Introduction to Aben Resources ...................

Post# of 1088

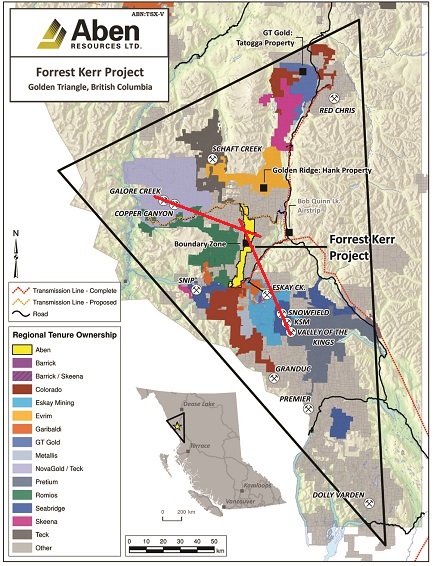

Aben Resources Ltd. is a publicly traded Canadian gold exploration company with significant projects in British Columbia, Yukon and Ontario. The company's operating goal is to acquire potential gold properties to discover bonanza gold deposits and sell them to gold producers seeking commercially viable gold deposits to replenish their dwindling reserves.

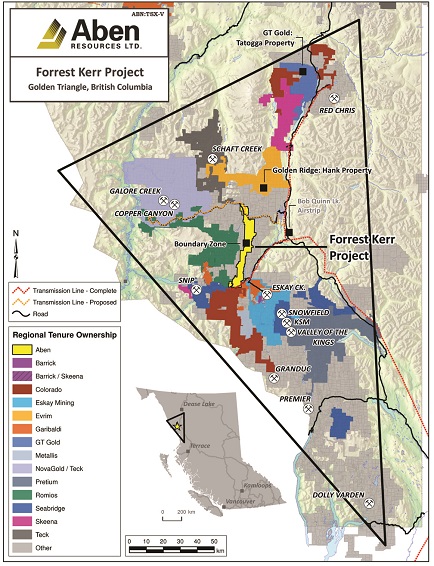

The Company's 100% owned flagship 23,000 hectares Forrest Kerr gold project is located in the heart of a region called the Golden Triangle in northwestern British Columbia. This region has hosted significant mineral deposits including: Pretium (Brucejack), Eskay Creek, Snip, Galore Creek, Copper Canyon, Schaft Creek, KSM, Granduc, Red Chris and more.

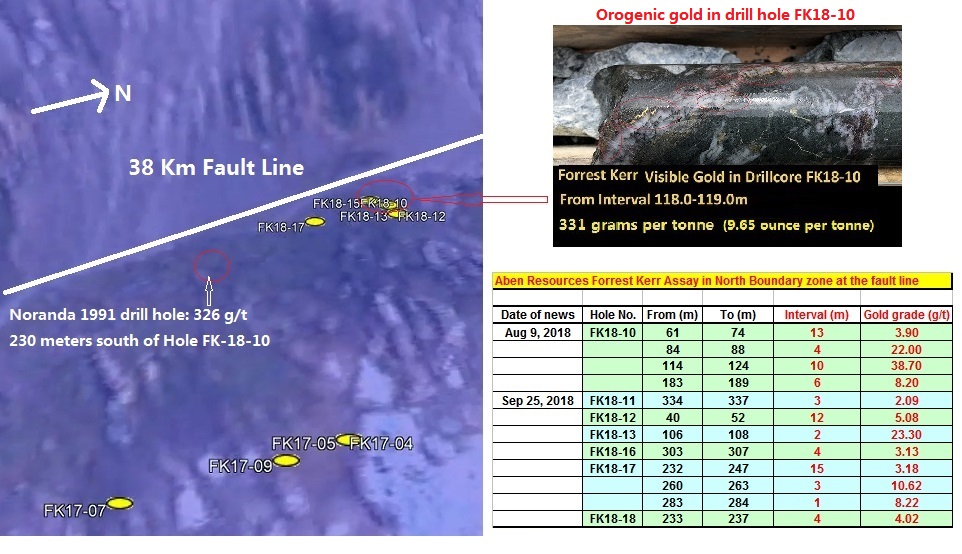

The first drill hole of 2018 at the Forrest Kerr Project discovered multiple high-grade zones with visible gold including 331 g/t gold over 1 meter, 62.4 g/t Gold over 6.0 meters within 38.7 g/t Gold over 10.0 meters starting at 114 meters downhole at the North Boundary Zone. Although the geological structure of Forrest Kerr is very intriguing that make setting priority drilling targets difficult, the Forrest Kerr Property remains an important asset to Aben Resources and geologic data collected through recent drill programs will continue to be analyzed and re-interpreted with the aim to conduct focused exploration programs. The Forrest Kerr Property is fully permitted and in good standing through March 2024.

