Aben Resources's two hot irons in the fire .......

Post# of 1088

Forrest Kerr gold project

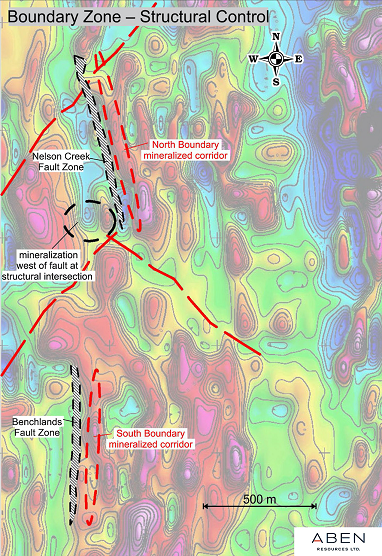

Forrest Kerr property is a huge area covering 23,397 hectares or 234 square Km (6.1 Km x 38.3 Km) while bonanza gold deposit occurs only in a small spot, so finding it is like looking for a pin in a haystack. But there is a greater chance of finding a gold mine along the 38 Km fault line that traverses the entire property in the north-south direction.

The Forrest Kerr in the Golden Triangle

ForrestKerrproject.jpg)

The Boundary Zone

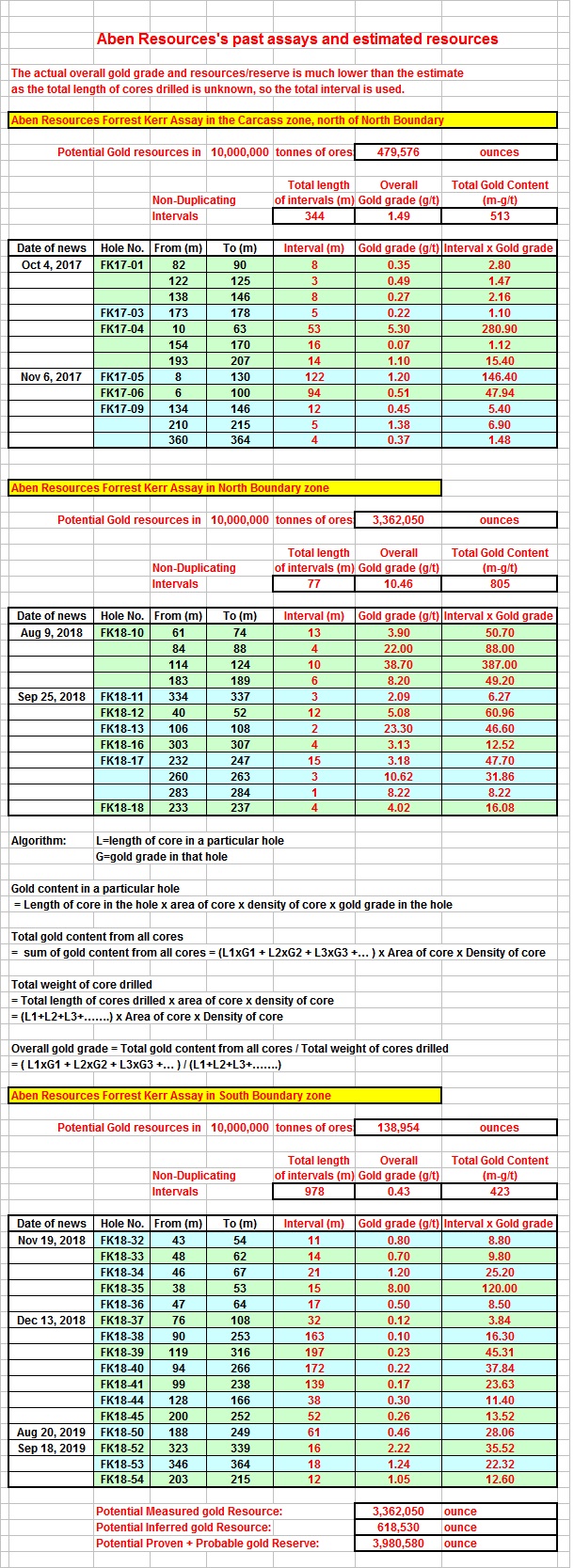

Assays from 3 different locations:

