When are Taxes Due? Important Tax Deadlines and Da

Post# of 9434

January 7, 2022

When are taxes due?

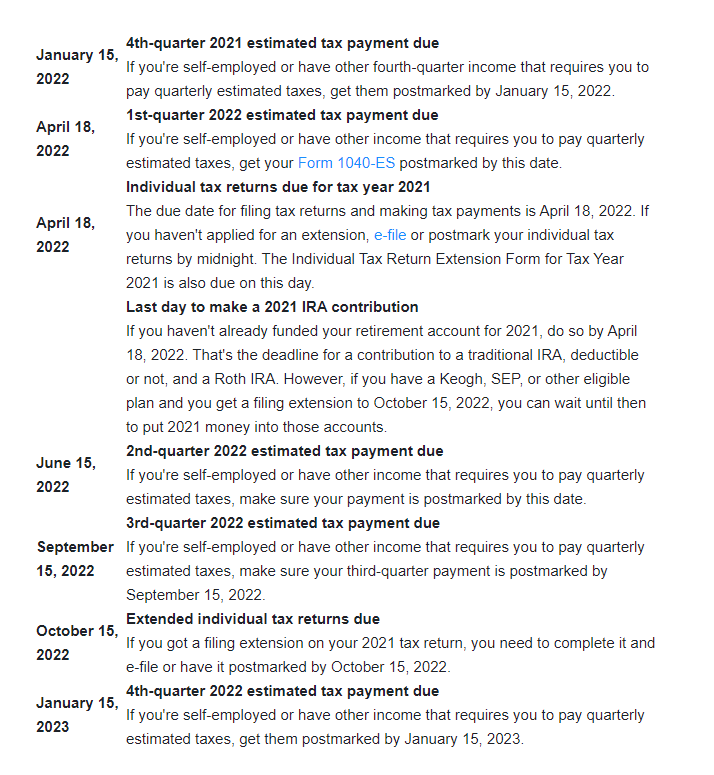

2021 was an eventful year for taxes, from extensions and exemptions to loans and stimulus checks. Wondering how all of those changes might affect your tax deadlines for the 2021 tax year, taxes you’ll file in 2022? If you're wondering, "When are taxes due, anyway?" here are the important dates at a glance

What if I miss a tax deadline?

If you missed one of these key tax deadlines, you have options. Those options depend on what deadline was missed and whether you owe money or are due a refund.

If you miss the tax filing deadline and are owed a refund

If you overpaid for the 2021 tax year, there's typically no penalty for filing your tax return late. However, you should file as soon as possible.

Generally, you have three years from the tax return due date to claim a tax refund. That means for 2021 tax returns, the window closes in 2025. After three years, unclaimed tax refunds typically become the property of the U.S. Treasury.

If you miss the tax filing deadline and owe tax

When you miss a tax filing deadline and owe money to the IRS, you should file your tax return as soon as possible. Every day your tax return is delinquent, the IRS typically charges interest, failure to file penalties and failure to pay penalties until you file your return and pay the balance due.

If you miss an estimated tax payment deadline

If you miss an estimated tax payment, make your payment as soon as you can. The penalties and interest the IRS charges depend on how much you owe and how late you are, but you can minimize the damage by making your payment as soon as possible.

What if I owe more than I can pay?

This year, many people are dealing with financial troubles due to the pandemic, job loss and other factors. If you're one of them, you may not have the funds available to pay your tax bill by the deadline. But don't put off filing just because you can't afford to pay the amount due on the day you need to file your tax return. The IRS starts charging penalties and interest on the day the return is due, no matter when you file. You can minimize the failure-to-file penalties by filing as soon as possible, paying as much as you can when you file and setting up an installment plan for the balance

What's the fastest way to file my tax return?

The fastest way to file your tax return is to file electronically.

E-filing your tax return to the IRS is more secure than paper filing. Because the tax return is electronically transmitted to the IRS, you don't have to worry about it getting lost in the mail or arriving late. You'll also get confirmation right away that the IRS received your return and has started processing it.

If you're waiting on a tax refund, the fastest way to get your money is to have it electronically deposited into your bank account. The IRS typically issues 90% of refunds in less than 21 days when taxpayers combine direct deposit with electronic filing.

What if I need more time?

Don't let a looming tax deadline force you to rush through the tax filing process and make a mistake on your return. Simply request an extension.

The IRS grants an automatic six-month extension of the tax filing deadline to anyone who requests it. You can request an extension electronically with TurboTax or mail Form 4868.

Just keep in mind, the tax extension gives you more time to file your return, not more time to pay the tax you owe. You'll need to estimate the amount you owe and make your payment by the tax filing deadline

Natural disasters

If you need more time because you live in an area hit by a natural disaster, you might qualify for tax relief from the IRS. The IRS often postpones the tax filing deadline for taxpayers who live in or have a business within a federally declared disaster area.

For example, the IRS announced it would postpone tax filing and tax payment deadlines for taxpayers affected by the September 2020 California wildfires. Taxpayers in that area who extended their 2019 tax returns to October 15, 2020, now have until January 15, 2021 to file those returns.

What if I made a mistake and need to refile my taxes?

It happens. You file your tax return, then realize you forgot to report some income or claim a certain tax credit. You don't need to redo your whole return. Simply file an amendment using Form 1040X.

IRS Form 1040X is a two-page form used to amend a previously filed tax return. TurboTax can walk you through the amendment process and, beginning with the 2019 tax year, even e-file your amended tax return for you

TurboTax has you covered

Many taxpayers scramble to figure out when are taxes due every year, but you can be confident that TurboTax is ready to help you file whenever you're ready. TurboTax asks simple questions about your tax situation and helps you fill out the right forms and find every deduction you qualify for so you can get every dollar you deserve.

If you have additional questions, you can connect live to a TurboTax Live tax expert for unlimited tax advice or even have a tax expert or CPA file for you from start to finish.

Remember, with TurboTax, we'll ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation

Source:

https://www.aol.com/finance/taxes-due-importa...39068.html

Several have told me that there aren't any tips, tricks, or loopholes unless you have a business. Well the stockjocky trader gets no breaks from what I see.

(0)

(0) (0)

(0)