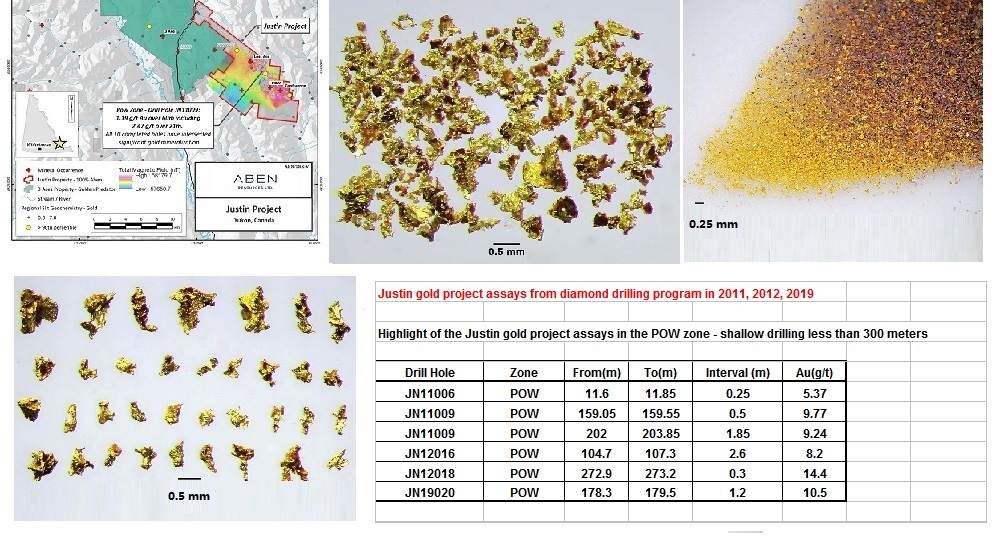

Aben also holds a 100% interest in the 7,411 hectares Justin gold project located in the southeast Yukon. Previous drilling by Aben intercepted 60 meters of 1.19 g/t Gold including 21 meters of 2.47 g/t Gold in the POW Zone. The geochemical signature of the mineralized zone is characterized by elevated Au, Bi, Cu, Mo and W supporting an Intrusion Related Gold System (IRGS).

In July, 2021 Aben acquired the Pringle North property in Red Lake, Ontario, in the vincinity of Great Bear Resources and Trillium Gold which have bonanza gold discovery. Magnetic Survey has been completed for mineralization study. The Red Lake Mining District enables a year-round mining activities due to its mild winter temperature. The region has produced over 22 million ounces of gold through 2004, worth over $US 35 billion at 2014 prices. The two principal mines, Campbell and Red Lake, both have historic ore grades averaging about 0.57 oz/ton (22 g/tonne) gold.

