company/fin...28/content

P-5 https://www.otcmarkets.com/otcapi/company/fin...27/content

NOW, LET'S TALK THE THREE MAJOR LEASES HELD BY ALLIED

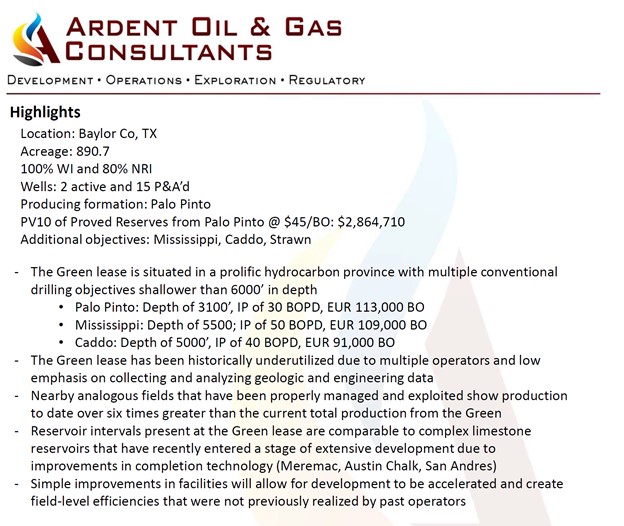

THE GREEN LEASE

First off, here is the Green Lease Map which is a Google Earth Map based on the Texas RR website coordinates:

GREEN LEASE GOOD FAITH DOCUMENTATION FOR ALLIED: https://uploadify.net/2141e6ab54113042/Green_...dfaith.pdf

THE 3RD PARTY ARDENT REPORT REGARDING THE GREEN LEASE LINK: https://www.otcmarkets.com/otcapi/company/fin...83/content

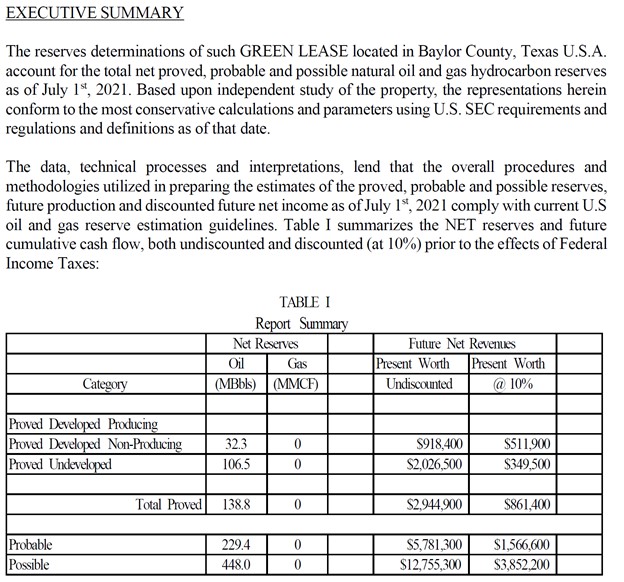

GREEN LEASE EXECUTIVE SUMMARY (OIL RESERVES REPORT) LINK: https://www.otcmarkets.com/otcapi/company/fin...17/content

IMPORTANT!!! All these numbers are based on oil at $46.26 per barrel.

To gain a better understanding of the value of each lease, we need to add together the PROVED, PROBABLE, and POSSIBLE reserves.

GREEN LEASE @ oil $46.26 per barrel:

Proved: $2,026,500

Probable: $5,781,300

Possible: $12,755,300

TOTAL GREEN LEASE: $20,563,100

BUT ALL THOSE NUMBERS ARE BASED ON OIL AT $46.26 per barrel!!! Stick with the post updated numbers are coming soon!

Let's turn our attention to the next lease held by Allied.

