You really are an ignorant shit and a f'ing Henny

Post# of 128843

Russia is a failed petro-state on the way to becoming an even bigger failure and a bigger pariah to Europe and much of the rest of the world. Plus, all those body bags containing Russian soldiers won't play well with Russian civilians.

Dumb fcks like you got too used to Trump's ass kissing of Putin.

Vibrations coming from Reagans grave, from all that spinning.

Warning, shithead, graphs, data and facts ahead. You know, the shit that gave you fits in HS?

Reality check:

How Could We Replace Russian Oil and Gas Exports?

January 29, 2022 by Brian Wang

How hard would it be to replace Russian oil and gas exports to Europe and then to Asia? Brad Templeton wrote on Facebook that 50% of Russians get their income from the government, which gets 43% of its revenue from oil and gas and is 1/3rd of the GDP. Putin rules only because Europe keeps sending him money to buy fossil fuel we want to stop burning.

Here is a summary:

* Germany can keep all six of their nuclear reactors running and not need to import 60 TWh per year of energy

* France can increase nuclear electricity exports to Germany which France has done for decades. This could replace half of Germany’s natural gas for electricity needs in 2022 and all of it by 2023.

* The US could increase nuclear energy generation to free up natural gas. This could be used to reduce non-European Liquified natural gas demands. Building up liquified natural gas production facilities and import and export terminals would take some time. But substantial progress could be made by next year.

* 2 out of the 5 million barrels per day of Russian oil exports could be replaced in 2022 and probably 1-2 million barrels per day for each of the next two years.

* there is also some short pipelines that would need to be built to move oil and gas around to new Eastern European locations

* The GDP hit could be minimized to 2-3% and it would be one year and less in 2023. Germany keep running their nuclear reactors. This is 60 TWh/year. The natural gas imports remaining would be 60 TWh/year. 30 TWh/year less than just one month ago and the shutdown of the three nuclear reactors.

France increasing electricity would replace the natural gas needed for German electricity. France would need to move around their shutdown for maintenance and refueling schedule to keep more generators online and then during a shutdown they need to perform stretch uprates 2-7% non turbine boosts. Maxing LNG imports as is already being done minimizes disruption. Maybe 10-20% drop in natural gas instead of 40% which is Russia’s share of Europe natural gas. Full recovery next year.

* It would likely end up being global swapping. China would take all of Russias oil and gas. Europe would then shift to its own nuclear energy and US, Canada, Saudi and Qatar oil and natural gas. But Russia would have no more energy leverage in Europe.

What happens if Russia cuts off or is forced to cut off its gas pipelines, and the answer is it would be tough, but Europe would manage. But what if Europe stops paying, not now, but in the spring, when it has 6 months before winter to reconfigure to use imported LNG and others sources, re-boot their shuttered nukes, install more renewables and turn up all the non-Russian fossil fuel it can get its hands on?

European utilities have increased orders of shipped liquefied natural gas cargoes over the Christmas and New Year period. This is mainly from the U.S. and Qatar, which have around 100 cargoes scheduled to arrive in Europe in January alone. Eurasia Group said, citing ship tracking data, that this reflected an increase of roughly 40% from the previous record in March 2021.

Total EU gas demand (October 2020-October 2021): 391.2 bcm

Total EU pipeline imports (October 2020-October 2021): 262.8 bcm

Gas storage utilization (and volume): 74% (73.4 bcm)

40% of the EU imports are from Russia.

The price of oil and gas would rise. The upside is Russia stops having the funds for Syria, Eastern Europe and other locations.

Germany is especially dependent on Russian gas. Germany turned off three nuclear reactors this month. They are still fully operational. They were planning on turning off the three last remaining nuclear reactors. Those last six reactors were some of the largest nuclear reactors. Nuclear reactors get shut down every two years for refueling.

It would be technically trivial to restart those three reactors now and to not shut down the last three nuclear reactors. Six months of maintenance and an uprating of the turbines could increase power by 5 to 10%. Nuclear reactors that have been shut down for years would be harder to restart if they have been substantially taken apart.

This is not the case for any of the six German reactors. Nuclear power in Germany accounted for 13.3% of the German electricity supply in 2021, generated by six power plants, of which three were switched off in the last 30 days.

Keeping the six running and uprating and maintaining during refueling would be 14% of German electricity needs. Germany generated 60 TWh from the nuclear reactors in 2020 and imported 60 TWh of natural gas in 2020. Don’t shut off the nuclear reactors and uprate them to 63 TWh this year or next year and then to 66 TWh by 2024.

France has not been running its nuclear fleet at maximum capacity. The immediate action would be to uprate, maintain and modernize existing nuclear reactors. It would also be to maintain them for their highest operating capability.

France is already running current reactors 10% below the power that they generated for most of the past twenty years. Uprates involve higher capacity turbines can be installed in under 12 months during an extended reactor refueling shutdown. Putting in the control systems and planning for maximum safe operating capacity should get France back to the 440 TWh they were average for the past 20 years.

This is an extra 40 TWh (aka 40,000 GWh). Uprates over the next 2-3 years could net another 40,000 GWh. France already supplies Germany with electricity. France can supply another 20-40 TWh of electricity that Germany needs by increasing nuclear power operations in 2022.

Germany would be down to about a 5% shortfall of electricity by the next winter and would be completely good by the winter afterwards. However, Europe does have more energy needs than just German electricity. There is also the usage of natural gas directly used for industrial processes.

French President Macron recently announced that the number one priority for his industrial strategy was for France to develop innovative small-scale nuclear reactors by 2030. These are reactors with less than 300 MW of power. This is about 4 to 5.5 times smaller than older nuclear reactor designs. This new build would not matter for about ten years.