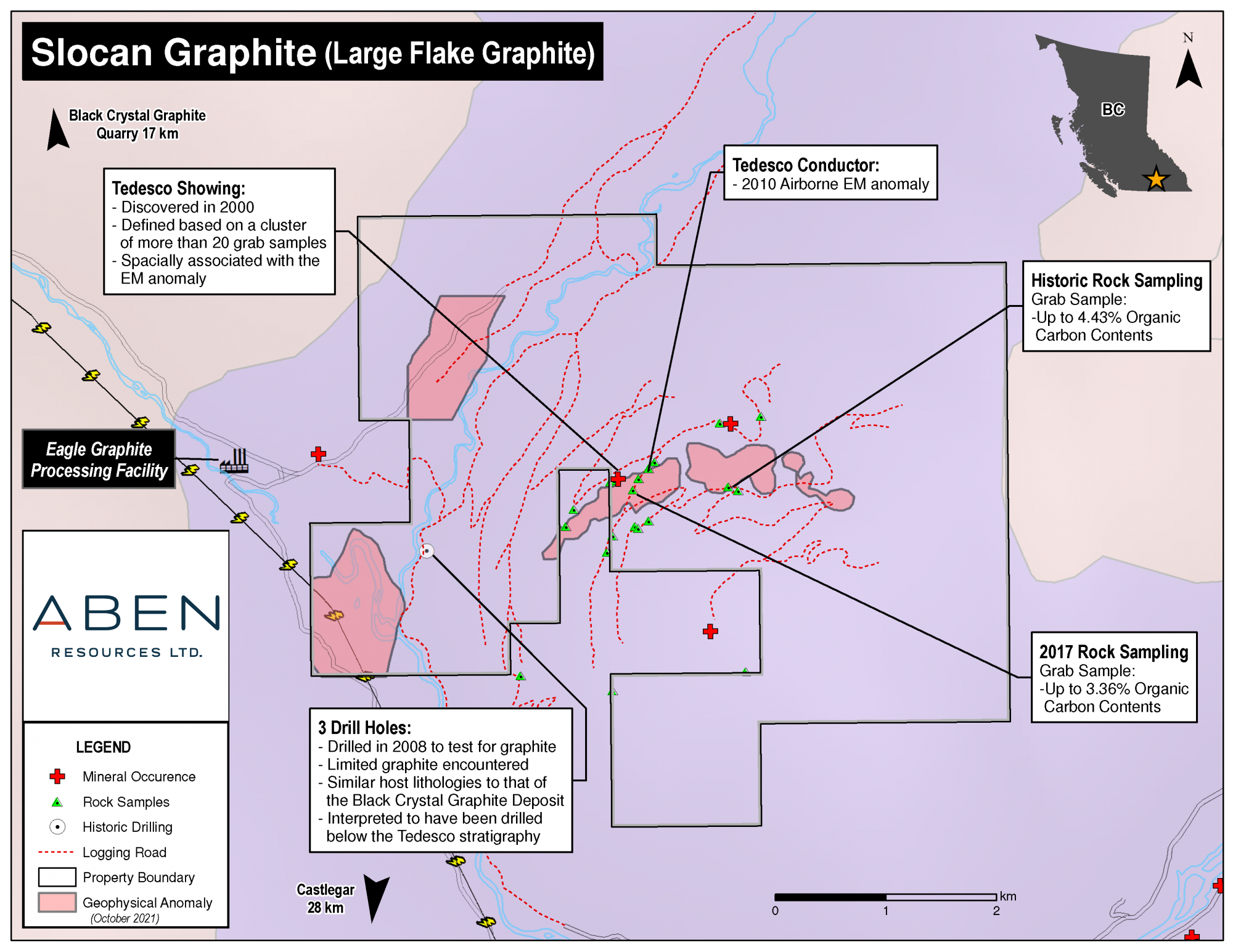

In November, 2021 Aben executed a formal option agreement with Eagle Plains Resources Ltd. for exclusive right to earn a 100% interest in the Slocan Graphite Project located 34km northwest of Castlegar, British Columbia. The Slocan Graphite project consists of 2,387 hactre (23.87 square kilometer) hosting several large flake graphite-bearing outcrops and float occurrences known as the Tedesco Zone which is interpreted to extend over 2.0 km. The property is in the vicinity of the graphite processing plant and facilities 1.5 Km to the west owned by Eagle Graphite Corporation. The facilities can process graphite at an annual capacity of 4,000 tonnes and ship it to US and worldwide.

Aben Resources website

https://www.abenresources.com/

Power Point Presentation

https://abenresources.com/investors/presentations/

Financial filings and official news release

https://sedar.com/DisplayCompanyDocuments.do?...o=00005652

Insider trading record

https://www.canadianinsider.com/company?ticker=ABN

===============

Stock Information

===============

Ticker Symbols:

TSX Venture, Canada: ABN.V

United States of America: OTCQB Market: ABNAF

Frankfurt Exchange, Germany: E2L2

=========================

Stock charts and stock trading

=========================

Canada: TSX Venture Exchange (share price in Canadian Dollar)

ABN.V Daily chart

https://stockcharts.com/h-sc/ui?s=ABN.V&p...3377072265

ABN.V Weekly chart

https://stockcharts.com/h-sc/ui?s=ABN.V&p...3880278736

ABN.V Monthly chart

https://bigcharts.marketwatch.com/advchart/fr...p;state=10

ABN.V Last 10 trades, Bid, Ask, Volume

http://www.stockwatch.com/Quote/Detail.aspx?s...p;region=C

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

USA: OTCQB (share price in US Dollar)

ABNAF Daily chart

https://stockcharts.com/h-sc/ui?s=ABNAF&p...8136657349

ABNAF Weekly chart

https://stockcharts.com/h-sc/ui?s=ABNAF&p...3797599655

ABNAF Monthly chart

https://bigcharts.marketwatch.com/advchart/fr...e=2&ti

ABNAF Last 10 trades

http://www.stockwatch.com/Quote/Detail.aspx?U:ABNAF

ABNAF Bids, Asks, Volume

https://www.otcmarkets.com/stock/ABNAF/quote

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Germany: Frankfurt Stock Exchange (share price in Euro)

E2L2 Weekly chart

https://bigcharts.marketwatch.com/advchart/fr...p;state=10

===============================

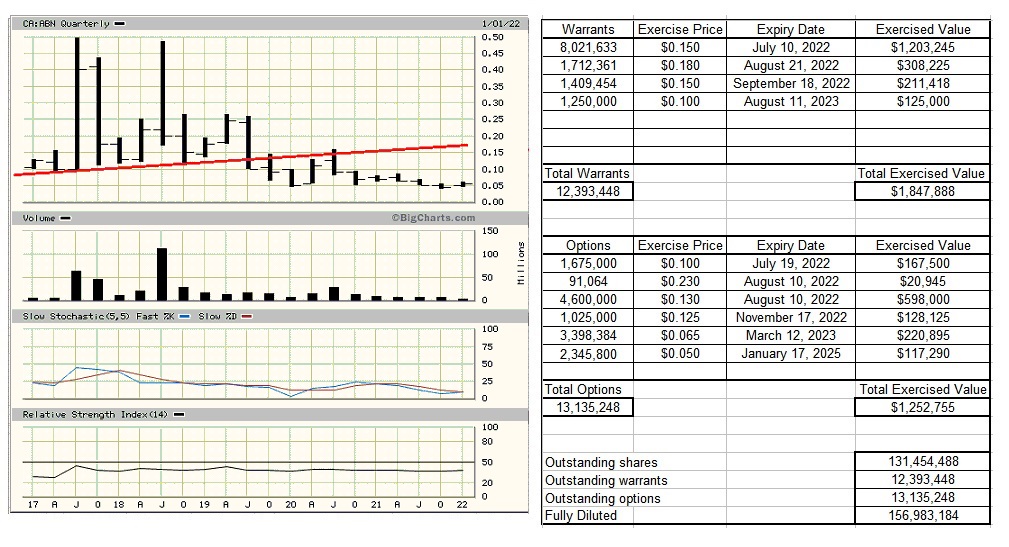

Outstanding Shares, Warrants, Options

===============================

https://investorshangout.com/images/MYImages/...ptions.jpg

=========================

Mining properties Information

=========================

Flagship Forrest Kerr property in the Golden Triangle of British Columbia

Forrest Kerr property covers 23,397 hectares or 234 square Km (6.1 Km x 38.3 Km)

