Part II - Drilling Deep Bambuser has a lovely r

Post# of 33177

Bambuser has a lovely report. Probably takes a lot of time to put together. Probably that gets more investors to invest. But not that easy to break out revenue that is one-time vs ongoing. Verb does that and much easier to read.

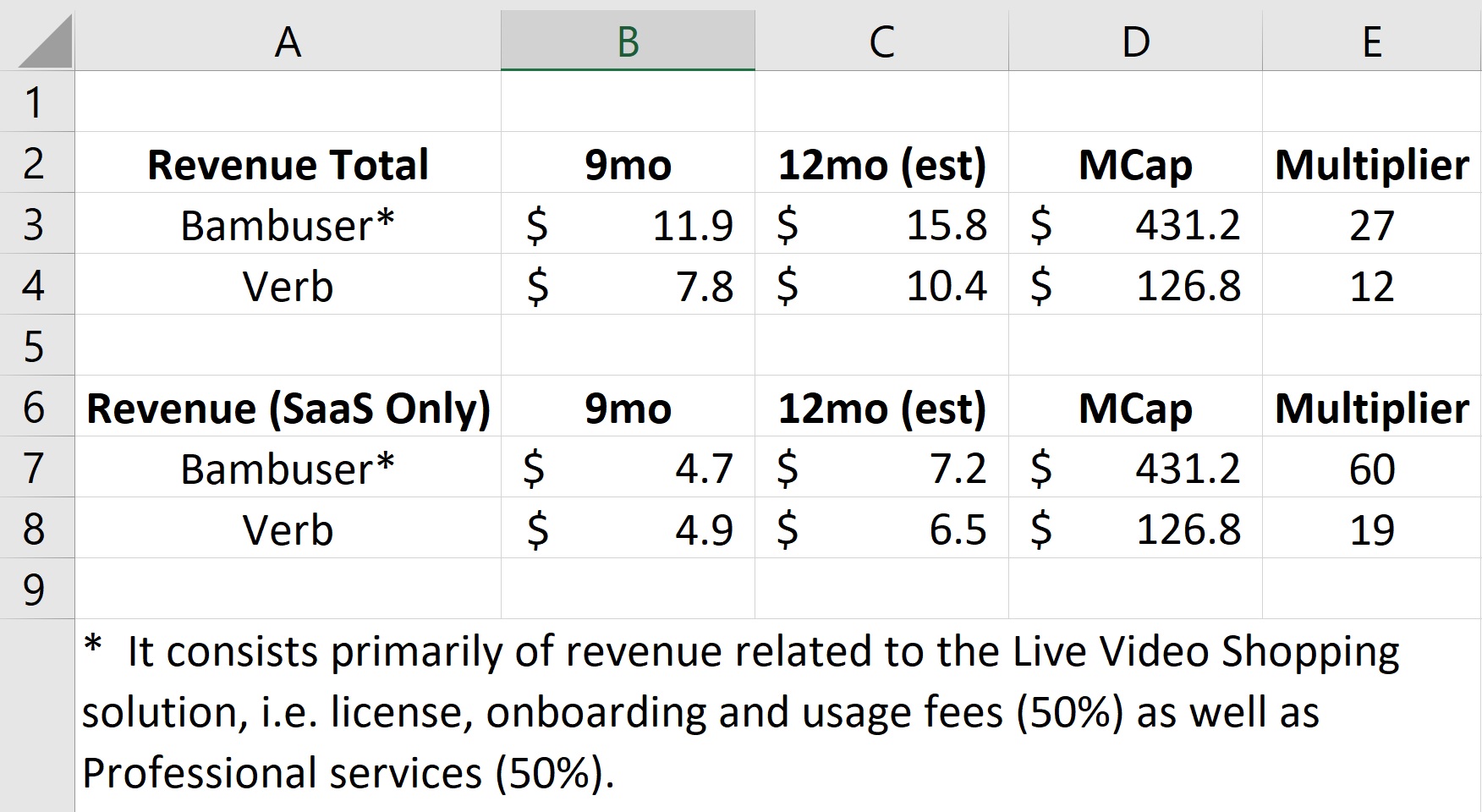

I took the YTD and peanut butter estimated Q4 based on the first 3, which means it should be higher, but good enough for what I'm doing.

Bambuser's revenue is primarily related to the Live Video Shopping solution, i.e. license, onboarding and usage fees (50%) as well as Professional services (50%). The problem is, what in that number is SaaS based. Onboarding and Professional services aren't MRR.

Remember Verb had a lot of revenue, but the multiplier of non-SaaS was really low. Analyst typically get very excited about SaaS. So Verb broke it out and had to go through a somewhat painful period of ramping down non-SaaS and ramping up SaaS. Mission accomplished.

If fact SaaS recurring revenue as a percentage of Total Digital revenue was 88%, compared with 76% for the same period last year and up over the 81% we reported in Q1 2021.

But what is Bambuser?

We'll not to easy to figure out. We know their MRR now stands at 6 MSEK. I tried to break out out in the above table estimating that growing Q by Q. Maybe it's close enough.

But you may want to look at the graphs on page 4...

https://assets-global.website-files.com/61695...3_2021.pdf

Bambuser Total Contract Value actually declined for Q3. If that was Verb, bedwetters would go nutz!

But that's OK as with the beauty of SaaS, MRR will continue to go up as you see on the graph on the left. But better if TCV went up like with Verb. If Bambuser loses customers the TCV may not make up for it.

BTW, Verb added $405,000 ARR last quarter. This quarter $500,000.

Increase of 25% and those are minimum numbers!

Is Bambuser valued correctly?

Is Verb valued correctly?

Up to each institution and investor to decide for themselves

What's the takeaway?

Both companies are doing well.

Both companies revenue should continue to go up as I see no reason why sales would all of a sudden stop unless they would lose more customers than they add.

Revenue going up means share price will go up

The big question is how fast

Two parts to that equation that will effect the share price

How fast they add revenue

What is the potential addressable market and potential of the company

That can be limitless, but we need to get MarketPlace and Verb.TV out the door first which will happen 'shortly'

For the trolls that harp on revenue, there are some companies out there that have zero revenue with a ton of potential so don't let bedwetters fool you. I posted a bunch over the years like Discord that is now valued at $15B

Oh and they just needed another $500M. Guess the investors weren't to upset about that

https://www.cnbc.com/2021/09/22/discord-doubl...round.html

Keep in mind Bambuser has had a head start, but Verb is more diversified. As stated on Bambuser Q, they are only now starting the renewal cycle of contracts so that shows you where they are at.

Institutions understand where companies like Verb are in this journey as evident of their buying and positions. Retail will get there also. I'm guessing the latter probably won't be a slow ramp, but a quick thing once things explode.

Next 4 weeks should be interesting for sure.

(17)

(17) (0)

(0)