https://investorshangout.com/images/MYImages/...ources.jpg

In the 2018 drilling program only 7 holes were drilled in the North Boundary zone while most of the $7 million raised was spent drilling in the low gold grade South Boundary zone to test for more high grade mineralization. All of the 7 holes drilled in the North Boundary zone encountered medium long intervals of high grade gold, especially visible gold in Hole FK18-10 with assay of 38 g/t over 10 meters including 331 g/t over 1 meter, corroborated with Noranda's 1991 discovery of 326 g/t at 230 meters south of Hole FK18-10. Despite of the spectacular high gold grade assay, investors were disappointed with the low grade gold assay that followed and sold off the shares, but the assays in the news was so confusing that they did not know the low grade gold is from South Boundary zone, not from the North Boundary zone. When there are holes with 331 g/t and 326 g/t visible gold, there could be more as the geologists get closer to the source: A gold vein with numerous gold arteries that can run for hundreds of meters, Aben and Noranda had drilled into one or two of those gold arteries. But the geology in Forrest Kerr is very complicated, the geologists are studying and analysing the data collected, only when they fully understand the intriguing geological struture will they set priority drilling targets.

Media commentary:

https://www.streetwisereports.com/article/201...angle.html

http://www.321gold.com/editorials/preston/preston111418.html

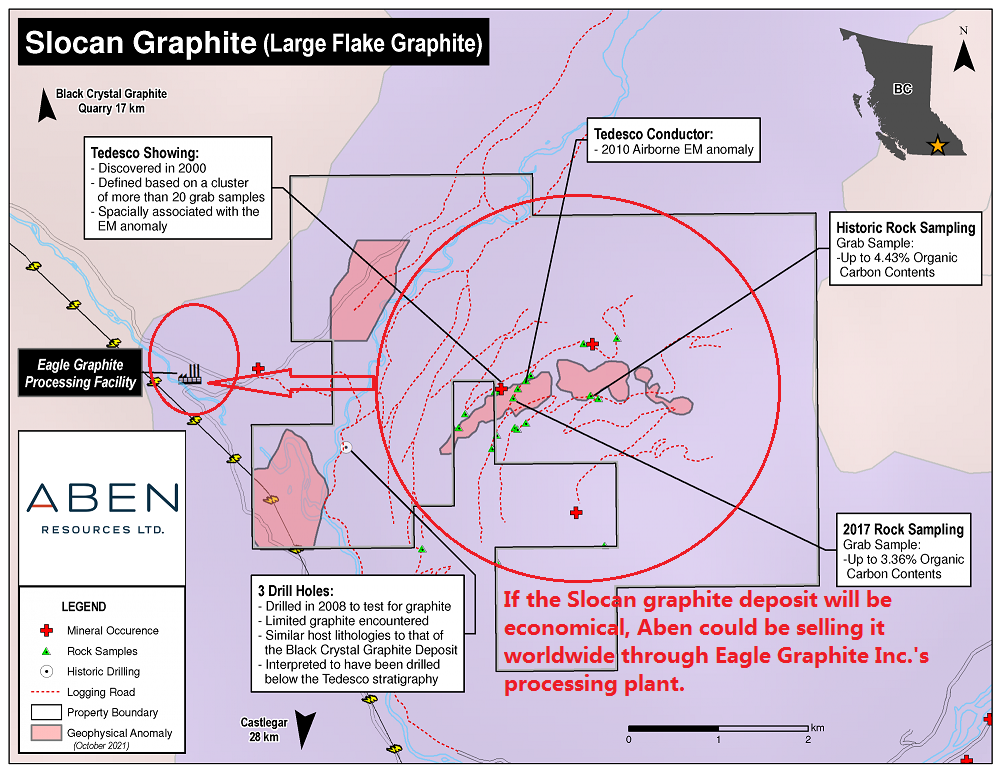

Slocan Graphite project

The company needs a lot of money to explore Pringle North and Slocan Graphite and to drill Forrest Kerr. James Pettit is very restrictive in share dilution, so massive share dilution in equity financing at this low share price is unlikely, unless shareholders will support financing at higher prices with less dilution and keep the Justin project. Else expect NI 43-101 Technical Report and good news on the sale of Justin gold project for around $8 or $9 million, that is the expenses the company has incurred on that project. The money will be used to explore Pringle North and Slocan Graphite and to drill the flagship Forrest Kerr gold project. He will bring Slocan Graphite to production and sell the natural graphite to the American electric vehicle industry through Eagle Graphite's processing facility nearby. The production in Slocan Graphite will generate millions dollar revenue for Aben Resources. Graphite price depends on flake size and purity, the large flake Slocan graphite should sell for at least $1,000 per tonne and at processing rate of 4,000 tonnes per year, potential annual revenue will be around $4 million less processing fee. So Slocan Graphite will be there to sustain the exploration in Forrest Kerr should the geologists need more time to understand the complicated geology of the area and to trace the high grade / visible gold to its source.