Introduction to The Golden Triangle of British Columbia

https://www.youtube.com/watch?v=rBY6t3FHu7I

Overview of Aben's Forrest Kerr project

https://www.youtube.com/watch?v=egG5OWpTq0s

Aben Resources - gold contents in drill cores

https://www.youtube.com/watch?v=rUuDeaYt5ew

Gold resources in Aben's neighbors

https://www.youtube.com/watch?v=eQpWgPJKln0

Slocan Graphite project in southern British Columbia

In November, 2021 Aben executed a formal option agreement with Eagle Plains Resources Ltd. for exclusive right to earn a 100% interest in the Slocan Graphite Project located 34km northwest of Castlegar, British Columbia. The Slocan Graphite project consists of 2,387 hactre (23.87 square kilometer) hosting several large flake graphite-bearing outcrops and float occurrences known as the Tedesco Zone, which is interpreted to extend over 2 km.

Graphite is a naturally occurring form of carbon and is an excellent conductor of both electricity and heat. It is becoming increasingly important as a critical strategic component in advancing alternative energy solutions including wind and solar power, hybrid vehicles and other alternative energy uses. It is also a mainstay of the steel production industry. Canada is currently ranked as the 5th largest supplier of graphite.

Past workers in the area concluded that geological, assay, and geophysical data indicate significant potential to form an economic deposit” (BC Assessment Report 26537). Eagle Plains geologists also confer that the high-quality, large flake graphite, spatial extent of conductivity from a 2010 airborne electromagnetic survey in the prestine unexplored region, excellent proximity to infrastructure and the favorable economic outlook for graphite as a strategic commodity make Slocan Graphite a compelling project for exploration and discovery.

The Slocan Graphite Project benefits from excellent infrastructure including a high-voltage transmission line within 1.2 km of the property boundaries, an extensive network of forestry roads on and around the property, and an existing graphite processing plant and facilities located 1.5 km west of the property, owned by Eagle Graphite Corporation. The processing plant has historically operated at a throughput rate of 20 tonnes of feed per hour, a rate roughly equivalent to an annual output of 4,000 tonnes of high carbon natural flake graphite. The facility is strategically located close to the US city of Spokane, Washington and the Canadian port of Vancouver, British Columbia, Eagle Graphite offers efficient and economical shipping of high grade material to destinations worldwide.

Slocan graphite project, 34 Km northwest of Castlegar, British Columbia

https://www.google.ca/maps/place/Castlegar+Ca...17.6631546

https://investorshangout.com/images/MYImages/...ite_16.png

2017 BC Government Geological Survey Assessment Report 37398 in the Slocan Graphite region

(Scroll down to page 18, 19, 20 to see what minerals are found in Slocan Graphite area)

https://aris.empr.gov.bc.ca/ARISReports/37398.PDF

Graphite market was valued at US$137.3 million in 2020 and is projected to reach $219.6 million by 2027 at a CAGR of 6.9%. Every million electric vehicle require around 75,000 tonnes of natural graphite. In 2020, spherical graphite demand in China alone was 240,000 tonnes, demand for graphite is forecasted increasing to 1.9 million tonnes by 2028.

Justin Project, Yukon

Aben owns 100% interest in the 7,411 hectares or 74 square Km Justin project in the southeast Yukon, it is a huge area equivalent to 8.61 Km x 8.61 Km. Previous drilling by Aben intercepted 60 meters of 1.19 g/t Gold including 21 meters of 2.47 g/t Gold in the POW Zone. The geochemical signature of the mineralized zone is characterized by elevated Au, Bi, Cu, Mo and W supporting an Intrusion Related Gold System (IRGS).

Due to short drilling seasons, the property is under-explored, the potential of discovering commercailly viable deposits in Justin remains high. There are companies interested in joint venture with Aben or optioning Justin project from Aben, future plan may include the sale of the project for $9 million as that is the expense the company has incurred on acquisition and exploration on the project.

https://www.abenresources.com/projects/justin/

https://investorshangout.com/images/MYImages/...assays.jpg

Feb 8, 2022 - Justin project NI 43-101 Technical Report

https://abenresources.com/news/aben-resources...l-updates/

June 13, 2019 - Youtube interview on Justin project

https://www.youtube.com/watch?v=13goOuptl_w

Pringle North project in Red Lake, Ontario

In July, 2021 Aben acquired the Pringle North property in Red Lake, Ontario and completed the Magnetic Survey for mineralization study. Unlike the Golden Triangle of British Columbia where drilling is seasonal, the Red Lake Mining District enables a year-round mining operation due to its mild winter temperature. The region has produced over 22 million ounces of gold through 2004, worth over $US 35 billion at 2014 prices. The two principal mines, Campbell and Red Lake, both have historic ore grades averaging about 0.57 oz/ton (22 g/tonne) gold.