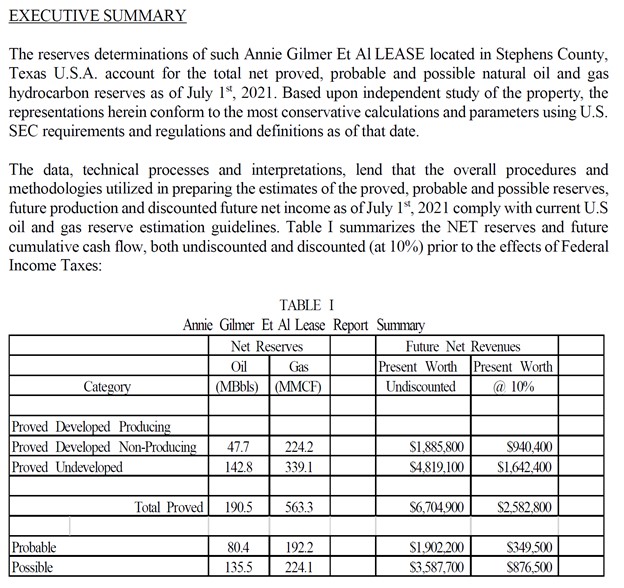

THE GILMER LEASE

First off, here is the Gilmer Lease Map which is a Google Earth Map based on the Texas RR website coordinates:

GILMER LEASE GOOD FAITH DOCUMENATION FOR ALLIED: https://uploadify.net/09198089347dd996/Gilmer_good_faith.pdf

ANNIE GILMER LEASE EXECUTIVE SUMMARY (OIL RESERVE REPORT) LINK: https://www.otcmarkets.com/otcapi/company/fin...40/content

Now let's look at the GILMER LEASE numbers at oil $46.26 per barrel:

Proved: $6,704,900

Probable: $1,902,200

Possible: $3,587,700

TOTAL GILMER LEASE: $12,194,800 at oil $46.26 per barrel (as per the executive summary)

Here are the approximations of these numbers based on oil at the current $110 per barrel:

GREEN LEASE:

Total at oil $46.26 per barrel: $20,563,100

Total at oil $110 per barrel: $48,896,260

GILMER LEASE:

Total at oil $46.26 per barrel: $12,194,800

Total at oil $110 per barrel: $28,997,578

Total oil from GREEN LEASE and GILMER LEASE held by $AGYP at oil $110: $77,893,838

OK. So now let's turn our attention to the next lease for Allied.

THE PROMETHEUS LEASE

First off, here is the Prometheus Lease Map which is a Google Earth Map based on the Texas RR website coordinates:

We currently do not have an executive summary oil report for the Prometheus Lease. We do have some clues as to how much it might be based on barrel per day production from 2014 and 2016: https://finance.yahoo.com/news/allied-energy-...00471.html

Quote:

“Our interest at the Prometheus Lease is the 28 Unit Well 1H, which was producing approximately 200 barrels of oil per day and 300,000 cubic feet of natural gas per day as recently as 2016.”

CEO George Montieth commented on the acquisition: "There are multiple wells included in the Prometheus Lease, one of which is currently producing about 60 barrels per day. But of utmost initial importance for Allied is bringing the Prometheus 1H Well back online. When this well was originally tested and submitted to the Texas railroad commission by Apache Corporation in 2014 their report showed 335 barrels production per day along with 298,000 cubic feet of natural gas per day with 2557 barrels of flow back and formation water. Allied will utilize 2021 technology and the experienced skill of our crew to try and match and perhaps even surpass these numbers of record."

Based on recent production numbers it looks like there is significant oil reserves at this location. Perhaps even more than the Green and Gilmer combined. Hopefully an executive summary will be forthcoming soon!

CURRENT OPERATIONS & PRODUCTION

Allied is successfully producing at 2 wells on the Green Lease and 1 well on the Prometheus Lease.

https://twitter.com/AlliedEnergyCo1/status/15...h_Z9nqPKxQ

As per other updates and due diligence we know that the Gilmer Lease has 3 wells. Once the electricity is restored Allied will have 6 producing wells. Currently they are producing at 3. But it is obvious that they are sitting on a massive supply of oil across their 3 active lease projects.