How graphite is priced

https://www.northerngraphite.com/about-graphi...e-pricing/

https://investorshangout.com/images/MYImages/...roject.png

About Slocan Graphite Project

Graphite is a naturally occurring form of carbon and is an excellent conductor of both electricity and heat. It is becoming increasingly important as a critical strategic component in advancing alternative energy solutions including wind and solar power, hybrid vehicles and other alternative energy uses. It is also a mainstay of the steel production industry. Canada is currently ranked as the 5th largest supplier of graphite.

The Slocan Graphite Project benefits from excellent infrastructure including a high-voltage transmission line within 1.2 km of the property boundaries, an extensive network of forestry roads on and around the property, and an existing graphite processing plant and facilities located 1.5 km west of the property, owned by Eagle Graphite Corporation.

Graphite mineralization was initially discovered in logging road exposures in the late 1990’s. Ground and airborne geophysical surveys were completed in the project area in 2000 and 2010 respectively. Both surveys indicated strong conductive anomalies that correlate well with surface mineralization and are interpreted to extend along strike and down-dip of known occurrences. A limited number of documented samples have been taken across the Tedesco horizon and analysed for carbon graphite ranging from trace values to grades of up to 3.36 and 4.43 per cent.

Graphite mineralization is hosted primarily in carbonate and calc-silicate lithologies within the Passmore Dome of the Valhalla Metamorphic Complex, a geologic setting consistent with a crystalline flake graphite deposit model. Previous operators have estimated the mineralized horizon to be up to 50m thick, however cite that it is difficult to determine due to a lack of surface exposure. The horizon has never been tested by diamond drilling.

Past workers in the area concluded: “Although the graphite occurrences at Tedesco are in the early stages of exploration, geological, assay, and geophysical data indicate significant potential to form an economic deposit” (BC Assessment Report 26537). Eagle Plains geologists are of the opinion that the high-quality, large flake character of the graphite mineralization found to date, spatial extent of conductivity from a 2010 airborne electromagnetic (“EM”) survey, minimal historic exploration activity, excellent proximity to infrastructure and the favorable economic outlook for graphite as a strategic commodity make Slocan Graphite a compelling project for continued exploration and a potentially significant component of Eagle Plain’s broad and varied portfolio of exploration projects. The project is consistent with EPL’s policy of identifying and acquiring undervalued exploration projects during cyclical downturns within a particular commodity space.

https://www.eaglegraphite.com/operations/

(Extract from Financial Report Management Discussion and Analysis)

Eagle Graphite Inc. is in the business of mineral exploration and is actively engaged in the acquisition, exploration and development of graphite properties in British Columbia. The Company owns a graphite quarry and processing plant which has historically operated at a throughput rate of 20 tonnes of feed per hour, a rate roughly equivalent to an annual output of 4,000 tonnes of high carbon natural flake graphite. Substantially all of the efforts of the Company are devoted to these business activities. To date the Company has not earned significant pre-production revenue and is considered to be in the exploration stage.

In 2006, Eagle Graphite acquired the Black Crystal graphite quarry and processing plant, located 3 km south of Valhalla Wilderness Park on the eastern slope of the Monashee mountains. Since the purchase, Eagle Graphite has invested in retooling the operation. The active 100-hectare open cast quarry area is surrounded by an additional 1,312 hectares of undeveloped mineral claims. The processing plant, using locally generated hydroelectricity, incorporates a closed system recirculating filtered water supply and uses low impact purification chemicals such as pine oil. Graphitic feed is drawn from the quarry using excavation equipment and carried by dump truck to the processing plant. The feed consists of loose sandy material, requiring little or no blasting. As the only facility capable of producing flake graphite in Western Canada or the USA, and strategically located close to the US city of Spokane, Washington and the Canadian port of Vancouver, British Columbia, Eagle Graphite offers efficient and economical shipping of high grade material to destinations worldwide.

BC Government 2017 Geological Survey Assessment of Slocan Graphite

Scroll down to page 18, 19, 20 to see what minerals are found in that property

https://aris.empr.gov.bc.ca/ARISReports/37398.PDF

Graphite market was valued at US$137.3 million in 2020 and is projected to reach $219.6 million by 2027 at a CAGR of 6.9%. Every million electric vehicle require around 75,000 tonnes of natural graphite. In 2020, spherical graphite demand in China alone was 240,000 tonnes, demand for graphite is forecasted increasing to 1.9 million tonnes by 2028.

(0)

(0) (0)

(0)