=================================================

Forrest Kerr - 2018 drill site and assay in North Boundary zone

=================================================

2018 drill site in the North Boundary zone

https://investorshangout.com/images/MYImages/...ryzone.jpg

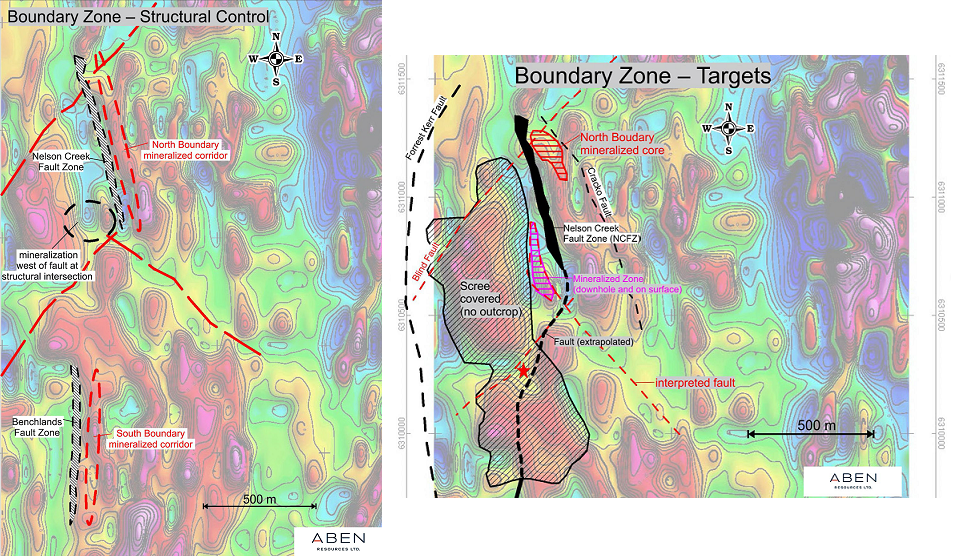

In the 2018 drilling program drill holes at 300 meters east of the fault line in the North Boundary zone encountered low grade gold but holes very close to the fault line encountered medium long intervals of high grade gold. Hole FK18-10 which has visible gold assayed 38 g/t over 10 meters including 331 g/t over 1 meter, corroborated with Noranda's 1991 discovery of 326 g/t located at 230 meters south of Hole FK18-10. Both Aben and Noranda had drilled into a gold artery and the gold in the drill core is orogenic gold originated from the Forrest Kerr fault line.

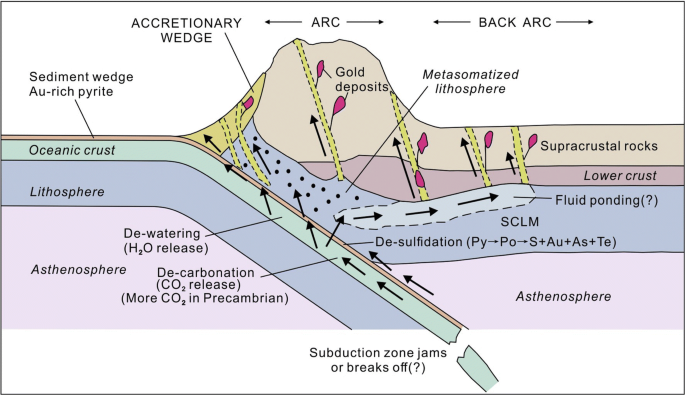

Facts about orogenic gold

Heated seawater deep in the Earth's crust circulated in the crust and dissolved gold and other minerals to form hydrothermal fluid with super-saturated gold and other minerals, when gold precipitated on rocks, they formed hydrothermal gold deposits. 2 Billions years ago, collision between the Pacific tectonic plate and North America tectonic plate with the phenomenon of subduction generated tremendous heat and pressure in the Earth's crust, forcing the hot gold-rich hydrothermal fluid to surge upward towards the surface through fault lines and precipitated the gold mineral on rocks while the Pacific coast buckled and was forced upward and skyward, forming the Rocky Mountain. The hydrothermal fluid could travel hundreds of meters from the fault lines, forming gold veins and gold arteries and precipitated gold on rocks, gold deposits formed this way had many names but eventually it was agreed that the name orogenic gold should be used in place of other names, 75% of the world's gold deposits are orogenic gold, others are volcanic in nature as lava eroded into soil, releasing gold and other minerals. The word orogeny is derived from Greek, meaning mountain creation. There is a high probability of finding gold vein(s) along the 38 Km fault line in Forrest Kerr just as the Stikine Resources did at a fault line in Eskay Creek as well as Great Bear Resources did along the LP fault line in its Dixie project in Red Lake.

