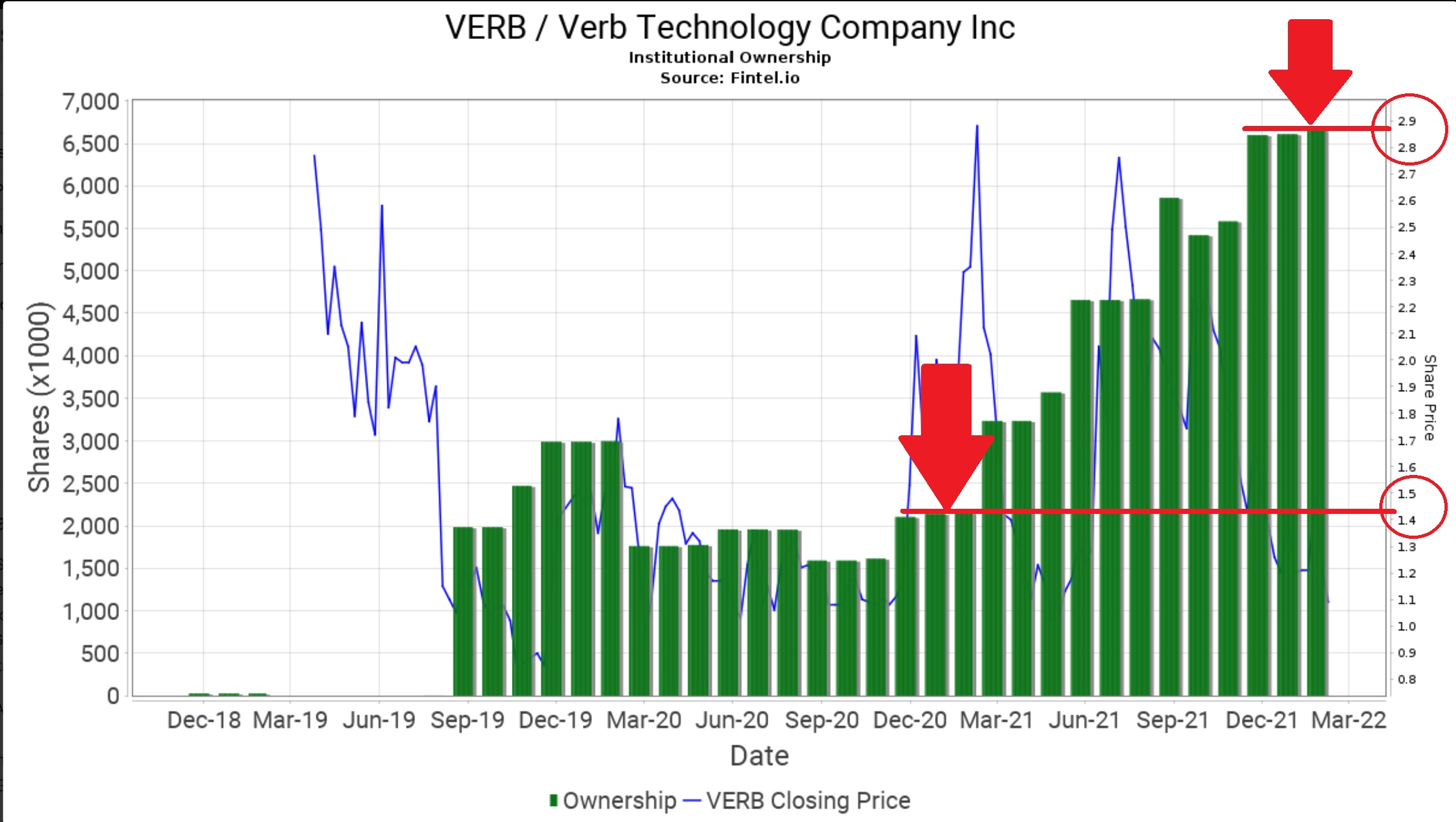

Was looking at the list of institutions that own V

Post# of 33180

EQ ADVISORS TRUST and Blackstone, the latter is the only one out of 49 institutions that shorted. Not much (-24,600) and you would wonder why bother, but we'll pulled the sheets off of sherts in a second.

Was wondering what institutional buying looked like in Q4 a year ago.

It pretty much almost exactly doubled. How about that? I thought the financial advisors on multiple sites said all the institutions were selling and we find out it was a big fat o lie and they actually doubled their position.

Then I was thinking, what did the shert report look like a year ago?

It wasn't much

This site only goes back to March. Notice the days to cover were low too.

https://www.nasdaq.com/market-activity/stocks...t-interest

Now this site is a barrel of monkey's fun

https://app.ortex.com/s/Nasdaq/VERB/short-interest

You can click on and off so many things.

Notice that orange line? That real high one when Verb peaked last July?

That is Failure to Deliver

"Failure to deliver (FTD) refers to a situation where one party in a transaction does not meet their obligation to either pay for or supply an asset."

Naked sherting is illegal per Regulation SHO and can lead to a failure to deliver (FTD)

Guess how many shert shares are still outstanding?

https://www.nasdaq.com/market-activity/stocks...t-interest

4,880,106 which pretty, pretty, pretty close to that Orange line.

No wonder why sherts get angry when you talk about shorts.

Double dog angry if you call them out.

I get it. If you illegal shorted 5M shares that YOU didn't have last July, that would be a crime and you would hope it just goes away just like Teddies 2x4 half assed creation stunt.

The volume on that day was 88M. FTD was 5.08M. There wasn't enough shares available to shert. Some cheated.

"The farther backward you can look, the farther forward you are likely to see"

To the naked sherts, I am still running a special on Skids

(17)

(17) (0)

(0)