I would guess that as Allied brings these wells online they will turn their attention to some of their other holdings and projects and continue to expand their oil production.

OTHER PROJECTS

Existing Oil & Gas Leases from https://alliedengycorp.com/projects/

In South and East Texas the Company has oil & gas leases in its inventory and where it is the operator of record with the RailRoad Commission, the governing body for oil and gas production in the state of Texas. There are additional leases available to be acquired, each of which contain wells that have produced oil commercially and in which commercial production can be re-established.

Byers Heirs #2 Deu Pree Field, Wood County

A well originally completed in the Woodbine formation from perforations of 5736’ – 80’ making 74 bbls per day of 16 deg gravity “heavy” oil and accumulating 78,000 bbls of oil. When abandoned in 1997 the well was capable of making 60 bbls of oil per day but at the time there was no market for heavy oil and the price per bbl was discounted considerably due to the low gravity. Today there is a large demand for this type of crude oil and it can receive a significant bonus over the posted price of West Texas Intermediate. The produced oil will be blended with condensate to raise the gravity of the product and lower the gravity of the condensate. This will alleviate any pricing discounts applied due to lower gravity of the oil and the higher gravity of the condensate.

The well has been successfully re-entered and is waiting on final completion, which will entail the drilling of 4 or 5 short lateral legs (horizontal) information to enhance the daily production rates.

There is another productive zone above the Woodbine that has produced in the field, the Sub-Clarksville, that can be completed for commercial production. At some point we will consider completing this zone and commingling the production with the Woodbine oil.

Byers #1, Deu Pree Field, Wood County

A well that is an offset to the #2 well and was completed in the Woodbine formation. It had an initial rate of 122 bbls of oil per day and accumulated 120,000 barrels of oil. It was abandoned in 1997 when a leak in the casing occurred and attempts to patch the leak failed. Today technology has improved dramatically and repairing a casing leak such as this one is much more successful. A re-entry of this well will be proposed to re-establish commercial production in the Woodbine and/or from a completion in the Sub-Clarksville. If the repairing of the casing leak is not successful a liner can be cemented inside the existing casing to repair the leak.

Cameron #1, Deu Pree Field, Wood County

A well that was drilled south of the two Byers wells. The well was completed in the SubClarksville formation as it was not drilled to a depth sufficient to evaluate the Woodbine formation. The initial rate was 91 bbls of oil per day and accumulated 30,000 bbls of oil. It was abandoned when the price of oil fell below $10 per bbl.

Continental State Bank #14, East Texas Field, Gregg County

Located in the East Texas Field this is a shut-in, fully equipped well capable of commercial production of oil from the Woodbine formation. Wells surrounding this well are currently producing commercial oil. The pump jack should be replaced with a submersible pump to allow for a greater daily fluid rate. In this field the amount of oil produced daily depends mainly on how much fluid is produced. Costs for the disposal of produced water is minimal as a connection to the East Texas Saltwater Disposal System is on the lease.

The Austin Chalk formation sits on top of the Woodbine and the well is located in an advantageous position geologically to afford the opportunity to produce commercial oil from that zone, which can be commingled with the Woodbine.

Thrash “A” #1 & #2, East Texas Field, Rusk County

2 wells equipped for production with the exception of a pump jack missing from the #2 well. A submersible pump should be placed in the well to increase the daily fluid rate. If successful in increasing the oil produced the pump jack on the #1 well should be replaced with a submersible pump.

Julia M. Finney Lease, East Texas Field, Rusk County

There are 8 shut-in wells on this lease completed in the Woodbine formation, of which 6 wells are fully equipped for production. The wells should be reworked and placed back into production. There are wells on all sides of the lease that are currently producing. Also, the lease is in a position whereby the Austin Chalk should be commercially productive. We are planning to eventually re-complete 3 or 4 of the wells in the Austin Chalk and 2 to 3 wells will be reconditioned to produce from the Woodbine using submersible pumps.