https://investorshangout.com/images/MYImages/...posits.png

Eagle Plains Resources's Youtube video on orogenic gold

https://www.youtube.com/watch?v=YEtfOGY5CWM

Map of Forrest Kerr and the Boundary Zone.

https://investorshangout.com/images/MYImages/...yzones.png

Being a close neighbor to Eskay Creek mine with similar geology, Forrest Kerr can potentially has similar gold deposits.

https://investorshangout.com/images/MYImages/...tlines.jpg

History of Eskay Creek mine, the world's massive high grade gold mine

In 1932 a prospector named Tom Mackay of Consolidated Stikine Resources was the first to recognize the area's unique geological setting after spotting an alluring rock outcrop from his single-engine bush plane. After staking the property he discovered a boulder broken free from its source higher up on the mountain, rolling several dozen meters downslope, assays from the boulder returned a spectacular five ounces of gold per tonne. Mackay explored the property for over 50 years but bonanza gold deposit was never found. In 1988 after investing in Consolidated Stikine Resources which held rights to Eskay Creek, geologist Ron Netolitzky became Stikine’s technical person and one of five controlling shareholders. He teamed up with Murray Pezim of Calpine Resources to raise $900,000 for a drill program and started exploring the area in the summer of 1990. After drilling 108 holes and with momentum building, they hit a fault line. Chet Idziszek, Pezim’s geologist with a M.Sc. degree from McGill University observed gradually increasing gold grade and increasing interval length of high grade gold in the assays, he had an intuition that he must be very close to the main gold vein, he studied the maps and analysed the terrain then he ragged the drill rig to a spot 350 meters from the last hole drilled and drilled hole #109. Bingo, assays from hole 109 returned spectacular 27.2 g/t gold, 30.2 g/t silver over 208 meters (682 feet). In 1994 Eskay Creek went into production that lasted 14 years, finally ended in 2008. Eskay Creek had the highest grade gold on the planet and produced 3.3 million ounces of gold at a breathtaking 45 g/t Au, also 160 million ounces of silver at 2,224 g/t. Stikine Resources was acquired by Placer Dome and International Corona for $67 per share. Ron Netolitzky has had a very successful career in mining and mineral exploration with decades of experience and having been directly associated with three major mineral discoveries in Canada that have subsequently been put into production: Eskay Creek, Snip and Brewery Creek. Ron Netolitzky was inducted into the Canadian Mining Hall of Fame in 2014.

====================================

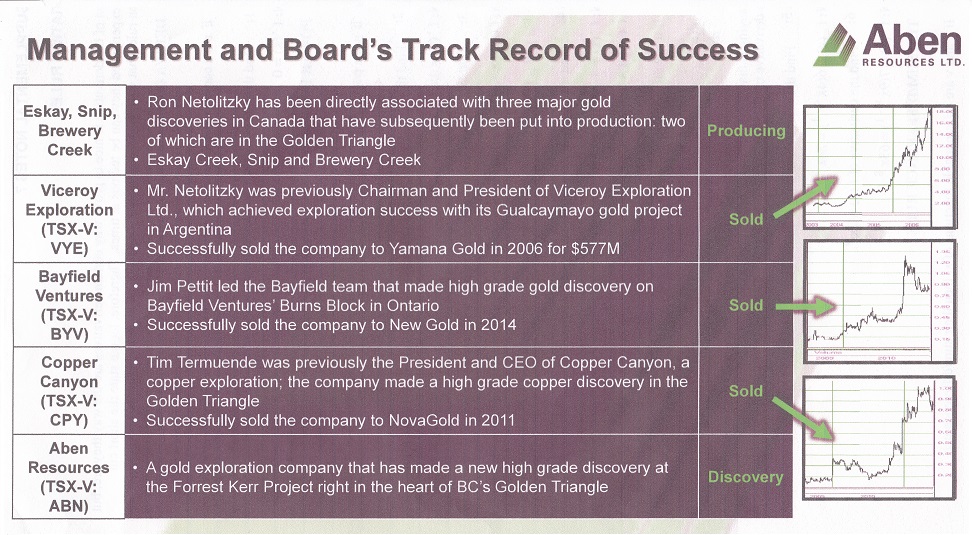

Management's track record of past explorations

=====================================

Mr. Ron Netolitzky and Mr. Timothy Termuende were appointed to the Board of Directors on March 3, 2011, they are experienced geologists with successful exploration track record.

https://sedar.com/GetFile.do?lang=EN&docC...Id=2832083

5 gold/copper mines (Eskay Creek mine, Snip mine, Burns Block mine and Copper Canyon mine in the Golden Triangle, Gualcamay mine in Argentina) were discovered by the 3 experienced, subtle and strategic geologists affiliated with Aben Resources with the corresponding companies sold to other mining companies.

https://investorshangout.com/images/MYImages/...essold.jpg

=================================================

Other buyout deals in the Golden Triangle of British Columbia

=================================================

Placer Dome and International Corona acquired Stikine Resources at Can$67 per share

https://www.northernminer.com/news/placer-sta...000178407/

Imperial Metals acquired American Bullion Minerals at Can$2.45 a share

https://www.imperialmetals.com/for-our-shareh...an-bullion

Newmont acquired GT Gold at $3.25 per share in a Can$393 million deal

https://www.newmont.com/investors/news-releas...fault.aspx

Australian gold and copper producer Newcrest Mining acquired Pretium Resources in a Can$3.84 billion deal

https://magazine.cim.org/en/news/2021/newcres...e%20region.