The US turned off two of the Indian Point Nuclear reactors in the last 21 months. Indian Point unit 2 was shutdown April 30, 2020, and to close Unit 3 on April 30, 2021. Natural gas use increased by four points to reach 43% of New York’s electricity in 2021 because of the NY shutdown.

Indian Point 3 generated over 8000 GWh per year. The two units generated about 15,250 GWh in 2017. The Indian Point generation would be 52 billion cubic feet of natural gas.

The US has nearly 100 nuclear reactors that generate 800 TWH (800,000 GWH per year of power). The US could maximize safe operations and perform uprates. A 5% increase in generation would produce 40,000 GWH/year in one year and another 40,000 GWh/year in two to three years. This could be used to reduce US natural gas needs and at the same time LNG (liquified natural gas) facilities would be increased.

From 1996 to today, in the US about 6.7 GW of nuclear-generating capacity—the equivalent of roughly six new large modern reactors—has been added to the fleet as a result of power uprates.

Getting U.S. Nuclear Regulatory Commission (NRC) approval for a power uprate is a lengthy and involved process, but it can be worthwhile because it allows owners to increase the maximum power level at which an existing nuclear power plant may operate.

Over the past 23 years, the NRC has approved 135 uprates (several units have been uprated more than once), with increases ranging from 0.4% to 20% greater than original license limits.

There are three types of uprates: 1) measurement uncertainty recapture power uprates, 2) stretch power uprates, and 3) extended power uprates.

Measurement uncertainty recapture power uprates increase the licensed power level by less than 2 percent. They are achieved by implementing improved techniques for calculating reactor power. This involves the use of state-of-the-art devices to more precisely measure the feedwater flow used to calculate reactor power. More precise measurements reduce the degree of uncertainty in the power level, helping analysts predict the ability of the reactor to be safely shut down under possible accident conditions.

Stretch power uprates are typically between 2 percent and 7 percent, with the actual increase depending on a plant design’s specific operating margin. Stretch power uprates usually involve changes to instrumentation settings but do not involve major plant modifications.

Extended power uprates (EPU) are greater than stretch power uprates and have been approved for increases as high as 20 percent. Extended power uprates usually require significant modifications to major pieces of non-nuclear equipment such as high-pressure turbines, condensate pumps and motors, main generators, and transformers.

TVA’s Browns Ferry Nuclear Plant (BFN) in Lawrence County, Alabama recently added 465 MW of power in an extended uprate. Browns Ferry replaced the steam dryers with a much more robust design capable of withstanding the higher acoustic loads. Although the acoustic loads increased as a result of higher steam flows, Browns Ferry did not experience any SRV acoustic resonances. The station’s three units were the world’s first boiling water reactors capable of producing more than 1 GW of power each.

A number of other changes were made to each unit as part of the EPU project. Among the more significant modifications were:

■ Feedwater and condensate booster pumps were upgraded from 33% to 50% capacity. Condensate pumps were upgraded from 33% to 40% capacity.

■ Standby liquid control system boron enrichment was increased to improve accident mitigation and greatly reduce transient suppression pool temperature.

■ Visco-elastic dampeners were installed in main steam lines to reduce turbine stop valve vibration and premature failure of stop valve position instrumentation.

■ Main condenser vacuum instrumentation was relocated to provide consistent condenser vacuum indication and protection.

Europe currently has 28 large-scale LNG import terminals which at maximum capacity could replace 43 percent of Europe’s demand. The terminals are mostly concentrated in Western Europe. So it would take longer to make LNG terminals for Poland or take make pipelines to move natural gas within Europe.

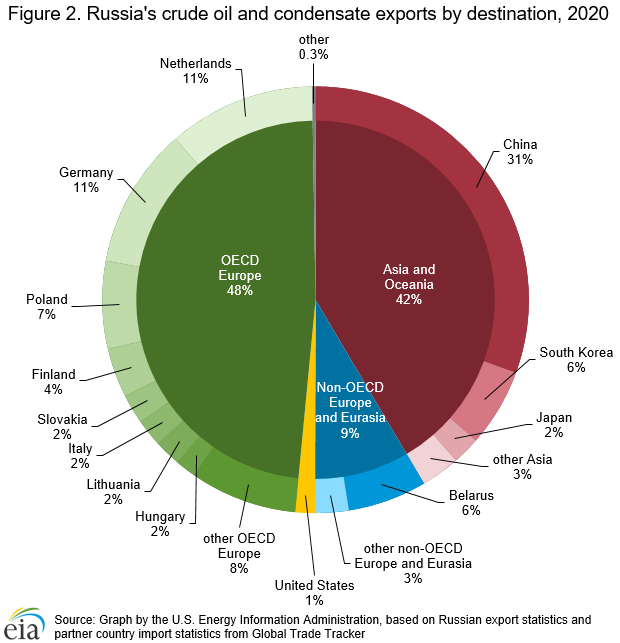

Russia exported almost 5 million b/d of crude oil and condensate in 2020. Most of Russia’s crude oil and condensate exports in 2020 went to European countries (48%), particularly Germany, the Netherlands, and Poland. Asia and Oceania accounted for 42% of Russia’s total crude oil and condensate exports, and China was the largest importing country of Russia’s crude oil and condensate, at 31%. About 1% of Russia’s total crude exports in 2020 went to the United States.

Maximizing US (shale oil), Canada (oilsand, shale oil and natural gas), Saudi Arabian oil, Kuwait and others could replace Russia’s 5 million barrels per day but it would take about four years to do it with an all out effort. The depressed industries and regions would be glad to operate all out. A 1 to 2 million barrel per day production increase mainly from Saudi and OPEC members could be achieved this year.

https://www.nextbigfuture.com/2022/01/get-off...d-gas.html

(1)

(1) (0)

(0)