Dora Hastings #1-R & #2, Glen Hummel, SW Field, Wilson County

2 wells located in south Texas that are completed in the Poth B Sand and equipped for production. In this area the Poth A, B, C and D sands are productive in various wells. The Poth A sand produces from a waterflood operation on adjacent leases to the east. The Poth C sand produces immediately to the north. The A, B and C sands are present in the offset wells to the east and in 2 wells that were completed in the Austin Chalk immediately to the west, and each are expected to be productive in our 2 wells. If warranted additional development may occur on the lease with new drilling or a re-entry on one of the Austin Chalk wells.

F. M. Ezzell #2, Palmer (Poth

Field, Wilson County

Field, Wilson County A well fully equipped for production with the exception of not having stock tanks and oil/water separation. There are other Poth sands that are productive in wells in the immediate area of this well and are expected to be present in this well. A cased hole log should be run in the well to evaluate other productive zones for re-completion. Also, the well should be reworked to re-establish commercial production from the B sand.

Moody & West Lease, Loma Novia & Government Wells S. Fields, Duval County

This is a prospect to drill a well to 2,800’ and complete in 1 of the 5 productive sands that are present in the Loma Novia and the Government Wells formations. The lease has produced previously but each productive well was not produced from each productive sand. The wells were abandoned due to the condition of the well equipment but were still productive. Also, there are 7 to 10 drilling sites for future development.

Future Development Projects

The Company also has a considerable number of additional projects that can and will be acquired that offer similar opportunities for commercial production at minimal costs. These projects are primarily located in South and East Texas but the Company will not limit itself to just these two areas. The Company will continue to originate potential projects internally, but management also has a very large network of contacts in the oil industry and will reach out to these contacts for reference to other projects. For the foreseeable future the Company expects to concentrate on projects within the State of Texas.

CONCLUSION

Having been an investor in $AGYP for well over a year I've watched them evolve from a research and development stage company to a producing oil company. There are several OTC companies that talk a big game and have leases that seem impressive on paper. But how many are actually producing and selling oil? We know that $AGYP is producing and selling oil. https://twitter.com/AlliedEnergyCo1/status/14...h_Z9nqPKxQ

I believe that they will continue to bring more wells to production over the next few months. I think $AGYP will be producing well over 1,000 barrels per day sometime this year.

My intention is to make this post a work in progress and add to it as others submit additional DD and the company continues to update investors.

Go $AGYP!!!

***Texas Railroad Website Help

Here is the link to all current Texas oil and gas companies: https://www.rrc.texas.gov/oil-and-gas/researc...r-contact/

Select one of the P5 files formats and then find Allied. Allied's operator # is 014357 and is found on this list by simply scrolling down or by doing a CTRL-F search. Here's what it says:

Quote:

(RRC Org No 014357)

ALLIED ENERGY OPERATING, LLC

2920 CANDACE CR

HORSESHOE BAY TX 78657

Phone No: (512) 293-9059

Emergency: (512) 293-9059

If you want to find out more about Allied on the Texas RR website, there is a host of things to be discovered about any oil and/or gas company operating in Texas: http://webapps2.rrc.texas.gov/EWA/ewaMain.do

Choose one of the items you'd like more information about and then enter Allied's operator number. Allied is operator number 014357. Or you can search by name.

This is also a helpful starting point for DD: https://www.rrc.texas.gov/resource-center/res...h-queries/

More helpful info specific to Allied and specific wells

Green lease API# 02380186 well K3

Gilmer lease API# 42930302 well 2

Prometheus lease API# 16934148 well 1H

API# 02380187

District 09

Lease #01423

Lease name GREEN /Well M1 /Field name RENDHAM POOL /County BAYLOR

API# 16934148

District 8A

Lease #70209

Lease name PROMETHEUS 28 UNIT/ Well 1H Field name PEG'S DRAW (MISSISSIPPIAN) / County GARZA

API# 42930302

District 7B

Lease #12106

Lease name GILMER, ANNIE ET AL /Well 2 /Field name ANNIE GILMER (MISS) County STEPHENS

(0)

(0) (0)

(0)