=============

Media coverage

=============

Equity.Guru video: Aben Resources' (ABN.V) golden triangle opportunity explained by Fabiana Lara

https://www.youtube.com/watch?v=-Mj2R4jvb0A

Nov 5, 2018 - Silver and Gold Summit - High grade gold and copper discovery in Forrest Kerr

https://cambridgehouse.com/video/8213/highgra...ources-ltd

May 17- 18, 2022 - Vancouver Resource Investment Conference (VRIC)

https://cambridgehouse.com/vancouver-resource...ources-ltd

================

Media Commentary

================

http://www.321gold.com/editorials/preston/preston111418.html

https://investingnews.com/company-profiles/ab...-triangle/

http://energyandgold.com/2018/05/08/aben-reso...-triangle/

https://www.streetwisereports.com/article/201...angle.html

=============================

Aben Resources in the social media

=============================

https://ca.linkedin.com/company/aben-resources-tsx-v-abn-

https://twitter.com/Aben_ABN/

=====================================

Ellis Martin Report and Resource Stock Digest

=====================================

Tune in from time to time for James Petit's update on the company's exploration in its projects. Subtitle will be displayed by clicking CC in the task bar.

https://www.youtube.com/results?search_query=...p=CAI%253D

==========================================================

Mining companies operating in the Golden Triangle of British Columbia

==========================================================

Aben Resources is a new comer to the Golden Triangle while most of the explorers have been operating there for decades, delineating their resources and reserves to enhance shareholder value. CEO James Pettit optioned Forrest Kerr in 2016, in the subsequent 3 years he drilled and incurred exploration expenses to meet the option agreement, completed the Earn-In in November 2019 and now owns 100% of Forrest Kerr property.

The following are mining explorers operating in the prolific Golden Triangle of British Columbia. Share prices are not up to date, they are for comparison only. With Aben's spectacular high grade / visible gold occurrence in the North Boundary zone of Forrest Kerr and potential bonanza discovery and with share price at rock bottom level, Aben offers investors the best value at basement entry level.

1 RG.V Romios Gold Resources $0.040 https://stockcharts.com/h-sc/ui?s=RG.V&p=...3258189645

2 DEC.V Decade Resources $0.040 https://stockcharts.com/h-sc/ui?s=DEC.V&p...1633995508

3 ABN.V Aben Resources $0.050 https://stockcharts.com/h-sc/ui?s=ABN.V&p...7496113214

4 MRO.V Millrock Resources $0.050 https://stockcharts.com/h-sc/ui?s=MRO.V&p...6836544963

5 SKYG.V Sky Gold Corp $0.100 https://stockcharts.com/h-sc/ui?s=SKYG.V&...4081325604

6 ENDR.V Enduro Metals Corporation $0.180 https://stockcharts.com/h-sc/ui?s=ENDR.V&...0889726269

7 SCOT.V Scottie Resources $0.170 https://stockcharts.com/h-sc/ui?s=SCOT.V&...5282581933

8 MTB.V Mountain Boy Minerals $0.170 https://stockcharts.com/h-sc/ui?s=MTB.V&p...5090334703

9 GLDN.V Golden Ridge Resources $0.170 https://stockcharts.com/h-sc/ui?s=GLDN.V&...4998380595

10 BBB.V Brixton Metals Corporation $0.130 https://stockcharts.com/h-sc/ui?s=BBB.V&p...4146375562

11 AMK.V American Creek Resources $0.175 https://stockcharts.com/h-sc/ui?s=AMK.V&p...4902895968

12 EVER.V Evergold Corp $0.140 https://stockcharts.com/h-sc/ui?s=EVER.V&...9306455150

13 GGI.V Garibaldi Resources Corp $0.250 https://stockcharts.com/h-sc/ui?s=GGI.V&p...6339012581

14 SASY.CA Sassy Resources $0.390 https://stockcharts.com/h-sc/ui?s=SASY.CA&...7712944421

15 MTS.V Metallis Resources $0.270 https://stockcharts.com/h-sc/ui?s=MTS.V&p...3708570676

16 DV.V Dolly Varden Silver Corp $0.500 https://stockcharts.com/h-sc/ui?s=DV.V&p=...0211663558

17 AOT.TO Ascot Resources $1.050 https://stockcharts.com/h-sc/ui?s=AOT.TO&...1773813526

18 QEX.V QuestEx Gold & Copper $0.780 https://stockcharts.com/h-sc/ui?s=QEX.V&p...7398162842

19 BNCH.V Benchmark Metals $1.020 https://stockcharts.com/h-sc/ui?s=BNCH.V&...8185217032

20 ESK.V Eskay Mining Corp $2.120 https://stockcharts.com/h-sc/ui?s=ESK.V&p...2221768177

21 TUO.V Teuton Resources Corp $2.220 https://stockcharts.com/h-sc/ui?s=TUO.V&p...1926720407

22 TUD.V Tudor Gold Corp $2.240 https://stockcharts.com/h-sc/ui?s=TUD.V&p...7186783346

23 SKE.TO Skeena Resources $12.620 https://stockcharts.com/h-sc/ui?s=SKE.TO&...2377942100

24 III.TO Imperial Metals Corp $3.900 https://stockcharts.com/h-sc/ui?s=III.TO&...3507076263

25 PVG.TO Pretium Resources $12.680 https://stockcharts.com/h-sc/ui?s=PVG.TO&...6630983759

26 ELD.TO Eldorado Gold Corp $10.050 https://stockcharts.com/h-sc/ui?s=ELD.TO&...6093748522

27 SEA.TO Seabridge Gold $19.600 https://stockcharts.com/h-sc/ui?s=SEA.TO&...0125765441

Due to lack of basic infrastructure like power line and accessible roads, exploration and discoveries have been arduous in the Golden Triangle in the past decades, it took Seabridge Gold 41 years to achieve its current mineral reserves and resources since its formation in 1979.

https://www.seabridgegold.com/company/overview

Thanks to Brian Kynoch, P.Eng. and President of Imperial Metals, his desire to construct a copper mine at Red Chris prompted the government to construct highway and roads and install power line through the Golden Triangle since 2012. With the basic infrastructure in place and with the progress in modern day mineral detection technology, potential rapid discovery of bonanza gold deposits in the Forrest Kerr fault zone and accurate resources estimate through 3-D imaging can be achieved.

===============

Chart Technicality

===============

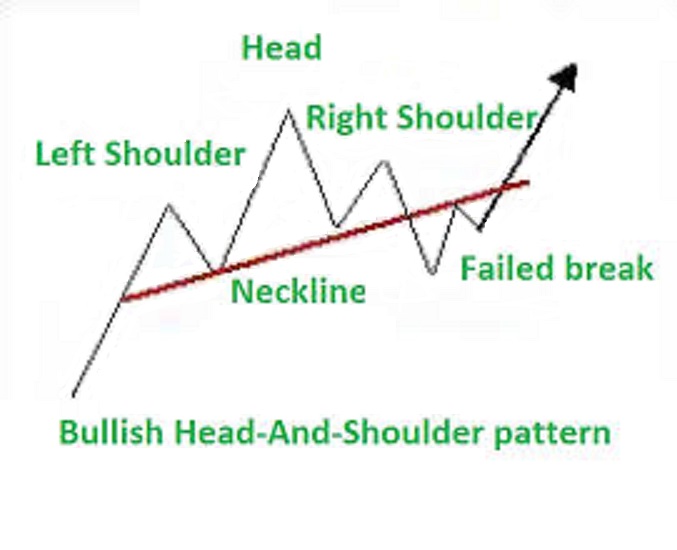

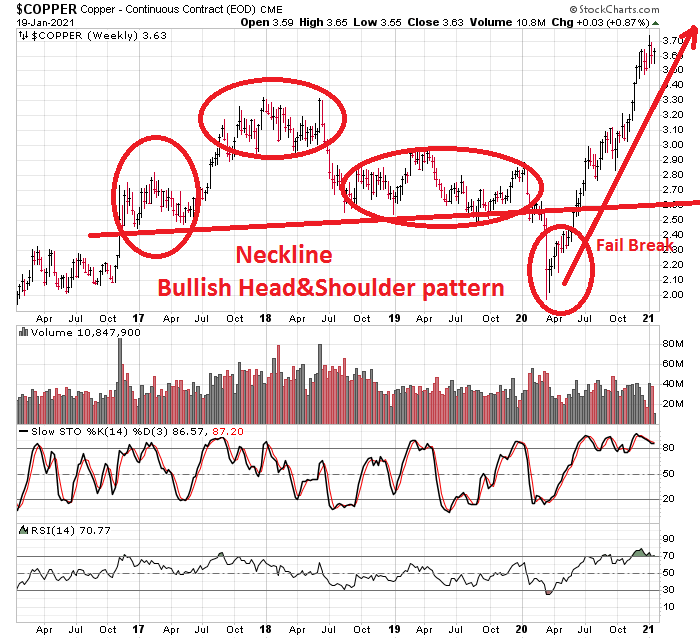

Chart is not only a historical record, quite often it can predict the future, it is an important trading tool, trading without charts is like an airplane pilot flying without any navigation instrument but only by hunch and guessing, chances are he will end up in crash-and-burn. Head-And-Shoulder is a natural chart formation in Nature, it is the most reliable and predictable chart pattern among all chart formations, Nature works mysteriously, no one knows why.

Bullish Head-And-Shoulder pattern - fail break pattern

Bullish Head-And-Shoulder pattern in copper

Bullish Head-And-Shoulder pattern in XAU mining index

Aben share price future scenario if the company will be sold

https://investorshangout.com/images/MYImages/....VQ5yr.gif

(0)

(0) (0)

(0)